Money

2023 Swiss Regulator: Credit Suisse Made ‘Serious Breach’ Of Law

GENEVA, Switzerland — Swiss regulators have determined that Credit Suisse committed a “serious breach” of law in connection with a now-bankrupt firm linked to Australian financier Lex Greensill and have launched an investigation that could result in penalties for four former bank executives.

FINMA, Switzerland’s financial markets authority, announced Tuesday that it had concluded enforcement proceedings against Credit Suisse that were initiated two years ago after bank partner Greensill Capital went bankrupt. At the time, Credit Suisse closed four funds that were linked to the partnership. About $10 billion was invested in these funds by bank clients.

Credit Suisse’s troubled ties to Greensill Capital were just one of a slew of issues that have resulted in repeated top-management shake-ups and corporate restructurings in recent years. Greensill Capital was also the subject of investigations in the United Kingdom, with allegations that the firm founded by Greensill, a former adviser to former British Prime Minister David Cameron, received lucrative government contracts before going bankrupt.

In Switzerland, FINMA announced that to conclude its investigation, Credit Swiss’s top executives must regularly review about 500 of its most important business relationships and record the responsibilities of about 600 of its highest-ranking employees. The authority also stated that it had opened four enforcement proceedings against former bank executives, whom it did not name.

FINMA announced that to conclude its investigation, Credit Swiss’s top executives

“FINMA came to the conclusion that Credit Swiss Group seriously broke its supervisory duty over the years by failing to identify, limit, and monitor risks in its business relationship with Lex Greensill,” it said. “FINMA thus concludes that a serious breach of Swiss supervisory law has occurred.”

The authority collaborates with financial institutions, including banks, insurance companies, and the Swiss stock exchange, to ensure proper internal controls and stability. FINMA’s ability to issue penalties is limited, but it does have the authority to revoke business licenses in extreme cases. If more severe penalties or fines are warranted, it is up to prosecutors to pursue them.

In Greensill’s “supply chain finance” model, his company acted as a middleman between businesses and their suppliers, paying invoices that suppliers issued to their customers in exchange for a fee. The claims against those customers were then converted into securities that could be sold. Financial products became far riskier than initially indicated over time.

Credit Suisse “made partly false and overly positive statements” to FINMA about how claims were chosen and the exposure to some debtors, according to FINMA.

Credit Suisse expressed its appreciation for the case’s resolution without naming Greensill. Since March 2021, the Zurich-based bank has taken steps to strengthen governance and control, including dismissing “several managers and employees” in its asset management division, among other things.

SOURCE – (AP)

Finance

Google And Apple Remove Binance from App Stores in the Philippines

The Securities and Exchange Commission (SEC) of the Philippines to deactivate Binance from their app stores. A press release on Tuesday stated that the regulator had written to Google and Apple requesting that Binance-controlled applications be removed from the Google Play Store and Apple App Store.

According to Emilio Aquino, chair of the Securities and Exchange Commission, the public’s continued access to Binance’s websites and apps “threatens the security of Filipino investors’ funds.”

According to the agency, Binance operated as an unregistered broker and offered unregistered securities to Filipinos, violating Philippine securities laws. As of the time of this writing, neither nor Google nor Apple could be reached for comment.

According to Aquino, blocking from the Apple and Google app stores would help prevent “further proliferation of its illegal activities in the country and to protect investors from its negative economic effects.”

The National Telecommunications Commission of the Philippines has previously blocked access to website in the country.

Earlier this year, the SEC warned the public against using in the Philippines, and began examining the possibility of blocking Binance’s services there. According to the SEC, Binance has actively promoted its services on social media to attract funds from Filipinos, despite the fact that it is not licensed.

As a result, the watchdog is urging Filipinos who have invested to close their positions as soon as possible, or to transfer their crypto holdings to their own crypto wallets or exchanges registered in the country.

Richard Teng, formerly CEO of UAE regulator Abu Dhabi Global Markets, was appointed as Binance’s CEO following a settlement with the U.S. government that involves a $4.3 billion fine for alleged money laundering violations. In addition to the action,

Binance has been witness to a litany of woes recently.

Former CEO Changpeng Zhao has been charged with violating the Bank Secrecy Act and has agreed to step down. Zhao’s sentencing is scheduled for April 30.

Several lawsuits have been filed against by the Securities and Exchange Commission and the Commodity Futures Trading Commission regarding alleged mismanagement of customer assets and the operation of an illegal, unregistered exchange.

News

Police Arrest Six People Over US$14.5 Million Gold Heist in Canada

Six people have been arrested, including a jeweler and a commercial airline employee, and police have issued warrants for three more suspects in connection with what they say the single-largest gold robbery in Canadian history.

According to Peel Regional Police in Ontario, a joint investigation with the United States Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) resulted in the filing of nearly two dozen charges against the suspects in connection with the nearly $20 million Canadian dollar ($14.5 million) heist that occurred a year ago.

During a news conference in Ontario on Wednesday, Peel Regional Police Detective-Sergeant Mike Mavity told reporters that 400 kilograms of gold bars weighing more than 900 pounds, as well as approximately CA$2.5 million ($1.8 million) in stolen bank notes, were hijacked at Toronto Pearson International Airport after arriving on a commercial flight from Europe.

In total, 6,600 gold bars of various sizes were stolen, each of which was “99.9% pure and contained individualized serial numbers,” according to Mavity.

Gold Was in Hull of Air Canada aeroplane: File Photo

According to Peel Regional Police in Ontario, a joint investigation with the United States Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) resulted in nearly two dozen charges being filed against the suspects in connection with the nearly $20 million Canadian dollar heist that occurred on April 17, 2023.

On April 17, 2023, the gold and money were loaded into the hull of an Air Canada flight in “an approved airline container” bound for Toronto.

At 3:56 p.m. same day, the flight arrived at Toronto Pearson International Airport, and the gold and cash were quickly removed from the aircraft and transported to an Air Canada facility.

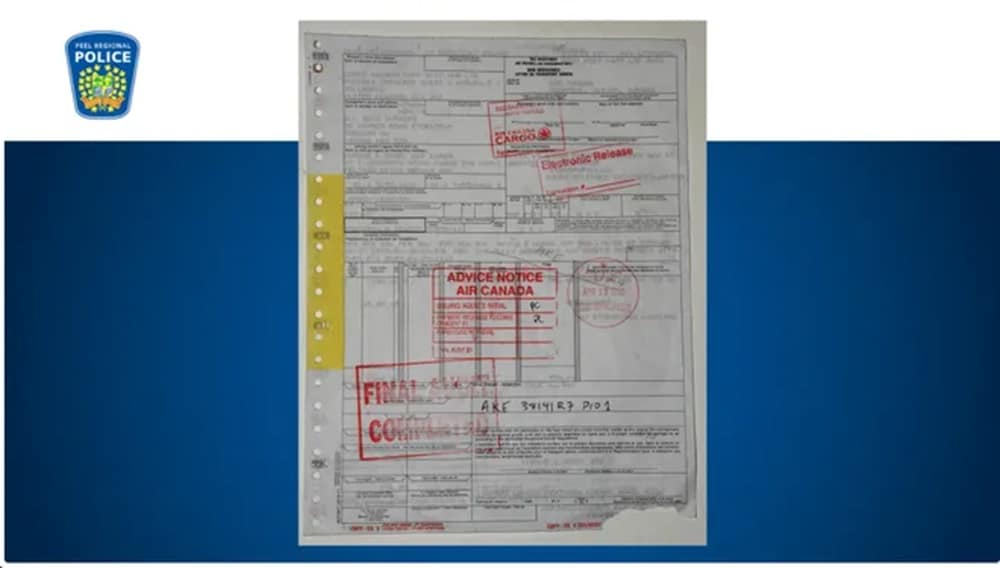

At 6:32 p.m., a man suspect came at air can freight driving a 5-ton truck and approached the property with what police called a counterfeit airway bill, a document used by carriers to track shipments.

Shortly after, a forklift arrived and loaded the item into the suspect’s truck. The suspect then drove off.

Fake Shipping Bill: Photo Peel Police

According to a police press release, officials discovered the document bill at 2:43 a.m. the next day to be a duplicate of an airline bill for a valid shipment of fish delivered and picked up the day before.

According to Mavity, the fake bill was produced at the Air Canada facility, and when officials discovered the products were gone, they used security footage to monitor part of the suspect’s subsequent trip until losing track of the truck in north Milton, an Ontario suburb.

Police stated that the crime was an inside operation and that a former Air Canada manager was wanted in the case.

So far police said they have arrested the following suspects in connection to the gold heist case:

- Air Canada employee Parmpal Sidhu, 54, of Ontario

- Jewelry store owner Ali Raza, 37, of Toronto

- Amit Jalota, 40, of Ontario

- Ammad Chaudhary, 43, of Ontario

- Prasath Paramalingam, 35, of Ontario

All five were released on bail and are scheduled to appear in court at a later date, Mavity said.

The truck driver who allegedly picked up the gold, Durante King-Mclean, 25 of Ontario, is currently in custody in the U.S. on firearms and trafficking related charges.

Here are the suspects at large:

- Air Canada manager Simran Preet Panesar, 31, of Ontario

- Archit Grover, 36, of Ontario

- Arsalan Chaudhary, 42, of Ontario

Only CA$90,000 ($65,000) of the more than CA$20 million recovered, said to Peel Regional Deputy Chief Nick Milinovich.

According to US Today, U.S. ATF Special Agent Eric DeGree, King-Mclean was detained in Pennsylvania following a traffic stop that resulted in the seizure of 65 illicit guns destined for Canada. According to DeGree, King-Mclean attempted to flee after police discovered the firearms in a rental car he was driving.

According to Air Canada spokesman Peter Fitzpatrick, two of the individuals identified by police worked for the airline’s cargo division at the time of the crime.

“One left the company prior to the arrests announced today, and the second has been suspended,” he stated, according to the site. “Because matter is now before the courts, we are unable to speak further.

According to the announcement, only about CA $90,000 (one kilogram of gold) has been found and melted down into bangle bracelets. According to authorities, the remaining gold was most likely melted down and used to purchase illicit weaponry.

“I commend our investigators, the ATF, other law enforcement partners, and our community for working together to identify and arrest those responsible for this brazen crime,” Peel Regional Police Chief Nishan Duraiappah said in a statement this week.

Anyone with information regarding the case should contact Peel Regional Police.

Finance

Why Gold Prices Are At Record Highs

From central banks to Costco shoppers, everyone is purchasing gold these days. Spot gold touched $2,364 per ounce on Tuesday, following seven consecutive sessions of record highs and trading at $2,336 per ounce on Monday. Year on year, gold is up 16.5%.

Investors who expect the Federal Reserve to lower its benchmark interest rate are the primary drivers of price increases, but other factors, such as central banks buying gold, headed by China, to reduce reliance on US currency, are also contributing.

Why Gold Prices Are At Record Highs

Central banks view gold as a long-term store of value and a haven during periods of economic and international crisis.

Gold is regarded as a reliable investment. When interest rates fall, gold prices often climb, as bullion becomes more tempting than income-paying assets such as bonds. Investors also view gold as a hedge against inflation, anticipating that it would preserve its value as prices rise.

According to Reuters, the People’s Bank of China purchased gold for the 17th consecutive month in March, adding 160,000 ounces to its stockpile of 72.74 million troy ounces.

According to a UBS research note dated April 9, central banks may wish to “diversify away” from the US currency and acquire it in the face of geopolitical instability. Demand drives up prices as China expands its reserves, which traditional investors have already increased.

According to a Capital Economics research report published on April 9, Chinese investors are looking to gold as an alternative asset due to recent downturns in property valuations and equity prices.

Other central banks, including India and Turkey, are expanding their reserves. According to UBS, India’s GDP growth is fueling these acquisitions.

A sign of the times?

According to Ulf Lindahl, CEO of Currency Research Associates, central banks’ appetite for gold indicates a declining reliance on the dollar.

Lindahl said in an email that dollars are becoming increasingly undesirable to central banks seeking to reduce their economic dependency on the United States.

According to a March JP Morgan research note, nations not allies of the United States may accumulate gold to “mix away from dollars” and lessen vulnerability to sanctions.

According to the note, central bank purchases have fuelled the rise in gold prices since 2022. According to JP Morgan, gold may be entering a strong era, as central bank purchases of gold in 2022 were more than double the average annual buy over the previous decade.

The price increase coincides with US Treasury Secretary Janet Yellen’s visit to China to address financial stability in US-China relations and what Yellen refers to as Chinese electric vehicle overproduction.

Mark Zandi, chief economist at Moody’s, believes that rising oil costs threaten the US economy.

According to the UBS research report, higher oil costs are anticipated to raise inflationary fears, causing gold prices to rise.

The typical view of gold

The spike in gold prices indicates that investors expect the Fed to drop interest rates later this year, but they may be concerned about the prospects of containing inflation without causing the US economy to enter a recession, sometimes known as a soft landing.

According to an April 9 research note from UBS, the prospect of Fed rate cuts remains the primary driver of optimistic sentiment toward gold.

Fed Chair Jerome Powell said in remarks on April 3 that inflation remains on a “sometimes bumpy path” toward the Fed’s 2% target and that rate cuts to rebalance the economy are expected to begin later this year.

According to CME Group data, 51% of investors currently predict a quarter-point decrease in June. However, employment growth in March exceeded projections, casting doubt on the need for numerous rate reductions in an economy that remains strong.

The Personal Consumption Expenditures price index, the Fed’s favored inflation gauge, increased 2.5% in the year ended in February. According to Department of Commerce figures issued this month, this represents a little uptick from the 2.4% increase in January.

The core PCE price index, which excludes the more volatile food and energy sectors, increased 0.3% monthly. Fed officials consider the index a key indicator of underlying inflation, and it fell from 0.4% in January when it increased at the strongest rate in a year.

So, why is gold soaring right now?

Some investors are buying into the frenzy around gold bullion as prices increase, pushing them further. On Reddit, proud buyers frequently create threads touting their collections.

Costco started selling bars online in August and silver coins in January. Wells Fargo estimates that the corporation currently sells up to $200 million in gold and silver per month. Chief Financial Officer Richard Galanti told analysts in December that the company had sold over $100 million in gold bars in the previous quarter.

The investment note, released on April 9, stated, “The accelerating frequency of Reddit posts, quick online sell-outs of product, and [the company’s] robust monthly eComm sales suggests a sharp uptick in momentum since the launch.”

Lindahl stated that “trend followers” and others capitalize on price increases as the long-term trend indicates much higher costs.

It’s also worth mentioning that gold has historically been a haven during political turmoil. Voters in almost 60 countries, including the US presidential election, will go to the polls this year. The increase in geopolitical and economic volatility highlights the value of precious metals.

SOURCE – (CNN)

-

Celebrity5 months ago

Shane MacGowan, Lead Singer Of The Pogues And A Laureate Of Booze And Beauty, Dies At Age 65

-

Entertainment5 months ago

Robert Downey Jr. Won’t Be Returning To The Marvel Cinematic Universe As Tony Stark

-

Politics5 months ago

Former US Secretary Of State Henry Kissinger Dies Aged 100

-

Politics5 months ago

Unveiling the Power and Influence of The Conservative Treehouse

-

Celebrity5 months ago

WWE Hall Of Famer Tammy ‘Sunny’ Sytch Sentenced To 17 Years In Prison For Fatal DUI Crash

-

Business5 months ago

Tesla’s Cybertruck Hits The Market With A Higher Price Tag And Plenty Of Challenges