Business

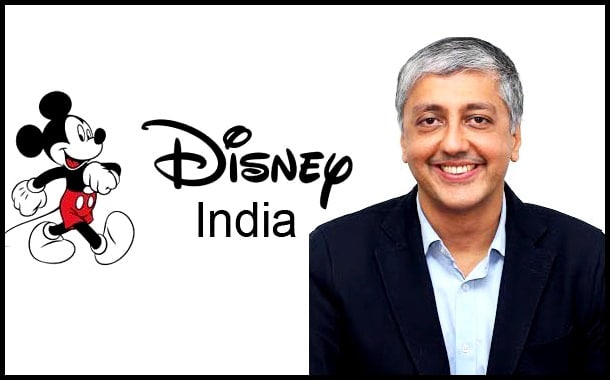

Disney Is Trying To Salvage Its Indian Dreams

The next three weeks could determine Walt Disney’s future in the world’s most populated country.

The Star India network was one of the crown jewels Disney (DIS) acquired when it paid $71 billion to Rupert Murdoch for most of 21st Century Fox five years ago.

With that mega acquisition, the Magical Kingdom acquired Fox’s business in India, obtaining a new audience of over 700 million people in the South Asian country, which is one of the world’s most active media markets.

However, Disney has not had the happily ever after it hoped for. In a late-year results call, CEO Bob Iger admitted that “parts of that business [in India] are challenged for us.”

The House of Mouse was hit most hard in 2022, when it lost the internet rights to stream the immensely popular Indian Premier League (IPL) cricket matches to billionaire Mukesh Ambani’s company.

The US corporation is now attempting to save its India ambition.

Disney and Ambani’s Reliance Industries are discussing merging their Indian media operations to build an entertainment juggernaut in which the Indian tycoon would have the upper hand.

According to Reuters, the corporations have hired lawyers and begun antitrust investigations into the merger. The Economic Times claimed in December that Ambani’s energy-to-telecom company would own 51%, with Disney holding the remaining 49%, citing unnamed sources. According to the Indian publication, the merger will likely be completed by next month.

Disney did not respond to CNN’s request for comment, while Reliance declined to comment.

Disney’s search for a partner in the world’s fastest-expanding major economy came when the Burbank-based firm dealt with several internal issues.

The 100-year-old Hollywood staple, like its competitors, faces an uncertain environment in the United States, where people are progressively abandoning linear TV in favour of TikTok and YouTube. However, Disney has been particularly severely struck by movie office disappointments and corporate upheavals.

In November, Iger stated that the business is exploring opportunities in India but wants to remain there.

The lukewarm star

It’s easy to understand why. With its relatively free economy and large English-speaking population, India is a desirable destination for global entertainment enterprises.

Prime Minister Narendra Modi’s government expects the country to soon become the world’s third-largest media and entertainment market, up from fifth place today. Disney was handed that market on a silver platter after acquiring Fox.

Star India had established its massive viewership by spending billions of dollars on broadcast rights to several of India’s most popular sports, including cricket, the country’s national preoccupation. In 2017, it outbid Facebook (META) and Sony (SONY) to acquire the IPL, one of the world’s most valuable sporting properties, for $2.6 billion over five years.

The network’s other significant advantage was its local content. Star India provides over 70 TV stations in nine languages in a country with nearly two dozen languages spoken.

However, Disney has yet to seize the chance.

While its TV division is growing well in India, Iger admitted in November that the company was failing in other sectors. Its streaming app, Hotstar, has lost millions of customers since losing the IPL rights to Reliance nearly two years ago.

Hotstar took another hit in March 2023 when it ceased broadcasting HBO content. Weeks later, Warner Bros. Discovery (WBD), the parent company of HBO and CNN, shifted its content to Ambani’s JioCinema, bringing dedicated Indian viewers of hit shows like “Game of Thrones” and “Succession” with them.

Aside from Ambani’s losses, critics have questioned Disney’s India strategy, particularly its aggressive sports expenditure.

The brand’s “entertainment assets would be attractive to any acquirer or partner …[but] … Disney’s India sports business has faced challenges.” According to Mihir Shah, vice president of research firm Media Partners Asia.

While Disney lost the internet rights to IPL matches in 2022, it retained the TV rights until 2027 for more than $3 billion. It also retained the rights to broadcast the International Cricket Council’s events until 2027 for an additional “staggering $3 billion,” Shah stated.

Financial troubles for the company will persist in the coming years, “largely attributed to Disney’s aggressive bidding in renewing rights,” he added.

The media conglomerate has also failed to fully capitalize on its streaming service’s “technical prowess” due to the loss of the IPL and “limited investments in local entertainment content,” according to Shah.

From antagonism to partnerships

The American company’s failures come when competition in India is heating up — the potential Reliance-Disney merger isn’t the only one being considered.

Disney Is Trying To Salvage Its Indian Dreams

Sony and India’s Zee Entertainment have negotiated for over two years about merging their companies and forming a $10 billion conglomerate. The destiny of that transaction is unknown, but analysts believe such corporate marriages will be critical to gaining scale and competing with global streaming giants like Netflix (NFLX) and Amazon (AMZN), both of which have a significant presence in India.

“These potential deals are a sign that India’s entertainment industry is entering a phase of consolidation, where only a handful of players with deep pockets will be able to operate,” said Aliasgar Shakir, a Motilal Oswal Financial Services analyst.

In a November earnings call, Iger stated that Disney intends to maintain its presence in India while focusing on improving the bottom line.

Ambani, Asia’s second richest man, can help Disney accomplish more with his billions and media ambitions.

The combined business would be huge, with over 100 TV stations and two streaming services.

“It is too early to interpret this as Disney scaling back in India,” Shah said. “The contours of the deal are still unknown, but it is looking more like a partnership between Reliance Industries and Disney.”

It might also mark the beginning of a power couple that extends beyond the media, with industry insiders speculating on a joint push into amusement parks.

“We have to remember that both these companies have business interests beyond media and entertainment, and this partnership could be a start of something bigger,” Shah said.

SOURCE – CNN

Business

Nintendo To Announce Switch Successor In This Fiscal Year As Profits Rise

TOKYO — Nintendo, a Japanese video game company, announced on Tuesday that it will provide details regarding a Switch home console replacement before March 2025.

Nintendo did not provide any information regarding the announcement when releasing its financial results, including if it will only announce its plans for the replacement product or debut it during this fiscal year.

“Within this fiscal year, we plan to reveal details on the Nintendo Switch successor. Nintendo Switch was first unveiled in March 2015. Thus, it will have been more than nine years since then, according to a statement from Shuntaro Furukawa, president of the business.

AP – VOR News Image

Nintendo To Announce Switch Successor In This Fiscal Year As Profits Rise

The fiscal year that concluded in March saw a 13% increase in earnings for Kyoto-based Nintendo Co. This was due to strong demand for Switch titles such as “The Legend of Zelda: Tears of the Kingdom.”

Nintendo increased its net profit from 432.7 billion yen to 490.6 billion yen ($3 billion) during the fiscal year that ended in March 2024. Sales increased 4% annually to 1.67 trillion yen ($11 billion), with almost 80% coming from outside of Japan.

Nintendo reports that in addition to “The Legend of Zelda,” which sold 20.6 million units worldwide during the fiscal year, “Super Mario Bros. Wonder” sold 13.4 million units, and “Pikmin 4” sold about 3.5 million units.

AP – VOR News Image

Nintendo To Announce Switch Successor In This Fiscal Year As Profits Rise

The Super Mario Bros. Movie’s release a year ago also helped sales.

Additionally beneficial was the yen’s depreciation versus the dollar, which increases the value of Japanese exporters’ foreign earnings in yen, such as Nintendo. Over the last fiscal year, the U.S. dollar has averaged roughly 151 Japanese yen, up from 133 yen the year before.

Nintendo was less enthusiastic about its financial results for the fiscal year through March 2025, predicting net profit to drop to 300 billion yen ($1.9 billion). Nintendo did not provide quarterly data.

