Finance

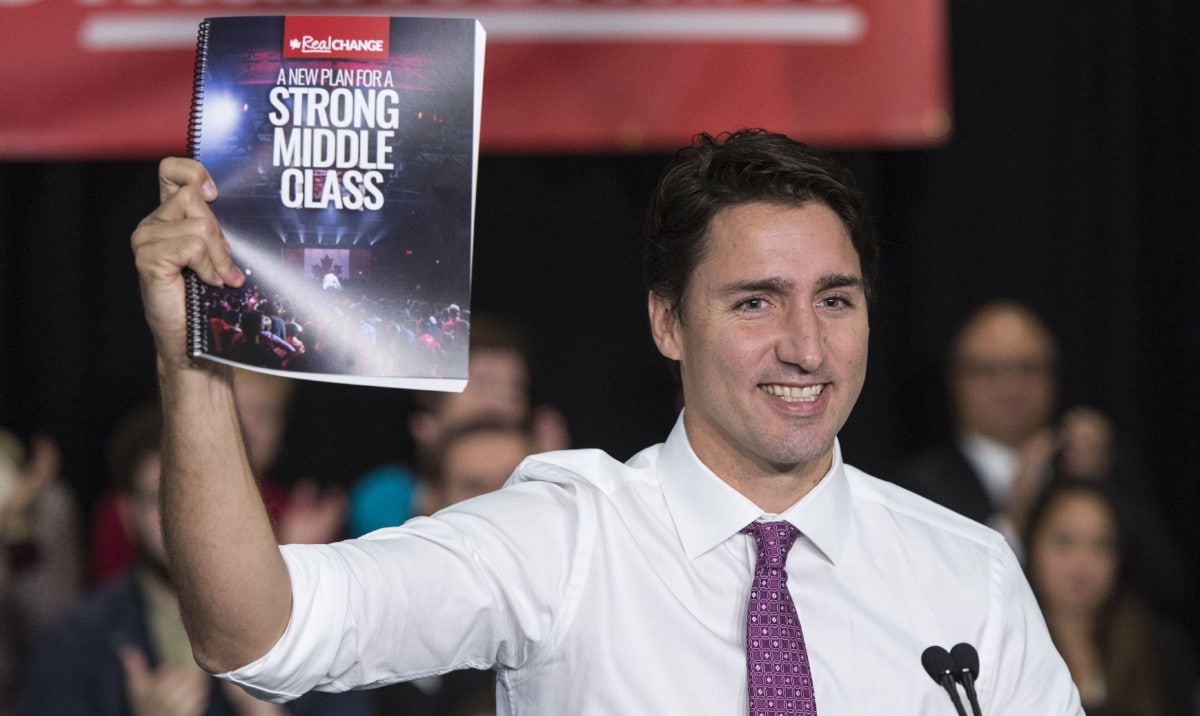

Trudeau Creates Tax to Solve Canada’s Housing Crisis, “Yes Another TAX”

Canada’s Prime Minister Justin Trudeau, under pressure over a lack of affordable housing, and his latest solution is to tax Canadian’s even more by introducing a tax on short-term rentals.now

Many Canadian’s subsidize their already highly taxed income by renting our rooms in their homes through Airbnb and other short term rentals. Well now Canada’s Finance Minister Chrystia Freeland will put an end to that, she has unveil tax reforms aimed at reducing the use of Airbnb Inc. and other short-term rental services in areas of Canada where those platforms are prohibited.

According to reports in Montreal’s La Presse and the Toronto Star, Freeland’s fall economic statement will include the proposal. According to news outlets, the government will restrict property owners from deducting expenses for short-term rentals in places where those services are already limited by other levels of government.

According to the Star and La Presse, the tax reform, which would take effect on January 1, is intended to punish property owners who violate local restrictions. A lack of suitable rental homes is an issue in locations like British Columbia, where the provincial government recently enacted new regulations that makes it more difficult for owners to post vacant properties on sites like Airbnb, VRBO, and Expedia.

Last month, Freeland stated that the federal government was investigating what instruments it may use to combat short-term rental sites, which result in “fewer homes for Canadians to rent, particularly in urban and populated areas of our country.”

According to La Presse, the federal government’s housing agency, Canada Mortgage & Housing Corp., would be given C$15 billion ($10.9 billion) to offer low-interest loans to real estate developers for the development of rental homes as part of a new housing package.

Trudeau Raises Tax on Alcohol

Prime Minister Justin Trudeau of Canada frequently declares that he is “working to make life more affordable.” Instead of doing the one thing that would immediately make living more cheap – cutting taxes – he’s leveraging inflation to go on a drinking binge.

Trudeau intends to boost the federal excise tax on alcohol once again in 2024. This time, it was by 4.7%. Even a 4.7% tax increase, however, minimizes the amount of tax you pay every time you go to the liquor store.

In Canada, taxes already account for over half of the price of beer, two-thirds of the price of wine, and more than three-quarters of the price of spirits. That means a 24-pack of pilsner, a couple bottles of Pinot, plus a bottle of vodka will set you back around $120. Over $75 of it is tax.

In fact, Canadians pay five times the tax on a case of beer as our southern neighbors. The tax on a case of beer in Saskatchewan, Prince Edward Island, and Newfoundland and Labrador is higher than the total price of a case in half of American states.

While Canadians pay greater taxes, Americans benefit from tax cuts. Between 2017 and 2019, Canadian beer taxes increased by $34 million for large brewers, whereas American beer taxes decreased by $31 million.

Since the 2017 budget, the federal government has been on a tax rise spree. The Trudeau government implemented an automatic tax hike escalator that year. That means that on April 1 of each year, the federal excise tax automatically increases with inflation.

With inflation at a 40-year high, Canadians will face a significant tax increase in 2024.

The escalator tax was initially unpopular because inflation was low. However, even minor tax increases might add up to large costs over time. Because of the automatic annual tax raise that began in 2017, the federal government’s alcohol excise taxes will have jumped 19% after next year’s boost.

According to polls, the growing cost of living is the single most pressing economic issue confronting Canadians. Any government that cares about affordability will cancel the forthcoming tax hike and eliminate the automatic tax escalation system.

Brownie points for restoring alcohol taxes to their pre-automatic tax escalation levels. After all, the administration has boosted its tax take without MPs voting on it since Budget 2017. This is inherently anti-democratic.

Votes on tax increases are required for democracy. That is why we have a House of Commons full of MPs elected by their voters and paid $194,000 by the public. The automatic tax rises, on the other hand, make a mockery of our democratic processes.

In fact, the one time MPs had the opportunity to vote on the most recent alcohol tax rise, they decisively voted to repeal it. Trudeau just rejected the non-binding motion and Parliament’s democratic will.

Canadians require assistance. And the simplest and most straightforward way for him to demonstrate that he cares about affordability is to cease his alcohol tax spree.

Finance

Economist Warns Over Canada Slipping into a Cashless Society

Canadian economist Carlos Castiblanco believes that Canada should follow in the footsteps of other countries and enact legislation to protect the use of cash in the country.

Castiblanco, together with the group Option Consommateurs, is urging the Trudeau government to follow the lead of other jurisdictions in the United States and Europe in enacting legislation to slow the transition to a cash-less society.

He stated that barely 10% of transactions in Canada now use cash, and that Canada must defend cash now before more merchants begin to refuse it totally.

It is vital to act now, he told CBC Radio’s Ontario Today, before businesses begin removing all of the infrastructure required to handle and manage actual cash.

“They are already used to dealing with cash, so this is the moment for the Trudeau government to act, before it is more complicated.”

A recent online poll of almost 1,500 people commissioned by a different group, Payments Canada, discovered that the majority of respondents were concerned about the potential of cashless stores and preferred to keep the ability to use cash.

Bank fees in Canada

Above all, cash has no bank fees, is not vulnerable to privacy breaches, and may be utilized during internet outages.

The Payments Canada paper, “Social policy implications for a less-cash society,” suggests legislative action, saying that cash-based transactions have decreased from 54% in 2009 to 10% by 2021.

Aftab Ahmed, one of its writers, explained who would be most affected by a cashless future in a recent piece for Policy Options, the Institute for Research on Public Policy’s online magazine.

“For many Canadians, including Indigenous people, homeless people, aging citizens, and others who are vulnerable, cash is both a beacon of economic stability and a source of financial insecurity. “Cash is an emergency lifeline and a symbol of cultural traditions,” Ahmed explained.

“Canada must avoid sleepwalking into a cashless future and instead recognize the risk of exacerbating financial exclusion of those most vulnerable.”

Refusing to accept cash

The currency issue has already caught fire outside of Canada, according to Castiblanco, with some US states and territories beginning to pass legislation to preserve access to cash.

In 2019, Philadelphia became the first city in North America to prohibit “any person selling or offering for sale consumer goods or services at retail from refusing to accept cash as a form of payment.”

Other U.S. cities, including New York, Seattle, and Los Angeles, have since taken action on the issue.

In New York, the policy recommends fines of up to $1,500, with the Councillor who proposed the guidelines claiming that prohibiting cashless transactions preserves privacy, equity, and consumer choice.

European countries such as Norway, Spain, and Ireland have enacted similar legislation. In Ireland, the rule would mandate cash transactions at companies like as pharmacies and grocery stores that supply basic goods and services.

Source: CBC

U.K News

UK National Debt Rises to the Highest in 62 Years

UK national debt grew this month to its highest level as a share of the economy since 1961, according to figures released on Friday, adding to the financial issues that the new administration will face when it takes office following a general election in two weeks.

The UK national debt, excluding state-controlled banks, hit 2.742 trillion pounds ($3.47 trillion), or 99.8% of annual GDP, in May, up from 96.1% the previous year, according to the Office for National Statistics.

The increase came despite somewhat lower-than-expected government borrowing in May, which was 15.0 billion pounds, compared to experts’ median projection of 15.7 billion pounds in a Reuters survey.

Following an election on July 4, Britain appears to be on the verge of a change of government, with Keir Starmer’s Labour Party leading Prime Minister Rishi Sunak’s Conservatives in surveys.

During the COVID-19 epidemic, state debt in Britain skyrocketed, and the public finances have been hampered by poor growth and a 16-year high in Bank of England interest rates.

Western Nations Debt

Most other Western countries had significant rises in debt during the same period, although British debt levels are lower than those of the United States, France, and Italy.

A person enters the Treasury government building in London, Britain, on March 5, 2024. REUTERS/Toby Melville/File Purchase Licensing Rights opens a new tab.

Borrowing in the UK totaled 33.5 billion pounds in the first two months of the fiscal year, 0.4 billion more than the same period in 2023 but 1.5 billion pounds less than government budget estimates expected in March.

Capital Economics consultants warned that the lower-than-expected borrowing figures represented less public investment and would provide little comfort to Britain’s future finance minister.

“They do little to reduce the scale of the fiscal challenge that awaits them, in part because of the upward pressure on the debt interest bill from higher interest rates,” said Alex Kerr, an assistant economist at Capital Economics.

Labour and the Conservatives want to keep to existing budget rules that require official estimates – most recently updated in March – to indicate that debt as a proportion of GDP is dropping in the fifth year of the forecast.

Higher interest rates than projected in March’s budget left Britain’s next chancellor with only 8.5 billion pounds of freedom to meet these standards, down from the historically low 8.9 billion in March, Kerr noted.

Both Labour and the Conservatives have committed not to raise income tax, value-added tax, or other major levies, but government budget predictions in March revealed that tax as a percentage of GDP was on track to hit its highest level since 1948.

