News

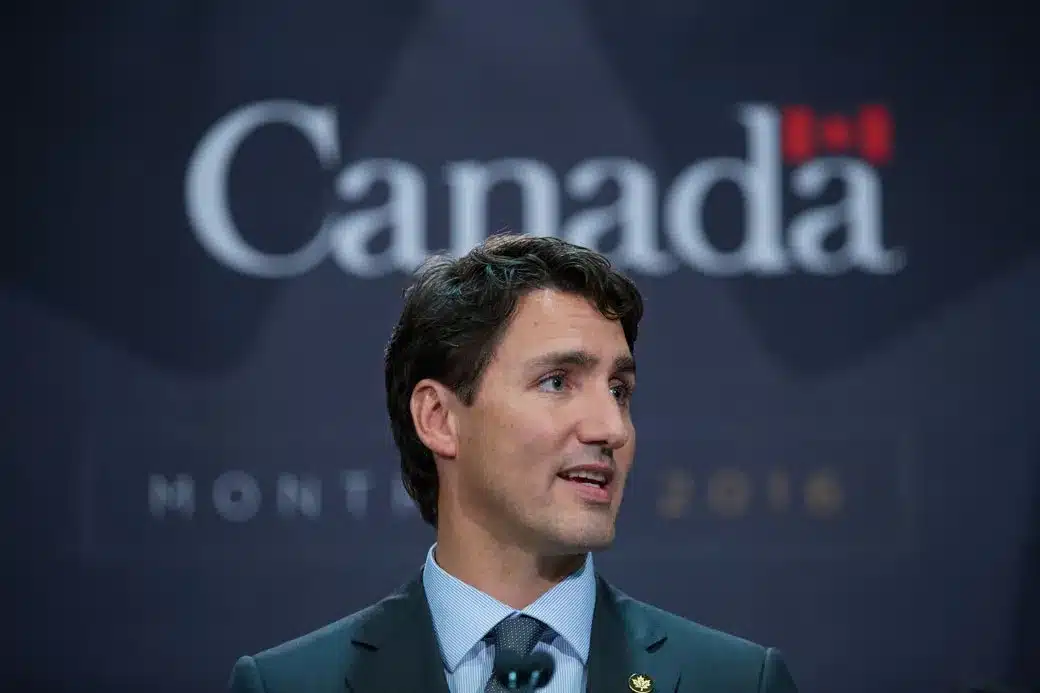

Trudeau Offers No Relief to Canadian Home Owners on Mortgage Rates

Only three years ago, Justin Trudeau was being challenged about the expense of carrying all that extra debt when the Prime Minister interrupted the reporter, CTV’s Glen McGregor, to reprimand him about how low interest rates were.

“Interest rates are at historic lows, Glen,” Trudeau added, a smug smile on his face.

Since then the Trudeau Liberals have boosted expenditure by 55% since gaining office, from $317 billion in 2016 to $490 billion presently. The government deficit increased from $29 billion to $40 billion, and the national debt increased from $648 billion to $1.2 trillion.

And the cost of debt service has risen from $25.7 billion in 2016 to $43.9 billion presently, and it is only going to rise further.

Cash-strapped Canadians who recently purchased homes with long-term variable rate mortgages may be paying up to $1,700 extra each month as a result of this year’s rate hikes.

Now, heavily indebted Canadians seeking for relief from a sharp spike in mortgage rates are in for some disappointment, as recent bond market moves indicate that interest rates will remain elevated for longer than originally thought due to tenacious inflation.

In comparison to the 30-year duration that is prevalent in the United States, nearly all Canadian mortgages have a period of five years or less. According to the Canada Mortgage and Housing Corporation (CMHC), home mortgage debt stood at C$2.08 trillion ($1.53 trillion) as of January 2023.

It implies that when around 20% of Canadian mortgages come up for renewal in the next year, many borrowers will be in a worse financial situation than they could have anticipated just a few months ago. Mortgage rates tend to lag after bond market movements.

“With each passing month, as rates rise, we discuss with consumers how much mortgage they can qualify for, and that’s been decreasing as rates rise,” said James Laird, co-CEO of Ratehub.ca.

Thanks to Trudeau the 5-year mortgage rate offered by major Canadian banks has risen to its highest level since November 2008, according to Bank of Canada data.

When it comes time to renew, homeowners who want to search for lower interest rates may have fewer options because they will have to re-qualify for the stress test at the newest interest rates with their new lender.

Read: Trudeau Now Blames Canada’s International Students for Housing Shortage

In 2021, Canada modified its stress test laws, forcing borrowers to demonstrate their ability to handle mortgage repayment 200 basis points above their contracted rate, and consumers will have to re-qualify if switching to a different lender at the time of renewal.

“That is a flaw in a stress test that hopefully will be fixed at some point.” “You’ll see more consumers than usual sticking with their lenders,” Laird said.

The likelihood of another interest rate hike in September has only increased as inflation has returned to above the Bank of Canada’s target range, while robust economic growth, particularly in the United States, has fueled concerns that rates will remain higher for longer.

With no promise of a rate drop in the near future, worried homeowners are increasingly struggling to make their monthly mortgage payments and, in some circumstances, being forced to sell their homes.

Daniel Foch, director of economic analysis at Toronto-based RARE Real Estate, cited Toronto Regional Real Estate Board statistics showing that power of sale – a clause that permits lenders to sell a borrower’s house if they default on mortgage payments – had increased in recent months.

According to the data, power of sale was used for 48 to 80 properties in the Greater Toronto Area in the last three months, up from 14 to 32 a year ago. According to Foch, that number is on course to reach 75 by the end of August.

With interest rates at a 22-year high, mortgage growth in Canada has fallen to its worst pace in about four years, according to KBW analysts, which is expected to weigh on banks’ quarterly earnings beginning this week.

“Whereas consumers may have had some strong income growth in the last 12 months to offset higher debt payments, that is not going to be the case in the next 12 to 24 months,” said Stephen Brown, deputy chief North America economist at Capital Economics.

“It will undoubtedly be problematic for the Canadian economy if interest rates remain at this level.”

News

Britain Must Be Ready for War in 3 Years, Warns New Army Chief

The new head of the Army has stated that Britain must be prepared to fight a war within three years.

Gen Sir Roland Walker has issued a warning about a variety of risks in what he calls a “increasingly volatile” environment.

However, he stated that war was not inevitable and that the Army had “just enough time” to prepare to prevent conflict.

He stated that the Army’s fighting capacity would be doubled by 2027 and tripled by the end of the decade.

Gen Walker warned that the Britain was under threat from a “axis of upheaval” in his first speech as Prime Minister on Tuesday.

Among the primary concerns confronting the Britain in the next years, as noted by the general in a briefing, is an enraged Russia, which may seek vengeance on the West for helping Ukraine, regardless of who wins the war.

He stated: “It doesn’t matter how it finishes. I believe Russia will emerge from it weaker objectively – or completely – but still very, very dangerous and seeking some form of retaliation for what we have done to assist Ukraine.”

Britain’s Government Defence Review and Military Challenges

He also warned that China was determined to retake Taiwan, and Iran was likely to seek nuclear weapons.

He stated that the threats they posed may become particularly acute in the next three years, and that these countries had formed a “mutual transactional relationship” since the war in Ukraine, sharing weaponry and technology.

However, he stated that the path to conflict was not “inexorable” if the UK re-established credible land troops to assist its deterrent strategy for avoiding war.

In his speech, he described his force of slightly over 70,000 regular troops as a “medium-sized army” and made no direct call for additional resources or men.

However, he pushed the British Army to adapt swiftly, focussing on technology such as artificial intelligence and weaponry rather than numbers.

His ultimate goal is for the Army to be capable of destroying an opponent three times its size.

This would entail firing quicker and farther, he said, aided by lessons learnt from the Ukraine war.

The general’s speech at the Royal United Services Institute land warfare conference comes only one week after the government began a “root and branch” defence review to “take a fresh look” at the challenges facing the armed services.

Defence Secretary John Healey launched the assessment, describing the existing status of the armed forces as “hollowed-out” and stating that “procurement waste and neglected morale cannot continue”.

According to the most recent Ministry of Defence (MoD) numbers from April 2024, the Britain’s regular Army forces total 75,325 troops (excluding Gurkhas and volunteers).

That figure has been declining in recent years, as recruiting has failed to match retention. The previous Conservative administration lowered the planned headcount from 82,000 to 72,500 by 2025.

Members of the NATO military alliance have agreed to spend at least 2% of GDP on defence by 2024, but several countries are unlikely to fulfil this goal.

The Britain presently spends 2.3% of its GDP on defence. Prime Minister Sir Keir Starmer has previously stated that the defence review will include a “roadmap” for increasing this to 2.5%, however he has yet to provide a date for this promise.

Source: BBC

News

Katie Ledecky Hopes For Clean Races At Paris Olympics In The Aftermath Of The Chinese Doping Scandal

PARIS — Katie Ledecky is looking for clean Olympic races. On Wednesday, Hope had pretty much reached her limit.

The American swimmer hopes to add to her six gold medals as she competes in the 400, 800, and 1,500 meters at the Paris Games. Her program starts with the heavy 400 on Saturday, featuring Ariarne Titmus and Summer McIntosh.

Katie Ledecky | ESPN Image

Katie Ledecky Hopes For Clean Races At Paris Olympics In The Aftermath Of The Chinese Doping Scandal

The 27-year-old Katie is competing in her fourth Summer Olympics, but the first since a doping scandal involving almost two dozen Chinese swimmers who tested positive for a banned chemical before the Tokyo Games — yet were permitted to compete with no consequences. The controversy has raised serious worries regarding the effectiveness of anti-doping initiatives.

Katie Ledecky | Vogue Image

“I hope everyone here is going to be competing clean this week,” Ledecky claimed. “But what truly counts is, were they training cleanly? Hopefully this has been the case. Hopefully, there has been worldwide testing.”

The International Olympic Committee has expressed concern over the ongoing US investigation into possible doping by Chinese swimmers. While awarding the 2034 Winter Olympics to Salt Lake City on Wednesday, the IOC urged Utah officials to do whatever they could to stop the FBI investigation.

“I think everyone’s heard what the athletes think,” Katie added. “They seek transparency. They want more answers to the remaining questions. At this point, we are here to race. We are going to race whoever is in the lane next to us.

“We are not paid to conduct the tests, so we trust those who follow their regulations. That applies both today and in the future.

Katie Ledecky | ESPN Image

Katie Ledecky Hopes For Clean Races At Paris Olympics In The Aftermath Of The Chinese Doping Scandal

SOURCE | AP

News

London Heatwave Alert: High Temperatures Set to Soar to 29C Next Week

As the summer holidays begin, London may experience an official heatwave with temperatures reaching up to 29 degrees Celsius.

The Met Office predicts a long period of sunny and dry weather for London after a soggy spring and summer.

After a cloudy day on Saturday, temperatures are expected to reach 27C on Sunday, with lots of sunlight.

On Monday and Tuesday, temperatures are forecast to peak at 29 degrees Celsius. Monday is forecast to offer more sunlight, while Tuesday may see some gloomy weather.

Temperatures are expected to remain in the high 20s next week, with lows of approximately 18C.

According to the Met Office, a heatwave is “an extended period of hot weather relative to the expected conditions of the area at that time of year, which may be accompanied by high humidity.”

In the United Kingdom, a heatwave is proclaimed when daily temperatures meet or surpass a certain level for at least three consecutive days.

In London, the heatwave threshold is 28 degrees Celsius.

The Met Office reported that the UK is experiencing hotter and wetter weather on average due to climate change.

The UK experienced its warmest May and April on record this year, despite damp and dismal conditions in many areas.

According to the Met Office’s State Of The UK Climate 2023 report published on Thursday, the UK experienced historic levels of extreme weather last year.

In the United Kingdom, 2023 was the second warmest year on record, bringing storms, flooding, strong heatwaves, and rising sea levels; only 2022 was warmer.

It was 0.8°C higher than the average from 1991 to 2020, and 1.66°C higher than the 1961 to 1990 average.

However, 2023 will be a “cool year” in comparison to 2100, based on the planet’s warming trajectory.

The government’s plan to adapt to the hazards presented by climate change is currently being challenged in the High Court by campaigners who allege the Tory administration’s July 2023 National Adaptation Programme (NAP) fails to adequately address 61 concerns.

Source: The Standard

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning