Electronics

Microsoft: Job cuts in tech sector spread, Microsoft lays off 10,000

Microsoft is laying off 10,000 employees, or nearly 5% of its workforce, joining other tech companies in slowing their pandemic-era expansions.

In a filing with the government on Wednesday, the company said that the layoffs were caused by “macroeconomic conditions and changing customer priorities.”

The software company, which is based in Redmond, Washington, also said that it was making changes to its hardware portfolio and combining its leased office locations.

With so many people working and studying from home, Microsoft is cutting far fewer jobs than it added during the COVID-19 pandemic as it responds to a surge in demand for its workplace software and cloud computing services.

“A large part of this is simply overeager hiring,” said Joshua White, a finance professor at Vanderbilt University.

Microsoft’s Staff Grew By 36%

In the two fiscal years after the outbreak, Microsoft’s staff grew by 36%, from 163,000 at the end of June 2020 to 221,000 in June 2022.

In an email to employees, CEO Satya Nadella said that the layoffs will affect “less than 5% of our total employee base,” and that some employees will find out today.

Nadella said, “We are cutting jobs in some areas, but we will keep hiring in key strategic areas.” He stressed how important it was to create a “new computer platform” based on advances in artificial intelligence.

Customers who increased their digital technology spending during the pandemic are now attempting to “optimize their digital spend to do more with less,” he said.

“We’re also seeing organizations in every industry and geography exercise caution as some parts of the world experience a recession and others anticipate one,” Nadella wrote.

Lots Of Cuts In The Tech Sector

Other tech firms have also cut jobs amid concerns about an economic slowdown.

Amazon and the company that makes business software, Salesforce, both cut a lot of jobs earlier this month. They did this to cut back on payrolls that grew quickly during the pandemic lockdown.

Amazon has announced the elimination of approximately 18,000 jobs. The layoffs are the largest in the Seattle company’s history, though they represent only a small portion of its 1.5 million global workforces.

Meta, Facebook’s parent company, is laying off 11,000 employees, or roughly 13% of its workforce. And Elon Musk, the new CEO of Twitter, has reduced the company’s workforce.

When Nadella spoke at the World Economic Forum’s annual meeting in Davos, Switzerland, on Wednesday, he did not directly mention the layoffs.

Finding A Balance After Covid

When the forum’s founder, Klaus Schwab, asked what the tech layoffs meant for the industry’s business model, Nadella stated that companies that boomed during the COVID-19 pandemic are now seeing “normalization” of that demand.

“Quite frankly, we in the technology industry will have to become more efficient, right?” According to Nadella. “It’s not about doing more with less than everyone else. We’ll have to make do with less. So we’ll have to demonstrate our productivity gains using our technology.”

Microsoft refused to comment on where the layoffs and office closures would be concentrated. On Wednesday, the company told employment officials in Washington state that it was firing 878 people from its offices in Redmond and the nearby cities of Bellevue and Issaquah.

It employed 122,000 people in the United States and 99,000 elsewhere as of June.

A Rapid Rise In Interest Rates

According to Vanderbilt professor White, all industries are looking to cut costs ahead of a possible recession, but tech companies may be especially sensitive to the rapid rise in interest rates, a tool that the Federal Reserve has used aggressively in recent months in its fight against inflation.

“This hits tech companies a little harder than industrials or consumer staples because a large portion of Microsoft’s value is on projects with cash flows that won’t pay off for several years,” he explained.

One of these projects is Microsoft’s recent investment in its startup partner in San Francisco, OpenAI, which makes the writing tool ChatGPT and other AI systems that can make readable text, images, and computer code.

Microsoft, which owns the Xbox game division, is also dealing with regulatory uncertainty in the United States and Europe, delaying its planned $68.7 billion takeover of video game company Activision Blizzard, which had approximately 9,800 employees a year ago.

SOURCE – (AP)

Electronics

Dyson To Axe Around 1,000 Jobs In Britain

Dyson, a vacuum cleaner company, will slash approximately 1,000 positions in Britain as part of a global restructuring.

Dyson | NY Times Image

Dyson To Axe Around 1,000 Jobs In Britain

James Dyson, the inventor of the bagless cleaner, founded the company, which employs 3,500 people in Britain, including at its R&D facility in Malmesbury, West England.

On Tuesday, Chief Executive Hanno Kirner stated, “We have grown quickly and, like all companies, we review our global structures on a regular basis to ensure we are prepared for the future.” As a result, we are suggesting organizational modifications that may lead to redundancy.

