News

Thieves Sell Couple’s Home for $1.7 Million in Toronto Canada Through Title Fraud

A couple from Toronto, Canada, recently discovered that thieves sold their home for $1.7 million while the couple was in the UK. Authorities say this type of theft is not common, but there has been a noticeable increase in comparable occurrences in the country’s most populous metropolis.

Early this year, Toronto police said they needed the public’s assistance in apprehending two suspects involved in a complex fraud scheme.

According to the BBC, the suspects used forged identities to pose as city property owners. They sold the house and handed the keys to the unwitting new owners. The true owners of the house had been out of the country on business since January 2022.

After noting that their mortgage payments had vanished from their bank accounts, the out-of-town couple discovered that their home had been sold without their knowledge.

The incident piqued the interest of many Canadians, particularly in the Greater Toronto Area and Vancouver, where real estate is considered a national obsession due to its high cost – the average home costs more than $ 1 million, and homes are scarce.

Similar claims from other Toronto property owners have emerged, and police say these previously uncommon examples of property title fraud appear to be on the rise.

These situations are “certainly unique to this moment in time,” according to Trevor Koot, CEO of the British Columbia Real Estate Association and a nearly 20-year industry veteran.

“I’ve never seen anything like it,” he stated, referring to the complexity employed to carry out these crimes.

What exactly is title fraud? How much has it increased in Toronto, Canada?

Mortgage fraud and title fraud are common schemes involving home or property ownership.

According to Brian King of King Advisory International Group, a Toronto-based organization investigating white-collar crime, mortgage fraud is more widespread.

Why does it take 30 years in Canada to buy a house?

It is committed when a fraudster uses forged identifying documents to get a second mortgage on a home in Canada they do not own, usually after the first mortgage has been paid off in full or almost so.

On the other hand, title fraud entails tenants impersonating the owner of a vacant home and selling it to serious buyers. This results in the property’s total title transfer.

If the home has title insurance, the true owner and buyer in Canada can usually obtain most of their money back. The insurance covers legal expenditures paid during the procedure and aids in re-establishing ownership.

Mr. King stated that he had seen increased mortgage and title fraud frequency since 2020.

According to him, his firm has experienced a “rash” of title fraud in recent years. In almost all cases, the homeowners lived elsewhere when fraudsters took over their property, in nations such as the United States and China.

Mr. King mentioned a couple from Toronto who relocated to the UK for work in 2018. Their house in Canada was later sold from beneath them in 2022. It was sold for C$1.7 million and had been completely refurbished when they discovered it had been stolen in June. As of February, the couple was still working on getting their home’s title returned.

According to John Rider, vice-president, between the 1960s and 2019, Chicago Title Insurance Company’s Canada branch saw only two occurrences of fraud – mortgage and title.

They are currently dealing with scores of cases, including at least five examples of title fraud, all in the Greater Toronto Area, which covers the city and adjacent towns.

Comparable incidents of title fraud have appeared in the province of British Columbia, which is home to the city of Vancouver, where the typical home costs C$1.1 million, albeit on a less frequent basis.

The BC Land Title and Survey Authority (LTSA) reported two attempts at title fraud since 2020, just one of which was successful. The public corporation noted that it is only aware of one previous incidence in 2019 and two in 2008 and 2009.

It claims that these fraud cases are extremely unusual, even though the LTSA processes up to one million land title applications annually.

Why are there more reports of title fraud?

Scientists are baffled as to why there has been such an increase in reported cases, notably in Toronto.

Mr. King believes that virtual real estate transactions during the pandemic may have made it more difficult to detect phony identification documents. He also mentioned that the epidemic had compelled some people to stay away from their homes for prolonged periods because to travel restrictions.

Others have noted the increasing sophistication of the criminals, some of whom have been tied to organized crime and appear to have a thorough understanding of the real estate sector in Canada.

According to Mr. Rider, the phony Identities used in these transactions frequently appear authentic, and offenders would hire professional actors to pose as homeowners and carry out the operation.

