Politics

18 Year Old Suspect Arrested In Slaying Of University Police Officer

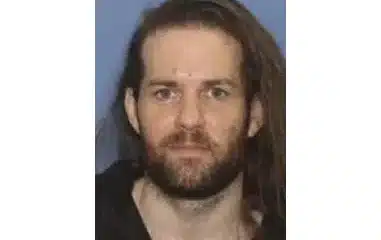

THE PHILADELPHIA — Authorities said they had arrested an 18-year-old suspect in the death of a Temple University police officer who was shot and killed Saturday night near campus after he allegedly tried to stop a carjacking.

The suspect was caught around 7 a.m. Sunday at his home in Buckingham Township by township, Philadelphia, state, and federal police, according to the office of the district attorney in Bucks County.

“Police used the deceased officer’s handcuffs to arrest the suspect,” prosecutors said, adding that Philadelphia and university police would release more information.

Officials at Temple University identified the slain officer as Christopher David Fitzgerald, who had been with the university police force since October 2021. He was shot shortly after 7 p.m. Saturday, according to authorities, and was pronounced dead at Temple University Hospital. According to Philadelphia Police Commissioner Danielle Outlaw, the officer “tried to intervene in a carjacking,” according to The Philadelphia Inquirer.

“Officer Fitzgerald gave his life to selflessly serve and defend this community,” Jennifer Griffin, vice president for public safety at the university, said in a statement. “This loss has left a huge void in all of our hearts. He was a father, husband, son, coworker, and friend.”

Jason Wingard, the president of the university, said he was “heartbroken” and called the shooting “a gut-wrenching reminder of the bravery and sacrifices our police officers make every day to protect our students, faculty, staff, and community” at a time when the city and the country are facing an “unprecedented epidemic of violence.”

Police Used The Deceased Officer’s Handcuffs To Arrest The Suspect

According to Ken Kaiser, Temple’s senior vice president and chief operating officer, it was the first shooting death of a campus officer in his more than 30 years at the university. “It just shakes everyone to their core,” he explained.

Pennsylvania Governor Josh Shapiro said he and First Lady Lori were “devastated for the family of the Temple University police officer who was killed in the line of duty tonight, bravely serving his community.”

“May his memory be a blessing,” he said, adding that they sent prayers to his family, Temple police, and the university community.

Joseph Regan, who is the head of the Fraternal Order of Police State Lodge, also sent his condolences.

“There are no words to describe the news that yet another suspect of our officers has been shot,” Regan said in a statement. “This officer is a hero whose legacy and selfless act will live on in our hearts and memories for the rest of our lives.”

According to the Inquirer, this was the first fatal shooting of an on-duty suspect police officer in Philadelphia since 2020.

SOURCE – (AP)

Celebrity

Bernice Johnson Reagon, Whose Powerful Voice Helped Propel The Civil Rights Movement, Has Died

Nashville, Tennessee – Bernice Johnson Reagon, a musician and scholar who utilised her rich, powerful contralto voice to support the American Civil Rights Movement and global human rights campaigns, died on July 16, according to her daughter’s social media post. She was 81.

Reagon was best known as the founder of Sweet Honey in the Rock, an internationally recognized African American female cappella group that she managed from 1973 until her retirement in 2004. The Grammy-nominated group’s purpose has been to educate, empower, and entertain. They sing songs from various genres, including spirituals, children’s music, blues, and jazz. Some of their original compositions pay tribute to American civil rights leaders and foreign liberation movements, such as the struggle against apartheid in South Africa.

Bernice Johnson Reagon, Whose Powerful Voice Helped Propel The Civil Rights Movement, Has Died

“She was incredible,” said Tammy Kernodle, a prominent professor of music at Miami University with a focus on African American music. She referred to Reagon as someone “whose divine energy, intellect, and talent all intersect in such a way to initiate change in the atmosphere.”

According to an obituary posted on social media by her daughter, musician Toshi Reagon, Reagon’s musical activism began in the early 1960s when she worked as a field secretary for the Student Nonviolent Coordinating Committee and became an initial member of the Freedom Singers. In 2010, the trio reassembled and was joined by Toshi Reagon to play for then-President Barack Obama in a White House performance series televised nationally on public television.

Reagon was born in 1942 in Dougherty County, Georgia, outside of Albany. In the early 1960s, he attended music workshops at Tennessee’s Highlander Folk School, an activist training ground. At an anniversary celebration in 2007, Reagon explained how the institution helped her recognize her musical history as unique.

“From the time I was born, we were always singing,” Reagon told me. “When you’re in a culture and, quote, ‘doing what comes naturally to you,’ you don’t notice it. I believe my work as a cultural scholar, singer, and composer would have been very different if someone had not drawn my attention to the people who need songs to stay alive, to keep themselves together, or to boost the energy in a movement.”

Reagon was arrested and dismissed from Albany State College after participating in a civil rights march. She eventually graduated from Spellman College. While a graduate student of history at Howard University and the vocal director of the D.C. Black Repertory Company, she founded Sweet Honey in the Rock.

In 1965, Reagon recorded her debut solo album, “Folk Songs: The South,” for Folkways Records. She joined Atlanta’s Harambee Singers as a founding member in 1966.

According to the Smithsonian, Reagon began working with the institution in 1969 when she was asked to organize and manage a 1970 festival program called Black Music Through the Languages of the New World. She went on to curate the African Diaspora Program and establish and lead the Program in Black American Culture at the National Museum of American History, where she ultimately became curator emeritus. She produced and played on many Smithsonian Folkways recordings.

Reagon was a distinguished professor of history at American University in Washington for a decade, commencing in 1993 and ending as a professor emerita.

According to Kernodle, we think that music has always been a component of civil rights activity, but it was people like Reagon who made music “part of the strategy of nonviolent resistance.” They brought those songs and practices from within the church to the streets and jail cells. And they popularised such songs.”

Bernice Johnson Reagon, Whose Powerful Voice Helped Propel The Civil Rights Movement, Has Died

“What she also did that was very important was that she historicised how that music functioned in the civil rights movement,” according to Kernodle. “Her dissertation was one of the first real studies of civil rights music.”

Reagon won two George F. Peabody Awards, including one for her role as lead scholar, conceptual producer, and host of the Smithsonian Institution and National Public Radio series “Wade in the Water: African American Sacred Music Traditions.”

She has received the Charles E. Frankel Prize and Presidential Medal for distinguished contributions to public awareness of the humanities, a MacArthur Fellows Program award, and the Martin Luther King Jr. Centre for Nonviolent Social Change’s Trumpet of Conscience Award.

SOURCE | AP

World

Too Soon For Comedy? After Attempted Assassination Of Trump, US Politics Feel Anything But Funny

Political jokes: is it too soon?

Many quarters responded with a loud yes at midweek, days after an assassination attempt on Republican former President Donald Trump shook the nation over decades of political violence in the United States.

Several late-night shows that rely on political humor instantly modified their plans, with Comedy Central’s “The Daily Show” canceling its Monday show and intending to broadcast from the Republican National Convention in Milwaukee this week. Its host, Jon Stewart, and his guests gave sad monologues.

By Tuesday, the comic rock duo Tenacious D, comprised of Jack Black and Kyle Gass, had canceled the remainder of their global tour “and all future creative plans” after Gass proclaimed onstage his birthday wish: “Don’t miss next time.” Gass apologized.

Too Soon For Comedy? After Attempted Assassination Of Trump, US Politics Feel Anything But Funny

Democratic President Joe Biden, no stranger to criticizing Trump, contacted his wounded competitor, paused his political advertisements and messaging, and urged the country to “cool” the rhetoric.

So, if comedy is tragedy plus time, when is joking acceptable again? And who gives a thumbs up, given that the shooter who targeted Trump also killed former fire chief Corey Comperatore while protecting his family?

The attempted assassination on Saturday, or any of the bloodshed that has afflicted the United States since its inception, is not funny. Trump was smacked in the ear while speaking to rallygoers in Pennsylvania. A Trump supporter and the gunman were dead, while two onlookers were injured. The attack sparked severe concerns about security shortcomings. It was the most recent example of political violence in America, where attacks on politicians date back to at least 1798 when two legislators from opposite parties brawled in the United States House.

Other examples abound in history texts, but the list from this century is particularly striking. Former Arizona Representative Gabby Giffords, D, was shot in the head in 2011. Republican Rep. Steve Scalise of Louisiana, the current House majority leader, was shot and badly injured in 2017. On January 6, 2021, a mob of Trump supporters invaded the US Capitol, preventing Congress from certifying Biden’s election. Paul Pelosi was bludgeoned at his home in 2022 by a guy looking for his wife, former House Speaker Nancy Pelosi.

In addition to that, unwavering fears about Biden’s fitness for office following his catastrophic debate performance, Trump’s conviction on 34 felony counts, and American politics in 2024 appear anything but hilarious.

However, political comedy is as old as politics and administration.

It softens the impact of democratic decisions and is a powerful tool for politicians aiming to alleviate or increase concerns about themselves or their opponents. And in recent years, Trump has been the focus of more jokes than anyone else. According to a 2020 study by George Mason University’s Center for Media and Public Affairs, late-night hosts made 97% of their jokes about Trump.

“It’s never too soon, unless it’s not funny,” Alonzo Bodden, a 31-year-old stand-up comedian, said in a phone interview Wednesday. He is not a Trump supporter but stated that comedians “will always make it funny no matter what happens.” That is what we do. “It is how we communicate.”

“In this case, Donald Trump is such a character and the fact that he wasn’t killed, the jokes started immediately,” said Bodden. “And I don’t believe he minds. He’s one of those persons who is always happy to be mentioned.”

Humor humanizes large figures.

Perhaps most effectively, political humor can make arrogant leaders appear more human or at least self-conscious.

Consider “covfefe,” Trump’s strange middle-of-the-night tweet in 2017 that went viral, prompting Jimmy Kimmel to despair that he’ll never write something funnier. “Make the Pie Higher,” a poem by late Washington Post cartoonist Richard Thompson, was composed solely of President George W. Bush’s botched words and was published for his inauguration in 2001.

“It is a very complicated economic point I was making there,” Bush said with a smirk at the Radio and Television Correspondents Dinner a few months later. “Believe me, what this country needs is taller pie.”

Before the debate, Biden attempted to use humor to bring the age issue to the forefront, but it became evident that the concern was more about his cognitive ability. “I know I’m 198 years old,” Biden declared, to wild laughter and clapping.

Too Soon For Comedy? After Attempted Assassination Of Trump, US Politics Feel Anything But Funny

Humor is such an effective campaign tactic that candidates flock to guest appearances on late-night shows, which have risen in political prominence. However, following the assassination, a pause settled over everything, as indicated by Stewart’s serious address on Monday.

“None of us knows what’s going to happen next other than there will be another tragedy in this country, self-inflicted by us to us, and then we’ll have this feeling again,” Stewart told the crowd.

“Though I could just as easily start the show moaning on the floor,” he laughed, “because how many times do we need to learn the lesson that violence has no role in our politics?”

As is customary for social media, it was acting more freely. “I think it’s ironic that Trump almost died from a gun today because he was too far right-leaning,” comedian Drew Lynch remarked on YouTube. “Alright. That’s all I have. I believe my neighbors might be listening.”

SOURCE | AP

World

To Counter China, NATO And Its Asian Partners Are Moving Closer Under US Leadership

Washington — In the third year of the war in Ukraine, NATO plans to strengthen ties with its four Indo-Pacific partners, who, while not members of the military alliance, are gaining prominence as Russia and China forge closer ties to counter the United States and the two Koreas’ support for opposing sides in Europe.

For the third consecutive year, the leaders of New Zealand, Japan, and South Korea will attend the NATO summit, which begins Tuesday in Washington, D.C., while Australia will send its deputy prime minister. China will watch the meeting intently, concerned about the alliance’s expanding interest beyond Europe and the Western Hemisphere.

“Partners in Europe increasingly see challenges halfway around the world in Asia as relevant to them, just as partners in Asia see challenges halfway around the world in Europe,” Secretary of State Antony Blinken told the Brookings Institution last week.

NATO | Reuters Image

To Counter China, NATO And Its Asian Partners Are Moving Closer Under US Leadership

America’s top diplomat stated that the US has been striving to tear down barriers between European alliances, Asian coalitions, and other global allies. “That’s part of the new landscape, the new geometry that we’ve put in place.”

As competition between the United States and China heats up, countries with similar security concerns are forging relations. Washington is attempting to limit Beijing’s ambition to challenge the US-led world order, which the Chinese government dismisses as a Cold War mindset aimed at restraining China’s inevitable growth.

On Monday, Beijing reacted strongly to unsubstantiated rumors that NATO and its four Indo-Pacific partners are preparing to release a document outlining their partnership and capabilities to respond to cyberattacks and disinformation.

Lin Jian, a Chinese foreign ministry spokeswoman, accused NATO of “breaching its boundary, expanding its mandate, going beyond its defense zone, and stoking confrontation.”

The conflict in Ukraine, which has put the West against Russia and its allies, has strengthened the case for greater collaboration among the United States, Europe, and its Asian allies. “Ukraine of today may become East Asia of tomorrow,” Japanese Prime Minister Fumio Kishida told the United States Congress in April.

The United States and South Korea accused Pyongyang of supplying Russia with ammunition, while Russian President Vladimir Putin paid a visit to North Korea last month and signed an agreement with leader Kim Jong Un calling for mutual military assistance.

South Korea and Japan, meanwhile, are deploying military equipment and humanitarian help to Ukraine. The US also claims China is sending Russia with machine tools, microelectronics, and other technology that will allow it to manufacture weapons for use against Ukraine.

South Korean President Yoon Suk Yeol will travel to Washington with “a strong message regarding the military cooperation between Russia and North Korea and discuss ways to enhance cooperation among NATO allies and Indo-Pacific partners,” his principal deputy national security adviser, Kim Tae-hyo, told reporters Friday.

New Zealand Prime Minister Christopher Luxon stated that discussions will “focus on our collective efforts to support the rules-based system.”

According to Mirna Galic, senior policy analyst on China and East Asia at the US Institute of Peace, the cooperation allows NATO to coordinate with the four partners on topics of shared concern rather than becoming a direct player in the Indo-Pacific. For example, she said in an analysis that they can share intelligence and agree on actions like sanctions and aid delivery, but they do not intervene in military crises outside their borders.

According to Luis Simon, director of Vrije Universiteit Brussel’s Centre for Security Diplomacy and Strategy, the NATO summit will allow the United States and its European and Indo-Pacific partners to counter China, Russia, North Korea, and Iran.

“The fact that the Euro-Atlantic and Indo-Pacific alliances are structured around a clear anchor — U.S. military power — makes them more cohesive and gives them a strategic edge as compared to the sort of interlocking partnerships that bind China, Russia, Iran, and North Korea,” Simon wrote in a commentary last week on War On the Rocks, a defense and foreign affairs website.

Zhu Feng, dean of the School of International Studies at Nanjing University in eastern China, expressed concern over NATO’s eastward swing. Beijing has asked that NATO refrain from interfering in Indo-Pacific security concerns and reconsider China as a strategic adversary.

“NATO should consider China as a positive force for the regional peace and stability and for global security,” Zhu indicated. “We also hope the Ukraine war can end as soon as possible … and we have rejected a return to the triangular relation with Russia and North Korea.”

“In today’s volatile and fragile world, Europe, the U.S. and China should strengthen global and regional cooperation,” according to Zhu.

NATO and China had little confrontation until 2019 when tensions between Beijing and Washington rose. The NATO summit in London mentioned China as a “challenge” that “we need to address together as an alliance.” Two years later, NATO upgraded China to a “systemic challenge” and stated that Beijing was “cooperating militarily with Russia.”

NATO | NPR Image

To Counter China, NATO And Its Asian Partners Are Moving Closer Under US Leadership

Following Russia’s invasion of Ukraine in 2022, leaders from Japan, South Korea, Australia, and New Zealand attended the inaugural NATO summit, where they highlighted China’s geopolitical problems. Beijing accused NATO of “collaborating with the US government for an all-out suppression of China.”

Beijing is concerned that Washington is creating a NATO-style alliance in the Indo-Pacific.

Chinese Senior Col. Cao Yanzhong, a scholar at China’s Institute of War Studies, asked US Defense Secretary Lloyd Austin last month if the US attempted to build an Asian version of NATO through partnerships and alliances. They include a grouping of the United States, Britain, and Australia; another with Australia, India, and Japan; and one with Japan and South Korea.

“What implications do you think the strengthening of the U.S. alliance system in the Asia-Pacific will have on this region’s security and stability?” Cao asked during the Shangri-la Dialogue security meeting in Singapore.

Austin responded that the United States merely collaborates with “like-minded countries with similar values and a common vision of a free and open Indo-Pacific.”

Beijing reached its own decision.

“The real intent of the U.S. Indo-Pacific strategy is to integrate all small circles into a big circle as the Asian version of NATO in order to maintain hegemony as led by the United States,” Chinese Lt. Gen. Jing Jianfeng stated at the meeting.

SOURCE | AP

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning