Money

The Best Real Money Online Casino Sites for 2024

(VORNews) – Are you still challenged by the demo mode, or is the prospect of a large payout necessary to feel the excitement of the game? Do not exit practice mode without familiarizing yourself with the top US-facing online casino sites that accept real money, regardless of your risk tolerance.

Just six states in the US now allow internet casinos to accept real money: West Virginia, Delaware, Connecticut, Michigan, New Jersey, and Pennsylvania. With so many options, gamers in each of these states might feel overwhelmed trying to choose an online casino to play at for real money.

To assist readers in making an informed decision, this article compares and contrasts many operators’ real-money online casino sites, including their welcome bonuses, games offered, ease of use, and more.

The Best Real Money Online Casino Sites for January 2024

When rating our top real money online casinos, we have high standards for everything from a good user experience and a diverse game selection to several payment choices and excellent customer service.

Rankings are based on a variety of factors, including dependable applications, generous bonuses, quick withdrawals, high-quality slots, and fair games. Our top ten real-money online casinos are regulated and registered in their respective states, ensuring their trustworthiness, safety, and security. Without further ado, here’s the list:

| Rank | Betting Site | Bonus | Legal in | Bet Now |

| 1. | BetMGM Casino | Get a 100% Deposit Match up to $1000 + $25 on the House | 21+, New customers only. NJ, MI, PA, WV only. Full T&Cs apply. | Visit BetMGM |

| 2. | Caesars Palace Online Casino | Get a 100% Deposit Match up to $2,500 + 2,500 Rewards Points! | 21+, New Customers only. NJ, MI, PA, WV only. Full T&Cs apply. | Visit Caesars |

| 3. | bet365 Casino | Get a Deposit Bonus up to $1,000 in Bonus Bets! | 21+ | New NJ Customers only. T&Cs apply. | Visit bet365 |

| 4. | FanDuel Casino | $1,000 Play It Again up to 24 Hours + 50 Bonus Spins | 21+, New Customers Only. NJ, PA, MI, WV only. T&Cs apply. | Visit FanDuel |

| 5. | Borgata Casino |

Up to $1,000 First Deposit Match + $20 Bonus |

21+ | New NJ, PA Customers only. T&Cs apply. | Visit Borgata |

| 6. | Bally Casino | Get $50 on Registration + Up to $100 Back in Cash on Your First Deposit! | 21+ | New NJ Customers only. T&Cs apply. | Visit Bally |

| 7. | Golden Nugget Online Casino | Get a $1,000 Deposit Match + 200 FREE Spins! | 21+ | New NJ Customers only. T&Cs apply. | Visit Golden Nugget |

| 9. | betPARX Casino | Get Your First 24 Hours of Casino Play Stress-Free up to $1,000 | New users only, 21+. Available in NJ, and PA only. Full T&C apply. | Visit betPARX: Pennsylvania New Jersey |

Trending Topics:

Taiwan Elects William Lai President for the First Time in History

Business

Warren Buffett Has Finally Revealed What Will Happen To His Money After He Dies

Warren Buffett suddenly changed how his vast fortune would be spent after his death.

Buffett, 93, the chairman of Berkshire Hathaway, told the Wall Street Journal that he has revised his will and does not intend to continue making payments to the Bill & Melinda Gates Foundation after his death. He plans to place his riches in a new charity trust controlled by his three children.

“The Gates Foundation has no money coming after my death,” Buffett told the Journal.

Buffett | Fortune image

Warren Buffett Has Finally Revealed What Will Happen To His Money After He Dies

Buffett told the Journal that he had altered his will multiple times, and he put together the most recent plan because he believes in his children’s beliefs and how they will share his fortune. Each of Buffett’s children runs a charitable organization.

“I feel very, very good about the values of my three children, and I have 100% trust in how they will carry things out,” Buffett said in a Journal interview.

Previously, Buffett stated in his will that more than 99% of his estate would be donated to the Bill & Melinda Gates Foundation and four family-related charities: the Susan Thompson Buffett Foundation, Sherwood Foundation, Howard G. Buffett Foundation, and the NoVo Foundation.

Buffett plans to continue making donations to the Gates Foundation during his lifetime.

Berkshire Hathaway announced Friday that Buffett is changing around 9,000 Class A shares into more than 13 million Class B shares. The Bill & Melinda Gates Foundation Trust will receive around 9.3 million shares, with the remainder distributed among the four Buffett family charities.

“Warren Buffett has been exceedingly generous to the Gates Foundation through more than 18 years of contributions and advice,” the foundation’s CEO, Mark Suzman, told CNN. “We are deeply grateful for his most recent gift and contributions totaling approximately $43 billion to our work.” (Melinda stated in May that she would leave the group; her last day was June 7, but the foundation’s name has not yet changed.)

Buffett donated over $870 million to his family’s four organizations last year, with an additional $750 million expected in 2022.

According to the corporation, after the newly announced donations, Buffett now holds 207,963 Berkshire Hathaway Class A shares and 2,586 Class B shares. The shares are worth approximately $128 billion. Warren Buffett suddenly changed how his vast fortune would be spent after his death.

Buffett, 93, the chairman of Berkshire Hathaway, told the Wall Street Journal that he has revised his will and does not intend to continue making payments to the Bill & Melinda Gates Foundation after his death. He plans to place his riches in a new charity trust controlled by his three children.

buffett | CNBC image

Warren Buffett Has Finally Revealed What Will Happen To His Money After He Dies

“The Gates Foundation has no money coming after my death,” Buffett told the Journal.

Buffett told the Journal that he had altered his will multiple times, and he put together the most recent plan because he believes in his children’s beliefs and how they will share his fortune. Each of Buffett’s children runs a charitable organization.

“I feel very, very good about the values of my three children, and I have 100% trust in how they will carry things out,” Buffett said in a Journal interview.

Previously, Buffett stated in his will that more than 99% of his estate would be donated to the Bill & Melinda Gates Foundation and four family-related charities: the Susan Thompson Buffett Foundation, Sherwood Foundation, Howard G. Buffett Foundation, and the NoVo Foundation.

Buffett plans to continue donating to the Gates Foundation during his lifetime.

Berkshire Hathaway announced Friday that Buffett is changing around 9,000 Class A shares into more than 13 million Class B shares. The Bill & Melinda Gates Foundation Trust will receive around 9.3 million shares, with the remainder distributed among the four Buffett family charities.

Warren Buffett Has Finally Revealed What Will Happen To His Money After He Dies

“Warren Buffett has been exceedingly generous to the Gates Foundation through more than 18 years of contributions and advice,” the foundation’s CEO, Mark Suzman, told CNN. “We are deeply grateful for his most recent gift and contributions totaling approximately $43 billion to our work.” (Melinda stated in May that she would leave the group; her last day was June 7, but the foundation’s name has not yet changed.)

Buffett donated over $870 million to his family’s four organizations last year, with an additional $750 million expected in 2022.

According to the corporation, after the newly announced donations, Buffett now holds 207,963 Berkshire Hathaway Class A shares and 2,586 Class B shares. The shares are worth approximately $128 billion.

SOURCE – (CNN)

Investment

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

NEW YORK — Amazon.com Inc.’s market value topped $2 trillion for the first time in afternoon trade on Wednesday.

The increase in Amazon’s stock market valuation comes just over a week after Nvidia reached $3 trillion and briefly became the most valuable firm on Wall Street.

Amazon | AP News Image

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

Nvidia’s chips power numerous AI applications, so the company’s price has skyrocketed.

Amazon has also made significant investments in AI as the technology’s popularity has increased worldwide.

Amazon | Forbes Image

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

The majority of the company’s attention has been on business-oriented products, such as AI models and a chatbot named Q, which Amazon makes available to businesses that use its cloud computing unit AWS.

In April, Amazon CEO Andy Jassy stated that AI capabilities have reaccelerated AWS’s growth and that it was on track to generate $100 billion in annual revenue.

Amazon | Forbes

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

Last year, the unit’s growth slowed as companies trimmed expenditures due to high inflation.

The digital behemoth has also invested $4 billion in Anthropic, a San Francisco-based AI business, to develop foundation models for generative AI systems. Amazon also creates and designs its own AI processors.

SOURCE – (AP)

Business

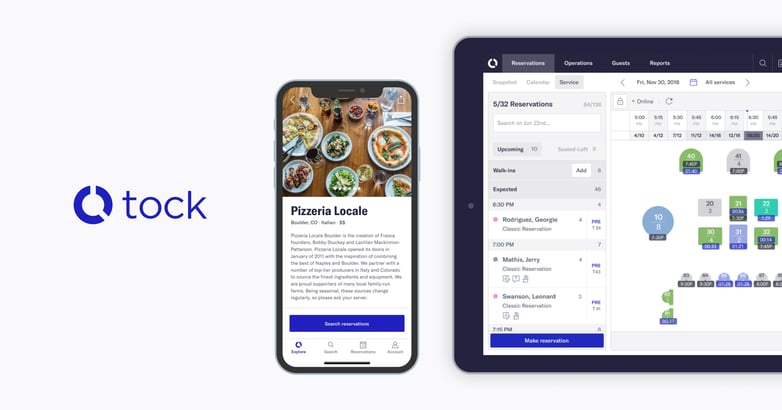

AmEx Buys Dining Reservation Company Tock From Squarespace For $400M

NEW YORK — American Express will pay $400 million for Squarespace’s Tock meal reservation and event management software.

AmEx began making dining and event purchases five years ago with the purchase of Resy, which provided cardmembers with access to difficult-to-find restaurants and locations.

AmEx | AP News Image

AmEx Buys Dining Reservation Company Tock From Squarespace For $400M

Other credit card difficulties have done the same thing. JPMorgan bought The Infatuation as a lifestyle brand in 2021.

Tock, founded in Chicago in 2014 and owned by Squarespace since 2021, offers reservation and table management services to about 7,000 restaurants and other venues.

AmEx | Yahoo Image

AmEx Buys Dining Reservation Company Tock From Squarespace For $400M

Tock has signed on restaurants such as Aquavit, a high-end Nordic restaurant in New York, and Chez Noir, a buzzy new restaurant in California.

Squarespace and Tock confirmed the acquisition on Friday.

AmEx’s purchase of Resy five years ago raised many heads in the credit card and dining industries. Since then, it’s become an important component of how the corporation secures high-end merchants to be AmEx-exclusive or to provide AmEx cardmembers with special treatment.

AmEx | Eat App Image

AmEx Buys Dining Reservation Company Tock From Squarespace For $400M

The number of eateries on the platform has increased fivefold.

AmEx also announced Friday that it will acquire Rooam, a contactless payment technology widely used in stadiums and other entertainment events. AmEx did not disclose the amount it paid for Rooam.

SOURCE – (AP)

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning