Tech

Big Tech Layoffs Tied to Record Inflation in 2022

Layoffs at Big Tech behemoths such as Twitter, Amazon.com, and Meta Platforms (Facebook) are the first on a large scale since early 2020.

After years of falling unemployment in the United States, it may appear that Silicon Valley is heralding the start of a dystopian future for workers. However, there is a good chance that what happens in Silicon Valley will not affect the rest of the economy.

A few years ago, big tech firms were quick to hire. After the pandemic struck in 2020, it took four months for employment in the “other information” sector to return to pre-pandemic levels. In comparison, total employment did not recover for another 29 months.

Regarding firing, Big tech in Silicon Valley is also ahead of the curve. Rising interest rates make capital more expensive, forcing businesses to cut spending on future projects.

This is especially difficult for tech companies that rely heavily on innovation to drive growth. Elon Musk cut Twitter’s headcount in half in November to cut costs. Employment has since fallen further as dissatisfied employees resign.

Companies are still hiring elsewhere. In September, there were roughly two job openings for every available worker.

According to Indeed, job postings for restaurant workers were up 38% from pre-pandemic levels as of Nov. 10. Listings for hospitality and tourism are 15% higher than they were previously.

Big Tech layoffs and slower hiring

Could Silicon Valley’s aches and pains spread? That depends on the Federal Reserve, which is mandated to reduce inflation from 6.3% to 2%, excluding food and energy prices.

In September, officials warned that the fight would almost certainly result in layoffs and slower hiring. According to the Fed’s projections, unemployment will reach 4.4% in 2024, implying that 1.2 million more people will be out of work.

Nonetheless, inflation appears to have peaked in June. On Wednesday, Fed Governor Christopher Waller suggested that such a trade-off might be avoidable.

This raises the prospect of a tech-specific adjustment rather than a white-collar recession. That’s not much consolation for employees returning their door badges. However, it suggests that Silicon Valley’s modest purge may be the worst it gets.

Amazon.com, Twitter, Meta Platforms, and other technology companies have recently laid off tens of thousands of workers as executives look to cut costs and prepare for slower growth.

According to the Federal Reserve, rising interest rates could lead to higher unemployment. Fed Chair Jerome Powell has repeatedly emphasized high job openings as a sign of an imbalanced labour market.

Inflation killing jobs

Inflation data released on November 10 showed that prices rose 7.7% yearly through October. This is a decrease from the previous month’s rate of 8.2%.

According to a KPMG study, at least 91 percent of top job creators are bracing for a Biden Recession, with more than half considering layoffs in the next six months.

“America’s CEOs are becoming an increasingly pessimistic group as inflation rages, and the Federal Reserve keeps hiking interest rates,” according to Fox Business.

Another recent survey found that more than a third of chief financial officers (CFOs) believe the United States is either in a recession or will be by the end of the year.

Layoffs at Big tech companies in the United States and Europe have recently increased due to record inflation, higher energy costs, and central banks aggressively raising interest rates, which has fueled recession fears.

During the coronavirus pandemic, technology companies increased hiring to meet increased consumer demand, but the tables have turned in 2022.

Global inflation has reached its highest level in nearly 40 years, forcing central banks to raise interest rates in late 2021, significantly reducing the amount of capital and liquidity available in markets for investment.

Major technology companies have been laying off employees or putting new hires on hold at an unprecedented rate to cut costs.

According to the data tracker website Layoffs.FYI, 788 tech companies have laid off 120,699 employees worldwide since the beginning of 2022.

According to a report by business information provider Crunchbase, over 67,000 workers in the US technology industry have been laid off this year.

Source: Reuters

Tech

AI Model Aitana Lopez “Racks Up” Over 300K Instagram Followers

Artificial intelligence (AI) is nearly ubiquitous, occupying video and audio environments. In recent years, the K-pop music industry has used deep-fake technology to create groups that resemble actual individuals. Now meet Aitana, Spain’s first AI model.

Eternity and Mave, virtual female groups developed using artificial intelligence, have blurred the barriers between entertainment and technology. Whether we like it or not, these accelerating and frightening shifts are here to stay.

AI has recently made influencers one of its goals. Aitana Lopez, a 25-year-old AI-powered influencer from Spain, is a pioneer in the field. Switching lanes to her Instagram, @fit_aitana will strike you with eerie realism, as her “virtual soul” has deliberately developed a personality that is exceptionally lifelike and resembles the presence of a real-life model.

Her Instagram account already has over 300,000 followers.

View this post on Instagram

Aitana, created by Ruben Cruz, the creator of AI modeling business The Clueless, is a an AI model.

According to Euronews, Cruz’s breakthrough idea was fueled by the agency’s struggle to form genuine business relationships with real-life influencers. “Many projects were put on hold due to problems beyond our control,” the Clueless creator stated.

The Clueless describes Aitana, who is 25 years old, as a “strong and determined woman, independent in her actions and generous in her willingness to help others”. The AI model is also described as a Scorpio with a passion for video games and a commitment to fitness. Her vibrantly crafted design highlights Aitana as a standout with a multifaceted personality.

Designers working on Aitana’s images at the agency.The Clueless Agency

The Clueless Agency describes the AI influencer with eye-catching pink hair as an outgoing persona with “complicated humour and self-centeredness.”

The AI-powered “gamer at heart and fitness lover” was born on December 11, 1998. Her Instagram photos depict a digitally produced universe that reinforces the notion that she is engaging in real-world activities.

Following her trendsetting debut, the AI agency unveiled her other virtual companion, The Clueless’ second AI model, Maia Lima.

Similar to the controversy and criticism surrounding K-pop’s experimental experimentation, the rise of AI influencers has pushed unrealistic beauty standards.

While it is possible to focus on current technological advancements, this side of the virtual story is not without concerns for the future.

Tech

Understanding HTTP Error 404: Meaning and Navigation Tips

Introduction to Error 404

An error 404 can be very frustrating for users when browsing the web. A 404 error indicates that the requested page is unavailable on the server when a webpage displays a 404 error. In this error, a standard response code indicates that the client could communicate with the server, but the server could not locate the requested information.

How Does Error 404 Occur?

There are several reasons why an error 404 occurs:

-

Page Deletion: The most common cause is accidentally or purposely removing a page from the server.

-

URL Mistyping: The user may enter the wrong URL in the address bar, resulting in a 404 error if the server cannot locate the correct URL.

-

Broken Links: A 404 error may also occur if a link points to a non-existent page.

Impact of Error 404 on SEO and User Experience

SEO Implications

Search engines such as Google crawl websites to index their content regularly, and encountering 404 errors on a website may have negative consequences for SEO. When a search engine finds numerous 404 errors on a site, it may interpret it as poor maintenance or lacking valuable content, resulting in lowered rankings.

User Experience

404 errors can be irritating for users. They disrupt the browsing flow and can discourage them from returning to the site. Poorly handled 404 errors reflect negatively on the site’s professionalism and reliability.

Best Practices for Handling Error 404

Following these best practices will assist you in effectively managing and mitigating the impact of 404 errors:

-

Custom Error Pages: Provide users useful information on custom 404 error pages, such as alternative pages or a search bar.

-

Regular Monitoring: Use tools and services to monitor for 404 errors, and resolve them as soon as possible by fixing broken links or redirecting users to relevant content.

-

301 Redirects: 301 redirects send users to a new page in the event a page has been permanently moved or deleted.

Technical Overview: HTTP Status Codes

There are a number of three-digit codes that indicate the outcome of an HTTP request. Examples of HTTP status codes related to errors include:

-

200 OK: Request succeeded.

-

301 Moved Permanently: Resource has been permanently moved.

-

404 Not Found: The requested resource was unavailable on the server.

Conclusion

If not addressed immediately, HTTP error 404: Not Found indicates that a requested webpage is unavailable on the server. This error can adversely affect SEO and user experience. A website owner can effectively manage 404 errors and provide a seamless browsing experience for users by implementing best practices such as custom error pages, regular monitoring, and proper redirects.

Tech

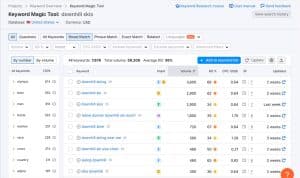

5 Most advanced keyword research tools to be used in 2024

Probably 12 different answers if you ask a dozen digital marketers what keyword research tools they use. If you’re familiar with these platforms, you’ll understand why such a wide range of opinions exist. Every keyword tool has its features and varies in how deep the data is.

For your SEO strategy to work, you need a reliable keyword researcher to help you determine what your customers are searching for. Despite the many options on the market, how do you pick one that meets your business’s needs and budget?

Here are 5 keyword research tools to help you climb the SERPs and stay in the search engine spotlight.

Short List of Keyword Research Tools

We compared keyword tools based on ease of use and metrics. We’ll then discuss each platform’s pros, cons, and intricacies to ensure it’s right for you.

-

Moz: Best overall

-

Semrush: Best for user intent analysis

-

Ahrefs: Best for keyword tracking and analysis

-

QuestionDB: Best for long-tail keywords

-

Google Keyword Planner: Best for paid advertising keywords

The Science Behind Keyword Research

Because each tool collects and processes data differently, metrics like search volume, difficulty, and page authority will vary.

Tools scrape the web for data, including:

-

Search engine results pages

-

Autocomplete suggestions

-

Google’s related searches and People Also Ask

-

Google Trends and Google Keyword Planner

-

Forums and social networks

-

Clickstream data tracks user movements

The best ones also inspect top-ranked pages for content, keyword frequency, and backlinks. Artificial intelligence can help interpret this data, pinpointing patterns that can help you gain ground.

Using different data sources and processes, each platform magically turns big data into the metrics you see on your screen.

It’s best to compare keywords within a tool, not across platforms. If you wanted to choose between “picture frames” and “wall art” on Ahrefs, you wouldn’t look at metrics on Ahrefs or Semrush. However, you can be sure comparisons run on a single platform are accurate.

Although each tool reported a different number, Andrei Prakharevich found that “mountain bikes” were the most popular and “gravel bikes” were the least popular, which is key to choosing a keyword.

Essential Features for Keyword Research Tools

We’re going to put together a keyword tool wish list. Ideally, you want a large database of keyword ideas and reliable metrics so you can decide what to target.

Some essential features include:

-

Keyword suggestions: A robust tool provides many keywords. Some use Google, YouTube, Amazon, and other search engines. If you’re trying to run an international business, check out a platform that lets you search by language and region.

-

Search volume: There’s no getting around this metric. Search volume tells you how many times a keyword has been searched. It doesn’t make sense to rank for keywords that aren’t popular.

-

Keyword difficulty: Based on the strength of the pages currently ranking, this metric shows how hard it is to rank for a low- to medium-difficulty keyword. Keywords with low- to medium-difficulty can help you get more visibility while you tackle more competitive terms.

-

Search intent: It is important to match your content to the user’s expectations. Some tools tell you a keyword’s search intent, such as navigational, commercial, informational, or transactional.

-

Competitor analysis: Compare competitor keywords to your own to ensure you don’t miss any opportunities. You can use some tools to see how your competitors rank and what backlinks they’ve built.

-

Website authority: Depending on the tool, this is also known as domain authority, domain rating, or authority score. It reflects the overall credibility of a website based on factors like backlinks.

Some platforms have other features, like site audits, on-page SEO recommendations, and content creation tools, but they’re not covered here.

5 Advanced Keyword Research Tools for 2024

No matter if you’re a small startup or an enterprise, we think these keyword research tools are worth your time. We’ve got free and paid options, from basic to comprehensive solutions. You might find one or two free tools that meet your needs. Please take advantage of free trials and give it a shot.

1. Moz Keyword Explorer

Best Overall

Intro to the Tool

Moz’s Keyword Explorer offers a wide range of metrics in an easy-to-navigate format. Our favorite part is its proprietary Priority Score, which helps you find keyword opportunities without getting bogged down with numbers. A paid subscription also gives you rank tracking, site crawls, on-page optimization, link research, and custom reports. Keyword Explorer is free but limited in scope.

Special Features Highlight

Moz throws you a lifeline if you’re drowning in data when analyzing keywords. It considers factors like search volume, keyword difficulty, and opportunity and creates a Priority Score. The Priority Score helps you figure out keywords that have good ranking potential. As Rand Fishkin explained, a Priority Score of 80 indicates high demand, moderate difficulty, and few SERP features detracting from organic search. Some of these factors contribute to lower scores.

Pricing

-

Free for 10 keyword queries

-

Monthly subscriptions range from $99 to $599

2. Semrush

Best for User Intent Analysis

Intro to the Tool

Semrush’s breadth is hard to beat. The platform has more than 55 tools, including keyword research, site audits, PPC, backlinking, and website optimization—it’s an end-to-end digital marketing tool. You can start with free tools like Keyword Magic and Keyword Overview, but they come with a price.

Special Features Highlight

Keywords aren’t the only thing you need for SEO. You need to understand why people use that keyword so you can create content that meets their needs. Are they looking for a deal, a deal, or learn something? You’ll see these tags on the Keyword Results page in the Search Intent column. Semrush uses an algorithm to mark up keywords as having navigational, informational, commercial, or transactional intent. Plan content by grouping keywords with the same intent.

Pricing

-

Free account with limited queries

-

7-day free trial

-

Monthly subscriptions range from $129.95 to $499.95

3. Ahrefs

Best for Keyword Tracking and Analysis

Intro to the Tool

Ahrefs is a leading search optimization tool, often grouped with Moz and Semrush. It’s great for tracking analytics and performance. It’s great for keyword research, link building, competitor analysis, content creation, and website audits.

Special Features Highlight

Ahrefs’ dashboard lets you monitor site performance by pulling key metrics from various sources.

Click specific boxes to see the details behind the report and adjust your SEO strategy as needed. You can also monitor changes in your site health, domain rating, organic keywords, backlinks, and traffic.

Pricing

-

Monthly subscriptions range from $99 to $999

4. QuestionDB

Best for Long-Tail Keywords

Intro to the Tool

By pulling data from forums where users answer each other’s questions, QuestionDB provides long-tail keywords in the form of questions.

Special Features Highlight

Using QuestionDB, you can spy on how your audiences chat naturally around a topic, which aligns perfectly with the conversational style of voice and Google’s SGE.

Due to their specificity, question keywords have a lower search volume. However, they’re less competitive and can help you reach highly qualified, niche audiences with precise search intent. Build topic clusters and establish expertise with QuestionDB.

Pricing

-

Free plan (up to 60 questions and no data)

-

$15/month Solo Plan (100 searches per month)

-

$50/month Agency Plan (500 searches per month)

5. Google Keyword Planner

Best for Paid Advertising Keywords

Intro to the Tool

Since the data comes directly from Google, SEO specialists also use this tool to drive organic traffic. Keyword Planner helps advertisers pick relevant keywords and estimate their ad spend. In your Google Ads account, you can find Keyword Planner in the Tools menu. Although it has limited features, it can help you find lucrative keywords and key themes you can use to build topic clusters.

Special Features Highlight

You can find keywords with high commercial intent using Keyword Planner, even though it doesn’t identify search intent. You’ll find which keywords advertisers will pay top dollar for, so you’re more likely to get lucrative traffic. Sort the keyword results by “Top of Page bid (high range).

Pricing

-

Free with a Google Ads account

The Future of Keyword Research

Although you’ll need a good keyword research tool (or two), there’s one thing to remember. Google sent us down this path with its helpful content system that prioritizes useful information. Modern SEO is moving from keyword-centric to user-centric.

That means you still need to know your primary keyword but don’t have to fit lists of semantic keywords into your content as much. Search engines often don’t rely on exact keyword matches anymore because they’re so good at understanding context.

The value of keyword research is to figure out what your audience wants to know about a topic and in what format. In other words, you aren’t relying on keywords but themes. You must put in some effort, assess the competition, and create charts, videos, FAQs, and other content to satisfy your audience.

-

News5 months ago

Death Toll From Flooding In Somalia Climbs To Nearly 100

-

Business5 months ago

Google Will Start Deleting ‘Inactive’ Accounts In December. Here’s What You Need To Know

-

Entertainment5 months ago

Merriam-Webster’s 2023 Word Of The Year Is ‘Authentic’

-

Sports5 months ago

Panthers Fire Frank Reich In His First Season With Team Off To NFL-Worst 1-10 Record

-

Celebrity5 months ago

Elon Musk Visits Destroyed Kibbutz and Meets Netanyahu in Wake of Antisemitic Post

-

Celebrity5 months ago

Shane MacGowan, Lead Singer Of The Pogues And A Laureate Of Booze And Beauty, Dies At Age 65