Money

Mormon Church Fined For Obscuring $32 Billion Investment Portfolio

SALT LAKE CITY, Utah — The Securities and Exchange Commission fined the Church of Jesus Christ of Latter-day Saints and its investment arm $5 million on Tuesday for using shell companies to conceal the size of the portfolio under church control.

As commonly known, the Mormon Church has billions of dollars invested in stocks, bonds, real estate, and agriculture. The presiding bishopric, which is made up of religious leaders, is in charge of Ensign Peak Advisers, which is a non-profit investment manager.

The Mormon church has agreed to pay $1 million in penalties, while Ensign Peak will pay $4 million.

According to Gurbir Grewal, the SEC’s enforcement director, Ensign Peak avoided disclosing investments “with the church’s knowledge,” denying the SEC and the accurate public information required by law.

According to federal investigators, the firm violated agency rules and the Securities Exchange Act for 22 years by failing to file paperwork that disclosed the value of its assets.

The Mormon Church Needs to Start Paying Taxes

Instead, they claimed Ensign Peak filed the forms through 13 shell companies they established while retaining decision-making authority. They also had “business managers,” most church employees, sign the required shell company filings.

“The Mormon Church was concerned that disclosing its portfolio, which had grown to approximately $32 billion by 2018,” the SEC said in a statement announcing the charges.

Because religious organizations are exempt from paying US taxes, the church and its Salt Lake City-based investment arm have come under increased scrutiny. Ensign Peak is a church-registered supporting organization and integrated auxiliary. Large investment managers are required to report stock holdings quarterly.

It gained traction in 2019 after a whistleblower claimed the church had amassed nearly $100 billion in funds instead of directing them to charitable causes. Since then, Ensign Peak has been a source of fascination and mystery for the nearly 17-million-member Utah-based faith, encouraging members worldwide to give 10% of their income in practice known as “tithing.”

Two years later, prominent church member James Huntsman filed a lawsuit against the mormon church, alleging that it misrepresented how it used donations and invested them in assets such as real estate and an insurance company rather than directing them to charitable causes. Last year, a judge dismissed the complaint, and Huntsman appealed the decision.

Earlier this month, the 2019 whistleblower, David Nielsen, a former Ensign Peak investment manager, submitted a 90-page memorandum to the United States Senate Finance Committee demanding oversight of the mormon church’s finances.

Church officials said that none of their holdings went unreported.

Mormon Church officials said that none of their holdings went unreported during the investigation period, and all were disclosed through separate companies. They stated that they had “relied on legal counsel regarding how to comply with its reporting obligations while attempting to maintain the portfolio’s privacy” and that Ensign Peak had changed its reporting strategy after learning of the SEC’s concerns in 2019.

“We affirm our commitment to following the law, apologize for any errors, and now consider this matter closed,” they said.

Sam Brunson, a Mormon church member and Loyola University Chicago tax law professor, said the $5 million fine differed from previous accusations against Ensign Peak because the church appears to have admitted some fault.

Failure to file SEC paperwork may not spark broader discussions about how the church manages its money, but it does reflect an “incredibly aggressive” strategy to keep certain information hidden from the public, he said.

“The Mormon Church has had an ethos of keeping its finances private for the last 70 years,” Brunson said.

SOURCE – (AP)

News

Police Arrest Six People Over US$14.5 Million Gold Heist in Canada

Six people have been arrested, including a jeweler and a commercial airline employee, and police have issued warrants for three more suspects in connection with what they say the single-largest gold robbery in Canadian history.

According to Peel Regional Police in Ontario, a joint investigation with the United States Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) resulted in the filing of nearly two dozen charges against the suspects in connection with the nearly $20 million Canadian dollar ($14.5 million) heist that occurred a year ago.

During a news conference in Ontario on Wednesday, Peel Regional Police Detective-Sergeant Mike Mavity told reporters that 400 kilograms of gold bars weighing more than 900 pounds, as well as approximately CA$2.5 million ($1.8 million) in stolen bank notes, were hijacked at Toronto Pearson International Airport after arriving on a commercial flight from Europe.

In total, 6,600 gold bars of various sizes were stolen, each of which was “99.9% pure and contained individualized serial numbers,” according to Mavity.

Gold Was in Hull of Air Canada aeroplane: File Photo

According to Peel Regional Police in Ontario, a joint investigation with the United States Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) resulted in nearly two dozen charges being filed against the suspects in connection with the nearly $20 million Canadian dollar heist that occurred on April 17, 2023.

On April 17, 2023, the gold and money were loaded into the hull of an Air Canada flight in “an approved airline container” bound for Toronto.

At 3:56 p.m. same day, the flight arrived at Toronto Pearson International Airport, and the gold and cash were quickly removed from the aircraft and transported to an Air Canada facility.

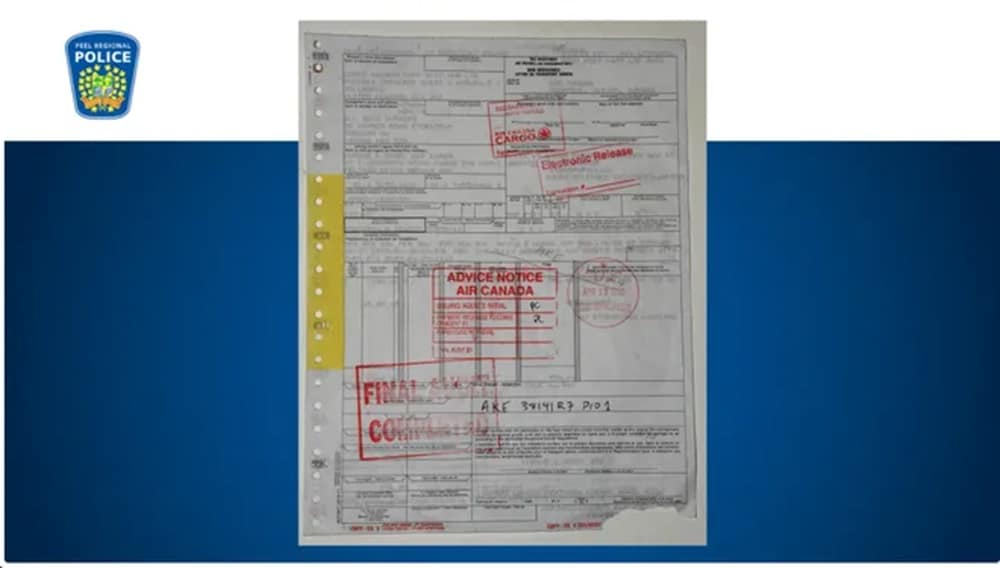

At 6:32 p.m., a man suspect came at air can freight driving a 5-ton truck and approached the property with what police called a counterfeit airway bill, a document used by carriers to track shipments.

Shortly after, a forklift arrived and loaded the item into the suspect’s truck. The suspect then drove off.

Fake Shipping Bill: Photo Peel Police

According to a police press release, officials discovered the document bill at 2:43 a.m. the next day to be a duplicate of an airline bill for a valid shipment of fish delivered and picked up the day before.

According to Mavity, the fake bill was produced at the Air Canada facility, and when officials discovered the products were gone, they used security footage to monitor part of the suspect’s subsequent trip until losing track of the truck in north Milton, an Ontario suburb.

Police stated that the crime was an inside operation and that a former Air Canada manager was wanted in the case.

So far police said they have arrested the following suspects in connection to the gold heist case:

- Air Canada employee Parmpal Sidhu, 54, of Ontario

- Jewelry store owner Ali Raza, 37, of Toronto

- Amit Jalota, 40, of Ontario

- Ammad Chaudhary, 43, of Ontario

- Prasath Paramalingam, 35, of Ontario

All five were released on bail and are scheduled to appear in court at a later date, Mavity said.

The truck driver who allegedly picked up the gold, Durante King-Mclean, 25 of Ontario, is currently in custody in the U.S. on firearms and trafficking related charges.

Here are the suspects at large:

- Air Canada manager Simran Preet Panesar, 31, of Ontario

- Archit Grover, 36, of Ontario

- Arsalan Chaudhary, 42, of Ontario

Only CA$90,000 ($65,000) of the more than CA$20 million recovered, said to Peel Regional Deputy Chief Nick Milinovich.

According to US Today, U.S. ATF Special Agent Eric DeGree, King-Mclean was detained in Pennsylvania following a traffic stop that resulted in the seizure of 65 illicit guns destined for Canada. According to DeGree, King-Mclean attempted to flee after police discovered the firearms in a rental car he was driving.

According to Air Canada spokesman Peter Fitzpatrick, two of the individuals identified by police worked for the airline’s cargo division at the time of the crime.

“One left the company prior to the arrests announced today, and the second has been suspended,” he stated, according to the site. “Because matter is now before the courts, we are unable to speak further.

According to the announcement, only about CA $90,000 (one kilogram of gold) has been found and melted down into bangle bracelets. According to authorities, the remaining gold was most likely melted down and used to purchase illicit weaponry.

“I commend our investigators, the ATF, other law enforcement partners, and our community for working together to identify and arrest those responsible for this brazen crime,” Peel Regional Police Chief Nishan Duraiappah said in a statement this week.

Anyone with information regarding the case should contact Peel Regional Police.

Business

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

A long-running antitrust lawsuit launched by retailers has been settled by Visa, Mastercard, and the banks that issue credit cards via them, two of the biggest credit card networks in the world.

According to a news release announcing the settlement Tuesday morning, the settlement is expected to reduce retailers’ swipe fees when customers make purchases using their Visa or Mastercard by $30 billion over five years.

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

The settlement is the outcome of a lawsuit filed in 2005 and exclusively pertains to US merchants. Everything is deemed final unless the US District Court approves it for the Eastern District of New York. Even in that instance, there may be a protracted appeals process.

According to the National Retail Federation, swipe fees typically cost retailers 2% of a client’s total transaction, but they can cost as much as 4% for certain premium rewards cards. The settlement would reduce such fees by at least 0.04 percentage points for a minimum of three years.

Furthermore, the settlement calls for Visa and Mastercard to continue charging swipe fees at the same rates as of December 31, 2023, for five years.

The NRF told CNN that the trade association for retailers had “some very real concerns” about the settlement.

Stephanie Martz, the general attorney and chief administrative officer of the NRF, told CNN that the lower swipe fees that may result from the settlement won’t significantly alter the landscape for retailers. Martz continued, “The savings would amount to pennies on the dollar.”

She continued, “The fact remains that these fees are an unfair business practice that benefits banks and harms consumers and merchants.”

How the changes will affect cardholders

While retailers have long said that swipe fees compel them to raise prices, customers would not necessarily save money due to the settlement.

This is so that retailers can charge extra to clients based on the type of Visa or Mastercard they use, thanks to the settlement. Cardholders who receive benefits like cash back or airline miles would suffer as a result of those surcharges due to the potential increase in swipe costs.

Conversely, as merchants could work with banks to persuade them to use what they saw as a favored card, some cardholders might receive discounts on goods and services.

Businesses that take Visa or Mastercard must take both types of cards.

Kim Lawrence, president of Visa North America, released a statement on Tuesday morning stating that the perks that Visa cardholders enjoy will not change. Furthermore, the deal will not further restrict Americans’ access to credit.

Mastercard spokesman Seth Eisen states that the settlement will not affect rewards or credit availability.

However, TD Cowen analyst Jaret Seiberg stated in a note on Tuesday that the settlement “will represent a threat to credit card rewards and small banks.” He bases this on his suspicion that retailers will “steer customers to preferred credit cards.”

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

According to Seiberg, smaller banks and credit unions are likely to oppose the settlement because it might significantly disadvantage them compared to larger banks that find it easier to negotiate with some of the biggest merchants in the country, such as Walmart.

An alternative to the recently proposed credit card legislation?

In addition to the settlement, a group of senators and representatives from both parties are advocating for new legislation that will lessen the power of Visa and Mastercard.

If the idea is approved, the biggest credit card issuers—JPMorgan Chase, Bank of America, and Citibank—would have to collaborate with two rather than just one processor. Additionally, they are unable to use both Visa and Mastercard as their processors.

Even when the settlement is finalized, NRF and other trade associations representing merchants will continue to support these rules.

However, the Republican leader of the House Financial Services Committee, Rep. Patrick McHenry, praised the settlement, calling it “welcome news.”

In a post on X on Tuesday morning, he stated that “legislation isn’t always as practical as commercial or private sector solutions.”

Visa And Mastercard Agree To $30 Billion Settlement That Will Lower Merchant Fees

The announcement on Tuesday comes just one month after Discover (DFS) and Capital One (COF) said they would merge, creating the largest credit card firm in the country if shareholders and financial regulators agreed. According to Seiberg, the settlement may make the merger more difficult to approve.

According to him, Capital One, which presently offers credit cards through Visa and Mastercard, would probably attempt to increase the number of people who use its credit cards by securing more agreements with retailers.

Following the deal’s announcement, Visa (V) and Mastercard (MA) shares slightly increased.

SOURCE – (CNN)

Business

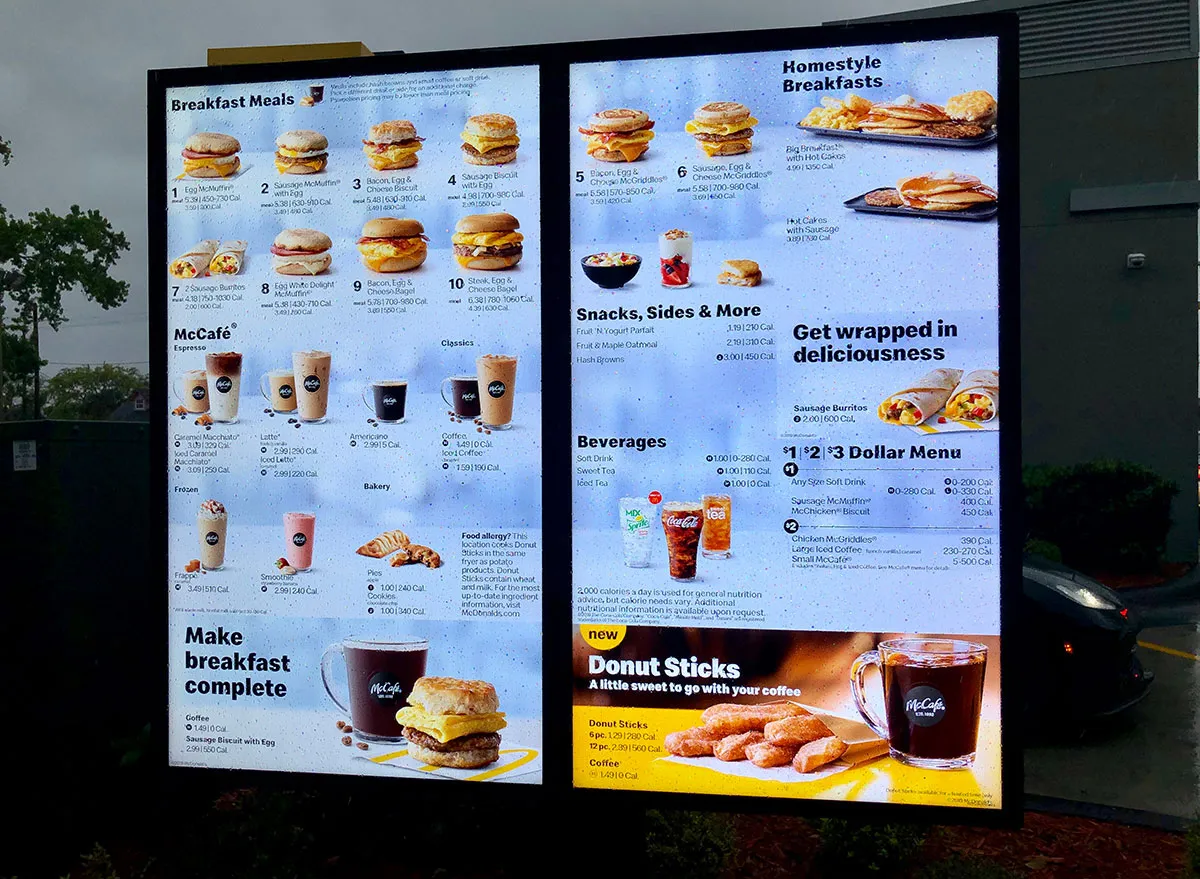

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

Some lower-income Americans are turning away from McDonalds in favour of cooking at home, according to the fast food chain’s chief financial officer, who spoke at an investor conference Wednesday.

“It’s a challenging consumer environment,” said Ian Borden, McDonald’s CFO, stressing that many people are struggling with inflation, rising interest rates, and shrinking savings.

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

The sting of inflation has prompted Americans to cut back on little luxuries. This includes spending on food at fast-food restaurants like McDonald’s, which traditionally valued value and affordability as major company objectives.

Dining out has become a luxury. According to February inflation figures from the Consumer Price Index, food prices at home rose 1% yearly, while restaurant prices rose 4.5%.

However, the current rise in restaurant pricing has reversed the trend from a year ago, when it was cheaper to dine out. At the time, restaurant costs were up 8.4%, while supermarket prices were up 10.2% year on year.

“Some of those consumers are just choosing to eat at home more often,” said Borden.

To reclaim these customers, Borden stated that McDonalds provides more bang for their money in the drive-thru, including packages priced at $4 or less at 90% of its US outlets.

“We want to make sure the consumer knows what’s available and obviously is thinking of us when they’re making their choices,” said Borden.

McDonalds has also struggled financially on a global scale. For example, the fast-food company has stated that the Middle East’s unrest has impacted regional sales.

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

Sales in its licensed markets division, which includes most of its Middle Eastern locations, increased by only 0.7% in the fourth quarter, significantly below the growth of more than 4% in the United States and other foreign companies.

Whether a client is shopping for groceries or eating out, prices appear lower than they have been in years since the pandemic began. According to CPI data, food inflation is rising at the slowest rate since May 2021. Grocery store price increases have reached their lowest point since June 2021, while food inflation in restaurants has increased by the least amount since July 2021.

McDonalds Prices Are Up, So Lower-Income Consumers Are Eating At Home

Consumers have also reduced their spending at bargain brand Family Dollar, whose parent firm announced Wednesday that it will close roughly 1,000 locations. According to company leaders, decades of rising inflation have driven customers away, reducing profits and aggravating competition with Dollar General and Walmart. Family Dollar also dealt with years of mismanagement and bad store conditions.

McDonalds stock was down about 3% in afternoon trading.

SOURCE – (CNN)

-

News5 months ago

Death Toll From Flooding In Somalia Climbs To Nearly 100

-

Business5 months ago

Google Will Start Deleting ‘Inactive’ Accounts In December. Here’s What You Need To Know

-

Entertainment5 months ago

Merriam-Webster’s 2023 Word Of The Year Is ‘Authentic’

-

Sports5 months ago

Panthers Fire Frank Reich In His First Season With Team Off To NFL-Worst 1-10 Record

-

Celebrity5 months ago

Elon Musk Visits Destroyed Kibbutz and Meets Netanyahu in Wake of Antisemitic Post

-

Celebrity5 months ago

Shane MacGowan, Lead Singer Of The Pogues And A Laureate Of Booze And Beauty, Dies At Age 65