Dyson | Joe Graham Image

Dyson To Axe Around 1,000 Jobs In Britain

“Dyson works in highly competitive global marketplaces where innovation and change are fast. We understand that we must always be entrepreneurial and adaptable – characteristics that Dyson has long valued.

SOURCE | AP

Business

Sony Says Focus Is On Creativity, With Games, Movies, Music, Sensors, IP, And Not Gadgets

TOKYO — Sony, a Japanese electronics and entertainment company, says it will focus on innovation in movies, animation, and video games rather than traditional gadgetry.

Its CEO, Kenichiro Yoshida, described the company’s plan Thursday, saying Sony was assisting creative workers in delivering what he called “kando,” a moving experience.

Yoshida would not comment on claims that Tokyo-based Sony and Apollo Global Management are interested in acquiring Paramount Global.

Sony | Pixa Bay Image

Sony Says Focus Is On Creativity, With Games, Movies, Music, Sensors, IP, And Not Gadgets

Yoshida stated that the business now focuses on the creative process rather than valuing prior items such as the Walkman portable music player and Trinitron color televisions. He stated that “synergies” are no longer defined by entertainment and electronics but by intellectual property encompassing animation, music, gaming, and films.

In an online briefing, he stated, “We will continue to support people’s creativity through our technology.”

Sony is adapting to harsher circumstances, as competitors produce cheaper but competitive gadgets. According to critics, pursuing careers in film, music, and other forms of entertainment can be financially difficult.

Beginning with the acquisition of EMI Music Publishing in 2018, Sony has invested over 1.5 trillion yen ($10 billion) in the last six years to boost its content creation.

Sony | Pixa Bay Image

Sony Says Focus Is On Creativity, With Games, Movies, Music, Sensors, IP, And Not Gadgets

In 2021, it bought Crunchyroll, which has over 13 million paid customers and distributes Japanese cartoons worldwide. Another was Yoasobi, a Japanese music duet that uses Vocaloid technology, or singing voice synthesizer software, and has gained a global following.

Sony’s real-time computer technology, which records “this moment,” as Yoshida called it, is employed in sports cameras because it can catch fast-moving subjects without distortion

According to Yoshida, it is also utilized for news coverage and editing, 3D video and computer graphics, including successful movies like “Godzilla Minus One” and games based on human athlete movements

Sony | AP News Image

Sony Says Focus Is On Creativity, With Games, Movies, Music, Sensors, IP, And Not Gadgets

Sony recently recorded a quarterly profit of 189 billion yen ($1.2 billion), up from 141 billion yen the year before. The PlayStation gaming machine manufacturer’s quarterly revenue increased 14% to 3.48 trillion yen ($22 billion).

However, for the fiscal year ending March 31, Sony’s profit fell 3% to 970 billion yen ($6.2 billion) due to poor performance in its financial services sector, which will be largely split off next year.

SOURCE – (AP)

Business

Amazon’s Self-Driving Robotaxi Unit Zoox Under Investigation By US After 2 Rear-End Crashes

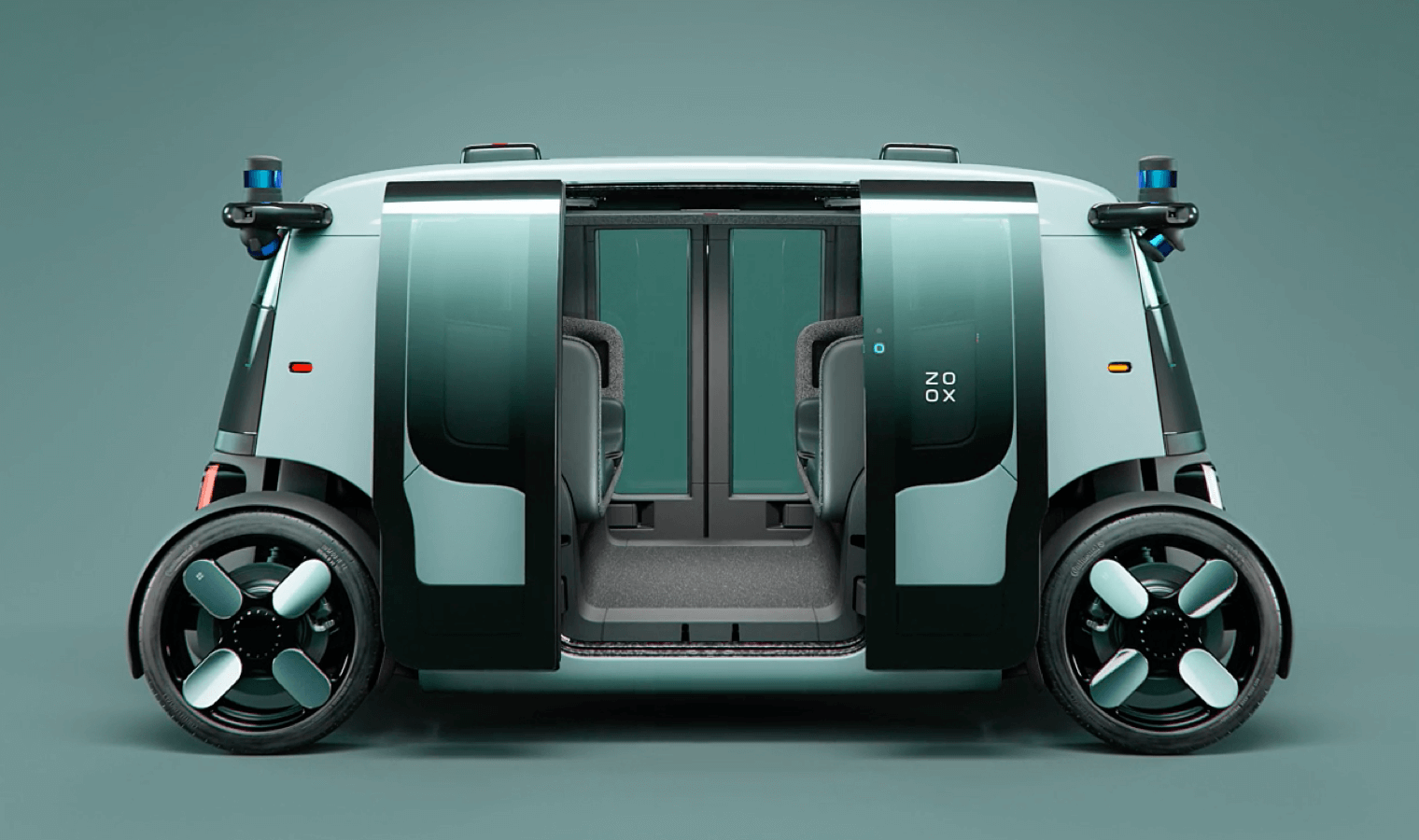

DETROIT — The US government’s highway safety department is looking into Amazon’s self-driving robotaxi company after two vehicles braked unexpectedly and were rear-ended by motorcyclists.

The National Highway Traffic Safety Administration announced Monday that it will assess Zoox’s automated driving system.

Both accidents occurred during the sunlight, and the riders sustained minor injuries. In all cases, the agency established that the Amazon vehicles operated in autonomous mode before the crashes.

AP – VOR News Image

Amazon’s Self-Driving Robotaxi Unit Zoox Under Investigation By US After 2 Rear-End Crashes

According to the government, the investigation will focus on the performance of the company’s automated driving system during the crashes and how it operates in crosswalks near pedestrians and other vulnerable road users.

A message was left early Monday requesting a response from the company.

Zoox reported the crashes by a requirement granted to automated vehicle firms in 2021.

Zoox – VOR News Image

Amazon’s Self-Driving Robotaxi Unit Zoox Under Investigation By US After 2 Rear-End Crashes

According to estimates, Amazon paid more than $1 billion for Zoox in June 2020. In 2023, the Foster City, California-based business announced that one of its unique-looking four-person shuttles would automatically transport personnel on public highways along a mile-long (1.6-kilometer) route between two facilities.

The corporation then planned to develop an exclusive shuttle service for its employees. Analysts believe Amazon will deploy the system for autonomous deliveries.

The cars feature no steering wheel or pedals. The interior is carriage-style, with two benches facing each other. It is a little under 12 feet (3.7 meters) long, about a foot (a third of a meter) shorter than a conventional Mini Cooper, and can reach 35 mph (56 km/h).

Zoox – VOR News Image

Amazon’s Self-Driving Robotaxi Unit Zoox Under Investigation By US After 2 Rear-End Crashes

The company was already under investigation by the NHTSA. In March 2022, the government began investigating the company’s certification that its car fulfilled federal safety standards for motor vehicles.

The agency stated at the time that it would investigate if Zoox used its testing techniques to establish that certain federal criteria did not apply due to the robotaxi’s unique configuration.

SOURCE – (AP)

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning