Survivor’s Ricard Foyé And Husband Andy Foyé Break Up!

Ricard and Andy Foye’s Pregnancies Break Transgender Barriers

Ricard Foyé and his husband, Andy Foyé, are leaving each other’s tribes on Survivor.

The couple, who have two children, Aurelia, four, and Lucia, two, are divorcing after seven years of marriage.

“Telling my kids that baba & daddy are separating will always hurt,” Richard tweeted on April 17 beside a family selfie. “We had a fantastic run. “Two beautiful babies and two angel babies, so much love.”

Ricard wrote a message to Andy, with whom he eloped on New Year’s Eve 2015, before they married in May 2018.

“You’re my best friend,” Ricard, who played on Season 41 of Survivor, continued. “Our first family trip as friends proved even more that we’re still soulmates, just in a different way.”

Andy has yet to officially remark on the split.

Ricard and Andy met while volunteering at an LGBT youth camp in 2015.

Ricard and Andy met while volunteering at an LGBT youth camp in 2015, and they married the following year. Andy, encouraged by his transgender community, told Ricard in 2018 that he had stopped taking hormone therapy and was ready to attempt to have children and carry them himself.

Andy referred to himself as a seahorse father because male seahorses had babies. Aurelia was born in 2019, and Lucia in 2021.

“Before meeting Ricard, I hadn’t thought about having kids and not carrying kids,” Andy told E! News in March 2022. “However, once I met him, it was clear I wanted to start a family with him.”

Ricard, for one, was originally skeptical, but “we met, and I learned so much more about my queer community and so much more about what’s possible.”

Since becoming a father, the Survivor star has been amazed by his children’s developing personalities.

“I thought they would just mimic us, use our mannerisms and phrasing until they were older,” he told E! News last year. “But [Aurelia] will be the person she will be, and that is entirely her responsibility.” We’re here to help her develop, and seeing her independence at such a young age is amazing. And Lucia is on her way. He’s a hoot.”

:max_bytes(150000):strip_icc():focal(584x449:586x451)/Ricard-Foye-01-041723-a1562d7a07e1488980e4ea07b4401496.jpg)

SOURCE – (Enews)

News

Police Arrest Six People Over US$14.5 Million Gold Heist in Canada

Six people have been arrested, including a jeweler and a commercial airline employee, and police have issued warrants for three more suspects in connection with what they say the single-largest gold robbery in Canadian history.

According to Peel Regional Police in Ontario, a joint investigation with the United States Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) resulted in the filing of nearly two dozen charges against the suspects in connection with the nearly $20 million Canadian dollar ($14.5 million) heist that occurred a year ago.

During a news conference in Ontario on Wednesday, Peel Regional Police Detective-Sergeant Mike Mavity told reporters that 400 kilograms of gold bars weighing more than 900 pounds, as well as approximately CA$2.5 million ($1.8 million) in stolen bank notes, were hijacked at Toronto Pearson International Airport after arriving on a commercial flight from Europe.

In total, 6,600 gold bars of various sizes were stolen, each of which was “99.9% pure and contained individualized serial numbers,” according to Mavity.

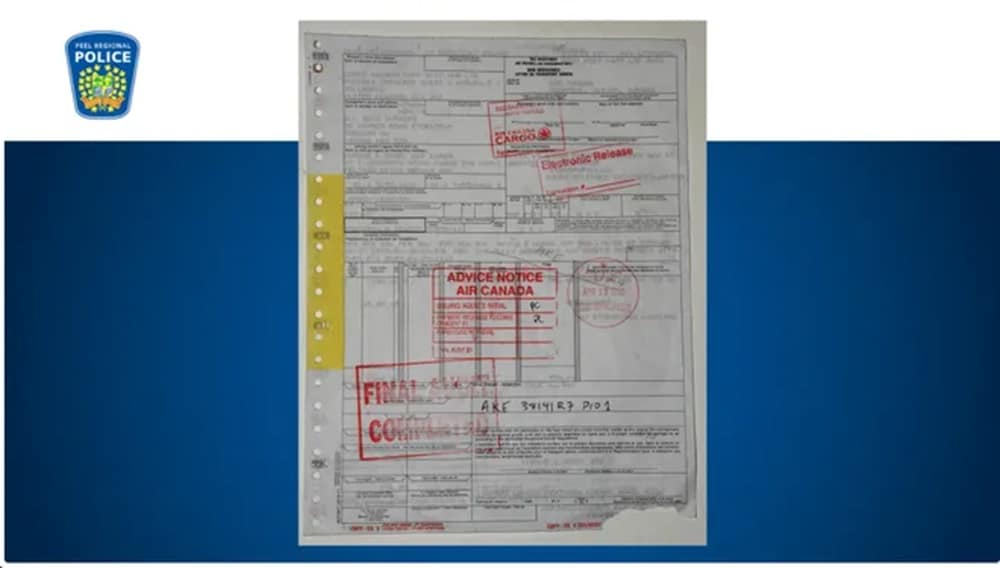

Gold Was in Hull of Air Canada aeroplane: File Photo

According to Peel Regional Police in Ontario, a joint investigation with the United States Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) resulted in nearly two dozen charges being filed against the suspects in connection with the nearly $20 million Canadian dollar heist that occurred on April 17, 2023.

On April 17, 2023, the gold and money were loaded into the hull of an Air Canada flight in “an approved airline container” bound for Toronto.

At 3:56 p.m. same day, the flight arrived at Toronto Pearson International Airport, and the gold and cash were quickly removed from the aircraft and transported to an Air Canada facility.

At 6:32 p.m., a man suspect came at air can freight driving a 5-ton truck and approached the property with what police called a counterfeit airway bill, a document used by carriers to track shipments.

Shortly after, a forklift arrived and loaded the item into the suspect’s truck. The suspect then drove off.

Fake Shipping Bill: Photo Peel Police

According to a police press release, officials discovered the document bill at 2:43 a.m. the next day to be a duplicate of an airline bill for a valid shipment of fish delivered and picked up the day before.

According to Mavity, the fake bill was produced at the Air Canada facility, and when officials discovered the products were gone, they used security footage to monitor part of the suspect’s subsequent trip until losing track of the truck in north Milton, an Ontario suburb.

Police stated that the crime was an inside operation and that a former Air Canada manager was wanted in the case.

So far police said they have arrested the following suspects in connection to the gold heist case:

- Air Canada employee Parmpal Sidhu, 54, of Ontario

- Jewelry store owner Ali Raza, 37, of Toronto

- Amit Jalota, 40, of Ontario

- Ammad Chaudhary, 43, of Ontario

- Prasath Paramalingam, 35, of Ontario

All five were released on bail and are scheduled to appear in court at a later date, Mavity said.

The truck driver who allegedly picked up the gold, Durante King-Mclean, 25 of Ontario, is currently in custody in the U.S. on firearms and trafficking related charges.

Here are the suspects at large:

- Air Canada manager Simran Preet Panesar, 31, of Ontario

- Archit Grover, 36, of Ontario

- Arsalan Chaudhary, 42, of Ontario

Only CA$90,000 ($65,000) of the more than CA$20 million recovered, said to Peel Regional Deputy Chief Nick Milinovich.

According to US Today, U.S. ATF Special Agent Eric DeGree, King-Mclean was detained in Pennsylvania following a traffic stop that resulted in the seizure of 65 illicit guns destined for Canada. According to DeGree, King-Mclean attempted to flee after police discovered the firearms in a rental car he was driving.

According to Air Canada spokesman Peter Fitzpatrick, two of the individuals identified by police worked for the airline’s cargo division at the time of the crime.

“One left the company prior to the arrests announced today, and the second has been suspended,” he stated, according to the site. “Because matter is now before the courts, we are unable to speak further.

According to the announcement, only about CA $90,000 (one kilogram of gold) has been found and melted down into bangle bracelets. According to authorities, the remaining gold was most likely melted down and used to purchase illicit weaponry.

