News

Rosalynn Carter, Outspoken Former First Lady, Dead At 96

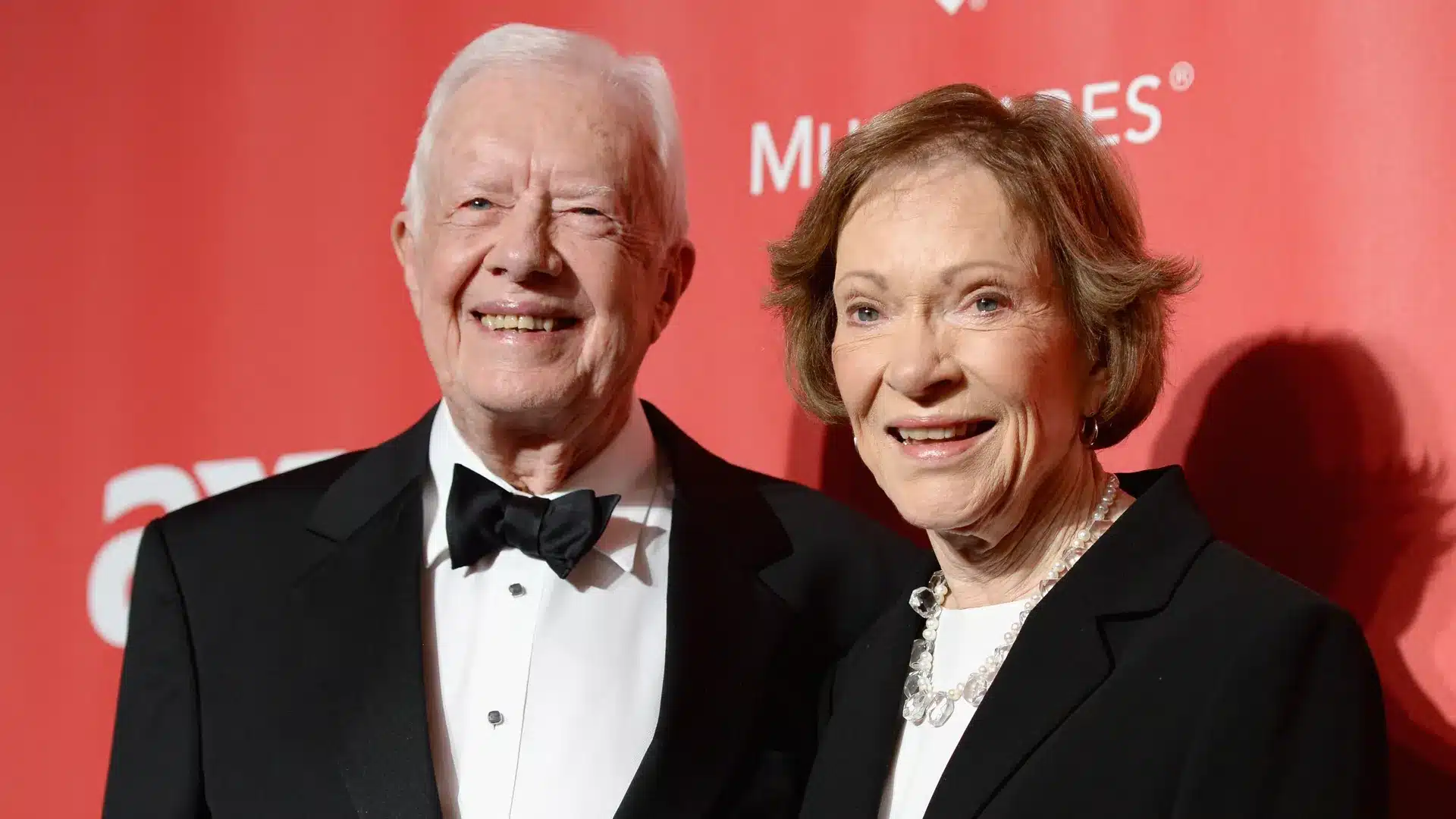

ATLANTA, Ga. – Rosalynn Carter, Jimmy Carter’s closest counsel throughout his one time as President of the United States and for the next four decades as a worldwide humanitarian, has died at the age of 96.

According to the Carter Center, she died on Sunday after suffering from dementia and poor health for several months. According to the announcement announcing her death, she “died peacefully, with family by her side” at 2:10 p.m. in Plains, Georgia.

“Rosalynn was my equal partner in everything I ever accomplished,” Carter stated. “She provided me with sound advice and encouragement when I needed it.” “As long as Rosalynn was alive, I knew someone loved and supported me.”

