Finance

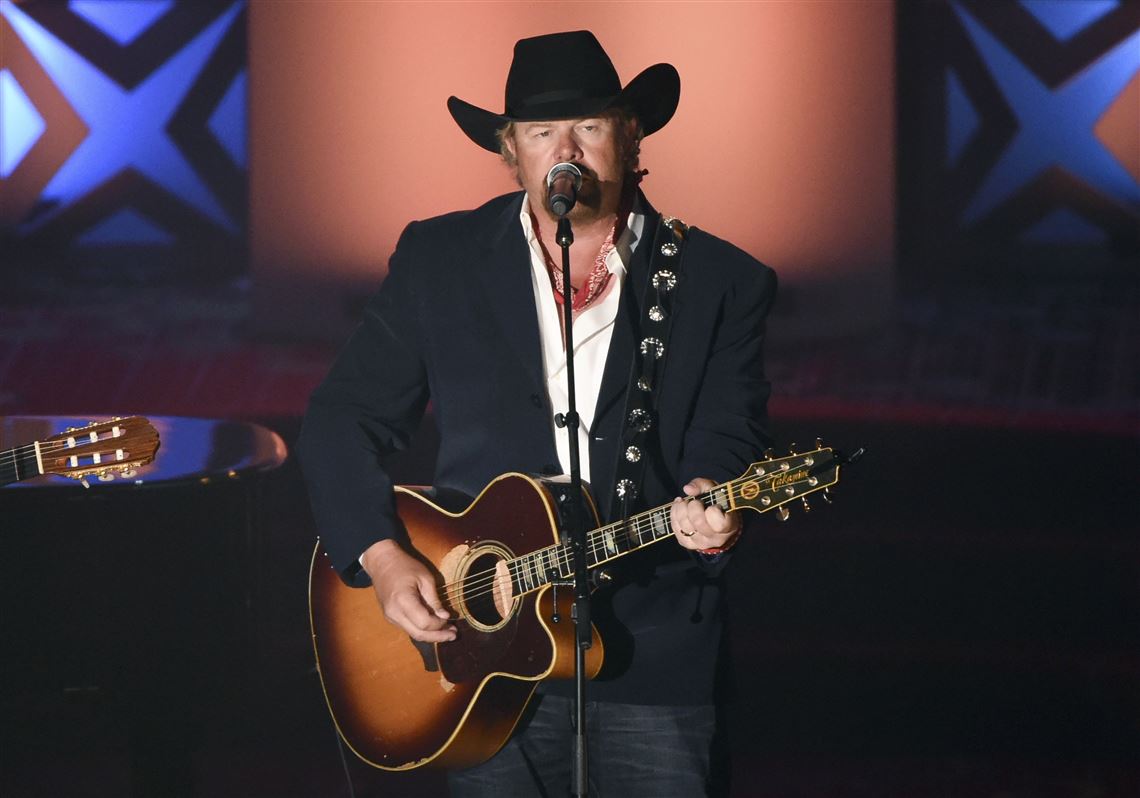

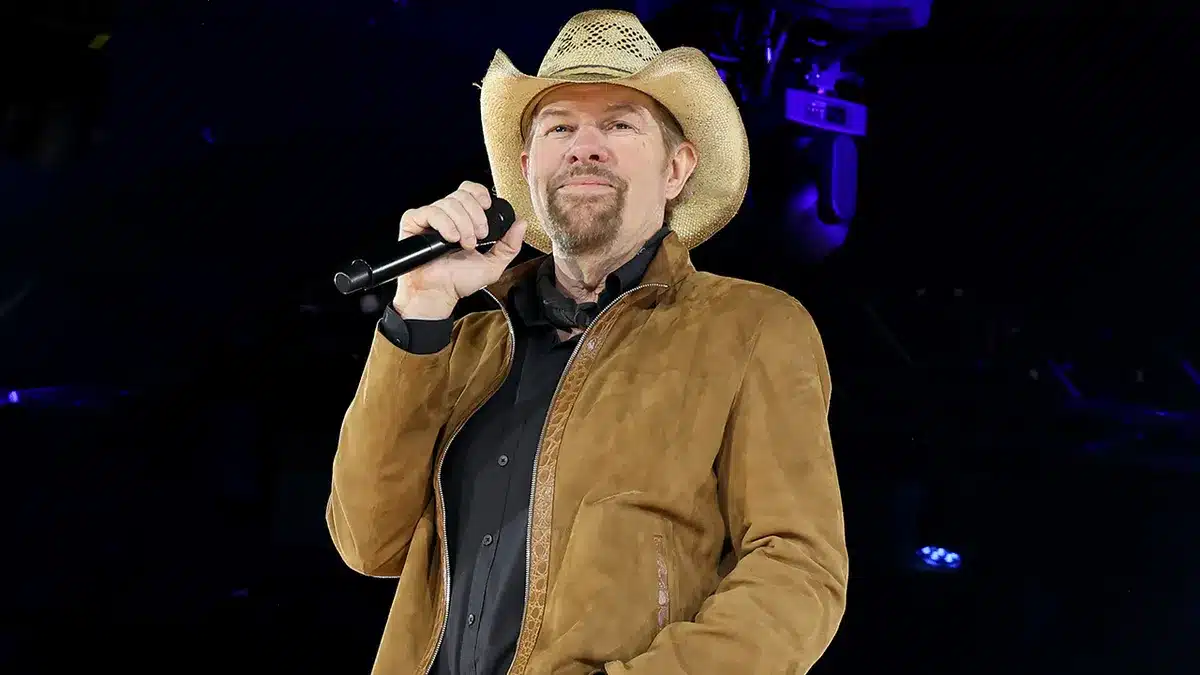

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

Toby Keith, a popular country singer known for his pro-American anthems who enraged detractors while also winning over millions of admirers, has died. He was 62.

According to a statement on his website, the singer-songwriter of “Should’ve Been a Cowboy,” who had stomach cancer, passed away peacefully on Monday with his family by his side. “He fought his fight with grace and courage,” the statement read. He disclosed his cancer diagnosis in 2022.

The 6-foot-4 vocalist rose to prominence during the country boom of the 1990s, producing songs that listeners enjoyed hearing. Throughout his career, he publicly clashed with other celebrities and journalists and frequently fought against record executives who sought to tame his rough edges.

He was recognized for his overt patriotism in post-9/11 songs like “Courtesy of the Red, White, and Blue,” as well as loud barroom songs like “I Love This Bar” and “Red Solo Cup.” He possessed a big, booming voice, a tongue-in-cheek sense of humour, and a range that could carry love and drinking songs.

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

His 20 No. 1 Billboard successes included “How Do You Like Me Now?!,” “As Good As I Once Was,” “My List,” and “Beer for My Horses,” a duet with Willie Nelson. His influences included fellow working-class songwriters such as Merle Haggard, and he had more than 60 singles on the Hot Country chart over his career.

Keith continues to perform despite his cancer treatments, most recently in Las Vegas in December. In 2023, he also performed at the People’s Choice Country Awards with his song “Don’t Let the Old Man In.”

“Cancer is a roller coaster,” he told KWTV in an interview broadcast last month. “You simply sit here and wait for it to go away. “It may never go away.”

Keith worked as a roughneck in Oklahoma’s oil fields as a young man, then played semi-pro football before beginning his singing career.

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

“I write and sing about life, and I don’t overanalyze things,” Keith told The Associated Press in 2001, following the popularity of his song “I’m Just Talking About Tonight.”

Keith received valuable lessons in the growing oil fields, which toughened him up and taught him the importance of money.

“The money to be made was unbelievable,” Keith told the Associated Press in 1996. “I graduated from high school in 1980, and they hired me in December 1979 for $50,000 a year. “I was 18 years old.

However, the domestic oilfield business crumbled, and Keith was not saved. “It almost broke us,” he admitted. “So, I just learned. I took care of my money this time.”

He played a few seasons as a defensive end for the Oklahoma City Drillers, a farm team for the now-defunct United States Football League. But he made consistent money playing music with his band on Oklahoma and Texas’s red dirt roadhouse circuit.

