Finance

BANK 2023: Class Action Suit Filed Against Silicon Valley Bank Parent

A class action lawsuit is being brought against the parent company of Silicon Valley Bank, its CEO, and its CFO on the grounds that they didn’t tell the public about the risks that rising interest rates would pose to their business.

A lawsuit was brought against SVB Financial Group, CEO Greg Becker, and CFO Daniel Beck in the Northern District of California. It requests that investors in SVB, between June 16, 2021, and March 10, 2023, get specific damages.

The Federal Reserve’s warnings about interest rate hikes needed to be adequately taken into account in some of SVB’s quarterly and yearly financial reports, according to the complaint brought by shareholders led by Chandra Vanipenta.

In particular, the lawsuit argued that annual reports for 2020 through 2022 “understated the dangers posed to the company by not reporting that likely interest rate hikes, as detailed by the Fed, had the potential to create permanent damage to the company,” the lawsuit stated.

Just as the tech sector began to expand, venture investors opened accounts at Silicon Valley Bank.

Additionally, it asserts that the business “failed to disclose that it was particularly susceptible to a bank run if its investments were adversely affected by rising interest rates.”

Small businesses and people who had deposits at the financial institution are concerned after Silicon Valley Bank’s collapse, which has shaken the technology sector. Some people are relieved by the Biden administration’s decision to guarantee all Silicon Valley Bank deposits over the insured maximum of $250,000 per account.

Silicon Valley swiftly became known as the “go-to” location for venture capitalists seeking financial partners more receptive to novel business ideas than its larger, more established competitors who were still lagging in terms of technology.

Just as the tech sector began to expand, venture investors opened accounts at Silicon Valley Bank and recommended the entrepreneurs they were funding do the same.

Their friendly relationship ended when the bank revealed a $1.8 billion loss on low-yielding bonds bought before interest rates spiked last year. This alarming news sparked a disastrous run on deposits among its tech-savvy customer base.

SOURCE – (AP)

Business

Tesla wants shareholders to reinstate $56 billion pay package for Musk rejected by Delaware judge

AUSTIN, Texas – Tesla will ask shareholders to approve the reinstatement of a $56 billion compensation package for CEO Elon Musk, which a Delaware judge rejected earlier this year, and move the electric car manufacturer’s headquarters from Delaware to Texas.

In a statement with federal regulators early Wednesday, the business stated that shareholders will vote on both measures at its annual meeting on June 13.

Winipeg Free Press – VOR News Image

Tesla wants shareholders to reinstate $56 billion pay package for Musk rejected by Delaware judge

The Tesla board of directors offered Musk an unprecedented compensation plan that could be worth $55.8 billion over ten years starting in 2018, but Chancellor Kathaleen St. Jude McCormick ruled in January that Musk is not eligible for it.

Five years ago, a Tesla shareholder lawsuit argued that the pay package should be void because Musk dictated it and forged agreements with directors who weren’t impartial to him.

Musk announced a month after the judge’s decision that he would try to relocate Tesla’s corporate listing to Texas, where he has already relocated the company’s headquarters.

Almost immediately after the judge’s order, Musk moved Neuralink, his privately held brain implant company, from Delaware to Nevada.

Tesla met all of the operational and stock value benchmarks outlined in a 2018 CEO pay package, according to Chairperson Robyn Denholm in a letter to shareholders this week. She also stated that Musk has met the automaker’s growth expectations.

“Because the Delaware Court second-guessed your decision, Elon has not been paid for any of his work for Tesla for the past six years, which has helped to generate significant growth and stockholder value,” Denholm said. “That strikes us — and the many stockholders from whom we already have heard — as fundamentally unfair, and inconsistent with the will of the stockholders who voted for it.”

According to a regulatory filing, Tesla delivered 1.8 million electric vehicles worldwide in 2023. However, the value of its shares has dropped sharply this year as sales of electric vehicles fall.

CTV News – VOR News Image

Tesla wants shareholders to reinstate $56 billion pay package for Musk rejected by Delaware judge

Future growth is still being determined, and it may be difficult to persuade shareholders to support a large pay package in a market where competition has increased globally, and demand for electric vehicle sales is declining. Shareholders will also be asked to submit a nonbinding advisory vote on future CEO pay.

Tesla’s stock has lost over one-third of its worth this year as dramatic price cuts have yet to attract new purchasers. The business said it shipped 386,810 automobiles from January to March, about 9% fewer than last year.

Musk’s package was valued at more than $55.8 billion at the time of the Delaware court verdict, but the court may have cost the erratic CEO more than $10 billion due to the company’s stock decline this year. According to the report, Musk’s 2018 remuneration totaled $44.9 billion at the close of trading on April 12.

Since last year, Tesla has reduced prices by up to $20,000 on some models. The price decreases caused the prices of used electric vehicles to fall, reducing Tesla’s profit margins.

Tesla announced this week that it would lay off nearly 10% of its workforce, or approximately 14,000 individuals.

Following receipt of a report from a special committee under the direction of one board member, Kathleen Wilson-Thompson, Tesla’s board stated in the filing that it sought shareholder approval of Musk’s 2018 compensation package.

WHDH – VOR News Image

Tesla wants shareholders to reinstate $56 billion pay package for Musk rejected by Delaware judge

The board stated that if a significant vote is cast against future executive pay packages, “we will consider our stockholders’ concerns, and the compensation committee will evaluate whether any actions are necessary to address those concerns.”

Tesla Inc. shares, which fell another 8% this week, were marginally down in trade shortly after Wednesday’s opening bell.

SOURCE – (AP)

Finance

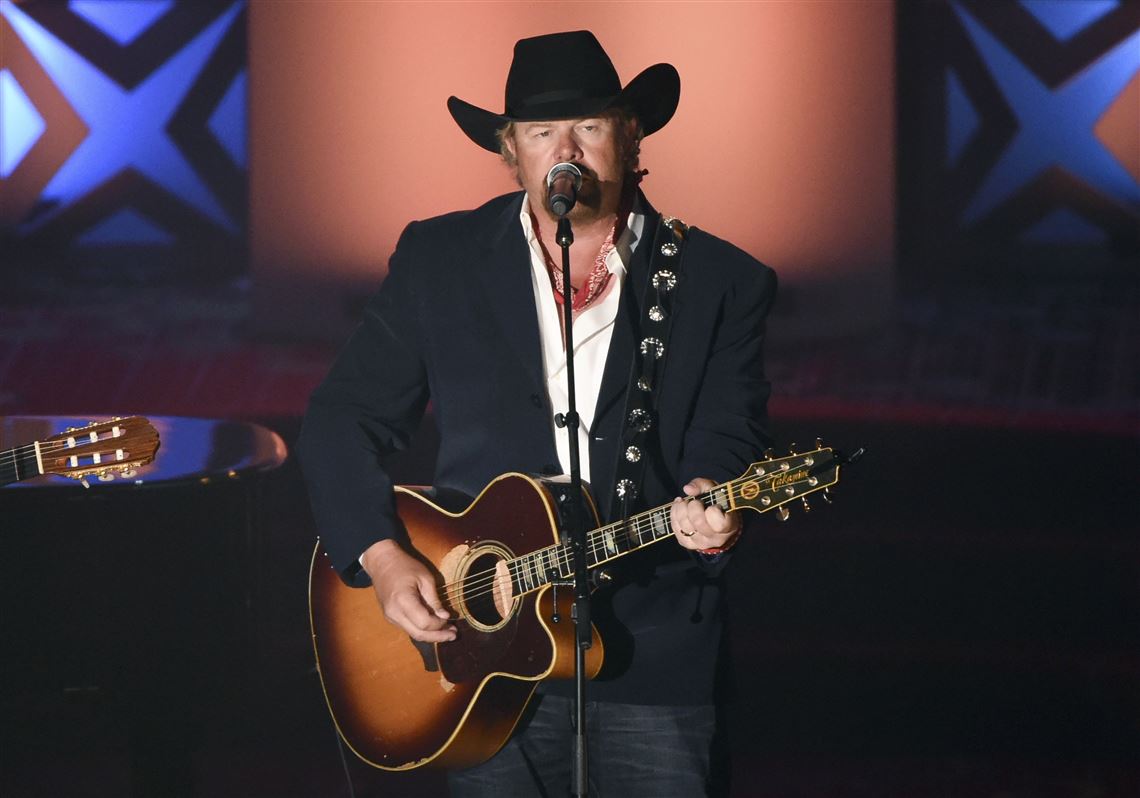

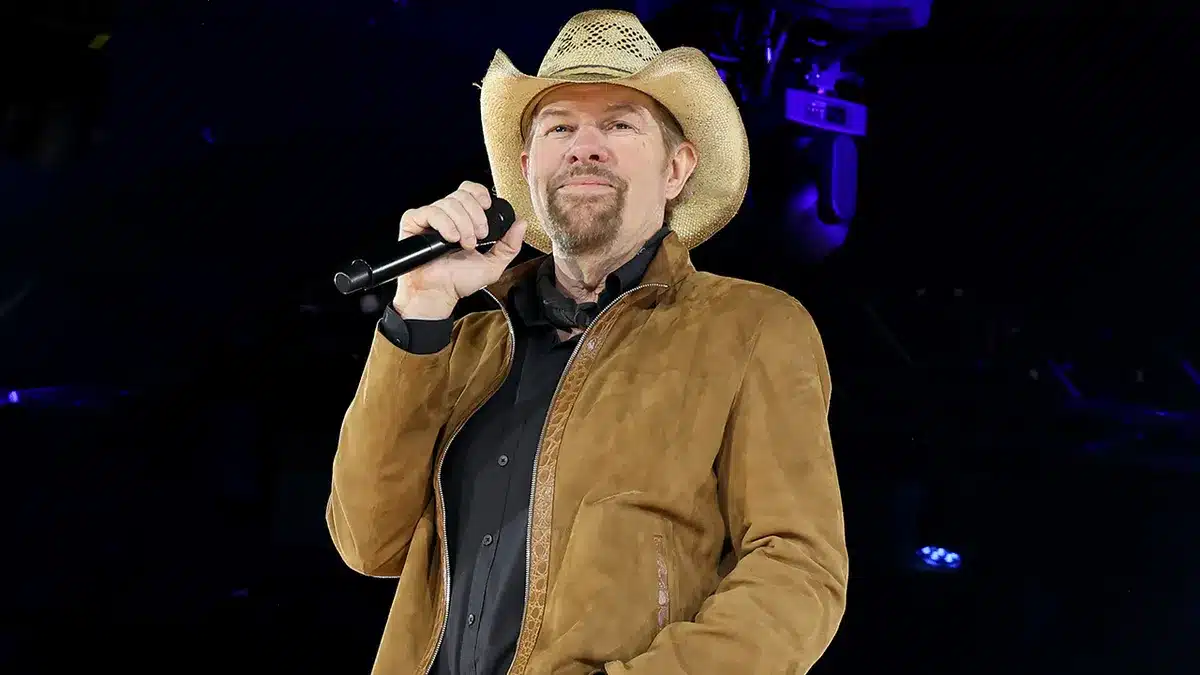

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

Toby Keith, a popular country singer known for his pro-American anthems who enraged detractors while also winning over millions of admirers, has died. He was 62.

According to a statement on his website, the singer-songwriter of “Should’ve Been a Cowboy,” who had stomach cancer, passed away peacefully on Monday with his family by his side. “He fought his fight with grace and courage,” the statement read. He disclosed his cancer diagnosis in 2022.

The 6-foot-4 vocalist rose to prominence during the country boom of the 1990s, producing songs that listeners enjoyed hearing. Throughout his career, he publicly clashed with other celebrities and journalists and frequently fought against record executives who sought to tame his rough edges.

He was recognized for his overt patriotism in post-9/11 songs like “Courtesy of the Red, White, and Blue,” as well as loud barroom songs like “I Love This Bar” and “Red Solo Cup.” He possessed a big, booming voice, a tongue-in-cheek sense of humour, and a range that could carry love and drinking songs.

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

His 20 No. 1 Billboard successes included “How Do You Like Me Now?!,” “As Good As I Once Was,” “My List,” and “Beer for My Horses,” a duet with Willie Nelson. His influences included fellow working-class songwriters such as Merle Haggard, and he had more than 60 singles on the Hot Country chart over his career.

Keith continues to perform despite his cancer treatments, most recently in Las Vegas in December. In 2023, he also performed at the People’s Choice Country Awards with his song “Don’t Let the Old Man In.”

“Cancer is a roller coaster,” he told KWTV in an interview broadcast last month. “You simply sit here and wait for it to go away. “It may never go away.”

Keith worked as a roughneck in Oklahoma’s oil fields as a young man, then played semi-pro football before beginning his singing career.

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

“I write and sing about life, and I don’t overanalyze things,” Keith told The Associated Press in 2001, following the popularity of his song “I’m Just Talking About Tonight.”

Keith received valuable lessons in the growing oil fields, which toughened him up and taught him the importance of money.

“The money to be made was unbelievable,” Keith told the Associated Press in 1996. “I graduated from high school in 1980, and they hired me in December 1979 for $50,000 a year. “I was 18 years old.

However, the domestic oilfield business crumbled, and Keith was not saved. “It almost broke us,” he admitted. “So, I just learned. I took care of my money this time.”

He played a few seasons as a defensive end for the Oklahoma City Drillers, a farm team for the now-defunct United States Football League. But he made consistent money playing music with his band on Oklahoma and Texas’s red dirt roadhouse circuit.

“All through this whole thing, the only constant thing we had was music,” he said. “But it’s difficult to sit back and say, ‘I’m going to make a fortune singing or writing music.’ I had no contacts.

His path eventually led him to Nashville, where he piqued the eye of Mercury Records’ head, Harold Shedd, best known for producing the success group Alabama. Shedd signed him to Mercury, where he launched his platinum debut album, “Toby Keith,” in 1993.

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

His breakout hit, “Should’ve Been a Cowboy,” was played 3 million times on radio stations, making it the most popular country song of the 1990s.

However, the label’s focus on worldwide superstar Shania Twain eclipsed the rest of the group, and Keith believed that the executives were attempting to steer him in a pop path.

“They were trying to get me to compromise, and I was living a miserable existence,” Keith was quoted as saying by the AP. “Everybody was trying to mould me into something I was not.”

Keith signed with DreamWorks Records in 1999, following a string of albums that included singles including “Who’s That Man” and a cover of Sting’s “I’m So Happy I Can’t Stop Crying.”

That’s when his multiweek hit “How Do You Like Me Now?!” went viral and became his first Top 40 smash. In 2001, he won male vocalist and album of the year at the Academy of Country Music Awards, screaming on stage, “I’ve waited a long time for this. “Nine years!”

Keith frequently wore his politics on his sleeve, particularly following the terrorist attacks on American soil in 2001, and he initially identified as a conservative Democrat before later claiming to be independent. He performed in events for Presidents George W. Bush, Barack Obama, and Donald Trump, who awarded him the National Medal of the Arts in 2021. His music and forthright opinions occasionally sparked controversy, which he appeared to relish.

His 2002 song “Courtesy of the Red, White and Blue (The Angry American)” carried a threat — “We’ll put a boot in your ass — It’s the American way” — to anyone who attempted to interfere with America.

That song was removed from a patriotic ABC Fourth of July special because producers felt it was too furious for the broadcast. Singer-songwriter Steve Earle described Keith’s song as “pandering to people’s worst instincts at a time when they are hurt and scared.”

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

Then there was the conflict between Keith and The Chicks (previously known as the Dixie Chicks), who became Keith’s target after singer Natalie Maines informed a crowd that they were embarrassed by then-President George W. Bush. Maines had previously described Keith’s song as “ignorant.”

Keith, who had previously stated that he backed any artist’s right to express their political views, juxtaposed a doctored photo of Maines with an image of Saddam Hussein at his shows, inciting even more outrage among fans.

Maines retaliated by wearing a blouse with the letters “FUTK” onstage at the 2003 ACM Awards, which many people saw as a rude message to Keith.

Keith, who has admitted to holding grudges, stormed out of the ACM Awards early in 2003 after being spurned in earlier categories, missing out when he was named entertainer of the year. Vincent Gill accepted on his behalf. He returned the following year and won the top prize for the second year in a row, as well as best male vocalist and album of the year for “Shock ‘n Y’all.”

His pro-military stance was more than just material for songs. He embarked on 11 USO trips to visit and perform for overseas troops. Throughout his career, he has helped raise millions of dollars for charity, including constructing a home in Oklahoma City for children with cancer and their families.

Keith restarted his career after Universal Music Group acquired DreamWorks, launching his record label, Show Dog, in 2005 alongside record executive Scott Borchetta, who founded his label, Big Machine.

“Probably 75% of the people in this town think I’ll fail, and the other 25% hope I fail,” he said.

Keith, Trace Adkins, Joe Nichols, Josh Thompson, Clay Walker, and Phil Vassar were among the artists signed to the label, which later became Show Dog-Universal Music.

His following singles were “Love Me If You Can,” “She Never Cried in Front of Me,” and “Red Solo Cup.” He was elected into the Songwriters Hall of Fame in 2015.

He received the BMI Icon award in November 2022, a few months after announcing his stomach cancer diagnosis.

“I always believed that songwriting was the most important aspect of this entire industry,” Keith told the audience of fellow singers and writers.

SOURCE – (AP)

Business

Amazon Will Invest In Diamond Sports As Part Of Bankruptcy Restructuring Agreement

Amazon will collaborate with Diamond Sports as part of a restructuring arrangement as the largest owner of regional sports networks seeks to exit bankruptcy.

Diamond controls 18 networks under the Bally Sports label. Those networks own 37 professional teams, including 11 baseball, 15 NBA, and 11 NHL.

Diamond Sports has been in Chapter 11 bankruptcy proceedings in the Southern District of Texas since filing in March. In a late 2021 financial file, the corporation reported $8.67 billion in debt.

Diamond Sports announced the terms of the transaction Wednesday morning. Amazon has no comments. It is still subject to clearance by the bankruptcy court.

Amazon Will Invest In Diamond Sports As Part Of Bankruptcy Restructuring Agreement

The agreement with Diamond Sports’ main creditors permits the company to emerge from bankruptcy, continue operations and avoid a catastrophic collapse of the regional sports network system, which would force the NBA, NHL, and MLB to step in and take over production and distribution of the majority of their teams.

Last season, MLB was forced to take over production and distribution of the San Diego Padres and Arizona Diamondbacks after Diamond let rights payments to the Padres lapse and could not reach an improved agreement with the Diamondbacks.

According to the terms of the restructuring deal, Amazon will make a minority investment in Diamond and enter into a commercial agreement to provide access to Diamond’s content through Prime Video.

Customers can watch their local team’s programming on Prime Video channels, which Diamond holds rights to. Price and availability will be revealed at a later date. Regional sports material will still be available on cable and satellite providers.

Amazon Prime already offers some New York Yankees and Brooklyn Nets games broadcast by the YES Network.

Diamond has also agreed, in principle, with Sinclair Broadcast Group to resolve pending litigation between the businesses.

Sinclair acquired the regional sports networks from The Walt Disney Company for almost $10 billion in 2019. The Department of Justice forced Disney to sell the networks before its acquisition of 21st Century Fox’s film and television assets could be approved.

Amazon Will Invest In Diamond Sports As Part Of Bankruptcy Restructuring Agreement

Even before Sinclair purchased the regional networks, the company was experiencing a downturn owing to cord-cutting and declining advertising revenue after entering into excessive long-term contracts with certain teams.

Diamond Sports Group was spun out from Sinclair last year after reaching an arrangement with its creditors.

Sinclair will pay Diamond $495 million as part of the settlement and will continue supporting Diamond’s reorganization. The settlement monies will also be used to repay some creditors.

“We are thrilled to have reached a comprehensive restructuring agreement that provides a detailed framework for a reorganization plan and substantial new financing that will enable Diamond to operate and thrive beyond 2024,” Diamond Sports CEO David Preschlack said in a statement.

“We are appreciative for Amazon’s and a handful of our top creditors’ backing, as they obviously believe in the business’s value-creation potential.

Amazon Will Invest In Diamond Sports As Part Of Bankruptcy Restructuring Agreement

Diamond’s immediate priority will be to implement the RSA and emerge from bankruptcy as a going concern for the benefit of our investors, staff, team, league and distribution partners, and the millions of fans who will continue to watch our broadcasts.”

Diamond just finalized agreements with the NHL and NBA to retain local rights through the end of the current season. It is still in talks with Major League Baseball about reworking agreements for the upcoming season, with the next court hearing set for Friday.

SOURCE – (AP)

-

News5 months ago

Death Toll From Flooding In Somalia Climbs To Nearly 100

-

Business5 months ago

Google Will Start Deleting ‘Inactive’ Accounts In December. Here’s What You Need To Know

-

Entertainment5 months ago

Merriam-Webster’s 2023 Word Of The Year Is ‘Authentic’

-

Sports5 months ago

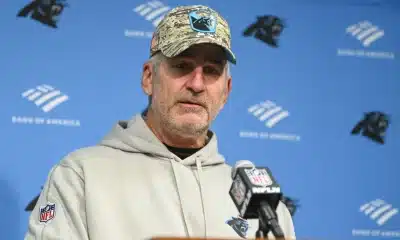

Panthers Fire Frank Reich In His First Season With Team Off To NFL-Worst 1-10 Record

-

Celebrity5 months ago

Elon Musk Visits Destroyed Kibbutz and Meets Netanyahu in Wake of Antisemitic Post

-

Celebrity5 months ago

Shane MacGowan, Lead Singer Of The Pogues And A Laureate Of Booze And Beauty, Dies At Age 65