Jill Biden said she had to “lead this off with a sad announcement” of Rosalynn Carter’s death while speaking at a Naval Air Station event in Norfolk, Virginia. “She was well-known for her work in mental health, caregiving, and women’s rights.” So I hope you’ll remember the Carter family in your prayers during the holidays,” she stated.

She spoke at a hangar where she and President Joe Biden prepared to host an early Thanksgiving dinner for service members and their families.

Rosalynn Carter, Outspoken Former First Lady, Dead At 96

The Carters were married for over 77 years, forming what they both called a “full partnership.” Unlike many prior first ladies, Rosalynn Carter attended Cabinet meetings, spoke out on difficult matters, and accompanied her husband on foreign tours. Aides to President Carter secretly referred to her as “co-president.”

“Rosalynn is my best friend… the perfect extension of me, probably the most influential person in my life,” Jimmy Carter told aides during their time in the White House, which lasted from 1977 to 1981.

Rosalynn Carter was a fiercely loyal and caring first lady who was also politically smart, and no one denied her influence behind the scenes. When her role in a widely publicized Cabinet shuffle was revealed, she was forced to publicly declare, “I am not running the government.”

Many presidential advisers claimed that her political instincts were superior to her husband’s, and they frequently sought her approval for a project before discussing it with the president. Her steely determination, ostensibly modest attitude, and sweet Southern accent prompted Washington reporters to dub her “the Steel Magnolia.”

According to both Carters, Rosalynn Carter was always the more political of the two. After Jimmy Carter’s overwhelming defeat in 1980, it was she, not the former president, who considered an unlikely comeback, and she said years later that she missed their life in Washington.

Jimmy Carter trusted her so much that, just months into his presidency, he dispatched her on a mission to Latin America to assure dictators that he meant what he said about refusing military aid and other forms of support to human rights abusers.

She also had strong sentiments about the Carter White House’s style. The Carters did not serve hard liquor at public events, but Rosalynn did allow US wine. There were fewer ballroom dancing nights and more square dancing and picnics.

Throughout her husband’s political career, she made mental health and senior issues her defining policy focus. When the news media didn’t cover her efforts as much as she thought they deserved, she chastised them for writing solely about “sexy subjects.”

Rosalynn Carter, Outspoken Former First Lady, Dead At 96

As honorary chairwoman of the President’s Commission on Mental Health, she once spoke before a Senate subcommittee, becoming the first lady to do so since Eleanor Roosevelt. She returned to Washington in 2007 to lobby Congress for better mental health care, stating, “We’ve been working on this for so long, and it finally seems to be in reach.”

She stated she became interested in mental health during her husband’s run for governor of Georgia.

“I used to come home and tell Jimmy, ‘Why are people telling me about their problems?'” “And he said, ‘Because you may be the only person they’ll ever see who knows someone who can help them,'” she explained.

Rosalynn Carter appeared more distraught than her husband after Ronald Reagan won the presidency in 1980. She first hesitated to return to Plains, Georgia, where they were both born, married and lived the majority of their life.

“I was hesitant, not at all sure that I could be happy here after the dazzle of the White House and the years of stimulating political battles,” she said in her autobiography, published in 1984, “First Lady from Plains.” Eventually, “we slowly rediscovered the satisfaction of a life we had left long before.”

Jimmy and Rosalynn co-founded The Carter Center in Atlanta to continue their work after leaving Washington. She led the center’s annual mental health symposium and gathered funds for programs to help the mentally ill and homeless. She also published “Helping Yourself Help Others,” a memoir about the difficulties of caring for elderly or unwell family, and a sequel, “Helping Someone With Mental Illness.”

Rosalynn Carter, Outspoken Former First Lady, Dead At 96

The Carters frequently departed home on humanitarian missions, building houses with Habitat for Humanity and supporting public health and democracy in foreign countries.

“I get tired,” she admitted of her journeys. “However, something wonderful always happens.” Going to a town where they have Guinea worm and then returning a year or two later and there is no Guinea worm, the people dance and sing — it’s so amazing.”

Jimmy Carter’s physicians identified four tiny lesions on his brain in 2015. The Carters felt he had only a few weeks to live. He was given a medicine to enhance his immune system and later declared that no indications of cancer remained. But when they first heard the news, she stated she didn’t know what to do.

“I depend on him when I have questions, when I’m writing speeches, anything, I consult with him,” she said.

She later assisted Carter’s recovery after he had hip replacement surgery at the age of 94 and had to relearn how to walk. She was with him earlier this year when he opted to forego additional medical procedures and initiate end-of-life care following a series of hospital stays.

Jimmy Carter is the longest-serving president of the United States. Rosalynn Carter was the second-longest-living first lady in American history, trailing only Bess Truman, who died at 97.

Rosalynn Carter, Outspoken Former First Lady, Dead At 96

Eleanor Rosalynn Smith, the eldest of four children, was born in Plains on August 18, 1927. Her father died while she was young, so when her mother went to work part-time, she took on much of the responsibility of caring for her siblings.

Rosalynn Carter also helped support the family by working at a beauty salon after school. “We were very poor and worked very hard,” she once stated, yet she continued her education, finishing as class valedictorian from high school.

Rosalynn Carter quickly fell in love with one of her best friend’s brothers. Jimmy and Rosalynn had known each other their entire lives — Jimmy’s mother, nurse Lillian Carter, was the one who delivered Rosalynn — but he went to the Naval Academy in Annapolis, Maryland, while she was still in high school.

Jimmy told his mother after a blind date, “That’s the girl I want to marry.” They married in 1946, shortly after his Annapolis graduation and Rosalynn’s graduation from Georgia Southwestern College.

Their boys were born at the locations where Jimmy Carter was stationed: John William (Jack) in Portsmouth, Virginia, in 1947; James Earl III (Chip) in Honolulu, Hawaii, in 1950; and Donnel Jeffery (Jeff) in New London, Connecticut, in 1952. Amy was born in 1967 in Plains. Carter was a state senator at the time.

Rosalynn Carter’s first opportunity to travel the world came from her Navy time. When Carter’s father, James Earl Sr., died in 1953, Jimmy Carter returned the family to Plains, where he took over the family property without asking his wife. She worked with him daily, keeping the books and weighing fertilizer trucks.

“We developed a partnership when we were working in the farm supply business,” Rosalynn Carter said proudly in an interview with The Associated Press in 2021. “On paper, I knew more about the business than he did.” He would listen to my suggestions.”

Lillian Carter said of her daughter-in-law at the height of the Carters’ political power: “She can do anything in the world with Jimmy, and she’s the only one.” He pays attention to her.”

SOURCE – (AP)

News

Britain Must Be Ready for War in 3 Years, Warns New Army Chief

The new head of the Army has stated that Britain must be prepared to fight a war within three years.

Gen Sir Roland Walker has issued a warning about a variety of risks in what he calls a “increasingly volatile” environment.

However, he stated that war was not inevitable and that the Army had “just enough time” to prepare to prevent conflict.

He stated that the Army’s fighting capacity would be doubled by 2027 and tripled by the end of the decade.

Gen Walker warned that the Britain was under threat from a “axis of upheaval” in his first speech as Prime Minister on Tuesday.

Among the primary concerns confronting the Britain in the next years, as noted by the general in a briefing, is an enraged Russia, which may seek vengeance on the West for helping Ukraine, regardless of who wins the war.

He stated: “It doesn’t matter how it finishes. I believe Russia will emerge from it weaker objectively – or completely – but still very, very dangerous and seeking some form of retaliation for what we have done to assist Ukraine.”

Britain’s Government Defence Review and Military Challenges

He also warned that China was determined to retake Taiwan, and Iran was likely to seek nuclear weapons.

He stated that the threats they posed may become particularly acute in the next three years, and that these countries had formed a “mutual transactional relationship” since the war in Ukraine, sharing weaponry and technology.

However, he stated that the path to conflict was not “inexorable” if the UK re-established credible land troops to assist its deterrent strategy for avoiding war.

In his speech, he described his force of slightly over 70,000 regular troops as a “medium-sized army” and made no direct call for additional resources or men.

However, he pushed the British Army to adapt swiftly, focussing on technology such as artificial intelligence and weaponry rather than numbers.

His ultimate goal is for the Army to be capable of destroying an opponent three times its size.

This would entail firing quicker and farther, he said, aided by lessons learnt from the Ukraine war.

The general’s speech at the Royal United Services Institute land warfare conference comes only one week after the government began a “root and branch” defence review to “take a fresh look” at the challenges facing the armed services.

Defence Secretary John Healey launched the assessment, describing the existing status of the armed forces as “hollowed-out” and stating that “procurement waste and neglected morale cannot continue”.

According to the most recent Ministry of Defence (MoD) numbers from April 2024, the Britain’s regular Army forces total 75,325 troops (excluding Gurkhas and volunteers).

That figure has been declining in recent years, as recruiting has failed to match retention. The previous Conservative administration lowered the planned headcount from 82,000 to 72,500 by 2025.

Members of the NATO military alliance have agreed to spend at least 2% of GDP on defence by 2024, but several countries are unlikely to fulfil this goal.

The Britain presently spends 2.3% of its GDP on defence. Prime Minister Sir Keir Starmer has previously stated that the defence review will include a “roadmap” for increasing this to 2.5%, however he has yet to provide a date for this promise.

Source: BBC

News

Katie Ledecky Hopes For Clean Races At Paris Olympics In The Aftermath Of The Chinese Doping Scandal

PARIS — Katie Ledecky is looking for clean Olympic races. On Wednesday, Hope had pretty much reached her limit.

The American swimmer hopes to add to her six gold medals as she competes in the 400, 800, and 1,500 meters at the Paris Games. Her program starts with the heavy 400 on Saturday, featuring Ariarne Titmus and Summer McIntosh.

Katie Ledecky | ESPN Image

Katie Ledecky Hopes For Clean Races At Paris Olympics In The Aftermath Of The Chinese Doping Scandal

The 27-year-old Katie is competing in her fourth Summer Olympics, but the first since a doping scandal involving almost two dozen Chinese swimmers who tested positive for a banned chemical before the Tokyo Games — yet were permitted to compete with no consequences. The controversy has raised serious worries regarding the effectiveness of anti-doping initiatives.

Katie Ledecky | Vogue Image

“I hope everyone here is going to be competing clean this week,” Ledecky claimed. “But what truly counts is, were they training cleanly? Hopefully this has been the case. Hopefully, there has been worldwide testing.”

The International Olympic Committee has expressed concern over the ongoing US investigation into possible doping by Chinese swimmers. While awarding the 2034 Winter Olympics to Salt Lake City on Wednesday, the IOC urged Utah officials to do whatever they could to stop the FBI investigation.

“I think everyone’s heard what the athletes think,” Katie added. “They seek transparency. They want more answers to the remaining questions. At this point, we are here to race. We are going to race whoever is in the lane next to us.

“We are not paid to conduct the tests, so we trust those who follow their regulations. That applies both today and in the future.

Katie Ledecky | ESPN Image

Katie Ledecky Hopes For Clean Races At Paris Olympics In The Aftermath Of The Chinese Doping Scandal

SOURCE | AP

News

London Heatwave Alert: High Temperatures Set to Soar to 29C Next Week

As the summer holidays begin, London may experience an official heatwave with temperatures reaching up to 29 degrees Celsius.

The Met Office predicts a long period of sunny and dry weather for London after a soggy spring and summer.

After a cloudy day on Saturday, temperatures are expected to reach 27C on Sunday, with lots of sunlight.

On Monday and Tuesday, temperatures are forecast to peak at 29 degrees Celsius. Monday is forecast to offer more sunlight, while Tuesday may see some gloomy weather.

Temperatures are expected to remain in the high 20s next week, with lows of approximately 18C.

According to the Met Office, a heatwave is “an extended period of hot weather relative to the expected conditions of the area at that time of year, which may be accompanied by high humidity.”

In the United Kingdom, a heatwave is proclaimed when daily temperatures meet or surpass a certain level for at least three consecutive days.

In London, the heatwave threshold is 28 degrees Celsius.

The Met Office reported that the UK is experiencing hotter and wetter weather on average due to climate change.

The UK experienced its warmest May and April on record this year, despite damp and dismal conditions in many areas.

According to the Met Office’s State Of The UK Climate 2023 report published on Thursday, the UK experienced historic levels of extreme weather last year.

In the United Kingdom, 2023 was the second warmest year on record, bringing storms, flooding, strong heatwaves, and rising sea levels; only 2022 was warmer.

It was 0.8°C higher than the average from 1991 to 2020, and 1.66°C higher than the 1961 to 1990 average.

However, 2023 will be a “cool year” in comparison to 2100, based on the planet’s warming trajectory.

The government’s plan to adapt to the hazards presented by climate change is currently being challenged in the High Court by campaigners who allege the Tory administration’s July 2023 National Adaptation Programme (NAP) fails to adequately address 61 concerns.

Source: The Standard

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning

/cloudfront-us-east-1.images.arcpublishing.com/gray/XC2TRA73CVCIVGAXTA3ECMUIVU.jpg)

:max_bytes(150000):strip_icc():focal(749x0:751x2)/jimmy-rosalynn-carter-95-birthday-081722-52b0d79ae6c04df49e382ab2d72cd900.jpg)