“I commend our investigators, the ATF, other law enforcement partners, and our community for working together to identify and arrest those responsible for this brazen crime,” Peel Regional Police Chief Nishan Duraiappah said in a statement this week.

Anyone with information regarding the case should contact Peel Regional Police.

Cryptocurrency

Bitcoin Value Drops as Halving Date Nears

Bitcoin’s value has fallen dramatically recently. Compared to its most recent all-time high of $73,750, the present price of Bitcoin is under $65,000, a decline of more than 12%. Both investors and cryptocurrency aficionados have noticed this unexpected drop.

The price of Bitcoin hit a new low of about $60,090.43 in the last several days, its lowest level since February. Given this declining tendency, the reasons impacting the bitcoin market have been the subject of debate.

This fall in Bitcoin’s value is due to important variables, such as legislative developments, fluctuating investor mood, and volatile markets. For those working in the cryptocurrency industry, it is essential to have a firm grasp of these aspects to successfully traverse the current market conditions.

It is crucial to keep up with the newest trends and developments in Bitcoin pricing in order to make educated investing decisions in the ever-changing cryptocurrency market. If you want to know why Bitcoin’s value dropped recently and how the digital asset market works, read on.

Factors Behind the Bitcoin Value Drop

The recent decrease in Bitcoin’s value can be attributed to various factors that have impacted the cryptocurrency market. Let’s delve into two significant aspects contributing to the decline in Bitcoin prices.

Market Uncertainty:

The volatile nature of the cryptocurrency market often leads to uncertainty among investors, causing fluctuations in Bitcoin prices. When market conditions become unpredictable, investors may react by selling off their Bitcoin holdings to mitigate potential losses. This rush to sell can cascade, putting downward pressure on Bitcoin prices.

Market trends, such as sudden price drops or rapid increases in trading volume, can contribute to heightened uncertainty. Factors like global economic instability, regulatory changes, or even major geopolitical events can further blur the outlook for Bitcoin’s value, prompting investors to reassess their positions and opt for selling, thus influencing the price downturn.

Regulatory Developments:

Another significant factor influencing the recent Bitcoin value drop is regulatory news and changes within the cryptocurrency space. Authorities worldwide have been increasingly focusing on regulating digital assets like Bitcoin, which can impact investor sentiment and confidence in the market.

Recent announcements of stricter regulations, bans on cryptocurrency trading in certain regions, or crackdowns on unregistered exchanges have all instilled fear and uncertainty among investors. Such regulatory developments can lead to a sell-off as market participants anticipate potential hurdles in trading, compliance, or even the overall legality of holding Bitcoin.

By closely monitoring market uncertainty and regulatory developments, investors can better understand Bitcoin’s value dynamics and make informed decisions amid the evolving cryptocurrency landscape. Staying informed about these factors is crucial for navigating the volatile nature of the crypto market and adapting to changing conditions to protect investments in digital assets.

Impact of Bitcoin Halving on Price

Bitcoin halving, a fundamental event in the Bitcoin network, plays a crucial role in influencing its price dynamics. Understanding how Bitcoin halving affects supply and demand helps predict potential price fluctuations in the cryptocurrency market.

Bitcoin Halving Explanation

Bitcoin halving, also known as halving, occurs approximately every four years and reduces miners’ rewards for verifying transactions by half. This process is coded into the Bitcoin protocol to limit the supply of new Bitcoins entering circulation. As a result, Bitcoin becomes scarcer over time, impacting its perceived value.

Historical Price Trends After Halving

Analyzing past Bitcoin halving events provides valuable insights into how the cryptocurrency’s price has reacted in the aftermath. Historically, Bitcoin prices have shown bullish trends post-halving, with significant price increases observed in the months following the event. This pattern is attributed to the reduced supply of new Bitcoins and increased investor demand.

By examining historical data and observing how Bitcoin’s price has behaved after previous halving events, investors and analysts can better understand potential price movements in the future. Market participants closely monitor the impact of Bitcoin’s halving on price to make informed decisions regarding their cryptocurrency investments.

Overall, Bitcoin’s halving serves as a pivotal moment that impacts Bitcoin’s supply-demand dynamics, ultimately influencing its market value and price fluctuations.

Bitcoin Price in USD and Recent Trend

Since the recent ups and downs in the cryptocurrency market have sparked curiosity among investors, let’s delve into the current state of Bitcoin’s value.

Current Bitcoin Price:

As of the latest data available, Bitcoin’s price in USD stands at approximately $61,244.38 per unit. Comparing this to recent highs, where Bitcoin surged above $64,000 and lows around $30,000, we can see the notable volatility that Bitcoin has experienced in the past weeks.

Price Fluctuations Analysis:

Various factors, including market demand, regulatory developments, and macroeconomic trends, have influenced the recent Bitcoin price fluctuations. The surge and retreat of Bitcoin value can be attributed to factors such as market speculation, news around Bitcoin halving events, and the overall sentiment towards the cryptocurrency market. These rapid price shifts showcase the cryptocurrency market’s unpredictable nature and the need for investors to stay updated on Bitcoin trends.

Analyzing the current Bitcoin price trend reveals a dynamic landscape where prices can shift rapidly based on market forces. Understanding the nuances of Bitcoin price fluctuations is pivotal for investors to make informed decisions about their holdings and successfully navigate the evolving cryptocurrency market landscape.

By staying informed about the latest Bitcoin to USD conversion rates and monitoring market indicators, investors can better position themselves in this fast-paced and ever-changing realm of digital currency trading. Bitcoin’s resilience and potential to act as a hedge against traditional financial assets make it a game-changer in the financial world, emphasizing the need for a strategic approach to effectively leverage its benefits.

The Role of Bitcoin Wallets in Value Fluctuations

The value of Bitcoin can experience significant fluctuations, influenced by various factors such as market demand, investor sentiment, and the role of Bitcoin wallets. Understanding how Bitcoin wallets affect price movements is essential for cryptocurrency enthusiasts.

Wallet Exchanges and Price Movement

Bitcoin transactions through wallets and exchanges play a crucial role in determining the price of Bitcoin. The volume of transactions on these platforms can impact supply and demand dynamics, affecting the overall market sentiment. Large buy or sell orders on exchanges can lead to price spikes or drops, creating volatility in the Bitcoin market. During times of high trading activity, the price of Bitcoin can experience rapid fluctuations, highlighting the interconnectedness between wallet usage and price movements.

Safety Measures in Wallet Usage

As Bitcoin’s value fluctuates, users must prioritize security measures to safeguard their investments held in Bitcoin wallets. Implementing robust security practices, such as using hardware wallets or two-factor authentication, can help protect funds from potential breaches or cyber-attacks during price drops. It is advisable for users to regularly update their wallet software, use strong passwords, and enable additional security features provided by wallet providers. By taking proactive steps to secure their Bitcoin holdings, users can mitigate price volatility risks and ensure their digital assets’ safety.

In conclusion, the role of Bitcoin wallets in value fluctuations underscores the need for users to understand the interconnected nature of wallet exchanges and price movements. By adopting proper safety measures and staying informed about market trends, cryptocurrency investors can confidently navigate through price fluctuations and protect their Bitcoin investments effectively.

Conclusion

Finally, investors are worried about Bitcoin’s future due to its recent decline in value, around $60,000. Reasons for the drop include market corrections, lower trading volumes, and significant holders taking profits after a period of high volatility.

Be wary of digital asset investments in light of this latest price drop, the biggest since February, and the inherent volatility of the cryptocurrency market. As Bitcoin’s value keeps changing, it’s important to stay informed and cautious when dealing with an ever-changing market. To lessen the blow of price swings in the unpredictable cryptocurrency market, investors should carefully monitor market movements and consider diversifying their holdings.

World

Argentina Asks To Join NATO As President Milei Seeks A More Prominent Role For His Nation

BUENOS AIRES, Argentina – Argentina formally sought on Thursday to join NATO as a worldwide partner, paving the stage for further political and security cooperation at a time when President Javier Milei’s right-wing government seeks to strengthen ties with Western powers and attract investment.

The request came as NATO Deputy General Secretary Mircea Geoana met with visiting Argentine Defense Minister Luis Petri in Brussels to discuss regional security problems.

Union – VOR News Image

Argentina Asks To Join NATO As President Milei Seeks A More Prominent Role For His Nation

Geoana said he supported Argentina’s bid to become an accredited partner in the alliance, which is a valuable role short of “ally” for nations outside NATO’s geographical territory and not compelled to participate in joint military actions. NATO membership is currently confined to European countries, Turkey, Canada, and the United States.

The classification may provide Argentina with access to modern technology, security systems, and training that it did not previously have, according to the Argentine presidency.

“Argentina plays an important role in Latin America,” Geoana stated at NATO headquarters. “Closer political and practical cooperation could benefit us both.”

Milei has been promoting a radical libertarian agenda aimed at undoing years of protectionist trade policies, overspending, and debilitating international debt that have thrown the country’s economy into disarray.

AP – VOR News Image

Argentina Asks To Join NATO As President Milei Seeks A More Prominent Role For His Nation

Over the last four months as president, he has reshaped Argentina’s foreign policy to one of almost unconditional support for the United States, as part of an effort to restore Argentina’s global economic prominence after previous administrations allowed relations with Washington and European allies to deteriorate.

Milei’s government is likewise looking for security gains from improved ties with Western countries. On Thursday, the US government revealed that it would provide Argentina with $40 million in foreign military financing for the first time in more than two decades, allowing critical US allies such as Israel to purchase American weapons.

The money, meant to assist Argentina equip and modernize its military, will help cover the cost of 24 American F-16 fighter aircraft purchased from Denmark earlier this week. Defense Minister Petri described the acquisition of the upgraded jets as “the most important military purchase since Argentina’s return to democracy” in 1983. Milei’s political opponents have criticized the $300 million price tag, which comes as he lowers government expenditure.

Formal partnership with NATO requires the agreement of all 32 NATO countries. Argentina’s relations with crucial NATO partner Britain have been strained since 1982, when the two went to war over the disputed Falkland Islands in the South Atlantic.

The Alliance’s other global partners include Afghanistan, Australia, Iraq, Japan, the Republic of Korea, Mongolia, New Zealand, and Pakistan. Colombia is now NATO’s lone partner in Latin America.

Giving a country the title of “global partner” does not guarantee that NATO allies will defend it in the case of an attack. That pledge, outlined in Article 5 of the North Atlantic Treaty Organization’s founding treaty, is limited to full members of the alliance.

Express – VOR News Image

Argentina Asks To Join NATO As President Milei Seeks A More Prominent Role For His Nation

NATO’s conversation with Argentina began in the early 1990s. Former President Bill Clinton labeled Argentina a “major non-NATO ally” in 1998, partly as a symbolic gesture to reward the pro-American government at the time for contributing soldiers on peacekeeping operations in Bosnia.

SOURCE – (AP)

-

News5 months ago

News5 months agoDeath Toll From Flooding In Somalia Climbs To Nearly 100

-

Business5 months ago

Business5 months agoGoogle Will Start Deleting ‘Inactive’ Accounts In December. Here’s What You Need To Know

-

Entertainment5 months ago

Entertainment5 months agoMerriam-Webster’s 2023 Word Of The Year Is ‘Authentic’

-

Sports5 months ago

Sports5 months agoPanthers Fire Frank Reich In His First Season With Team Off To NFL-Worst 1-10 Record

-

Celebrity5 months ago

Celebrity5 months agoElon Musk Visits Destroyed Kibbutz and Meets Netanyahu in Wake of Antisemitic Post

-

Celebrity5 months ago

Celebrity5 months agoShane MacGowan, Lead Singer Of The Pogues And A Laureate Of Booze And Beauty, Dies At Age 65