Business

Charlie Munger, Who Helped Warren Buffett Build Investment Powerhouse Berkshire Hathaway, Dies At 99

OMAHA, Nebraska – Charlie Munger, who assisted Warren Buffett in transforming Berkshire Hathaway into an investment juggernaut, died in a California hospital. He was 99.

Berkshire Hathaway confirmed in a statement that Munger died Tuesday morning at the hospital, just over a month before his 100th birthday.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said. The legendary investor also paid respect to Munger in his annual letter to Berkshire shareholders earlier this year.

Munger acted as Buffett’s sounding board for investment and business choices and helped run Berkshire Hathaway for more than five decades as its vice chairman.

Charlie Munger, Who Helped Warren Buffett Build Investment Powerhouse Berkshire Hathaway, Dies At 99

Munger had needed a wheelchair for years to move around, but he had stayed mentally alert. That was evident as he handled hours of questions at the annual meetings of Berkshire Hathaway and the Daily Journal Corp. earlier this year and in recent interviews with an investing podcast, The Wall Street Journal, and CNBC.

Munger liked to remain in the shadows and let Buffett be the face of Berkshire Hathaway, and he frequently downplayed his contributions to the company’s extraordinary success.

On the other hand, Buffett has always credited Munger for pushing him beyond his early value investing tactics to acquire wonderful businesses at low prices, such as See’s Candy.

“Charlie has taught me a lot about valuing businesses and human nature,” Buffett stated in 2008.

Buffett’s early success was founded on lessons learned from former Columbia University professor Ben Graham. He would buy stock in companies selling for less than their assets were worth and then sell the shares when the market price rose.

Munger and Buffett began purchasing Berkshire Hathaway stock in 1962 for $7 and $8 per share, respectively, and bought ownership of the New England textile factory in 1965. Over time, the two brothers molded Berkshire into its current conglomerate by reinvesting profits from its businesses in companies such as Geico Insurance and BNSF Railroad. They also kept a high-profile stock portfolio, including big Apple and Coca-Cola stakes. The stock reached $546,869 on Tuesday, and many investors became wealthy by holding on to it.

Munger gave a lengthy interview to CNBC earlier this month in anticipation of his 100th birthday, and the business network aired parts from that discussion on Tuesday. In his characteristically self-deprecating tone, Munger summarized Berkshire’s achievement as avoiding mistakes and working well into his and Buffett’s 90s.

“We got a little less crazy than most people and a little less stupid than most people and that really helped us,” remarked Munger. In a special letter he published in 2014 to commemorate 50 years of helping manage the company, he went into greater depth on the reasons for Berkshire’s success.

Charlie Munger, Who Helped Warren Buffett Build Investment Powerhouse Berkshire Hathaway, Dies At 99

Buffett and Charlie resided more than 1,500 miles (2,400 kilometers) apart for their collaboration, but Buffett stated he would phone Munger in Los Angeles or Pasadena to confer on every major decision he made.

“Many will miss him, perhaps none more than Mr. Buffett, who relied heavily on his wisdom and counsel.” I envied their friendship. “They challenged each other while also seeming to enjoy each other’s company,” Edward Jones analyst Jim Shanahan said.

Berkshire would probably do fine without Charlie, according to CFRA Research analyst Cathy Seifert, but there is no way to replace the role he served. After all, Munger was one of the few people ready to tell Buffett he was incorrect about something.

“The most pronounced impact, I think, is going to be over the next several years as we see Buffett navigate without him,” he said.

Charlie grew raised in Omaha, Nebraska, only five blocks from Buffett’s current home, but because Munger is seven years older, the two men never met as youngsters, even though both worked at the grocery shop owned by Buffett’s grandfather and uncle.

When the two men met at an Omaha dinner party in 1959, Munger was a Southern California lawyer, and Buffett headed an investing business in Omaha.

Buffett and Munger hit it off right away, according to the biography in the canonical book on Munger, “Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger.”

During the 1960s and 1970s, the two men traded investment ideas and occasionally invested in the same companies. They became the two largest shareholders in one of their mutual investments, trading stamp maker Blue Chip Stamp Co., and purchased See’s Candy, the Buffalo News, and Wesco. Munger was appointed vice chairman of Berkshire Hathaway in 1978 and chairman and president of Wesco Financial in 1984.

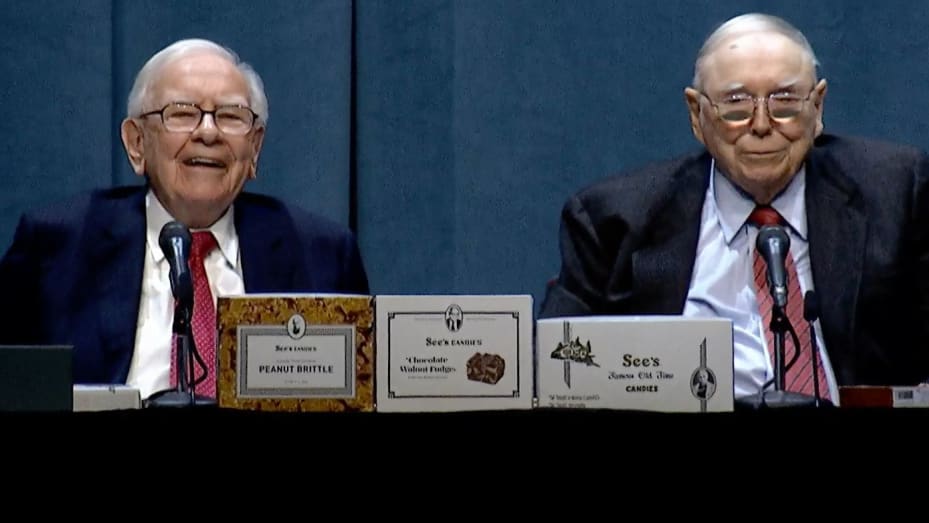

Berkshire’s legions of devoted shareholders who frequently filled an Omaha arena to hear the two men will recall Munger’s curmudgeonly comments when addressing questions alongside Buffett at the annual meetings.

Charlie was well-known for saying, “I have nothing to add” after several of Buffett’s lengthy responses at Berkshire meetings. However, Munger frequently provided crisp responses that cut to the heart of an issue, such as his advice on finding a solid investment in 2012.

“If it’s got a really high commission on it, don’t bother looking at it,” he told me.

Whitney Tilson, an investor, has attended the Berkshire Hathaway annual meetings for the past 26 years to learn from Charlie and Buffett, who shared life lessons and investing advice. Tilson stated that Charlie taught that after attaining some success, “your whole approach to life should be how not to screw it up, how not to lose what you’ve got” because reputation and integrity are the most valuable assets and can be lost in an instant.

“In the investment world, it’s the same thing is in your personal world, which is your main goal should be avoiding the catastrophic mistakes that could destroy an investment record, that can destroy a life,” he stated.

“Charlie has taught me a lot about valuing businesses and human nature,” Buffett stated in 2008.

Munger famously summarized the counsel, “All I want to know is where I’m going to die so (that) I never go there.”

Munger was well-known for being an avid reader and student of human behavior. He used several models from fields such as psychology, physics, and mathematics to evaluate potential investments.

Munger attended the University of Michigan in the 1940s but dropped out to serve as a meteorologist in the Army Air Corps during WWII.

He then acquired a law degree from Harvard University in 1948 despite having yet to complete an undergraduate degree. He co-founded a legal practice in Los Angeles that carries his name today, but he quickly realized that he preferred investing.

At one point, Charlie had a fortune of more than $2 billion and was named one of the wealthiest Americans. Munger’s fortune dwindled over time as he gave away more of it, but the ever-increasing value of Berkshire’s stock kept him affluent.

Munger has greatly contributed to Harvard-Westlake, Stanford University Law School, the University of Michigan, and the Huntington Library, among others. After his wife died in 2010, he also left much of his Berkshire stock to his eight children.

Charlie also served on the boards of Good Samaritan Hospital and the Los Angeles-based private Harvard-Westlake School. Munger also served on the board of Costco Wholesale Corp. and as chairman of the Daily Journal Corp. for many years.

SOURCE – (AP)

Business

Tesla Stock Tumbles After Its Profit Plunged

Telsa second-quarter profit fell more than 40% from the previous year as the electric car business faced more EV competition from established automakers and a slowing in global EV sales growth.

The decline in income is a dramatic contrast to a corporation that developed to become the world’s most valuable automobile based on rising sales and profitability.

The findings highlight how Tesla, a pioneer in introducing electric vehicles to American drivers, is now facing more domestic and international competition. And as the EV market matures, customer interest in EVs has declined.

Tesla | Auto Guide

Tesla Stock Tumbles After Its Profit Plunged

Tesla (TSLA) shares plunged almost 12% on Wednesday morning, pushing down the broader market. Tesla’s stock was down roughly 1% this year through Tuesday’s close after plunging as much as 44% earlier in the year.

Tesla announced adjusted earnings of $1.8 billion in the quarter or 52 cents per share. Analysts expected 61 cents per share earnings, down from 91 cents the previous year. Its crucial profit margin fell substantially as a series of EV price cuts took its toll.

From April to June, the company had its second consecutive quarter of year-over-year sales decreases and its first consecutive quarter of dropping sales volume. Tesla’s only previous quarterly sales decline since going public occurred early in the pandemic when stay-at-home orders caused its plants to close.

Tesla did not provide a new sales target for the full year. However, it stated: “In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023.”

On the investor’s call following the announcement, Tesla CEO Elon Musk criticized the quality of EVs produced by other manufacturers, claiming that it was simply a short-term issue for Tesla and not a long-term one. He added that Tesla is still persuaded that the world is going towards fully electric transportation systems, not just for automobiles, planes, and ships.

Musk also stated that the business would provide more information on fully automated robotaxis in October rather than August as initially intended. The business calls its driver assistance feature “Full Self Driving,” but drivers must still be prepared to take control of the vehicle. According to the company’s earnings statement, Tesla still confronts regulatory and technical challenges before offering self-driving cars.

Musk stated that he still believes it is possible to reach by the end of this year and certainly by next year, but cautioned: “My predictions on this have been overly optimistic in the past.”

Tesla | Top Gear Image

Tesla Stock Tumbles After Its Profit Plunged

The company faces government probes into several of Musk’s boasts about Full Self-Driving capabilities. The company has also been the subject of a Department of Justice investigation, though it is unclear what the current situation is.

However, he disclosed that Tesla’s plans to build an assembly factory in Mexico had been placed on hold. The plans were disclosed more than a year ago, but Musk said they have been halted until after the presidential election due to Republican contender Donald Trump’s vow to impose taxes on Mexican-imported vehicles. Musk is a big Trump booster, having endorsed him and reportedly pledged tens of millions of dollars to the former president’s re-election campaign. Trump promised comparable duties on Mexican-made autos in 2019 but has yet to follow through.

SOURCE – CNN

Business

Bitcoin Surpasses $67,000 in Anticipation of Trump’s Keynote Address.

(VOR News) – Over the Bitcoin course of the last twenty-four hours, the sum of money that has been liquidated in short positions for Bitcoin BTC +4.71% has increased to more than $34 million.

This is a significant increase from the previous state of affairs. The fact that Bitcoin, the digital asset with the highest market capitalisation, has broken beyond the barrier of $67,000 is the reason for this new development.

Nashville, Tennessee will host this year’s Bitcoin Conference.

According to the website of the conference, the former president of the United States is set to make an appearance on the Nakamoto Stage on July 27 at 2:00 p.m. Central Time for a session that will last thirty minutes.

This information is indicated on the website. Yesterday, on the final day of the conference, the session is scheduled to take place.

As a direct result of the increase in the price of bitcoin that took place during the course of the previous day, a total of holdings representing a value of 54 million dollars were sold off.

As a consequence of the increased volatility of the market, the cryptocurrency market as a whole went through liquidations that amounted to more than two hundred million dollars within the same time period. This is evidenced by the data that were provided by Coinglass.

The information that is provided by The Block’s Bitcoin Price Page reveals that the current value of Bitcoin is around $67,330 at the time that this article is being written and published.

This information is provided by The Block. Over the course of the past twenty-four hours, there has been an increase that is greater than five percent.

President Trump will invest in bitcoin by 2024.

Because of the keynote presentation that he will deliver at Bitcoin 2024, Donald Trump will create history by becoming the first candidate for the presidency of the United States of America to visit a conference of this kind that is sponsored by the industry.

This will be something that he will accomplish by attending Bitcoin 2024. In spite of the fact that there is a little amount of information available concerning the specifics of his discussion, the organisers have already claimed that it will be “historic.”

Throughout the course of his presidency, President Trump has adopted a variety of perspectives about a wide range of cryptocurrencies, including bitcoin and others from the same category.

He voiced his disapproval of cryptocurrencies on Twitter in July 2019, saying, “I am not a fan of bitcoin and other cryptocurrencies, which are not money and whose value is highly volatile and based on thin air.”

He was referring to the fact that certain cryptocurrencies are not money. His hatred for these cryptocurrencies has been made clear in his statements.

Specifically, he expressed his discontent with the bitcoin market.

Which was the subject of his expression. This viewpoint was reiterated by him in 2021, when he gave an interview to Fox Business in which he referred to the digital asset as a hoax and voiced his concern that it may compete with the United States dollar or other currencies. In addition, he expressed his concern that it could be used to compete with other currencies.

Nevertheless, throughout the course of the last six months, Trump has rebuilt himself as the “crypto president.” The fact that he chose Ohio Senator JD Vance, who is an investor in bitcoin, to be his vice presidential candidate lends credence to the notion that a Donald Trump presidency may be advantageous to cryptocurrencies.

This is an extra point of interest that is worth mentioning. Bitcoin is an investment that Vance has made.

During the course of the previous day, the dominance of Bitcoin increased slightly to 52.8%, as indicated by the data that were provided by Coingecko. On the other hand, the dominance of ether decreased slightly to 15.5%.

Indicative of the fact that Bitcoin’s dominance rose, both of these data are indicative of reality. After reaching its highest position, the GM 30 Index, which is comprised of a selection of the top 30 cryptocurrencies, witnessed a climb of 3.08% within the same time period, hitting 133.99.

This was after the index had reached its highest peak.

SOURCE: TBN

SEE ALSO:

Sanstar Stock Gains after Listing: Should you Buy, Sell, or Hold?

MMTC’s Shares Surge 20% to Reach a One-Year High; What’s Ahead for This PSU Stock?

Tesla’s Stock is Down due to the Ongoing Decline in Profits.

Business

Sanstar Stock Gains after Listing: Should you Buy, Sell, or Hold?

(VOR News) – Sanstar shares made a quiet Dalal Street debut on Friday, which was less than market participants had anticipated as a consequence of their expectations.

However, the number of buyers rose significantly following the stock’s listing, suggesting that investors are interested in purchasing the company at reduced prices.

At Rs 109 per share, Sanstar shares were offered on the National Stock Exchange (NSE) at a premium of approximately 15%. The stock was listed on the Bombay Stock Exchange (BSE) at a premium of 12 percent over the issue price of Rs 95 per share.

Nevertheless, the stock attained a price of Rs 127.68, achieving a 20% upper circuit and bringing the cumulative profits to 34.4 percent over the price at which it was initially issued.

The majority of analysts continue to maintain a positive outlook on the company and suggest that investors remain invested in the stock for a period of time that varies from medium to long term.

On the other hand, there are some experts who suggest that investors record profits after achieving a respectable profit during the initial trading session.

A successful initial public offering (IPO) was achieved by Sanstar

The company’s shares are currently trading at Rs 109 per share, an increase of 15% from their issue price of Rs 95.

This performance is positive, according to Shivani Nyati, Head of Wealth at Swastika Investmart; however, it fails to satisfy the expectations that were established prior to the listing. The broader market volatility that ensued subsequent to the budget’s announcement was a contributing factor.

Sanstar has been listed, which is a fantastic development, despite the fact that it did not meet the initial hype.

The company’s future expansion is supported by the interest of investors and the company’s robust foundations. Investors have the option to maintain their stake at the issue price, according to her.

Sanstar’s initial public offering (IPO) had the potential to be subscribed between July 19 and July 23, as the business issued its shares at a price range of Rs 90-95 per share, with a lot size of 150 shares.

Sanstar’s follow-on offering yielded a total of Rs 510.15 crore in revenue. This offering comprises a wholly new share sale of up to 397.10 equity shares and an offer-for-sale of up to 1.19 crore equity shares.

Sanstar got a 15% premium because of demand.

Which contributed to the company’s successful launch on the bourses today. According to Prathamesh Masdekar, Research Analyst at StoxBox, Sanstar has established enduring relationships with its consumers and currently serves more than 525 customers, with 162 new customers joining during fiscal year 24.

“The company is committed to expanding its customer base by leveraging the relationships it has established with customers in India and around the world, while simultaneously actively seeking out opportunities to establish new relationships.

“”Because of this, we recommend to the market participants that they keep the shares for a period of time ranging from the medium to the long term,” according to him.

A total of 82.99 subscriptions were received from consumers worldwide for the Sanstar issue. The quota for qualified institutional vendors (QIBs) was satisfied 145.68 times during the auction.

A remarkable 136.50 percent of the quota that was designated for non-institutional investors was subscribed to. The portions that were specified for retail investors were only subject to requests for bids 24.23 times during the three-day bidding procedure.

Sanstar’s listing was lower than anticipated, despite the fact that markets were trending upward. Prashanth Tapse, Senior Vice President of Research at Mehta Equities, maintains that designated investors should record profits on the day of listing, despite the market’s optimistic outlook.

Compared to other listed peers, Sanstar’s valuations are a little higher.

Sanstar is a manufacturer in India that specialises in the manufacturing of plant-based products and ingredient solutions for industrial products, pet food, and food.

Pantomath Capital Advisors served as the exclusive book-running lead manager for Sanstar’s initial public offering (IPO), while Link Intime India served as the registrar.

According to Amit Goel, Co-Founder and Chief Global Strategist at Pace 360, the market volatility in the Indian markets resulted in Sanstar shares failing to meet pre-listing expectations. Sanstar shares were listed on the National Stock Exchange (NSE) at a price of Rs 109.

We strongly recommend that investors take profits in the near term following the completion of the listing. He continues, “It is advised that long-term investors maintain their positions in the company due to its strong fundamentals.”

SOURCE: BTN

SEE ALSO:

MMTC’s Shares Surge 20% to Reach a One-Year High; What’s Ahead for This PSU Stock?

Disney Reaches Tentative Agreement With California Theme Park Workers

Tesla’s Stock is Down due to the Ongoing Decline in Profits.

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning