Business

Tax Season Is Under Way. Here Are Some Tips To Navigate It.

NEW YORK — Tax season began Monday, and for many filing US tax returns — particularly those doing so for the first time — it may be a difficult chore that is sometimes pushed until the last minute. But, if you want to escape the stress of the approaching deadline, get organised as soon as possible.

Whether you do your taxes, go to a tax clinic, or hire a professional, navigating the tax system may take time and effort. Courtney Alev, Credit Karma’s consumer financial advocate, suggests you take it easy on yourself.

“Take a breath. Take some time, set out an hour, or work through it over the weekend. “You’ll hopefully realise that it’s much simpler than you think,” Alev added.

If you need more clarity on the process, there are numerous free tools available to assist you navigate it.

Here’s what you should know:

When is the deadline for filing taxes?

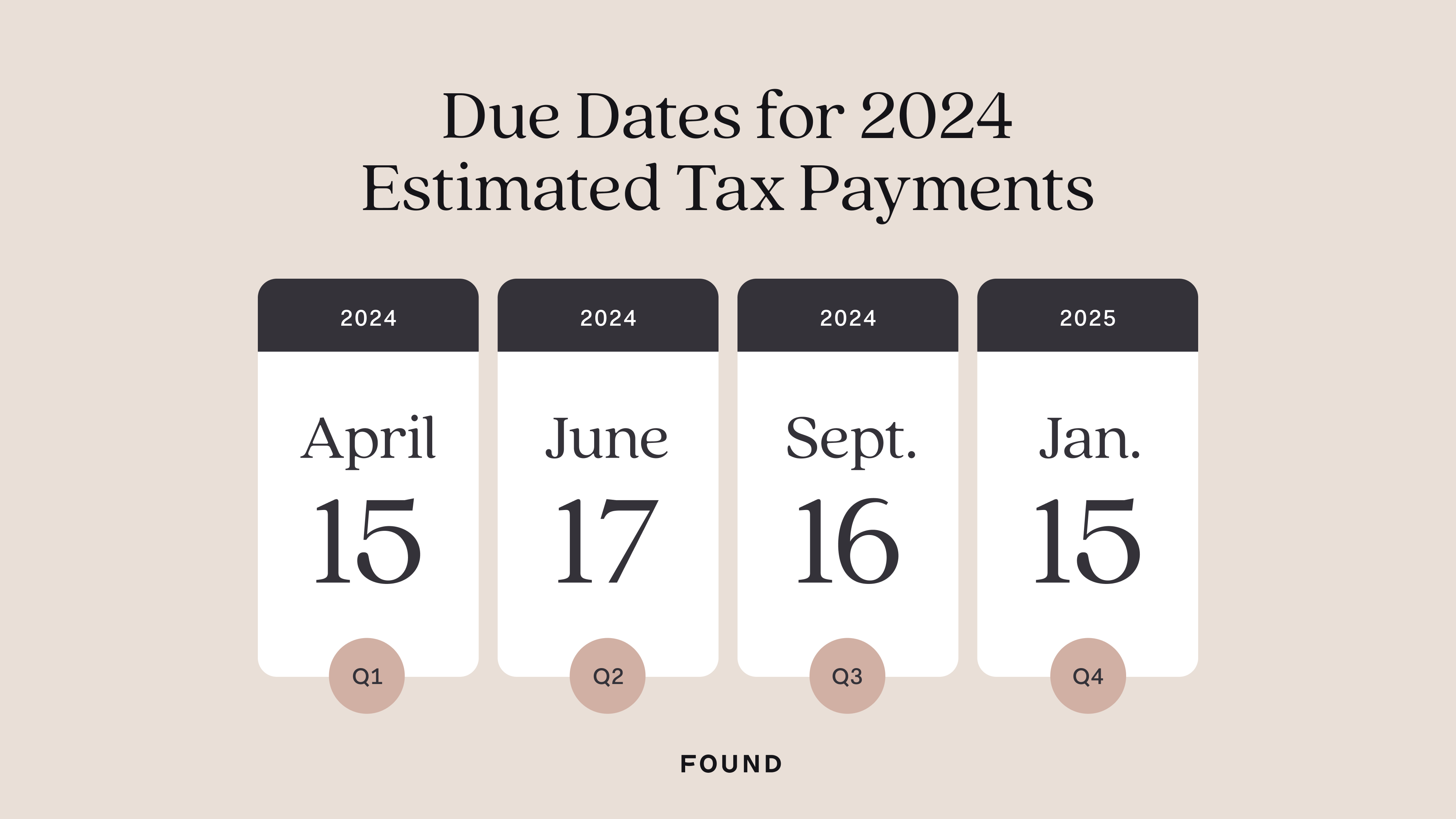

Taxpayers have until April 15 to file forms for 2023.