“IDs are so easily falsified now that they can’t be relied on to close a $3 million transaction,” Mr. Rider added.

There is also the financial aspect of these crimes. Real estate in Toronto, Canada, has appreciated dramatically over the last two decades, with the average property costing C$198,150 in 1996. It was C$1.18m last year.

“It makes logical that there is a lot of emphases on where real estate is very valuable,” said Ron Usher, general counsel for the Society of Notaries Public in British Columbia, Canada.

However, Mr. Usher noted that little is known about these alleged incidents of title fraud, which are frequently complex.

“These are not easy crimes to commit, and they are frequently caught and prevented.”

He and others have asked for a national review to discover the underlying causes and whether more can be done to protect Canadian homeowners.

News

2024 | Alex Jones Fighting Attempt To Sell His Social Media Account Rights In Infowars Auction

Alex Jones, a conspiracy theorist, is attempting to prevent his personal social media accounts from being sold in the upcoming auction of his Infowars media platform to pay more than $1 billion owed to relatives of the Sandy Hook Elementary School shooting, claiming that doing so would violate his privacy and deny him the opportunity to start over after bankruptcy.

The trustee in charge of liquidating and selling Infowars and its parent company, Free Speech Systems, asked a federal judge on Friday to include the social media accounts in the November and December auctions. The judge postponed a ruling on the case for at least a week.

Alex Jones | AP News Image

Alex Jones Fighting Attempt To Sell His Social Media Account Rights In Infowars Auction

Jones’s lawyers contend that Infowars or FSS does not hold the personal media profiles that use his real name but by him personally and should, therefore, be regarded as part of his “persona” that cannot be owned by anybody other than himself.

They say that trustee Christopher Murray does not have the power to sell the social media accounts and warn that a purchaser may face challenges over whether they were obtained legally.

U.S. Bankruptcy Judge Christopher Lopez in Houston said a proposed ruling on the future sale of the social media accounts that protected Jones’ right to sue over ownership later was ambiguous, and he scheduled another hearing in a week.

“We should have great clarity and everybody agrees that something can be sold before it can be sold,” Lopez told the media. “I want a buyer or bidder to know exactly what they believe they can buy. I do not want to put a potential buyer at risk of litigation.”

The trustee also wants to be able to sell the rights to revenues from Jones’ book “The Great Reset: And the War for the World,” which was published in August 2022, and his video game “Alex Jones NWO Wars,” which was launched in 2023 and stars Jones as the hero in a shooting game.

Despite his company’s impending closure, Jones has promised to continue his discussion shows through other means, including a new website and personal social media profiles. He has also recommended that his fans purchase Infowars’ assets, allowing him to continue hosting his show as an employee under the Infowars brand in the company’s hometown of Austin, Texas.

In court filings, the trustee’s legal team argued that Jones’ X account, as well as others on Telegram, Gab, Parler, and other platforms, “are frequently used to promote and post Infowars content, and in some cases, have a significant number of followers.” Jones’ X account has about 3 million followers.

The trustee contended that the social media accounts of influencers, celebrities, and political figures had become valuable assets and that Jones’ accounts had piqued the attention of various parties interested in purchasing them.

Jones’ attorneys stated that if they were sold, the buyer would determine the outcome of the action.

“We got comfortable with the trustee that if certain parties were the successful bidder, there would be litigation later, but if certain parties were the successful bidder, there wouldn’t be litigation later,” Vickie Driver, one of Jones’ attorneys, told the judge.

Alex Jones | AP news Image

Alex Jones Fighting Attempt To Sell His Social Media Account Rights In Infowars Auction

“There is value to some folks in buying these assets and using them in one way, and value to other folks to use them in another way,” Mr. Driver stated.

Jones and his company both declared bankruptcy in 2022, the same year Sandy Hook families won nearly $1.5 billion in defamation and emotional distress lawsuits against Jones for repeatedly claiming the 2012 school shooting was a hoax staged by “crisis actors” to pass more gun control legislation. The Newtown, Connecticut, massacre killed 20 first-graders and six educators.

During two civil cases in Texas and Connecticut, parents and children of many of the victims testified that Jones’ phony conspiracies and the conduct of his followers had traumatized them. They claimed they were hounded and threatened by Jones’ supporters, some of whom visited the mourning families in person, claiming the shooting never occurred and their children did not exist. One parent stated that someone threatened to dig up his deceased son’s grave.

Jones is appealing the civil jury findings, citing free speech rights and challenging whether the families established a link between his views and the individuals who harassed and intimidated the relatives. He has since acknowledged that the incident took place.

SOURCE | AP

News

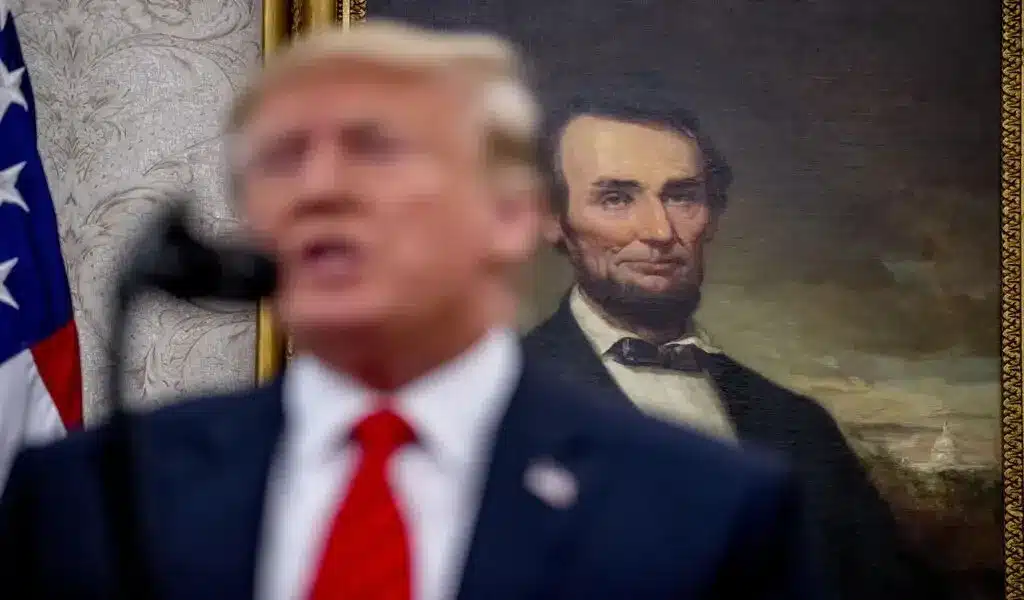

Suitable and appropriate? Donald Trump Often Compares Himself To Lincoln.

(VOR News) – In four scores and seven years, Donald Trump compared himself to Abraham Lincoln, lauded him, and criticized him. Our descendants should study why the 45th president, who wants to be the 47th, keeps mentioning the 16th.

“This is Donald Trump, hopefully your favorite president of all time, better than Lincoln and better than Washington,” Donald Trump said in a December 2022 video presenting “Trump digital trading cards” after announcing his third presidential bid.

The Republican Party claims that the Great Emancipator has been treated worse than Lincoln and done more for Blacks than anybody else since Lincoln. Donald Trump calls it “the weave.” It appears in his odd mix of personal grievances, apocalyptic warnings about Democratic Vice President Kamala Harris’s victory, cultural references, and self-promotion.

Donald Trump criticized Harris in California using Lincoln on October 13.

Our nation—what’s wrong? The speaker said, “Look, Abraham Lincoln was the greatest.” Study this. Are you okay with our actions? “She is an absolute disaster.”

Later that week, a Tennessee 10-year-old asked “Fox and Friends” about Trump’s childhood hero. Donald Trump mentioned Reagan at Reagan’s 1981 inauguration despite being in his thirties. After praising Lincoln, he questioned the conflict six weeks after his inauguration.

“Lincoln was likely an exceptional president; however, why was that not resolved?” Trump insists he would have prevented the Ukraine and Israel wars. “I am a man who is illogical.” The Civil War occurred. Trump’s unusual background fascinated Lincoln Forum chairman Harold Holzer.

Holzer said “The issue with Donald Trump’s utilization of Lincoln is that it is a form of malice directed at a select few, followed by a larger number, and ultimately Lincoln.” Many politicians have exploited Lincoln’s legacy. Holzer noted that most people associate the Illinois rail splitter with its simplicity.

On Lincoln’s birthday weekend, Barack Obama’s 2007 presidential campaign launch at Springfield’s Old State Capitol, where Lincoln served for eight years in the House, was remarkable. At the Democratic National Convention this year, Obama invoked the “better angels of our nature,” as Lincoln did in his inaugural address, to unite the nation.

Gerald Ford, who reluctantly became vice president during Watergate, famously said, “I am a Ford, not a Lincoln.” Another Illinoisan, Adlai Stevenson, recalled Lincoln’s reaction to losing the presidency to Dwight Eisenhower in 1952: He was like a child who stubbed his toe—too elderly to cry, too painful to laugh.

“This is not a novel concept.” Presidents have historically referred to their predecessors, according to Coastal Carolina University presidential expert Justin Vaughn. Trump’s approach and persona are unique. It often lacks nuance. Trump’s passion isn’t total.

Biden’s poor performance aided Jimmy Carter’s reign, Donald Trump added.

Trump’s love-hate relationship with Lincoln stems from his desire to protect and improve his legacy, Vaughn says. During their June debate, Trump and Biden argued about the Presidential Greatness Project, a political historian’s poll co-authored by Vaughn and revised in December. Lincoln was the greatest US president, while Trump was the worst.

According to Vaughn, Donald Trump’s dealmaker implies that the Union might have been rebuilt without Civil War violence. Compromises have underpinned US slavery throughout history. Holzer predicted a War Between the States to eradicate slavery and unite the nation. He said “better negotiators than Donald Trump, such as Henry Clay, attempted to resolve the sectional crisis without success.”

Trump says he has done more for Black Americans than any president since Lincoln, noting his criminal justice reform and opportunity zone initiatives to bring investment to poor neighborhoods.

Lincoln’s Emancipation Proclamation freed slaves in rebellious states, shocking the South and the Union-loving North. Just weeks before his assassination, his hard and skilled work helped enact the 13th Amendment, which abolished involuntary servitude in the US.

“There is no comparison to be drawn between former Presidents Abraham Lincoln and Donald Trump” based merely on the Emancipation Proclamation, says slavery expert Daina Ramey Berry, dean of humanities and fine arts at UC-Santa Barbara. Berry said “People regarded Lincoln as the Great Emancipator and an advocate for unity and freedom after slavery was abolished.” The declaration had no immediate effect.

The self-effacing Lincoln may react differently to the altercation than a circuit-riding attorney. The court saw Bloomington, Illinois attorney Ward Hill Lamon, Lincoln’s bodyguard in Washington, tear his trousers. The lawyers snidely replaced Lamon’s pants.

Lincoln dropped a paper in the hat instead of a coin, writing, “I can contribute nothing to the end in view.”

SOURCE: AP

SEE ALSO:

A Tropical Storm Floods Philippine Towns And Kills 76 People.

News

A Tropical Storm Floods Philippine Towns And Kills 76 People.

(VOR News) – Tropical Storm Trami left behind debris in the northern Philippines, which property owners cleared with rakes and spades on Friday.

At the same time, search and rescue teams were combing the sludge in search of individuals who had disappeared. The search for missing individuals proceeded, and it was determined that 76 individuals had passed away.

