Business

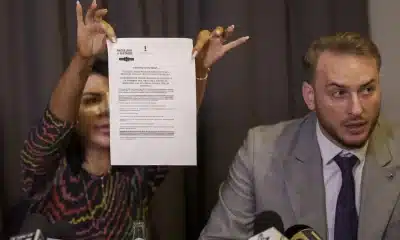

Andrew Tate Wins Legal Challenge Over Seized Assets

Controversial influencer Andrew Tate has won an appeal in a Romanian court, seeking the release of assets seized by authorities.

Andrew is under investigation in the nation on allegations of human trafficking and rape, which he denies.

On Monday, Bucharest’s Court of Appeal ordered a fresh trial for the held assets, which include expensive cars.

The victorious appeal included Mr Tate’s brother Tristan and two connected entities.

The brothers filed an appeal against a December 2023 court verdict that affirmed the constitutionality of their asset seizure.

Andrew Tate Wins Legal Challenge Over Seized Assets

A higher court ruled on Monday that the earlier ruling had been reversed and submitted for retrial.

The ruling means the Tate brothers can return to court and file a new civil action to retrieve their seized assets.

The appeal named two corporations as parties: SC Ground Breaking Development SRL, The Cannon Run Limited, and the Tate brothers.

In a statement on his official Twitter account, Andrew Tate stated that a judge must now demonstrate that the riches were obtained illegally to justify the ongoing seizure, adding, “They won’t prove a thing because it never happened.”

Court documents unsealed in June revealed that the brothers made millions of euros and bought expensive assets and homes through their commercial activities, which included sexual content and online self-help classes.

Andrew Tate Wins Legal Challenge Over Seized Assets

Both the brothers reject allegations made by Romanian investigators that they exploited women through their pornographic content business, which prosecutors claim operated as a criminal gang.

An indictment issued in June mentioned two female Romanian associates in addition to the British-American brothers, as well as seven accused victims.

The brothers were initially arrested in December 2022 and served time in prison before being placed on house arrest. While they are no longer in jail, the brothers cannot leave Romania while the inquiry continues.

In January 2023, luxury cars were spotted being removed from a house owned by the Tates near Bucharest. During the raids, watches worth millions of euros were confiscated.

Andrew Tate Wins Legal Challenge Over Seized Assets

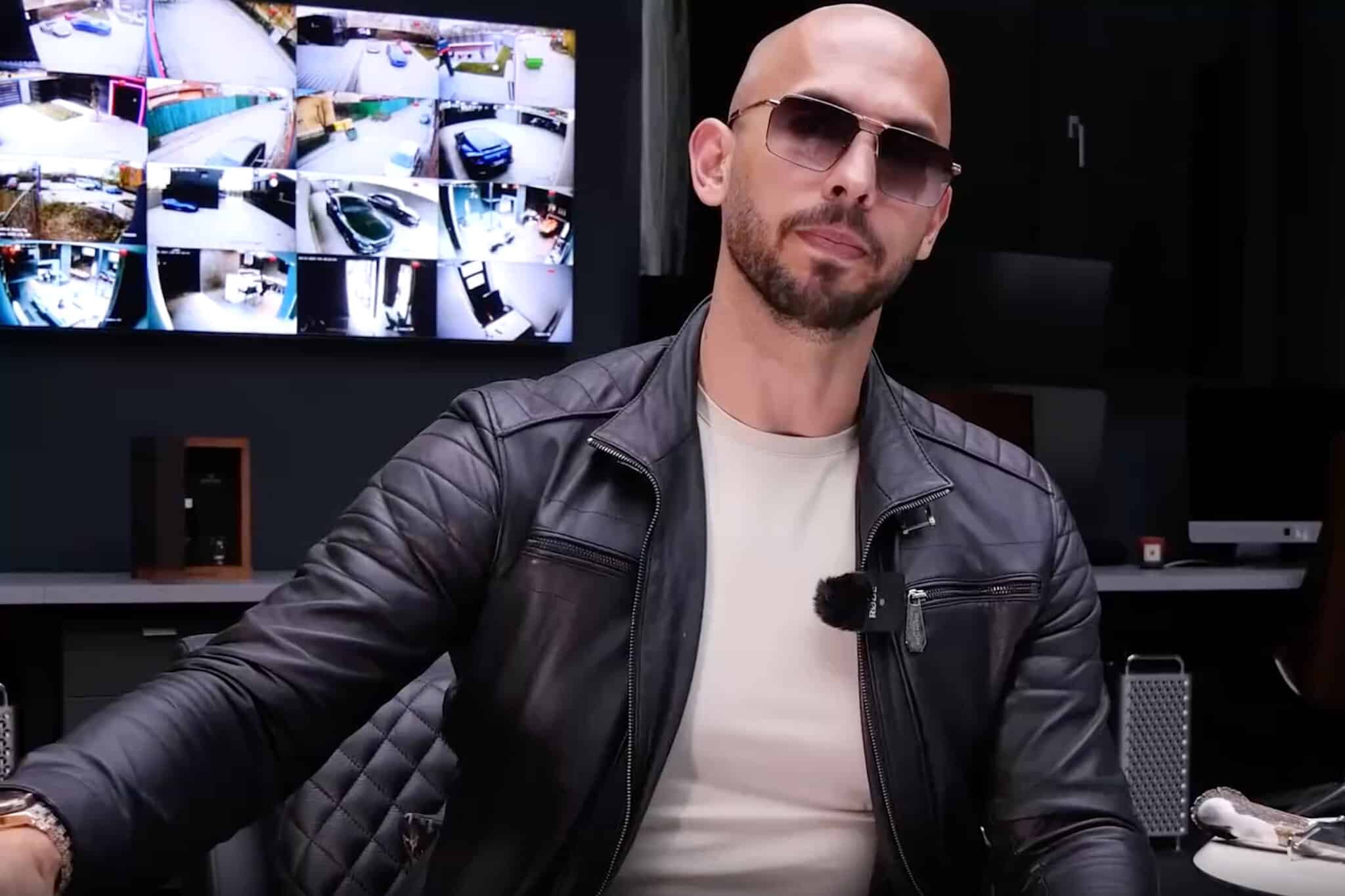

Andrew, a former kickboxing world champion, is known for his controversial views on success, wealth, and masculinity. He gained widespread attention through his participation in reality TV shows and his outspoken social media presence.

Andrew often shares advice on self-improvement, financial independence, and the importance of taking control of one’s life. Despite facing criticism for his unapologetic approach, he has amassed a significant following of individuals seeking motivation and guidance in achieving their goals.

Andrew’s unfiltered and direct communication style resonates with many aspiring entrepreneurs and individuals pursuing personal development.

SOURCE – (BBC)

Business

Costco Is Offering The Peloton Bike+ At 300 Locations This Holiday Season.

(VOR News) – Costco Wholesale Corporation COST is poised to attract fitness enthusiasts this Christmas season with the introduction of the Peloton Bike+ at its 300 sites nationwide and online.

The deal will occur during the holiday season. The wholesale retail giant and Peloton Interactive, Inc. (PTON) have collaborated to provide consumers with the opportunity to purchase high-quality fitness equipment at affordable prices.

Given Peloton’s established brand and the growing consumer demand for at-home fitness solutions, this initiative is expected to be advantageous for both companies.

For a brief while, we have been providing exclusive Bike+ rates at Costco.

The Peloton Bike+ will be available for purchase by Costco customers for a brief period starting on November 1, 2024, and ending on February 15, 2025, or until supplies run out.

With an extended guarantee that lasts for 48 months, the bike is expected to retail for $1,999 in-store and $2,199 online (including delivery). The same model, however, is listed on the Peloton website as costing $2,495.00.

Among the features of the Peloton Bike+ are a rotating screen and an auto-resistance mode that automatically changes strength in response to teacher cues. It is also possible to manually adjust the bike’s resistance knob.

Customers who purchase the $44/month All-Access Membership have unrestricted access to Peloton’s vast content library, which includes sixteen different training categories. It also allows users to set up separate accounts for every household member.

A Method for Interacting With Costco’s 136 Million Customers

The 136 million devoted Costco members will have the chance to save money on high-quality, well-known brand products thanks to this relationship, which is Peloton’s first seasonal retail engagement in the US.

By collaborating with Costco, which is renowned for its loyal customer base and dedication to offering premium linked fitness equipment at competitive costs, Peloton has significant potential to introduce its high-end connected fitness gadgets to a new and rich market.

The three main benefits of Costco are its customer-focused approach, strategic investments, and concentration on membership development. PTON will have the opportunity to engage with more members who are interested in physical fitness thanks to this collaboration.

The business has great expectations that it will eventually be able to expand its product distribution through Costco into new geographic areas and is particularly excited about the potential for learning from this first seasonal connection.

Other Details Concerning the Costco Stock Market

Costco’s success can be attributed mostly to its membership-based business strategy. This tactic produces a steady stream of revenue and cultivates outstanding client loyalty.

Access to Costco’s warehouses, where customers may buy a wide range of products at steep discounts, is granted to members upon payment of an annual fee. In addition to ensuring a steady flow of income, this plan’s execution gives the organization’s members a feeling of exclusivity and value.

COST is constantly changing due to shifts in the market and consumer preferences. The company’s product line is always growing to encompass a variety of goods and necessities that are highly sought after by customers. Costco has been able to increase its market share both domestically and abroad by using market research and creating customized products.

Costco’s promising future is a result of a number of variables, including as its appealing product mix, steady store traffic, pricing power, and sound financial standing. By employing a strategy that prioritizes lower pricing, Costco has been effective in drawing in customers who value convenience in addition to affordability.

Over the last six months, COST’s stock has increased by 23.5%, outpacing the growth of the overall industry by 12.4% and the S&P 500 index by 15.2%.

Costco is currently ranked as the second-best buy choice on Zacks. Here is the full list of stocks that have been assigned the Zacks #1 Rank (Strong Buy) for today.

SOURCE: YFN

SEE ALSO:

The Volkswagen China CMO Faced Expulsion From China Due To Drug Use.

American Airlines Paid $50 Million For How It Handled Disabled Passengers.

Business

The Volkswagen China CMO Faced Expulsion From China Due To Drug Use.

(VOR News) – Subsequent to the results of a positive drug test conducted by Volkswagen following his return from a vacation in Thailand, Jochen Sengpiehl, the chief marketing officer for Volkswagen Group China, was mandated to exit the country.

This resulted in the cessation of his employment. The Chinese government’s social media platforms have allegedly exhibited considerable interest in this recent event, according to the German publication Bild-Zeitung.

AFP said that German officials verified the news on Tuesday. The confirmation was reportedly made. Sengpiehl was placed in jail for more than ten days and given the direction to leave the country immediately after Chinese police discovered evidence of cannabis and cocaine in his blood, as reported by AFP.

Sengpiehl They also ordered Volkswagen to leave the country immediately.

It took Volkswagen and officials from the German embassy some time to be able to successfully negotiate his immediate release after he had been held for a period of time.

The newspaper Bild, on the other hand, claims that he was compelled to leave the country soon after being required to do so.

Campaign Asia-Pacific endeavored to contact Volkswagen Group for a statement regarding the matter. The subsequent text is a summarized version of the statement issued by a global spokesperson:

We request your understanding that we shall refrain from further commenting on the substance of your inquiries due to our contractual and data protection confidentiality requirements.

The incident sheds a bright light on the many different legal landscapes that are involved in the use of drugs.

Although Germany decriminalized the use of cannabis earlier this year and Thailand became the first Asian nation to decriminalize it for medical purposes in 2022 (although the use of cannabis for recreational purposes is scheduled to be prohibited by the end of the year), China continues to uphold extremely stringent anti-narcotics laws, with severe penalties for those who violate them.

There are also severe Volkswagen penalties for those who violate these laws.

The decade of the 1990s marked the beginning of Sengpiehl’s professional development at Nissan. After that, he moved on to work at BBDO and Daimler respectively. After serving as senior vice president and chief marketing officer at Volkswagen AG, he went on to work for WPP for a period of time.

During his time at Volkswagen AG, he held both of these positions. In the time leading up to his appointment as Senior Vice President and Chief Marketing Officer at Hyundai Motor Europe, he was the founder of his own business, which was called Jochen Sengpiehl Automotive Brand Management.

Sengpiehl arrived back at Volkswagen in 2017 and was promoted to the role of chief marketing officer for the global market. This marked his return to the company. It is because of the well-known catchphrase “Das Auto” (which translates to “The Car”) that he is already highly recognized.

It was in the year 2020 that Sengpiehl, who was serving as the worldwide chief marketing officer for the brand at the time, claimed responsibility for controversial advertising that promoted the Golf 8 and featured a video that was racist.

Within a short period of time, Volkswagen issued an apology, removed the commercial from its official Instagram profile, and started an investigation within the company. The year 2022 marked Sengpiehl’s relocation to China, where he assumed the position of China Chief Marketing Officer.

According to Volkswagen, China is a market that holds a significant amount of importance. BYD, a Chinese automotive business, surpassed Volkswagen to become the best-selling car brand in China after the country opened its market for automobiles in 2023.

Volkswagen had previously held this position. When it came to this particular aspect, this was the very first time that China had ever surpassed Volkswagen

SOURCE: CN

SEE ALSO:

American Airlines Paid $50 Million For How It Handled Disabled Passengers.

Early In 2026, Disney Will Name Bob Iger’s Replacement As CEO.

Business

American Airlines Paid $50 Million For How It Handled Disabled Passengers.

(VOR News) – On Wednesday, American Airlines paid a penalty of fifty million dollars levied by the United States of America Department of Transportation.

The Department of Transportation charged the airline with “numerous serious violations” of the laws safeguarding passengers with disabilities flying by aircraft.

Following an inquiry, the Department of Transportation (DOT) discovered breaches at American Airlines encompassing a four-year period, starting in 2019 and running through 2023. Following an investigation, the DOT found these infractions.

Along with reports of recurrent failures to offer timely wheelchair assistance, the United States Department of Transportation claims to have identified instances of “unsafe physical assistance that at times resulted in injuries and undignified treatment of wheelchair users.”

Americans had also handled hundreds of wheelchairs illegally, either by damaging them or by postponing their return, over the duration of the inquiry.

In a statement he issued, Secretary of Transportation Pete Buttigieg said, “The era of tolerating poor treatment of airline passengers with disabilities is over.” This comment came from Buttigieg.

“American Airlines violated passengers with disabilities’ rights with this penalty.”

The Secretary of Transportation declared in his speech. We hope that by enforcing fines higher than the cost of operations for American Airlines, we will be able to influence industry behavior generally and stop such kinds of misuse from the starting point. This will be achieved with the aim of stopping such kinds of abuse.

The Department of Transportation (DOT) gathered dozens of advocates for persons with disabilities at a February meeting in Washington, District of Columbia, to investigate the prospect of a rule mandating American Airlines to enhance their performance.

Among those included in this group was Thomas Braddy, the National Council on Independent Living’s current director. “There was too much damage to my chair,” Braddy said during the hearing, “which is why I stopped flying.”

Apart from the fact that it stopped him from traveling with his wife whenever they traveled on holiday, he said his inability to fly had slowed down his professional development.

Senator Tammy Duckworth, representing Illinois, was a casualty of the Iraq War and lost both legs. She delivered a speech at the conference in which she examined the parallels between a wheelchair and a bodily part. “If this fails, you have caused my injury.”

Duckworth has documented that airlines often destroy wheelchairs—including her own as well as those of others. Duckworth claims they were able to destroy 892 wheelchairs in one month last year.

This was within the year before. ” Imagine for a moment that airlines had shattered 892 pairs of legs in just one month, and the average American found out about this. Though there have been none, it is natural to expect a lot of indignation.

During the announcement of the fine, the Department of Transportation (DOT) displayed an American Airlines employee putting a wheelchair down a baggage ramp in this footage taken at Miami International Airport. The DOT videotaped the clip.

American Airlines says it has long helped disabled people.

American Airlines has said this: This dedication Reportedly, it has spent $175 million this year on services, infrastructure, training, and new technology to help ease their path and move their specialist equipment. Reports state this.

According to a press release the company sent, the airline got more than eight million wheelchair assistance requests in 2023. According to corporate data, less than 0.1 percent of consumers reported having a complaint related to a disability.

“Today’s agreement reaffirms American’s commitment to taking care of all of our customers,” Julie Rath, senior vice president of American Transportation, said.

The Department of Transportation has said that the issues it discovered are not particular to American Airlines. The government claims that it is now looking at infractions of a like kind that have happened at other US airlines. These transgressions have happened all throughout the nation

SOURCE: NPR

SEE ALSO:

Morgan Stanley Has Added OpenAI-Powered Chatbots To Its Wall Street Business.

Starbucks’ Baristas Are Disorganized. Analyst Claims It Has The Money To Pay Extra Help.

-

News3 weeks ago

The Biden Administration can go Ahead With Student Loan Forgiveness, Says a Federal Judge.

-

News3 weeks ago

Tesla Recalls 27,000 Cybertrucks Due To A Rearview Camera Issue

-

World3 weeks ago

Uber Hires Yandex Spinoff Ride-Hail and Autonomous Delivery With Avride

-

Tech3 weeks ago

Accenture and NVIDIA Collaborate to Enhance AI Implementation.

-

Tech3 weeks ago

Meta has started the Facebook Content Monetization Program.

-

Election News3 weeks ago

Chief Operating Officer Of Truth Social’s Parent Company Resigns