Source: Reuters

Canada’s Household Debt Nears $3 Trillion Under Trudeau

U.K News

Bank of England Keeps Key Interest Rate at 5.25% Despite Inflation Falling

The Bank of England maintained its main interest rate at a 16-year high of 5.25% on Thursday, despite inflation falling to its target of 2%, with several policymakers warning that a premature decrease may spark another wave of price increases.

Seven of the nine members of the bank’s ruling Monetary Policy Committee voted against a rate drop for the second week in a row, while two supported one. Interest rates have been constant since August, following a series of rises.

The statement accompanying the vote made it plain that there was disagreement on the forecast for inflation, with some expressing concern about continued significant price increases in the services sector, the key driver of the British economy.

“It’s good news that inflation has returned to our 2% target,” said Bank of England Governor Andrew Bailey, who voted to maintain current policy. “We need to be sure that inflation will stay low and that’s why we’ve decided to hold rates at 5.25% for now.”

The decision will likely dismay the ruling Conservative Party ahead of the United Kingdom’s general election in two weeks. Prime Minister Rishi Sunak would have seen a cut as good economic news, especially if it came with a drop in mortgage rates.

Upcoming UK Election

The panel maintained that the upcoming election, which the main opposition Labour Party, led by Keir Starmer, is generally expected to win, did not influence its conclusion. It stated that the decision was, as always, based on meeting the 2% inflation objective “sustainably in the medium term.”

Economists anticipate a rate decrease is on the way, either at the bank’s next policy making meeting in August or the one following in September. They expect clear evidence by then that inflation will remain close to the target for the next year or two.

“We continue to believe that the MPC will ease restrictive policy beginning in the summer and deliver two rate cuts this year,” said Sanjay Raja, Deutsche Bank’s senior U.K. economist.

The reduction in the primary inflation measure to a near three-year low of 2% in the year to May does not imply that prices are falling; rather, they are rising at a slower rate than they have in recent years during a cost-of-living crisis that has resulted in reduced living standards for millions in Britain.

Central banks worldwide dramatically increased borrowing costs from the lows seen during the coronavirus pandemic, when prices began to rise, first due to supply chain issues accumulated during the pandemic and then due to Russia’s invasion of Ukraine, which pushed up energy costs.

Bank of England unduly cautious

Higher interest rates, which cool the economy by making borrowing more expensive, have helped to reduce inflation, but they have also weighed on the British economy, which has hardly expanded since the pandemic’s recovery.

Critics of the Bank of England argue that it is unduly cautious about inflation and that keeping interest rates too high for too long will put undue strain on the economy. It is an accusation that has also been leveled at the United States Federal Reserve, which has held interest rates constant in recent months.

“Given that the U.K. has moved onto a milder inflationary trajectory, rate setters remain overly cautious about the likelihood of loosening policy, risking impeding the U.K.‘s growth prospects,” said Suren Thiru, economics director at The Institute of Chartered Accountants in England and Wales.

Some central banks, like the European Central Bank, have begun to decrease interest rates as inflationary pressures have subsided. On Thursday, the Swiss National Bank cut its main interest rate by a quarter of a percentage point to 1.25%.

Source: The Associated Press

-

World2 weeks ago

Former President Trump Survives Being Shot at Pennsylvania Rally

-

Tech4 weeks ago

Huawei Launches 5G-A Pioneers Program at MWC Shanghai 2024: Paving the Way for a Connected Future

-

Sports4 weeks ago

NBA Draft: Kyle Filipowski Withdraws Unexpectedly From The First Round

-

Tech4 weeks ago

ChatGPT Answers Undiscovered Questions and Outperforms Students.

-

News4 weeks ago

US Supreme Court Rejects Drug Deal that Protects the Sackler Family

-

Health4 weeks ago

US Health Agency Issues Dengue Virus Infection Warning