A significant rainstorm resulted in inundation that compelled tens of thousands of individuals to evacuate their residences. In certain regions, the amount of precipitation that would typically fall over the course of two months was accumulated in a mere two days. The floods that transpired were precipitated by inundation.

On Friday, residential property owners in the northern Philippines employed rakes and spades to clear the detritus that had been left behind by Tropical Storm Trami. At the same time, search and rescue teams were combing the sludge in search of individuals who had disappeared.

Tropical Storm confirmed 76 deaths after searching for missing people.

A significant rainstorm resulted in inundation that compelled tens of thousands of individuals to evacuate their residences. In certain regions, the amount of precipitation that would typically fall over the course of two months was accumulated in a mere two days.

The floods that transpired were precipitated by the inundation. He continued, “We are optimistic that the floods will abate today, as the rain has ceased,” in allusion to his own statements.

In contrast, President Ferdinand Marcos announced on Friday that rescue workers are still encountering significant obstacles in their efforts to reach the region, particularly in the province of Bicol. He believed that this issue was particularly prevalent in the region.

He remarked, “That is the challenge we are encountering with Bicol; it is exceedingly difficult to infiltrate.” He also stated that excessively saturated soil had caused “landslides in regions that had never encountered them previously.” He was referencing the difficulty of reaching the Bicol region, located in the Philippines.

Precipitation occurred for a total of two months. Educational institutions and government buildings on the largest island of Luzon were still closed as of Friday. Furthermore, Tropical Storm surge warnings were discontinued along the island’s western coast as the Tropical Storm advanced further into the ocean. Precipitation occurred for a total of two months.

Batangas province received “two months’ worth of rain,” which is equivalent to 391.3 millimeters, on October 24th and 25th, according to Jofren Habaluyas, a specialist with the state weather office. The quantity of precipitation in question is equivalent to the amount that would be expected to descend over the course of two months.

Tropical Storm Sandy discharged a torrent of volcanic mud, which inundated some cities.

The flooding caused streets to transform into rivers. The inundation necessitated the evacuation of more than three hundred and twenty thousand individuals from their residences. Following the conclusion of an official tally that occurred late on Thursday evening, this information was disclosed to the public.

Rescue personnel in Naga city and Nabua municipality employed boats to establish communication with individuals who were stranded on rooftops. A significant number of these residents expressed their preference for receiving assistance through Facebook posts.

The local disaster department has ordered the search for a missing fisherman, whose boat capsized in the waters of Bulacan province, located to the west of Manila, to be suspended on Friday due to the presence of strong currents. The boat that the fishermen were employing vanished in conjunction with the swells. The fisherman’s skiff capsized in the waters beyond western Manila.

Each year, the Philippines and the oceans that encircle them are struck by approximately twenty powerful Tropical Storm and typhoons. Scores of individuals are killed during the course of these Tropical Storm, in addition to causing devastation to homes and other significant structures.

Climate change has a direct impact on the occurrence of cyclones in the Asia-Pacific region, according to a recent analysis. The origin of these Tropical Storm is closer to the coasts, and they intensify more rapidly. Additionally, they persist over land for extended periods.

SOURCE: GN

SEE ALSO:

The NYSE Intends To Prolong Daily Trading Hours To 22 On Its Arca Exchange.

Canada Will Reduce Immigration Targets For 2025 As Trudeau Acknowledges His Policy Failed

-

News3 weeks ago

The Biden Administration can go Ahead With Student Loan Forgiveness, Says a Federal Judge.

-

News3 weeks ago

Tesla Recalls 27,000 Cybertrucks Due To A Rearview Camera Issue

-

World3 weeks ago

Uber Hires Yandex Spinoff Ride-Hail and Autonomous Delivery With Avride

-

Tech3 weeks ago

Accenture and NVIDIA Collaborate to Enhance AI Implementation.

-

Tech3 weeks ago

Meta has started the Facebook Content Monetization Program.

-

Election News3 weeks ago

Chief Operating Officer Of Truth Social’s Parent Company Resigns

.jpeg)