Nintendo has sold over 141 million Switch units, with 15.7 million of those sales occurring in the recently ended fiscal year.

Providing a consistent flow of entertaining games is essential because these sales tend to decrease steadily over time.

AP – VOR News Image

Nintendo To Announce Switch Successor In This Fiscal Year As Profits Rise

This month, “Endless Ocean Luminous,” a virtual scuba diving experience that included whales, vibrant fish, and other aquatic species, went on sale. Next month, the plumber Mario’s sibling will appear in “Luigi’s Mansion 2,” which will go on sale.

Nintendo is also preparing a new movie for a global release in April 2026. It hopes to attract more fans to its property with the later this year debuts of Donkey Kong Country at Universal Studios Japan and a Nintendo museum in Kyoto.

SOURCE – (AP)

Business

Disney’s Streaming Business Turns A Profit In First Financial Report Since Challenge To Iger

Due to restructuring and impairment losses, The Walt Disney Co. saw a deficit in its second quarter; nevertheless, adjusted profit exceeded forecasts, and the company’s streaming division made money. The corporation raised its forecast for the year since theme parks also performed well.

Disney announced on Tuesday that it expects its combined streaming businesses to be profitable in the fourth quarter and to be a significant future growth driver for the company, with further improvements in profitability in fiscal 2025. Disney acknowledged that it foresees its overall streaming business softening in the current quarter due to its platform in India, Disney+Hotstar.

Disney+ and Hulu are part of the direct-to-consumer division, which reported quarterly operating income of $47 million, up from a $587 million loss the previous year. Revenue reached $5.64 billion, up 13%.

reporter – VOR News Image

Disney’s Streaming Business Turns A Profit In First Financial Report Since Challenge To Iger

The second-quarter operating deficit for the combined streaming businesses—Disney+, Hulu, and ESPN+—dropped to $18 million from $659 million, while revenue increased to $6.19 billion from $5.51 billion.

In the second quarter, core Disney+ subscribers increased by almost 6%.

However, Disney’s streaming business is improving despite its cable division losing ground. That segment’s sales decreased by 8% in the most recent quarter.

“Upon examining our organization holistically, it is evident that the transformation and expansion endeavors we initiated last year have persistently produced favorable outcomes,” Iger stated in a written statement.

During Disney’s conference call, Iger announced that the business will incorporate an ESPN tab into Disney+ by year-end, following suit with Hulu. This will provide live sports and studio content for U.S. users via the Disney+ app.

In February, ESPN, Fox, and Warner Bros. Discovery revealed their intentions to introduce a sports streaming service in the autumn that will feature content from all four major professional sports leagues and at least 15 other networks.

Iger added that the business will begin enforcing stricter measures against password sharing for its streaming service in select areas starting next month, with plans to go global in September.

Disney, like its competitors like Netflix, has high-quality streaming material, but Iger stated that the company’s current priority needs to be expanding its technological capabilities. These steps—including the password crackdown—are anticipated to increase revenue.

This is the first financial report since last month, when investors fiercely opposed activist investor Nelson Peltz’s attempts to win seats on the company board. They supported Iger’s efforts to revitalise the business following a difficult period.

While some Disney investors may have been hoping for more from the quarterly report, Thomas Monteiro, senior analyst at Investing.com, noted that “the company has tilted its operation back to its core business model, which is more conservative by nature.”

Monteiro concentrated on the business’s attempts to profit from its streaming section.

“Amidst Hollywood’s massive strike period, the big surprise of the day came on the streaming front, which finally managed to bring profits – way ahead of predictions,” stated Monteiro. “This suggests that the more global, low-production-cost Netflix-like model is probably the best course of action for an organization that needs to reevaluate its overall growth expectations.”

Disney’s theme parks abroad recorded a 29% increase in revenue, while its domestic theme parks saw a 7% gain.

However, Disney admitted that the quarter’s higher theme park expenses resulted from inflation.

ringer – VOR News Image

Disney’s Streaming Business Turns A Profit In First Financial Report Since Challenge To Iger

The business reported that while visitors to Disneyland raised their spending due to higher ticket and hotel room prices, guests at Walt Disney World increased their spending due to higher ticket prices.

The November debut of World of Frozen, a portion of the park including attractions based on the well-known “Frozen” films, helped Hong Kong Disneyland overseas.

Like many other tourist spots, Disney is still used to post-pandemic visitation.

Chief Financial Officer Hugh Johnston stated on the call, “We are seeing some evidence of a global moderation from peak post-Covid travel, even though consumers are still traveling in record numbers and we are still seeing healthy demand.”

Disney lost $20 million for the quarter that ended on March 30, or one penny per share. In contrast, the company made $1.27 billion in profit a year prior, or 69 cents per share.

Charges for restructuring and impairment increased to $2.05 billion from $152 million during the same period last year.

After deducting charges and other things, adjusted earnings came in at $1.21 per share, well exceeding the $1.12 per share projected by Zacks Investment Research’s panel of experts.

Disney announced that it has revised its full-year adjusted profits per share growth forecast to 25% in light of its second-quarter results. Before, it had projected growth of at least 20%.

The Burbank, California-based company’s revenue increased to $22.08 billion from $21.82 billion in the previous year, but it fell short of $22.13 billion in Wall Street projections.

Disney didn’t release any major movie titles in the second quarter compared to the same period last year, which included the release of “Ant-Man and the Wasp: Quantumania,” which caused content sales and license revenue to drop by 40%. The continuous release of “Avatar: The Way of Water,” released in December 2022, also contributed to the outcomes from a year ago.

melanie – VOR News Image

Disney’s Streaming Business Turns A Profit In First Financial Report Since Challenge To Iger

Over 8% of the shares dropped during morning trade.

The Walt Disney Company reported in February that it was implementing “significant cost reductions,” in the first quarter of that year, it cut its selling, general, and other operations expenses by $500 million. In 2023, the corporation laid off thousands of workers.

In a state court battle over Walt Disney World’s future development after the Florida governor took over the theme park resort’s governance, friends of Governor Ron DeSantis and Disney came to a settlement deal in March.

Actors’ Equity Association, the union that represents character performers at Disneyland in California, said last month that they had submitted a petition to be recognized as a union.

SOURCE – (AP)

Business

US Seeks Information From Tesla On How It Developed And Verified Whether Autopilot Recall Worked

DETROIT — The company’s Autopilot semi-automatic driving technology is present in more than 2 million vehicles, and federal highway safety investigators want Tesla to explain how and why it developed the repair.

The National Highway Traffic Safety Administration in the United States has 20 crash reports after the recall remedy was distributed as an online software update in December, raising doubts about the recall’s effectiveness.

The question of whether Autopilot should be permitted to run on roadways other than limited access highways was also addressed by the recall update. Increased warnings to drivers on roads with intersections served as a remedy.

AP – VOR News

US Seeks Information From Tesla On How It Developed And Verified Whether Autopilot Recall Worked

However, investigators said they were unable to distinguish between alerts to drivers to pay attention sent before the recall and following the installation of the revised software in a letter to Tesla that was published on the agency’s website on Tuesday. The agency stated that it would assess the effectiveness of driver warnings, particularly in cases where a driver-monitoring camera is obscured.

The government focused on how Tesla employed human behavior to test the efficacy of the recall after receiving voluminous information on the company’s development of the patch.

The letter, according to Phil Koopman, a professor at Carnegie Mellon University who specializes in automated driving safety, indicates that the recall was largely ineffective in resolving Autopilot issues and was instead an attempt to appease the NHTSA, which had requested the recall following more than two years of research.

Everyone watching can tell that Tesla attempted to take the least amount of action to see what they could get away with, according to Koopman. “And NHTSA needs to act quickly to prevent other automakers from releasing subpar solutions.”

Safety advocates have long feared that Autopilot was not intended for use on roads other than limited-access highways, despite the fact that it can keep a vehicle in its lane and at a safe distance from objects in front of it.

The NHTSA is reacting to lawmakers’ criticism for what they see as a lack of action on autonomous vehicles, according to Missy Cummings, a professor of engineering and computing at George Mason University and expert on automated vehicles.

“The feedback loop is functioning, despite how clumsy our government is,” Cummings stated. “I believe the leadership of the NHTSA is now persuaded that this is an issue.”

yahoo – vor news image

US Seeks Information From Tesla On How It Developed And Verified Whether Autopilot Recall Worked

In an 18-page letter, the NHTSA questions Tesla on how it applied human behavior science to Autopilot’s development and how important it is to include human factors.

Additionally, it requests that Tesla list all positions involving the assessment of human behavior along with the credentials of the employees. Additionally, it queries Tesla on the status of the positions.

The Associated Press contacted Tesla early on Tuesday to inquire about the letter.

Tesla is firing about 14,000 employees, or 10% of the company, as part of a cost-cutting measure to address declining worldwide sales.

Cummings expressed her suspicion that Elon Musk, the CEO, would have fired anyone who possessed knowledge of human behavior, a critical ability required to implement partially automated systems like Autopilot, which are incapable of operating on their own and necessitate human intervention at all times.

“You better have someone on your team that knows what they are doing in that sector if you’re going to have a technology that depends upon human interaction,” she stated.

According to Cummings, her research indicates that the human brain is left with limited functions once a driving system takes over human steering. Many drivers tend to check out and rely too much on the system.

She stated, “You can be a million miles away in your head, you can have your eyes on the road, and you can have your head fixed in one position.” “You won’t be made to pay attention by all the driver monitoring technologies in the world.”

The NHTSA also requests information from Tesla in its letter regarding how the recall remedy resolves driver misunderstanding regarding whether Autopilot has been turned off if they apply force to the steering wheel. In the past, drivers might not have realized immediately that they needed to take control of the vehicle if Autopilot had been disabled.

wikipedia – VOR News Image

US Seeks Information From Tesla On How It Developed And Verified Whether Autopilot Recall Worked

A feature that provides a “more pronounced slowdown” to notify drivers when Autopilot has been turned off was added to the recall. However, drivers must manually activate the function; it is not done automatically by the recall remedy. Investigators questioned how many motorists have made that move.

Telsa is requesting NHTSA. “What do you mean that even though you have a cure, it never turns on?” stated Koopman.

According to him, the letter indicates that the NHTSA is investigating whether Tesla conducted tests to ensure the changes were effective. “After examining the solution, I found it difficult to accept that numerous analyses have demonstrated that these will enhance safety,” Koopman stated.

According to the agency, Tesla also released safety improvements following the recall patch to lessen hydroplaning-related crashes and collisions in high-speed turn lanes. The NHTSA declared that it would investigate Tesla’s decision to omit the changes from the initial recall.

According to safety experts, NHTSA may pursue additional recall remedies, impose restrictions on the Autopilot operating range, or even order Tesla to disable the technology until it is corrected.

In 2021, the NHTSA launched its Autopilot investigation in response to 11 instances of Teslas hitting parked emergency vehicles while operating on Autopilot. The NHTSA stated in documents outlining the reasons for the investigation’s termination owing to the recall that it eventually discovered 467 Autopilot-related collisions that resulted in 54 injuries and 14 fatalities.

SOURCE – (AP)

-

Sports5 months ago

Saints’ Aggressive Play-Calling Ends Up Coming Back To Hurt Them In Loss To Rams

-

Business5 months ago

Nike Says It Will Cut $2 Billion In Costs In A Major Warning For Consumers

-

Politics5 months ago

Claudine Gay: Harvard President Won’t Lose Job Over Congress Row

-

Business5 months ago

Federal Court Revives Lawsuit Against Nirvana Over 1991 ‘Nevermind’ Naked Baby Album Cover

-

News4 months ago

The Rise of Woke Ideology in Western Culture

-

Learning5 months ago

POLG Mutations and Its Impact on Children’s’ Health