Money

2023 Swiss Regulator: Credit Suisse Made ‘Serious Breach’ Of Law

GENEVA, Switzerland — Swiss regulators have determined that Credit Suisse committed a “serious breach” of law in connection with a now-bankrupt firm linked to Australian financier Lex Greensill and have launched an investigation that could result in penalties for four former bank executives.

FINMA, Switzerland’s financial markets authority, announced Tuesday that it had concluded enforcement proceedings against Credit Suisse that were initiated two years ago after bank partner Greensill Capital went bankrupt. At the time, Credit Suisse closed four funds that were linked to the partnership. About $10 billion was invested in these funds by bank clients.

Credit Suisse’s troubled ties to Greensill Capital were just one of a slew of issues that have resulted in repeated top-management shake-ups and corporate restructurings in recent years. Greensill Capital was also the subject of investigations in the United Kingdom, with allegations that the firm founded by Greensill, a former adviser to former British Prime Minister David Cameron, received lucrative government contracts before going bankrupt.

In Switzerland, FINMA announced that to conclude its investigation, Credit Swiss’s top executives must regularly review about 500 of its most important business relationships and record the responsibilities of about 600 of its highest-ranking employees. The authority also stated that it had opened four enforcement proceedings against former bank executives, whom it did not name.

FINMA announced that to conclude its investigation, Credit Swiss’s top executives

“FINMA came to the conclusion that Credit Swiss Group seriously broke its supervisory duty over the years by failing to identify, limit, and monitor risks in its business relationship with Lex Greensill,” it said. “FINMA thus concludes that a serious breach of Swiss supervisory law has occurred.”

The authority collaborates with financial institutions, including banks, insurance companies, and the Swiss stock exchange, to ensure proper internal controls and stability. FINMA’s ability to issue penalties is limited, but it does have the authority to revoke business licenses in extreme cases. If more severe penalties or fines are warranted, it is up to prosecutors to pursue them.

In Greensill’s “supply chain finance” model, his company acted as a middleman between businesses and their suppliers, paying invoices that suppliers issued to their customers in exchange for a fee. The claims against those customers were then converted into securities that could be sold. Financial products became far riskier than initially indicated over time.

Credit Suisse “made partly false and overly positive statements” to FINMA about how claims were chosen and the exposure to some debtors, according to FINMA.

Credit Suisse expressed its appreciation for the case’s resolution without naming Greensill. Since March 2021, the Zurich-based bank has taken steps to strengthen governance and control, including dismissing “several managers and employees” in its asset management division, among other things.

SOURCE – (AP)

Business

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

A long-running antitrust lawsuit launched by retailers has been settled by Visa, Mastercard, and the banks that issue credit cards via them, two of the biggest credit card networks in the world.

According to a news release announcing the settlement Tuesday morning, the settlement is expected to reduce retailers’ swipe fees when customers make purchases using their Visa or Mastercard by $30 billion over five years.

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

The settlement is the outcome of a lawsuit filed in 2005 and exclusively pertains to US merchants. Everything is deemed final unless the US District Court approves it for the Eastern District of New York. Even in that instance, there may be a protracted appeals process.

According to the National Retail Federation, swipe fees typically cost retailers 2% of a client’s total transaction, but they can cost as much as 4% for certain premium rewards cards. The settlement would reduce such fees by at least 0.04 percentage points for a minimum of three years.

Furthermore, the settlement calls for Visa and Mastercard to continue charging swipe fees at the same rates as of December 31, 2023, for five years.

The NRF told CNN that the trade association for retailers had “some very real concerns” about the settlement.

Stephanie Martz, the general attorney and chief administrative officer of the NRF, told CNN that the lower swipe fees that may result from the settlement won’t significantly alter the landscape for retailers. Martz continued, “The savings would amount to pennies on the dollar.”

She continued, “The fact remains that these fees are an unfair business practice that benefits banks and harms consumers and merchants.”

How the changes will affect cardholders

While retailers have long said that swipe fees compel them to raise prices, customers would not necessarily save money due to the settlement.

This is so that retailers can charge extra to clients based on the type of Visa or Mastercard they use, thanks to the settlement. Cardholders who receive benefits like cash back or airline miles would suffer as a result of those surcharges due to the potential increase in swipe costs.

Conversely, as merchants could work with banks to persuade them to use what they saw as a favored card, some cardholders might receive discounts on goods and services.

Businesses that take Visa or Mastercard must take both types of cards.

Kim Lawrence, president of Visa North America, released a statement on Tuesday morning stating that the perks that Visa cardholders enjoy will not change. Furthermore, the deal will not further restrict Americans’ access to credit.

Mastercard spokesman Seth Eisen states that the settlement will not affect rewards or credit availability.

However, TD Cowen analyst Jaret Seiberg stated in a note on Tuesday that the settlement “will represent a threat to credit card rewards and small banks.” He bases this on his suspicion that retailers will “steer customers to preferred credit cards.”

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

According to Seiberg, smaller banks and credit unions are likely to oppose the settlement because it might significantly disadvantage them compared to larger banks that find it easier to negotiate with some of the biggest merchants in the country, such as Walmart.

An alternative to the recently proposed credit card legislation?

In addition to the settlement, a group of senators and representatives from both parties are advocating for new legislation that will lessen the power of Visa and Mastercard.

If the idea is approved, the biggest credit card issuers—JPMorgan Chase, Bank of America, and Citibank—would have to collaborate with two rather than just one processor. Additionally, they are unable to use both Visa and Mastercard as their processors.

Even when the settlement is finalized, NRF and other trade associations representing merchants will continue to support these rules.

However, the Republican leader of the House Financial Services Committee, Rep. Patrick McHenry, praised the settlement, calling it “welcome news.”

In a post on X on Tuesday morning, he stated that “legislation isn’t always as practical as commercial or private sector solutions.”

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

The announcement on Tuesday comes just one month after Discover (DFS) and Capital One (COF) said they would merge, creating the largest credit card firm in the country if shareholders and financial regulators agreed. According to Seiberg, the settlement may make the merger more difficult to approve.

According to him, Capital One, which presently offers credit cards through Visa and Mastercard, would probably attempt to increase the number of people who use its credit cards by securing more agreements with retailers.

Following the deal’s announcement, Visa (V) and Mastercard (MA) shares slightly increased.

SOURCE – (CNN)

Business

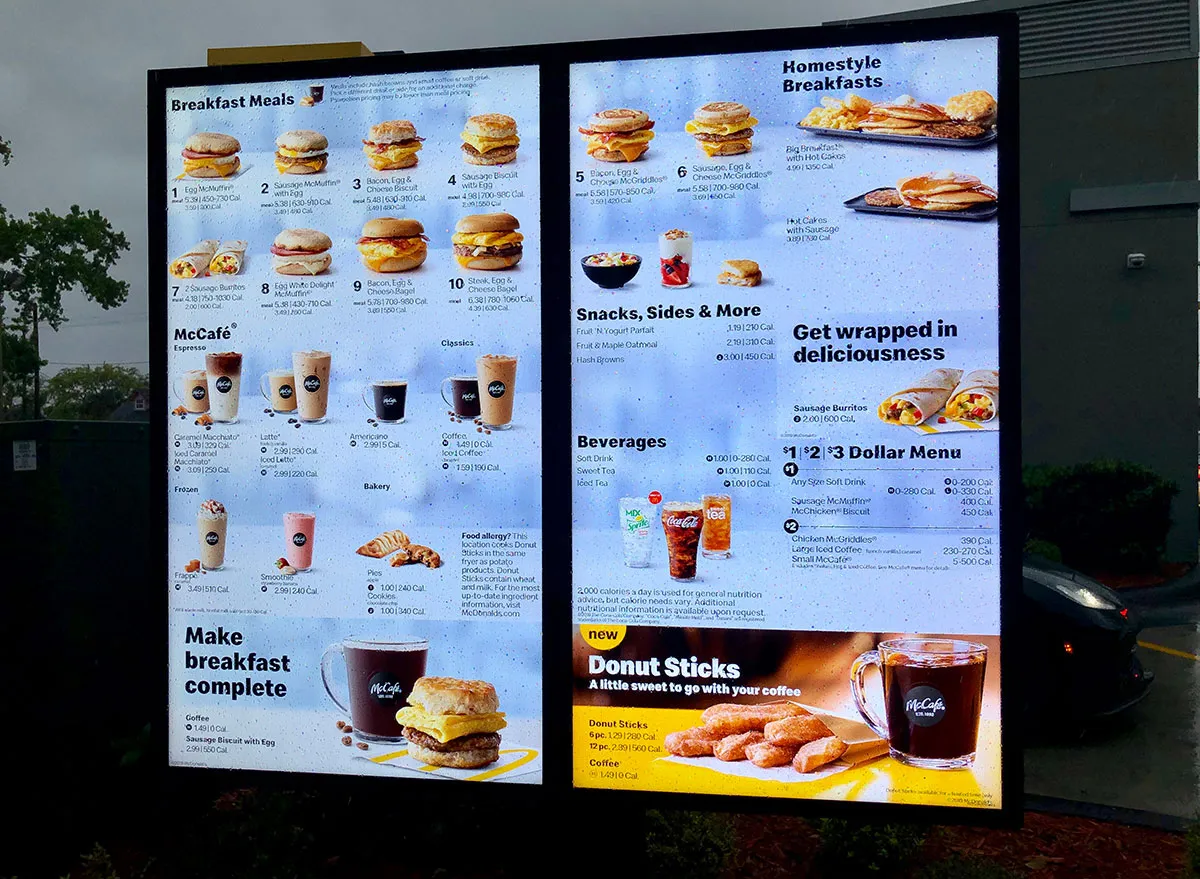

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

Some lower-income Americans are turning away from McDonalds in favour of cooking at home, according to the fast food chain’s chief financial officer, who spoke at an investor conference Wednesday.

“It’s a challenging consumer environment,” said Ian Borden, McDonald’s CFO, stressing that many people are struggling with inflation, rising interest rates, and shrinking savings.

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

The sting of inflation has prompted Americans to cut back on little luxuries. This includes spending on food at fast-food restaurants like McDonald’s, which traditionally valued value and affordability as major company objectives.

Dining out has become a luxury. According to February inflation figures from the Consumer Price Index, food prices at home rose 1% yearly, while restaurant prices rose 4.5%.

However, the current rise in restaurant pricing has reversed the trend from a year ago, when it was cheaper to dine out. At the time, restaurant costs were up 8.4%, while supermarket prices were up 10.2% year on year.

“Some of those consumers are just choosing to eat at home more often,” said Borden.

To reclaim these customers, Borden stated that McDonalds provides more bang for their money in the drive-thru, including packages priced at $4 or less at 90% of its US outlets.

“We want to make sure the consumer knows what’s available and obviously is thinking of us when they’re making their choices,” said Borden.

McDonalds has also struggled financially on a global scale. For example, the fast-food company has stated that the Middle East’s unrest has impacted regional sales.

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

Sales in its licensed markets division, which includes most of its Middle Eastern locations, increased by only 0.7% in the fourth quarter, significantly below the growth of more than 4% in the United States and other foreign companies.

Whether a client is shopping for groceries or eating out, prices appear lower than they have been in years since the pandemic began. According to CPI data, food inflation is rising at the slowest rate since May 2021. Grocery store price increases have reached their lowest point since June 2021, while food inflation in restaurants has increased by the least amount since July 2021.

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

Consumers have also reduced their spending at bargain brand Family Dollar, whose parent firm announced Wednesday that it will close roughly 1,000 locations. According to company leaders, decades of rising inflation have driven customers away, reducing profits and aggravating competition with Dollar General and Walmart. Family Dollar also dealt with years of mismanagement and bad store conditions.

McDonalds stock was down about 3% in afternoon trading.

SOURCE – (CNN)

Business

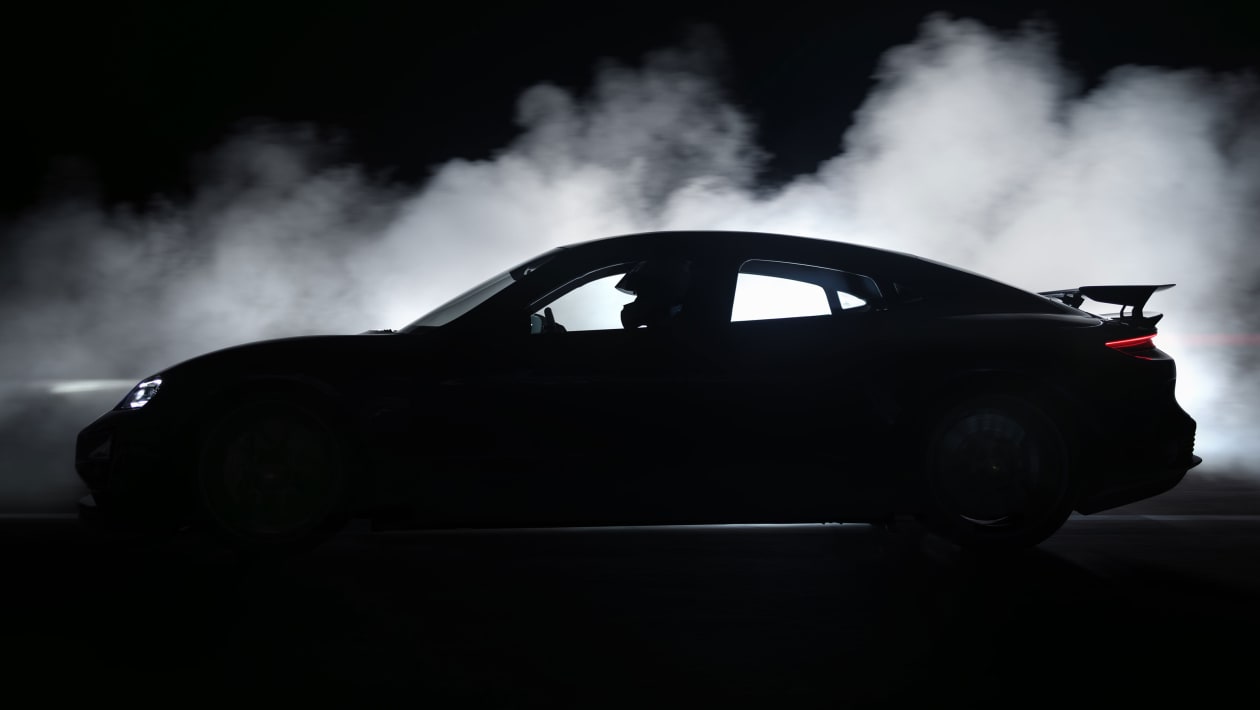

Porsche Unveiled One Of The World’s Fastest Road Cars, With A 1,000-Horsepower ‘Launch Control’ Button.

Porsche today unveiled its most powerful production or mass-produced vehicle. The 1,093-horsepower electric Taycan Turbo GT, which will be available this summer, has already set two electric car racetrack speed records. It even beat the record set by a Tesla Model S by an impressive 18 seconds.

Electric automobiles are more likely to have high horsepower and impressive acceleration than gasoline-powered vehicles, especially since EVs can have numerous motors. Of course, such performance metrics have little practical relevance. It would be only possible to approach this car’s capabilities anywhere else if a racetrack is present, and only a few drivers would be capable of doing so.

Porsche Unveiled One Of The World’s Fastest Road Cars, With A 1,000-Horsepower ‘Launch Control’ Button.

This is about allowing buyers to brag about their car’s theoretical capabilities. And, as governmental pressure to sell more EVs grows, Porsche is putting aside reservations about whether electric cars, with their massive batteries and near-silent operation, can be as exhilarating as gas-powered vehicles.

The Taycan Turbo GT established a world record lap time on Germany’s legendary Nürburgring Nordschleife, a tight, demanding track where automakers regularly test their most competitive sports cars. The Nürburgring requires automobiles that are fast, accelerate rapidly, and corner properly. Sports car manufacturers, like Porsche, will brag about setting a record.

This Turbo GT, a new variant of the electric Taycan, has two motors. Together, they can generate more than 1,000 horsepower. However, this kind of high-horsepower EV experience will be costly. The Porsche will cost approximately $230,000.

The Taycan Turbo GT typically has a maximum power output of 777 horsepower, which is a lot by any standard. However, it has a “launch control” button that allows maximum acceleration from a standstill. When pressed, power output can be raised to 1,093 horsepower for a zero-to-60 time of as little as 2.1 seconds.

How powerful is powerful? In contrast, a regular gas-powered 911 Carrera makes 379 horsepower and is still very quick. A typical Toyota Prius, while not particularly fast, can produce 196 horsepower.

The new Porsche also includes a special “Attack mode” that can be set. This mode increases output to 937 horsepower while firming up the suspension for improved handling. However, “Attack mode” will only last 10 seconds at a time.

According to a spokeswoman, these power levels can only be sustained briefly since the required cooling for the motors and batteries and the actual power output would empty the batteries too quickly.

Porsche Unveiled One Of The World’s Fastest Road Cars, With A 1,000-Horsepower ‘Launch Control’ Button.

The previous record holder at the Nürburgring Nordschleife was the Tesla Model S Plaid Track Package. (The $2.2 million Rimac Nevera electric supercar, which is not a regular production car, was two-tenths a second faster than the Porsche.) The Taycan’s lap time makes the Turbo GT the fastest four-door car on that track, whether electric or not.

Porsche’s EV, the Taycan, is named after a Turkish term that means “spirit of a colt.” The Taycan is typically a four-seat, four-door automobile. It was Porsche’s first entirely electric vehicle, unveiled in 2019. (The German sports car company was formed in 1931 and is now owned by the Volkswagen Group.)

The Taycan Turbo GT will be available in two configurations. One option is the regular Taycan Turbo GT, which will be quick but quite comfortable for street driving. Like most Porsche Taycan vehicles, it will have four seats.

The Porsche Taycan Turbo GT with Weissach Package eliminates backseats and other comfort features to minimise weight. The standard clock in the dashboard needs to be included. However, this more aggressive, track-oriented version of the car will not cost more due to the savings on items such as seats and a clock.

Porsche Unveiled One Of The World’s Fastest Road Cars, With A 1,000-Horsepower ‘Launch Control’ Button.

Despite the title, neither of these automobiles has turbochargers because electric vehicles do not employ turbochargers to force air into internal combustion engines. The name of this car means that it is powerful and swift.

Porsche has announced that the next generation of its Boxster and Cayman two-door sports vehicles will be electric. However, Porsche management has stated that the classic 911 sports vehicle will be the final Porsche model to fully electrified.

SOURCE – (CNN)

-

News5 months ago

News5 months agoDeath Toll From Flooding In Somalia Climbs To Nearly 100

-

Business5 months ago

Business5 months agoGoogle Will Start Deleting ‘Inactive’ Accounts In December. Here’s What You Need To Know

-

Entertainment5 months ago

Entertainment5 months agoMerriam-Webster’s 2023 Word Of The Year Is ‘Authentic’

-

Sports5 months ago

Sports5 months agoPanthers Fire Frank Reich In His First Season With Team Off To NFL-Worst 1-10 Record

-

Celebrity5 months ago

Celebrity5 months agoElon Musk Visits Destroyed Kibbutz and Meets Netanyahu in Wake of Antisemitic Post

-

Celebrity5 months ago

Celebrity5 months agoShane MacGowan, Lead Singer Of The Pogues And A Laureate Of Booze And Beauty, Dies At Age 65