“All through this whole thing, the only constant thing we had was music,” he said. “But it’s difficult to sit back and say, ‘I’m going to make a fortune singing or writing music.’ I had no contacts.

His path eventually led him to Nashville, where he piqued the eye of Mercury Records’ head, Harold Shedd, best known for producing the success group Alabama. Shedd signed him to Mercury, where he launched his platinum debut album, “Toby Keith,” in 1993.

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

His breakout hit, “Should’ve Been a Cowboy,” was played 3 million times on radio stations, making it the most popular country song of the 1990s.

However, the label’s focus on worldwide superstar Shania Twain eclipsed the rest of the group, and Keith believed that the executives were attempting to steer him in a pop path.

“They were trying to get me to compromise, and I was living a miserable existence,” Keith was quoted as saying by the AP. “Everybody was trying to mould me into something I was not.”

Keith signed with DreamWorks Records in 1999, following a string of albums that included singles including “Who’s That Man” and a cover of Sting’s “I’m So Happy I Can’t Stop Crying.”

That’s when his multiweek hit “How Do You Like Me Now?!” went viral and became his first Top 40 smash. In 2001, he won male vocalist and album of the year at the Academy of Country Music Awards, screaming on stage, “I’ve waited a long time for this. “Nine years!”

Keith frequently wore his politics on his sleeve, particularly following the terrorist attacks on American soil in 2001, and he initially identified as a conservative Democrat before later claiming to be independent. He performed in events for Presidents George W. Bush, Barack Obama, and Donald Trump, who awarded him the National Medal of the Arts in 2021. His music and forthright opinions occasionally sparked controversy, which he appeared to relish.

His 2002 song “Courtesy of the Red, White and Blue (The Angry American)” carried a threat — “We’ll put a boot in your ass — It’s the American way” — to anyone who attempted to interfere with America.

That song was removed from a patriotic ABC Fourth of July special because producers felt it was too furious for the broadcast. Singer-songwriter Steve Earle described Keith’s song as “pandering to people’s worst instincts at a time when they are hurt and scared.”

Toby Keith, Country Singer-Songwriter, Dies At 62 After Stomach Cancer Diagnosis

Then there was the conflict between Keith and The Chicks (previously known as the Dixie Chicks), who became Keith’s target after singer Natalie Maines informed a crowd that they were embarrassed by then-President George W. Bush. Maines had previously described Keith’s song as “ignorant.”

Keith, who had previously stated that he backed any artist’s right to express their political views, juxtaposed a doctored photo of Maines with an image of Saddam Hussein at his shows, inciting even more outrage among fans.

Maines retaliated by wearing a blouse with the letters “FUTK” onstage at the 2003 ACM Awards, which many people saw as a rude message to Keith.

Keith, who has admitted to holding grudges, stormed out of the ACM Awards early in 2003 after being spurned in earlier categories, missing out when he was named entertainer of the year. Vincent Gill accepted on his behalf. He returned the following year and won the top prize for the second year in a row, as well as best male vocalist and album of the year for “Shock ‘n Y’all.”

His pro-military stance was more than just material for songs. He embarked on 11 USO trips to visit and perform for overseas troops. Throughout his career, he has helped raise millions of dollars for charity, including constructing a home in Oklahoma City for children with cancer and their families.

Keith restarted his career after Universal Music Group acquired DreamWorks, launching his record label, Show Dog, in 2005 alongside record executive Scott Borchetta, who founded his label, Big Machine.

“Probably 75% of the people in this town think I’ll fail, and the other 25% hope I fail,” he said.

Keith, Trace Adkins, Joe Nichols, Josh Thompson, Clay Walker, and Phil Vassar were among the artists signed to the label, which later became Show Dog-Universal Music.

His following singles were “Love Me If You Can,” “She Never Cried in Front of Me,” and “Red Solo Cup.” He was elected into the Songwriters Hall of Fame in 2015.

He received the BMI Icon award in November 2022, a few months after announcing his stomach cancer diagnosis.

“I always believed that songwriting was the most important aspect of this entire industry,” Keith told the audience of fellow singers and writers.

SOURCE – (AP)

Finance

Economist Warns Over Canada Slipping into a Cashless Society

Canadian economist Carlos Castiblanco believes that Canada should follow in the footsteps of other countries and enact legislation to protect the use of cash in the country.

Castiblanco, together with the group Option Consommateurs, is urging the Trudeau government to follow the lead of other jurisdictions in the United States and Europe in enacting legislation to slow the transition to a cash-less society.

He stated that barely 10% of transactions in Canada now use cash, and that Canada must defend cash now before more merchants begin to refuse it totally.

It is vital to act now, he told CBC Radio’s Ontario Today, before businesses begin removing all of the infrastructure required to handle and manage actual cash.

“They are already used to dealing with cash, so this is the moment for the Trudeau government to act, before it is more complicated.”

A recent online poll of almost 1,500 people commissioned by a different group, Payments Canada, discovered that the majority of respondents were concerned about the potential of cashless stores and preferred to keep the ability to use cash.

Bank fees in Canada

Above all, cash has no bank fees, is not vulnerable to privacy breaches, and may be utilized during internet outages.

The Payments Canada paper, “Social policy implications for a less-cash society,” suggests legislative action, saying that cash-based transactions have decreased from 54% in 2009 to 10% by 2021.

Aftab Ahmed, one of its writers, explained who would be most affected by a cashless future in a recent piece for Policy Options, the Institute for Research on Public Policy’s online magazine.

“For many Canadians, including Indigenous people, homeless people, aging citizens, and others who are vulnerable, cash is both a beacon of economic stability and a source of financial insecurity. “Cash is an emergency lifeline and a symbol of cultural traditions,” Ahmed explained.

“Canada must avoid sleepwalking into a cashless future and instead recognize the risk of exacerbating financial exclusion of those most vulnerable.”

Refusing to accept cash

The currency issue has already caught fire outside of Canada, according to Castiblanco, with some US states and territories beginning to pass legislation to preserve access to cash.

In 2019, Philadelphia became the first city in North America to prohibit “any person selling or offering for sale consumer goods or services at retail from refusing to accept cash as a form of payment.”

Other U.S. cities, including New York, Seattle, and Los Angeles, have since taken action on the issue.

In New York, the policy recommends fines of up to $1,500, with the Councillor who proposed the guidelines claiming that prohibiting cashless transactions preserves privacy, equity, and consumer choice.

European countries such as Norway, Spain, and Ireland have enacted similar legislation. In Ireland, the rule would mandate cash transactions at companies like as pharmacies and grocery stores that supply basic goods and services.

Source: CBC

U.K News

UK National Debt Rises to the Highest in 62 Years

UK national debt grew this month to its highest level as a share of the economy since 1961, according to figures released on Friday, adding to the financial issues that the new administration will face when it takes office following a general election in two weeks.

The UK national debt, excluding state-controlled banks, hit 2.742 trillion pounds ($3.47 trillion), or 99.8% of annual GDP, in May, up from 96.1% the previous year, according to the Office for National Statistics.

The increase came despite somewhat lower-than-expected government borrowing in May, which was 15.0 billion pounds, compared to experts’ median projection of 15.7 billion pounds in a Reuters survey.

Following an election on July 4, Britain appears to be on the verge of a change of government, with Keir Starmer’s Labour Party leading Prime Minister Rishi Sunak’s Conservatives in surveys.

During the COVID-19 epidemic, state debt in Britain skyrocketed, and the public finances have been hampered by poor growth and a 16-year high in Bank of England interest rates.

Western Nations Debt

Most other Western countries had significant rises in debt during the same period, although British debt levels are lower than those of the United States, France, and Italy.

A person enters the Treasury government building in London, Britain, on March 5, 2024. REUTERS/Toby Melville/File Purchase Licensing Rights opens a new tab.

Borrowing in the UK totaled 33.5 billion pounds in the first two months of the fiscal year, 0.4 billion more than the same period in 2023 but 1.5 billion pounds less than government budget estimates expected in March.

Capital Economics consultants warned that the lower-than-expected borrowing figures represented less public investment and would provide little comfort to Britain’s future finance minister.

“They do little to reduce the scale of the fiscal challenge that awaits them, in part because of the upward pressure on the debt interest bill from higher interest rates,” said Alex Kerr, an assistant economist at Capital Economics.

Labour and the Conservatives want to keep to existing budget rules that require official estimates – most recently updated in March – to indicate that debt as a proportion of GDP is dropping in the fifth year of the forecast.

Higher interest rates than projected in March’s budget left Britain’s next chancellor with only 8.5 billion pounds of freedom to meet these standards, down from the historically low 8.9 billion in March, Kerr noted.

Both Labour and the Conservatives have committed not to raise income tax, value-added tax, or other major levies, but government budget predictions in March revealed that tax as a percentage of GDP was on track to hit its highest level since 1948.

Source: Reuters

Canada’s Household Debt Nears $3 Trillion Under Trudeau

U.K News

Bank of England Keeps Key Interest Rate at 5.25% Despite Inflation Falling

The Bank of England maintained its main interest rate at a 16-year high of 5.25% on Thursday, despite inflation falling to its target of 2%, with several policymakers warning that a premature decrease may spark another wave of price increases.

Seven of the nine members of the bank’s ruling Monetary Policy Committee voted against a rate drop for the second week in a row, while two supported one. Interest rates have been constant since August, following a series of rises.

The statement accompanying the vote made it plain that there was disagreement on the forecast for inflation, with some expressing concern about continued significant price increases in the services sector, the key driver of the British economy.

“It’s good news that inflation has returned to our 2% target,” said Bank of England Governor Andrew Bailey, who voted to maintain current policy. “We need to be sure that inflation will stay low and that’s why we’ve decided to hold rates at 5.25% for now.”

The decision will likely dismay the ruling Conservative Party ahead of the United Kingdom’s general election in two weeks. Prime Minister Rishi Sunak would have seen a cut as good economic news, especially if it came with a drop in mortgage rates.

Upcoming UK Election

The panel maintained that the upcoming election, which the main opposition Labour Party, led by Keir Starmer, is generally expected to win, did not influence its conclusion. It stated that the decision was, as always, based on meeting the 2% inflation objective “sustainably in the medium term.”

Economists anticipate a rate decrease is on the way, either at the bank’s next policy making meeting in August or the one following in September. They expect clear evidence by then that inflation will remain close to the target for the next year or two.

“We continue to believe that the MPC will ease restrictive policy beginning in the summer and deliver two rate cuts this year,” said Sanjay Raja, Deutsche Bank’s senior U.K. economist.

The reduction in the primary inflation measure to a near three-year low of 2% in the year to May does not imply that prices are falling; rather, they are rising at a slower rate than they have in recent years during a cost-of-living crisis that has resulted in reduced living standards for millions in Britain.

Central banks worldwide dramatically increased borrowing costs from the lows seen during the coronavirus pandemic, when prices began to rise, first due to supply chain issues accumulated during the pandemic and then due to Russia’s invasion of Ukraine, which pushed up energy costs.

Bank of England unduly cautious

Higher interest rates, which cool the economy by making borrowing more expensive, have helped to reduce inflation, but they have also weighed on the British economy, which has hardly expanded since the pandemic’s recovery.

Critics of the Bank of England argue that it is unduly cautious about inflation and that keeping interest rates too high for too long will put undue strain on the economy. It is an accusation that has also been leveled at the United States Federal Reserve, which has held interest rates constant in recent months.

“Given that the U.K. has moved onto a milder inflationary trajectory, rate setters remain overly cautious about the likelihood of loosening policy, risking impeding the U.K.‘s growth prospects,” said Suren Thiru, economics director at The Institute of Chartered Accountants in England and Wales.

Some central banks, like the European Central Bank, have begun to decrease interest rates as inflationary pressures have subsided. On Thursday, the Swiss National Bank cut its main interest rate by a quarter of a percentage point to 1.25%.

Source: The Associated Press

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Business4 weeks ago

Free Speech And Digital Rights Groups Argue TikTok Law Would Infringe On The First Amendment