What do I need to do to file my tax return?

While the required documents may vary by situation, here is a broad outline of what everyone needs:

—Social Security Number

– W-2 documents, if you are employed.

– 1099-G if you are unemployed.

— 1099 paperwork if you are self-employed.

—Investment and savings records

—Any allowable deduction, such as educational costs, medical bills, charitable contributions, etc.

—Tax credits, such as the child tax credit and the retirement savings contribution credit.

The IRS website provides a more detailed document list.

Tom O’Saben, director of tax content and government relations at the National Association of Tax Professionals, recommends gathering all of your paperwork in one location before beginning your tax return and having your records from the previous year if your financial status has significantly altered.

To protect themselves from identity theft, O’Saben recommends taxpayers create an identity protection PIN with the IRS. Once you’ve created a number, the IRS will require it when you file your tax return.

How Do I File My Taxes?

You can file your taxes online or on paper. However, there is a significant time gap between the two methods. The IRS can process paper filings for up to six months, whereas electronic filings take only three weeks.

WHAT RESOURCES ARE THERE?

For those earning $79,000 or less yearly, the IRS provides free guided tax preparation that handles your arithmetic. If you have any issues while completing your tax forms, the IRS has an interactive tax aid tool that can provide answers depending on your information.

Aside from famous corporations like TurboTax and H&R Block, taxpayers can use licenced professionals such as certified public accountants. The IRS provides a directory of tax preparers around the United States.

The IRS also finances two programs providing free tax assistance: VITA and Tax Counselling for the Elderly (TCE). People who earn $64,000 or less per year, have disabilities, or speak little English are eligible for the VITA programme. People over the age of 60 are eligible for the TCE programme. The IRS has a website where you may find organisations that host VITA and TCE clinics.

If you have a tax problem, clinics nationwide can help you handle it. These tax clinics typically provide services in multiple languages, including Spanish, Chinese, and Vietnamese.

HOW CAN I AVOID MISTAKES ON MY TAX RETURN?

Many people are concerned about getting in trouble with the IRS if they make errors. Here’s how to avoid some of the more popular ones:

—Confirm your name on your Social Security card.

When working with customers, O’Saben always requests that they bring their Social Security cards to double-check their number and legal name, which can change when people marry.

“You may have changed your name, but you didn’t change it with Social Security,” he remarked. “If the Social Security number doesn’t match the first four letters of the last name, the return will be rejected, and that will delay processing.”

—Look for tax statements if you’ve opted out of paper mail.

Many people prefer to avoid receiving snail mail; however, doing so may result in your tax paperwork being included.

“If you didn’t get anything in the mail doesn’t mean that there isn’t an information document out there that you need to be aware of and report accordingly,” he said.

—Be sure to record all of your income.

If you worked more than one job in 2023, you’ll need the W-2 forms for each.

What about the Child Income Credit?

Last month, Congress announced a bipartisan deal to expand the child tax credit. The tax credit is $2,000 per kid, with just $1,600 refundable. The plan would gradually boost the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 the following year, and $2,000 for 2025 tax returns.

According to the Centre for Budget and Policy Priorities, if this deal is implemented, around 16 million low-income children will benefit from expanding the child tax credit. Lawmakers hope to move this bill as quickly as feasible.

What if I make a mistake?

Mistakes happen, and the IRS takes a different response in each case. In general, if you make a mistake or leave something out of your tax returns, the IRS will audit you, according to Alev. An audit indicates that the IRS will ask for additional documentation.

“Generally, they are quite understanding and willing to collaborate with others. “You won’t be arrested if you type in the wrong field,” Alev stated.

What if it has been years since I filed?

You can file taxes late; if you were expecting a refund, you may still receive it. If you last filed years ago and owe money to the IRS, you may face penalties, but the agency can work with you to set up payment plans.

How Can I Avoid Scams?

Tax season is a perfect time for tax scams, according to O’Saben. These frauds can be delivered via phone, text, email, or social media. The IRS does not use any of these methods to reach taxpayers.

Tax preparers can sometimes be fraud perpetrators, so ask many questions. According to O’Saben, this could be a warning sign if a tax preparer tells you you will receive a greater refund than in past years.

If you need help seeing what your tax preparer is doing, request a copy of the tax return and ask questions about each entry.

How long should I keep copies of my tax returns?

It’s usually a good idea to preserve a record of your tax returns in case the IRS audits you on something you reported years ago. O’Saben recommends retaining copies of your tax returns for up to seven years.

How Do I File a Tax Extension?

You can request an extension if you run out of time to file your tax return. However, remember that the extension only allows you to file your taxes, not pay them. Pay an estimated amount before the deadline to avoid penalties and interest if you owe taxes. If you expect a refund, you will still get it when you file your taxes.

Filing an extension gives you till October 15 to file your taxes. You can file for an extension using your preferred tax software or preparer, the IRS Free File tool, or by mail.

What happens if you file your taxes late?

You may face several fines if you miss the tax deadline and do not file for an extension. If you miss the deadline, you may face a failure-to-file penalty. According to the IRS, the penalty will be 5% of the unpaid taxes for each month the tax return is late.

You will face a failure-to-pay penalty if you owe taxes and fail by the deadline. Interest will be levied on both outstanding taxes and penalties. If you are eligible for a refund, you will not be penalised and will get your tax return payment. If you had unusual circumstances that prevented you from filing or paying your taxes on time, you may be entitled to waive or decrease your penalty.

You can apply for a payment plan if you owe too much in taxes. Payment options will allow you to repay over time

SOURCE – (AP)

Business

Tesla Stock Tumbles After Its Profit Plunged

Telsa second-quarter profit fell more than 40% from the previous year as the electric car business faced more EV competition from established automakers and a slowing in global EV sales growth.

The decline in income is a dramatic contrast to a corporation that developed to become the world’s most valuable automobile based on rising sales and profitability.

The findings highlight how Tesla, a pioneer in introducing electric vehicles to American drivers, is now facing more domestic and international competition. And as the EV market matures, customer interest in EVs has declined.

Tesla | Auto Guide

Tesla Stock Tumbles After Its Profit Plunged

Tesla (TSLA) shares plunged almost 12% on Wednesday morning, pushing down the broader market. Tesla’s stock was down roughly 1% this year through Tuesday’s close after plunging as much as 44% earlier in the year.

Tesla announced adjusted earnings of $1.8 billion in the quarter or 52 cents per share. Analysts expected 61 cents per share earnings, down from 91 cents the previous year. Its crucial profit margin fell substantially as a series of EV price cuts took its toll.

From April to June, the company had its second consecutive quarter of year-over-year sales decreases and its first consecutive quarter of dropping sales volume. Tesla’s only previous quarterly sales decline since going public occurred early in the pandemic when stay-at-home orders caused its plants to close.

Tesla did not provide a new sales target for the full year. However, it stated: “In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023.”

On the investor’s call following the announcement, Tesla CEO Elon Musk criticized the quality of EVs produced by other manufacturers, claiming that it was simply a short-term issue for Tesla and not a long-term one. He added that Tesla is still persuaded that the world is going towards fully electric transportation systems, not just for automobiles, planes, and ships.

Musk also stated that the business would provide more information on fully automated robotaxis in October rather than August as initially intended. The business calls its driver assistance feature “Full Self Driving,” but drivers must still be prepared to take control of the vehicle. According to the company’s earnings statement, Tesla still confronts regulatory and technical challenges before offering self-driving cars.

Musk stated that he still believes it is possible to reach by the end of this year and certainly by next year, but cautioned: “My predictions on this have been overly optimistic in the past.”

Tesla | Top Gear Image

Tesla Stock Tumbles After Its Profit Plunged

The company faces government probes into several of Musk’s boasts about Full Self-Driving capabilities. The company has also been the subject of a Department of Justice investigation, though it is unclear what the current situation is.

However, he disclosed that Tesla’s plans to build an assembly factory in Mexico had been placed on hold. The plans were disclosed more than a year ago, but Musk said they have been halted until after the presidential election due to Republican contender Donald Trump’s vow to impose taxes on Mexican-imported vehicles. Musk is a big Trump booster, having endorsed him and reportedly pledged tens of millions of dollars to the former president’s re-election campaign. Trump promised comparable duties on Mexican-made autos in 2019 but has yet to follow through.

SOURCE – CNN

Business

Bitcoin Surpasses $67,000 in Anticipation of Trump’s Keynote Address.

(VOR News) – Over the Bitcoin course of the last twenty-four hours, the sum of money that has been liquidated in short positions for Bitcoin BTC +4.71% has increased to more than $34 million.

This is a significant increase from the previous state of affairs. The fact that Bitcoin, the digital asset with the highest market capitalisation, has broken beyond the barrier of $67,000 is the reason for this new development.

Nashville, Tennessee will host this year’s Bitcoin Conference.

According to the website of the conference, the former president of the United States is set to make an appearance on the Nakamoto Stage on July 27 at 2:00 p.m. Central Time for a session that will last thirty minutes.

This information is indicated on the website. Yesterday, on the final day of the conference, the session is scheduled to take place.

As a direct result of the increase in the price of bitcoin that took place during the course of the previous day, a total of holdings representing a value of 54 million dollars were sold off.

As a consequence of the increased volatility of the market, the cryptocurrency market as a whole went through liquidations that amounted to more than two hundred million dollars within the same time period. This is evidenced by the data that were provided by Coinglass.

The information that is provided by The Block’s Bitcoin Price Page reveals that the current value of Bitcoin is around $67,330 at the time that this article is being written and published.

This information is provided by The Block. Over the course of the past twenty-four hours, there has been an increase that is greater than five percent.

President Trump will invest in bitcoin by 2024.

Because of the keynote presentation that he will deliver at Bitcoin 2024, Donald Trump will create history by becoming the first candidate for the presidency of the United States of America to visit a conference of this kind that is sponsored by the industry.

This will be something that he will accomplish by attending Bitcoin 2024. In spite of the fact that there is a little amount of information available concerning the specifics of his discussion, the organisers have already claimed that it will be “historic.”

Throughout the course of his presidency, President Trump has adopted a variety of perspectives about a wide range of cryptocurrencies, including bitcoin and others from the same category.

He voiced his disapproval of cryptocurrencies on Twitter in July 2019, saying, “I am not a fan of bitcoin and other cryptocurrencies, which are not money and whose value is highly volatile and based on thin air.”

He was referring to the fact that certain cryptocurrencies are not money. His hatred for these cryptocurrencies has been made clear in his statements.

Specifically, he expressed his discontent with the bitcoin market.

Which was the subject of his expression. This viewpoint was reiterated by him in 2021, when he gave an interview to Fox Business in which he referred to the digital asset as a hoax and voiced his concern that it may compete with the United States dollar or other currencies. In addition, he expressed his concern that it could be used to compete with other currencies.

Nevertheless, throughout the course of the last six months, Trump has rebuilt himself as the “crypto president.” The fact that he chose Ohio Senator JD Vance, who is an investor in bitcoin, to be his vice presidential candidate lends credence to the notion that a Donald Trump presidency may be advantageous to cryptocurrencies.

This is an extra point of interest that is worth mentioning. Bitcoin is an investment that Vance has made.

During the course of the previous day, the dominance of Bitcoin increased slightly to 52.8%, as indicated by the data that were provided by Coingecko. On the other hand, the dominance of ether decreased slightly to 15.5%.

Indicative of the fact that Bitcoin’s dominance rose, both of these data are indicative of reality. After reaching its highest position, the GM 30 Index, which is comprised of a selection of the top 30 cryptocurrencies, witnessed a climb of 3.08% within the same time period, hitting 133.99.

This was after the index had reached its highest peak.

SOURCE: TBN

SEE ALSO:

Sanstar Stock Gains after Listing: Should you Buy, Sell, or Hold?

MMTC’s Shares Surge 20% to Reach a One-Year High; What’s Ahead for This PSU Stock?

Tesla’s Stock is Down due to the Ongoing Decline in Profits.

Business

Sanstar Stock Gains after Listing: Should you Buy, Sell, or Hold?

(VOR News) – Sanstar shares made a quiet Dalal Street debut on Friday, which was less than market participants had anticipated as a consequence of their expectations.

However, the number of buyers rose significantly following the stock’s listing, suggesting that investors are interested in purchasing the company at reduced prices.

At Rs 109 per share, Sanstar shares were offered on the National Stock Exchange (NSE) at a premium of approximately 15%. The stock was listed on the Bombay Stock Exchange (BSE) at a premium of 12 percent over the issue price of Rs 95 per share.

Nevertheless, the stock attained a price of Rs 127.68, achieving a 20% upper circuit and bringing the cumulative profits to 34.4 percent over the price at which it was initially issued.

The majority of analysts continue to maintain a positive outlook on the company and suggest that investors remain invested in the stock for a period of time that varies from medium to long term.

On the other hand, there are some experts who suggest that investors record profits after achieving a respectable profit during the initial trading session.

A successful initial public offering (IPO) was achieved by Sanstar

The company’s shares are currently trading at Rs 109 per share, an increase of 15% from their issue price of Rs 95.

This performance is positive, according to Shivani Nyati, Head of Wealth at Swastika Investmart; however, it fails to satisfy the expectations that were established prior to the listing. The broader market volatility that ensued subsequent to the budget’s announcement was a contributing factor.

Sanstar has been listed, which is a fantastic development, despite the fact that it did not meet the initial hype.

The company’s future expansion is supported by the interest of investors and the company’s robust foundations. Investors have the option to maintain their stake at the issue price, according to her.

Sanstar’s initial public offering (IPO) had the potential to be subscribed between July 19 and July 23, as the business issued its shares at a price range of Rs 90-95 per share, with a lot size of 150 shares.

Sanstar’s follow-on offering yielded a total of Rs 510.15 crore in revenue. This offering comprises a wholly new share sale of up to 397.10 equity shares and an offer-for-sale of up to 1.19 crore equity shares.

Sanstar got a 15% premium because of demand.

Which contributed to the company’s successful launch on the bourses today. According to Prathamesh Masdekar, Research Analyst at StoxBox, Sanstar has established enduring relationships with its consumers and currently serves more than 525 customers, with 162 new customers joining during fiscal year 24.

“The company is committed to expanding its customer base by leveraging the relationships it has established with customers in India and around the world, while simultaneously actively seeking out opportunities to establish new relationships.

“”Because of this, we recommend to the market participants that they keep the shares for a period of time ranging from the medium to the long term,” according to him.

A total of 82.99 subscriptions were received from consumers worldwide for the Sanstar issue. The quota for qualified institutional vendors (QIBs) was satisfied 145.68 times during the auction.

A remarkable 136.50 percent of the quota that was designated for non-institutional investors was subscribed to. The portions that were specified for retail investors were only subject to requests for bids 24.23 times during the three-day bidding procedure.

Sanstar’s listing was lower than anticipated, despite the fact that markets were trending upward. Prashanth Tapse, Senior Vice President of Research at Mehta Equities, maintains that designated investors should record profits on the day of listing, despite the market’s optimistic outlook.

Compared to other listed peers, Sanstar’s valuations are a little higher.

Sanstar is a manufacturer in India that specialises in the manufacturing of plant-based products and ingredient solutions for industrial products, pet food, and food.

Pantomath Capital Advisors served as the exclusive book-running lead manager for Sanstar’s initial public offering (IPO), while Link Intime India served as the registrar.

According to Amit Goel, Co-Founder and Chief Global Strategist at Pace 360, the market volatility in the Indian markets resulted in Sanstar shares failing to meet pre-listing expectations. Sanstar shares were listed on the National Stock Exchange (NSE) at a price of Rs 109.

We strongly recommend that investors take profits in the near term following the completion of the listing. He continues, “It is advised that long-term investors maintain their positions in the company due to its strong fundamentals.”

SOURCE: BTN

SEE ALSO:

MMTC’s Shares Surge 20% to Reach a One-Year High; What’s Ahead for This PSU Stock?

Disney Reaches Tentative Agreement With California Theme Park Workers

Tesla’s Stock is Down due to the Ongoing Decline in Profits.

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning