Cryptocurrency

Bitcoin ETFs Approved for the First time by the SEC, Boosting Crypto Advocates

(Z.News) – Cryptocurrency aficionados are predicting that the approval of the first spot bitcoin exchange-traded funds by the US Securities and Exchange Commission will attract more institutional and individual investors.

Sponsors of the eleven exchange-traded funds (ETFs) that were approved for listing by the leading US securities regulator included both well-established companies like Fidelity and Invesco and up-and-coming digital firms like Grayscale and Ark Invest.

To promote its iShares Bitcoin Trust, BlackRock will ring the opening bell at Nasdaq on Thursday morning, marking the beginning of trading for the first funds. These funds trade on exchanges like stocks and have unique tax protection in the US.

After months of waiting and a contentious legal fight, the approval has finally arrived. As a cherry on top of an already eventful day, hackers momentarily took over the SEC’s X social media account and fraudulently claimed that the applications had already been granted, causing Bitcoin’s price to fluctuate wildly.

Thursday morning saw Bitcoin trading 3% higher at around $47,000, which is still significantly lower than its $69,000 peak in November 2021 but over three times higher than its $16,000 low in December 2022 following the now-infamous crypto exchange FTX’s bankruptcy.

Several markets have already offered spot bitcoin ETFs

Although several markets have already offered spot bitcoin ETFs, US approvals are anticipated to signal a significant turning point for the most popular and liquid cryptocurrency unit.

Previously, US institutional and individual investors had to choose between purchasing on unregulated exchanges or paying more for exchange-traded funds (ETFs) that invest in bitcoin futures; now, they may have direct exposure to the currency through a regulated instrument.

“It’s a huge milestone; it’s recognition of bitcoin being a large-scale traditional investment,” commented Jad Comair, chief executive of Melanion Capital, the first business to create a bitcoin-themed ETF in the EU. “We’re letting people into Wall Street.”

The ruling also represents the SEC’s about-face. For over a decade, the regulator fought against spot bitcoin ETFs, citing the manipulated and fraudulent nature of cryptocurrencies as the reason.

However, Grayscale was able to overturn the watchdog’s previous rejection of a spot Bitcoin application last year. In August, a federal appeals court determined that the judgment lacked reasonable basis, leading to calls for the SEC to reconsider its position.

Although some ETF watchers are skeptical that huge quantities would pour into the products, crypto aficionados are wagering that the ETFs will significantly increase demand for digital assets. In 2021, ProShares raised $1 billion in just two days after launching the first exchange-traded fund (ETF) based on bitcoin.

However, organizations concerned about consumer safety and investors’ capital have voiced concerns that making the product accessible through an ETF would lure regular people to put their money into a market that has a history of scandals and wild price swings.

If approved, the clearance will “unleash crypto predators on tens of millions of investors and retirees but will also likely undermine financial stability,” according to Better Markets president Dennis Kelleher.

In a statement, SEC Chair Gary Gensler attempted to diffuse the conflict. Investors should “remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” he said, adding, “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin.

“After a day of gains of up to 1.5% due to the misleading post on the SEC’s X account, bitcoin prices fell by as much as 3.4% following the regulator’s correction. Aspiring exchange-traded funds are comparable as they all put their money into Bitcoin. Except for Grayscale and Hashdex, all firms want to debut naturally.

Grayscale wants to turn its $29 billion bitcoin trust into an exchange-traded fund (ETF), and Hashdex wants to turn its bitcoin futures fund into a spot fund. The new ETF suppliers are already engaged in a pricing battle with each other. Several investment firms have pledged to forego costs in the first few months of trading, and this week alone we’ve seen updates from BlackRock, Fidelity, and others that state their fees would be less than half a percent.

The chief executive of Grayscale, Michael Sonnenshein, told the Financial Times that his business has reduced its cost from 2% to 1.5% but had no plans to decrease it anymore.

He went on to say that GBTC “is coming to market in a very differentiated way from other ETF issuers that are starting from zero and are just getting their product launched” since it is a conversion from an existing product.

Cathie Wood, of Ark, described Bitcoin as a “public good” and expressed her confidence in utilizing the product as a loss leader. Her business would not apply its 0.21% charge until six months after debut or until its ETF exceeds $1 billion.

“Our goal is to ensure that information is accessible and made as accessible as possible,” Wood stated to the Financial Times. Making the most money possible is not our goal here. Other actively managed goods are available to us and can be of assistance.

The funds will deviate from the standard practice of exchange-traded funds (ETFs) by using cash instead of the underlying asset—bitcoin in this case—to generate and redeem new shares.

Despite the SEC’s initial opposition to a spot bitcoin ETF for over a decade, ProShares was able to establish the first of several ETFs that contain bitcoin futures in late 2021.

Notable ETF providers soon followed Grayscale’s lead and submitted their applications; the SEC then began collaborating with these firms to refine their plans.

The issuers have recently moved to a cash-based creation process, disclosed which financial institutions would issue and redeem shares, and outlined their plans to prevent market manipulation.

Wood said that the SEC, while being “one of the most skeptical regulators in the world and has gotten to the finish line and approved it,” maintained its stance. “And you know, this has been the subject of extensive battle testing.”

Trending Topics:

Israel Officials Support Gaza Destruction, Court Hears

Cryptocurrency

Disneyland Character And Parade Performers In California Vote To Join Labor Union

Anaheim, California – Disneyland actors who bring Mickey Mouse, Cinderella, and other popular characters to life at the Southern California resort voted to unionize after a three-day referendum that ended on Saturday.

The Actors’ Equity Association labor union announced Saturday that cast members at Disney’s theme parks near Los Angeles voted overwhelmingly for the union to become the bargaining agent for approximately 1,700 workers.

According to an association website that tracked balloting among cast members, 78.7% (953 votes) supported the passage, and 21.3% (258 votes) opposed it

AP – VOR News Image

Disneyland Character And Parade Performers In California Vote To Join Labor Union

“They say that Disneyland is ‘the place where dreams come true,’ and for the Disney Cast Members who have worked to organize a union, their dream came true today,” Actors’ Equity Association President Kate Shindle said in a statement on Saturday night.

Shindle described the workers as the “front lines” of the Disneyland guest experience. She said the association and cast members will address health and safety improvements, salaries, benefits, working conditions, and job security before meeting with Walt Disney Company executives to negotiate worker priorities into a contract.

The union now represents theatrical actors in Disney’s Florida parks.

According to the association, the National Labor Relations Board’s regional director will certify the results within a week, assuming no election challenges.

The NLRB did not immediately respond to The Associated Press’s email requesting confirmation or other information about the vote.

The election was held on Wednesday, Thursday, and Saturday in Anaheim, California after employees filed cards earlier this year to join the “Magic United” unit.

Pixa Bay – VOR News Image

Disneyland Character And Parade Performers In California Vote To Join Labor Union

Parade and character workers who advocated for unionization said they like helping to create a fantastic experience at Disneyland. However, they were anxious when asked to begin hugging people after returning to work during the coronavirus pandemic. They also claimed that elaborate outfits and unpredictable timetables cause damage.

Most of the Disneyland Resort’s more than 35,000 employees, including cleaning crews, pyrotechnic specialists, and security personnel, are already unionized. The resort contains Disneyland, the Walt Disney Company’s oldest theme park, Disney California Adventure and Anaheim’s shopping and entertainment center, Downtown Disney

In recent years, Disney has been accused of failing to pay a living wage to its Southern California employees, who face excessive housing prices and frequently drive long distances or live in cramped quarters. Parade performers and character actors are paid a base rate of $24.15 per hour, up from $20 before January, plus premiums for certain roles.

Union membership has been declining in the United States for decades, but organizations have enjoyed increased public support in recent years during high-profile contract negotiations with Hollywood studios and Las Vegas hotels. The National Labor Relations Board (NLRB), which protects workers’ rights to organize, announced more than 2,500 filings for union representation during the fiscal year 2023, the most in eight years.

PixaBay – VOR News Image

Disneyland Character And Parade Performers In California Vote To Join Labor Union

The International Brotherhood of Teamsters, a union that normally represents transportation workers, organized those who play Mickey, Goofy, and Donald Duck in Florida over 40 years ago.

At the time, Florida performers complained about unclean costumes and harassment from customers, including youngsters who kicked the shins of Disney villains like Captain Hook.

SOURCE – (AP)

Cryptocurrency

Bitcoin Value Drops as Halving Date Nears

Bitcoin’s value has fallen dramatically recently. Compared to its most recent all-time high of $73,750, the present price of Bitcoin is under $65,000, a decline of more than 12%. Both investors and cryptocurrency aficionados have noticed this unexpected drop.

The price of Bitcoin hit a new low of about $60,090.43 in the last several days, its lowest level since February. Given this declining tendency, the reasons impacting the bitcoin market have been the subject of debate.

This fall in Bitcoin’s value is due to important variables, such as legislative developments, fluctuating investor mood, and volatile markets. For those working in the cryptocurrency industry, it is essential to have a firm grasp of these aspects to successfully traverse the current market conditions.

It is crucial to keep up with the newest trends and developments in Bitcoin pricing in order to make educated investing decisions in the ever-changing cryptocurrency market. If you want to know why Bitcoin’s value dropped recently and how the digital asset market works, read on.

Factors Behind the Bitcoin Value Drop

The recent decrease in Bitcoin’s value can be attributed to various factors that have impacted the cryptocurrency market. Let’s delve into two significant aspects contributing to the decline in Bitcoin prices.

Market Uncertainty:

The volatile nature of the cryptocurrency market often leads to uncertainty among investors, causing fluctuations in Bitcoin prices. When market conditions become unpredictable, investors may react by selling off their Bitcoin holdings to mitigate potential losses. This rush to sell can cascade, putting downward pressure on Bitcoin prices.

Market trends, such as sudden price drops or rapid increases in trading volume, can contribute to heightened uncertainty. Factors like global economic instability, regulatory changes, or even major geopolitical events can further blur the outlook for Bitcoin’s value, prompting investors to reassess their positions and opt for selling, thus influencing the price downturn.

Regulatory Developments:

Another significant factor influencing the recent Bitcoin value drop is regulatory news and changes within the cryptocurrency space. Authorities worldwide have been increasingly focusing on regulating digital assets like Bitcoin, which can impact investor sentiment and confidence in the market.

Recent announcements of stricter regulations, bans on cryptocurrency trading in certain regions, or crackdowns on unregistered exchanges have all instilled fear and uncertainty among investors. Such regulatory developments can lead to a sell-off as market participants anticipate potential hurdles in trading, compliance, or even the overall legality of holding Bitcoin.

By closely monitoring market uncertainty and regulatory developments, investors can better understand Bitcoin’s value dynamics and make informed decisions amid the evolving cryptocurrency landscape. Staying informed about these factors is crucial for navigating the volatile nature of the crypto market and adapting to changing conditions to protect investments in digital assets.

Impact of Bitcoin Halving on Price

Bitcoin halving, a fundamental event in the Bitcoin network, plays a crucial role in influencing its price dynamics. Understanding how Bitcoin halving affects supply and demand helps predict potential price fluctuations in the cryptocurrency market.

Bitcoin Halving Explanation

Bitcoin halving, also known as halving, occurs approximately every four years and reduces miners’ rewards for verifying transactions by half. This process is coded into the Bitcoin protocol to limit the supply of new Bitcoins entering circulation. As a result, Bitcoin becomes scarcer over time, impacting its perceived value.

Historical Price Trends After Halving

Analyzing past Bitcoin halving events provides valuable insights into how the cryptocurrency’s price has reacted in the aftermath. Historically, Bitcoin prices have shown bullish trends post-halving, with significant price increases observed in the months following the event. This pattern is attributed to the reduced supply of new Bitcoins and increased investor demand.

By examining historical data and observing how Bitcoin’s price has behaved after previous halving events, investors and analysts can better understand potential price movements in the future. Market participants closely monitor the impact of Bitcoin’s halving on price to make informed decisions regarding their cryptocurrency investments.

Overall, Bitcoin’s halving serves as a pivotal moment that impacts Bitcoin’s supply-demand dynamics, ultimately influencing its market value and price fluctuations.

Bitcoin Price in USD and Recent Trend

Since the recent ups and downs in the cryptocurrency market have sparked curiosity among investors, let’s delve into the current state of Bitcoin’s value.

Current Bitcoin Price:

As of the latest data available, Bitcoin’s price in USD stands at approximately $61,244.38 per unit. Comparing this to recent highs, where Bitcoin surged above $64,000 and lows around $30,000, we can see the notable volatility that Bitcoin has experienced in the past weeks.

Price Fluctuations Analysis:

Various factors, including market demand, regulatory developments, and macroeconomic trends, have influenced the recent Bitcoin price fluctuations. The surge and retreat of Bitcoin value can be attributed to factors such as market speculation, news around Bitcoin halving events, and the overall sentiment towards the cryptocurrency market. These rapid price shifts showcase the cryptocurrency market’s unpredictable nature and the need for investors to stay updated on Bitcoin trends.

Analyzing the current Bitcoin price trend reveals a dynamic landscape where prices can shift rapidly based on market forces. Understanding the nuances of Bitcoin price fluctuations is pivotal for investors to make informed decisions about their holdings and successfully navigate the evolving cryptocurrency market landscape.

By staying informed about the latest Bitcoin to USD conversion rates and monitoring market indicators, investors can better position themselves in this fast-paced and ever-changing realm of digital currency trading. Bitcoin’s resilience and potential to act as a hedge against traditional financial assets make it a game-changer in the financial world, emphasizing the need for a strategic approach to effectively leverage its benefits.

The Role of Bitcoin Wallets in Value Fluctuations

The value of Bitcoin can experience significant fluctuations, influenced by various factors such as market demand, investor sentiment, and the role of Bitcoin wallets. Understanding how Bitcoin wallets affect price movements is essential for cryptocurrency enthusiasts.

Wallet Exchanges and Price Movement

Bitcoin transactions through wallets and exchanges play a crucial role in determining the price of Bitcoin. The volume of transactions on these platforms can impact supply and demand dynamics, affecting the overall market sentiment. Large buy or sell orders on exchanges can lead to price spikes or drops, creating volatility in the Bitcoin market. During times of high trading activity, the price of Bitcoin can experience rapid fluctuations, highlighting the interconnectedness between wallet usage and price movements.

Safety Measures in Wallet Usage

As Bitcoin’s value fluctuates, users must prioritize security measures to safeguard their investments held in Bitcoin wallets. Implementing robust security practices, such as using hardware wallets or two-factor authentication, can help protect funds from potential breaches or cyber-attacks during price drops. It is advisable for users to regularly update their wallet software, use strong passwords, and enable additional security features provided by wallet providers. By taking proactive steps to secure their Bitcoin holdings, users can mitigate price volatility risks and ensure their digital assets’ safety.

In conclusion, the role of Bitcoin wallets in value fluctuations underscores the need for users to understand the interconnected nature of wallet exchanges and price movements. By adopting proper safety measures and staying informed about market trends, cryptocurrency investors can confidently navigate through price fluctuations and protect their Bitcoin investments effectively.

Conclusion

Finally, investors are worried about Bitcoin’s future due to its recent decline in value, around $60,000. Reasons for the drop include market corrections, lower trading volumes, and significant holders taking profits after a period of high volatility.

Be wary of digital asset investments in light of this latest price drop, the biggest since February, and the inherent volatility of the cryptocurrency market. As Bitcoin’s value keeps changing, it’s important to stay informed and cautious when dealing with an ever-changing market. To lessen the blow of price swings in the unpredictable cryptocurrency market, investors should carefully monitor market movements and consider diversifying their holdings.

Business

Bitcoin To The Moon? Here’s Why It’s Near An All-Time High, With A Surge Of 20%

Last month, as bitcoin hit $45,000, JPMorgan Chase CEO Jamie Dimon compared it to a Pet Rock and told people to “stop talking about this s—.” Investors are currently laughing all the way to the bank.

In just five days, the cryptocurrency had surged by 20%. With Wednesday’s gains, the coin is on track to reach an all-time high of about $69,000 in November 2021, the last time it traded above $60,000.

Bitcoin To The Moon? Here’s Why It’s Near An All-Time High

Billions of dollars have flowed into the cryptocurrency since the US Securities and Exchange Commission approved bitcoin exchange-traded funds last month, contributing to the boom.

The other key element at work is the impending “halving” of Bitcoin. Halving is a built-in feature of Bitcoin that automatically limits the rate at which new coins enter circulation. It occurs every four years and, in principle, raises the price of Bitcoin because it increases the scarcity of an already finite currency.

This occurs because miners (the programmers responsible for solving complicated math problems inherent in the currency) see their Bitcoin-denominated payout cut in half when a threshold is reached.

Bitcoin To The Moon? Here’s Why It’s Near An All-Time High

In the past, halvings have triggered substantial bull markets. However, there is no clear rule that guarantees this conclusion every time. Various events, such as the prospect of additional rules, might reduce any possible advantages from a halving.

However, investors are hopeful that this will not play out, and they are hurrying to get in on the action or pay out their winnings. Coinbase, a cryptocurrency exchange platform, faced substantial interruptions due to the increased trade volume, according to CEO Brian Armstrong in a post on X Wednesday.

“Some users may see a zero balance across their Coinbase accounts & may experience errors in buying or selling,” Coinbase Support said on X at 1 p.m. ET Wednesday. “Our team is looking into this and will provide an update shortly. “Your assets are safe.”

Bitcoin To The Moon? Here’s Why It’s Near An All-Time High

An hour and a half later, Coinbase announced in another X post that it was “beginning to see improvement in customer trading.” It also stated that consumers may still be experiencing problems “due to increased traffic.”

Coinbase declined to comment to CNN about the problems other than the X postings.

SOURCE – (CNN)

-

Sports5 months ago

Sports5 months agoSaints’ Aggressive Play-Calling Ends Up Coming Back To Hurt Them In Loss To Rams

-

Business5 months ago

Business5 months agoNike Says It Will Cut $2 Billion In Costs In A Major Warning For Consumers

-

Business5 months ago

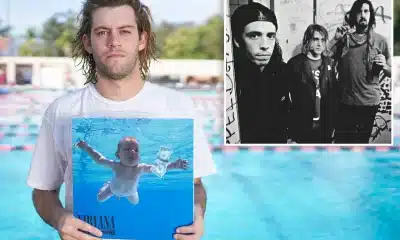

Business5 months agoFederal Court Revives Lawsuit Against Nirvana Over 1991 ‘Nevermind’ Naked Baby Album Cover

-

News5 months ago

News5 months agoThe Rise of Woke Ideology in Western Culture

-

Business5 months ago

Business5 months agoWayfair CEO: Employees Need To Work Longer Hours, After Laying Off 5% Off The Company

-

Learning5 days ago

Learning5 days agoExploring TVA Nouvelles Quebec’s Premier News Source