Business

New Sanctions on Russia and Their Impact on Global Trade, Markets

Sanctions used to be a topic for diplomats and policy experts. Today, they affect gas bills, food prices, and even mortgage rates. The latest rounds of new sanctions on Russia in 2024 and 2025 show this very clearly.

After Russia’s full-scale invasion of Ukraine in 2022, many countries chose sanctions instead of direct war. In 2025, the US, EU, UK, and allies pushed new packages that hit Russian energy, banks, and military-linked companies harder than before. These moves are now reshaping how countries buy energy, how ships move around the world, and how money flows through global markets. They also sit at the heart of Europe’s Energy Crisis.

The European Union’s 19th sanctions package, along with new US measures, now targets Russian oil, gas, LNG, and finance in a much deeper way. As a result, Europe is racing to find new energy suppliers, companies are rewriting trade routes, and investors are watching markets jump on every new headline.

What Are the New Sanctions on Russia and Why Do They Matter?

Sanctions are basically rules that limit or block trade and finance with a country, company, or person. They are a tool that governments use when they want to punish bad behavior, but do not want a direct military fight.

In late 2025, the EU adopted its 19th package of sanctions against Russia. It is the toughest so far. Official EU statements explain that this package targets Russian energy exports, including liquefied natural gas (LNG), as well as banks, crypto services, and companies in other countries that help Russia’s war effort. You can see this described in more detail in the EU’s announcement on the 19th package of sanctions against Russia.

At the same time, the US and UK increased pressure on Russian oil majors and financial channels that still help Russia earn foreign currency and buy imported goods.

Why does this matter for regular people? Because Russia is a major exporter of oil, gas, LNG, metals, and grain. When those flows are restricted or rerouted, prices and supplies change, often far from the war itself. That change feeds into global trade, stock markets, and day-to-day costs for households.

Simple Explanation of Sanctions and How They Work

Think of sanctions as strict rules for doing business. Governments tell banks and companies: “You cannot deal with that person, that company, or that country, at least not in certain areas.”

Some common types of sanctions are:

- Trade bans: For example, no importing Russian oil or LNG into the EU.

- Financial blocks: Cutting Russian banks off from global payment systems.

- Export controls: Limiting high-tech gear, machinery, or chemicals that can be used for weapons.

- Asset freezes and travel bans: Blocking the money and movement of certain people.

Here is a simple example. If a Russian oil company is on a sanctions list, a European bank may not be allowed to process its payments. So the company cannot easily get paid in euros or dollars. That makes it harder for Russia to sell energy and to fund its war.

The official goal of these tools is to pressure leaders and the war economy, not to punish ordinary people. In real life, though, regular people often feel the side effects, like higher fuel or food prices.

Key New Measures in 2025: Energy, Finance, and Military Trade

The 19th EU package is a big step up. According to EU and news reports, including finance-focused coverage of the 19th sanctions package and Reuters reporting on the LNG ban and ship list, the latest measures include:

Energy

- A full ban on Russian LNG imports into the EU, with phase-out periods for existing contracts.

- Tighter limits on Russian oil, including exports linked to big companies like Rosneft and Gazprom Neft.

- A crackdown on Russia’s “shadow fleet”, with over 500 ships listed for trying to hide the origin of oil or dodge price caps.

Finance

- EU firms will be banned from using Russian financial messaging systems such as SPFS, SBP, and Mir, starting in early 2026.

- New sanctions on crypto exchanges and services that help Russia move money outside the regular banking system.

- More Russian banks added to EU and US sanctions lists.

Military and war economy

- Extra export bans on items that can support Russia’s military industry, such as certain metals, electronics, and construction materials.

- Dozens of new individuals and companies linked to the war or to sanctions evasion added to sanction lists.

- Companies in third countries, including parts of Asia and the Middle East, targeted if they help Russia dodge rules.

Legal and compliance experts have summarized how broad this 19th package is, for example in analyses like Skadden’s overview of the EU sanctions update and Rimon Law’s summary of new export restrictions.

How These Sanctions Are Different From Earlier Ones

Right after the 2022 invasion, sanctions focused on some banks, elites, and high-tech exports. Many energy flows, especially gas, were left partly open. Europe still depended on Russian pipeline gas and some oil.

As the war dragged on, the logic changed. The newest measures:

- Hit core energy exports harder

Earlier packages left large gaps for LNG and some oil routes. The 19th EU package moves toward a total LNG ban and closes many of those gaps. - Widen the target list

More banks, more companies, more ships, more individuals. Sanctions now reach deeper into Russia’s energy system and war economy. - Push back against workarounds

The EU and US now pay closer attention to traders, banks, and shippers in third countries that help Russia bypass rules.

Because of these changes, sanctions now affect not just Russia, but the whole web of global trade, shipping, and finance that used to move Russian goods.

How New Russia Sanctions Are Shaping Global Trade Flows

When a major exporter like Russia faces new limits, trade routes bend. Ships change ports. Contracts get rewritten. Middlemen appear.

The latest sanctions affect three big areas:

- Energy trade, especially oil, gas, and LNG.

- Key raw materials, such as metals, fertilizers, and grains.

- Shipping and insurance, which act as the backbone of trade.

All of this links back to Europe’s Energy Crisis, where the loss of Russian energy has forced a huge and costly shift to new suppliers.

Energy Trade Disruptions and Europe’s Energy Crisis

Before the war, Europe relied heavily on Russian pipeline gas. When those flows dropped, Europe turned to LNG from many places, including still from Russia in the short term. The new EU LNG ban removes that last piece over time.

This is central to Europe’s Energy Crisis. Europe now needs to:

- Replace Russian pipeline gas and LNG with imports from the US, Qatar, and African producers.

- Compete with Asian buyers for the same LNG cargoes.

- Make sure storage tanks are full before each winter.

When more buyers chase the same limited gas, prices can jump. That hits:

- Households, through higher heating and electricity bills.

- Factories, through higher energy costs that cut profits or force shutdowns.

- Governments, which may spend more on subsidies or price caps.

The crisis in Europe feeds into global markets. If Europe buys more LNG from the US, that affects how much is left for other regions and what price they pay.

Shifts in Oil, Gas, and LNG Trade Routes Worldwide

Russian oil and gas do not simply vanish. They look for new homes.

Here is what is happening:

- Oil that used to go to Europe now sails to Asia, especially India and China, often on longer routes that use more ships and time.

- Russia offers discounts to buyers willing to ignore or work around Western sanctions and price caps.

- A “shadow fleet” of older tankers moves Russian oil under different flags, hidden ownership, or switched-off tracking systems.

- Europe increases LNG imports from friendly countries and signs long-term contracts to replace Russian supply.

These shifts bring higher transport costs and more complex logistics. New trading hubs and middlemen appear in places like the Middle East, the Caucasus, and parts of Asia. This extra friction often shows up as higher prices for end buyers.

Impact on Food, Metals, and Other Key Commodities

Russia and Ukraine are both major food and raw material exporters. That includes:

- Wheat and other grains.

- Fertilizers such as potash and nitrogen products.

- Metals like nickel and aluminum.

Sanctions on Russian banks, shipping, and insurance, plus the risk from war in the Black Sea region, can slow these exports or make them more expensive.

For poorer countries that import a lot of food or fertilizer, higher prices can hit hard. If fertilizer costs more, farmers may use less, which can reduce crop yields. Less supply can push food prices higher. That is how a war in Europe and sanctions on Russia can affect the price of bread or meat in faraway regions.

Even when food and fertilizers are not directly banned, the extra cost of ships, insurance, and financing still raises prices along the supply chain.

New Trade Partners and Alliances Outside the West

As Western markets close, Russia has looked for partners elsewhere. It has deepened ties with:

- BRICS countries, like China and India.

- Middle Eastern states, that seek cheap oil and gas.

- Some African and Latin American countries, that want investment or discounted fuel.

At the same time, more companies in these regions face pressure from US and EU sanctions if they help Russia buy weapons or evade rules. Some Chinese, Gulf, and other firms have already been listed for supplying sensitive goods or finance linked to the war.

This raises a bigger question: will world trade split into blocks? One block could be centered on US and EU rules, with stricter sanctions and controls. Another could trade more freely with Russia, Iran, and other sanctioned states.

For businesses, this means more uncertainty. They may need separate supply chains for different markets, and they face higher legal and reputational risks.

How Sanctions on Russia Are Moving Global Markets and Prices

Markets react to news in seconds. When governments announce new sanctions, traders quickly guess what that means for supply, demand, and risk.

For Russia sanctions, three areas move first:

- Energy prices, especially oil and gas.

- Stock markets and currencies.

- Inflation and interest rates.

These shifts affect regular people through fuel prices, grocery bills, and borrowing costs.

Oil and Gas Prices: Why Energy Costs Stay Volatile

Energy markets do not like uncertainty. Every time there is a new LNG ban, ship blacklist, or banking restriction, traders worry about tighter supply.

A simple rule helps:

- When supply shrinks and demand stays strong, prices tend to rise.

- When supply grows or demand falls, prices tend to drop.

With Russia sanctions, many traders expect some loss of supply or at least higher transport costs. That supports higher prices than before the war. At the same time, if the global economy slows, or if Europe has a mild winter with full gas storage, prices can fall back.

Because these forces push in both directions, energy prices stay jumpy. This constant up and down is a key part of Europe’s Energy Crisis, since businesses and households struggle to plan when they do not know what their bills will look like a few months ahead.

Stock Markets, Currencies, and Investor Fear

Stock markets often react strongly to big sanctions news:

- Energy company stocks can rise if investors expect higher oil and gas prices that boost profits.

- Airlines, shipping lines, and heavy industry can fall if investors fear higher fuel and raw material costs.

- Banks and insurers may drop if they face legal or credit risks from sanctions.

Currencies also move:

- Countries that export oil and gas sometimes see stronger currencies when prices rise.

- The Russian ruble has faced heavy pressure since 2022, with capital controls and sanctions limiting trade in the currency.

- Safe-haven currencies, like the US dollar and Swiss franc, can gain when investors get scared and pull money out of riskier places.

Investors also worry about how strict enforcement will be. A new round of penalties for shipowners or traders can quickly change sentiment and add to swings in markets.

Inflation, Interest Rates, and What Households Feel

Sanctions and trade shocks feed into inflation. When energy, shipping, and raw materials cost more, companies often pass that on to consumers. This shows up in:

- Higher heating and electricity bills.

- More expensive gasoline and diesel.

- Rising prices for food and packaged goods.

Central banks use interest rates to fight inflation. If prices rise too fast, they may raise rates. That can cool demand but also makes loans, credit cards, and mortgages more expensive.

This is a sharp trade off. On one side, sanctions try to weaken Russia’s war machine. On the other, they can add to price pressure around the world. In Europe, energy-driven inflation has been a big piece of Europe’s Energy Crisis, forcing governments to respond with tools like tax cuts, targeted subsidies, and caps on certain energy prices.

What Comes Next for Sanctions, Europe’s Energy Crisis, and Global Trade?

No one knows exactly how long the war in Ukraine will last or how far sanctions will go. Still, some paths look more likely than others.

Looking ahead, three big questions stand out:

- How much tighter will sanctions and enforcement become?

- How will Europe’s energy system change over the next decade?

- Will global trade split into blocks or slowly reconnect?

Possible Future Sanctions and Tighter Enforcement

Many governments have already signaled that more could come if the war continues. Future steps might include:

- Closing more loopholes in the oil price cap system.

- Targeting more banks and trading firms in third countries.

- Expanding controls on dual-use goods that can help the Russian military.

Experts often stress that enforcement matters as much as new rules. If ship tracking, cargo checks, and payment monitoring get stronger, sanctions will bite harder.

For global supply chains, that could mean:

- More checks and paperwork for cargoes that might involve Russia.

- Higher compliance costs for shipping, insurance, and banks.

- A greater chance of delays in energy and raw materials deliveries.

Long Term Impact on Europe’s Energy Crisis and Green Transition

Europe’s Energy Crisis is not only about this winter or next year. It is also reshaping long term energy plans.

The loss of cheap Russian gas has pushed European leaders to:

- Speed up investment in solar, wind, and other renewables.

- Build more LNG terminals, pipelines, and storage connected to friendly suppliers.

- Promote energy savings in homes and factories, from better insulation to smarter grids.

Over time, these steps can make Europe less dependent on risky suppliers and more stable. Cleaner energy also helps with climate goals.

There is a hard side too:

- New infrastructure and renewable projects cost a lot of money.

- Some regions depend on old energy industries and fear job losses.

- Political debates grow over who pays, how fast to move, and how to protect vulnerable groups during the transition.

The mix of sanctions, security worries, and climate policy will drive Europe’s choices for many years.

Global Trade: Risk of Fragmentation or Chance to Rebuild?

The global trade system is under stress. Some companies and countries talk about “de-risking” from overly tight ties to any single partner, especially those seen as risky or unfriendly.

Two broad paths are possible:

- Deeper fragmentation

The world splits more into trade blocks. One block is centered on the US and EU, with strong sanctions and security rules. Another block includes Russia, China, Iran, and others that trade more among themselves, sometimes with separate payment and tech systems. - Partial rebuild and adjustment

Over time, some trust returns in areas that are less sensitive. Trade flows shift but do not completely break. Countries keep security in mind but still seek gains from trade.

In both paths, companies are already:

- Spreading suppliers across more countries.

- Shortening some supply chains or bringing key production closer to home.

- Rewriting contracts to handle sanctions and political risk better.

This can increase costs but may reduce the chance of sudden shocks like those seen since 2022.

Conclusion

The latest new sanctions on Russia have moved far beyond the early steps of 2022. They now cut deep into energy exports, finance, and the war economy, and they reach into third countries that help Russia work around the rules. These measures reshape Europe’s Energy Crisis, alter global trade routes, and stir markets every time a new package or enforcement move is announced.

Sanctions are meant to reduce Russia’s ability to fund and fight the war in Ukraine. At the same time, they bring real side effects, from higher gas and electricity bills in Europe to rising food prices in poorer countries. The choices that governments make on sanctions, energy policy, and trade will shape prices, jobs, and stability long after the war ends.

For anyone who pays a power bill, buys groceries, or holds a mortgage, these issues are not distant geopolitics. They are part of daily life. Paying attention to Europe’s Energy Crisis, sanctions policy, and global trade helps people understand why costs are changing and what might come next, even if they live far from Russia or Europe.

Related News:

Russia Bans Facebook, Meta Says It Will Do Everything To Restore Service

Business

Tech Giant Oracle Abandons California After 43 Years

SAN FRANCISCO – Oracle Corporation, the database and cloud computing giant valued at more than $550 billion, has shifted its corporate headquarters from California to Texas. The news did not come with a press conference or a bold announcement. It appeared in a single line inside a Securities and Exchange Commission (SEC) filing released on a Friday evening, a timing that tends to limit attention.

Oracle began in 1977 in Santa Clara under the name Software Development Laboratories. For more than 40 years, it has built its identity in the Golden State. Its well-known cylindrical campus in Redwood Shores, Redwood City, became part of Silicon Valley’s visual story.

Co-founded by billionaire Larry Ellison, the company grew into a major employer across California and a steady source of tax revenue and local spending. After 43 years, Oracle is moving its headquarters, pointing to employee flexibility in a post-pandemic workplace.

Oracle kept its statement short, saying it is “implementing a more flexible employee work location policy and has changed its Corporate Headquarters from Redwood City, California to Austin, Texas.” There was no long explanation, no executive statement, and no analyst call tied to the move.

The wording fits with the remote-work shift across tech. Oracle said it will keep supporting key office hubs, including sites in California, while giving employees more choice in where they work.

Some critics read the quiet release as intentional. By placing the update in routine regulatory paperwork right before the weekend, Oracle reduced the immediate media surge that often follows big corporate moves. Texas Governor Greg Abbott praised the decision on social media, calling Texas “the land of business, jobs, and opportunity.” California leaders have been far less vocal.

Newsom Stays Silent

As of press time, Governor Gavin Newsom’s office has not issued a public statement about Oracle’s headquarters change. People familiar with the administration describe frustration, along with a focus on California’s broader economy. One aide, speaking privately, framed these moves as part of a national pattern, not a direct verdict on state policy.

That quiet approach differs from Newsom’s recent public defense of California’s economy. He has pointed to strong tourism spending and the state’s large share of Fortune 500 companies.

Newsom has also argued that California still draws more investment than it loses. Still, Oracle’s departure, after moves by Hewlett Packard Enterprise and well-known relocations tied to Elon Musk, gives fresh energy to critics.

They often point to high taxes, heavy regulation, and a steep cost of living. California’s top personal income tax rate of 13.3% is a frequent talking point. Oracle, however, linked its decision to workplace flexibility.

Part of a Broader Shift

Oracle joins a growing list of tech companies that are rethinking long-term ties to California. Hewlett-Packard Enterprise moved its headquarters to Houston earlier this month. Elon Musk relocated to Texas and has taken public shots at California policies.

Smaller companies have made similar choices, drawn by Texas’s lack of a state income tax and its business-friendly reputation.

Austin also isn’t new ground for Oracle. The company opened a campus there in 2018, and the city has continued to attract tech talent and investment.

Even with the headquarters change, Oracle still has a major presence in California. Thousands of workers are likely to stay, whether in offices or working remotely. Real estate watchers expect the Redwood Shores site to remain active, though parts of it could be subleased or repurposed over time.

What It Means for California’s Economy

Losing a headquarters label often carries more symbolism than immediate job losses. Many corporate moves shift mailing addresses and executive offices more than day-to-day staffing. California also remains a global tech center, home to Apple, Google, and Meta. It leads the nation in venture capital and ranks high in patent activity.

Even so, the move hits during ongoing debates about housing costs, homelessness, and energy prices. Groups such as the Bay Area Council have pushed for reforms, warning that the state’s reputation with business could weaken over time. Others argue that California’s diverse economy, talent base, and quality of life still make it hard to replace.

Oracle’s decision reflects a workplace reality where a physical headquarters matters less than it once did. For Texas, it’s a clear win and another boost for Austin’s push to stand alongside older tech centers. For California, it’s another reminder that companies now have more options, and many are willing to act on them.

As one longtime Silicon Valley voice put it, companies may relocate, but innovation sticks around when people support it. Whether Governor Newsom addresses Oracle’s move directly remains unclear, but the brief SEC filing made the shift official.

Related News:

Trump Cancels $4 Billion in Federal Funding for California High-Speed Rail

Business

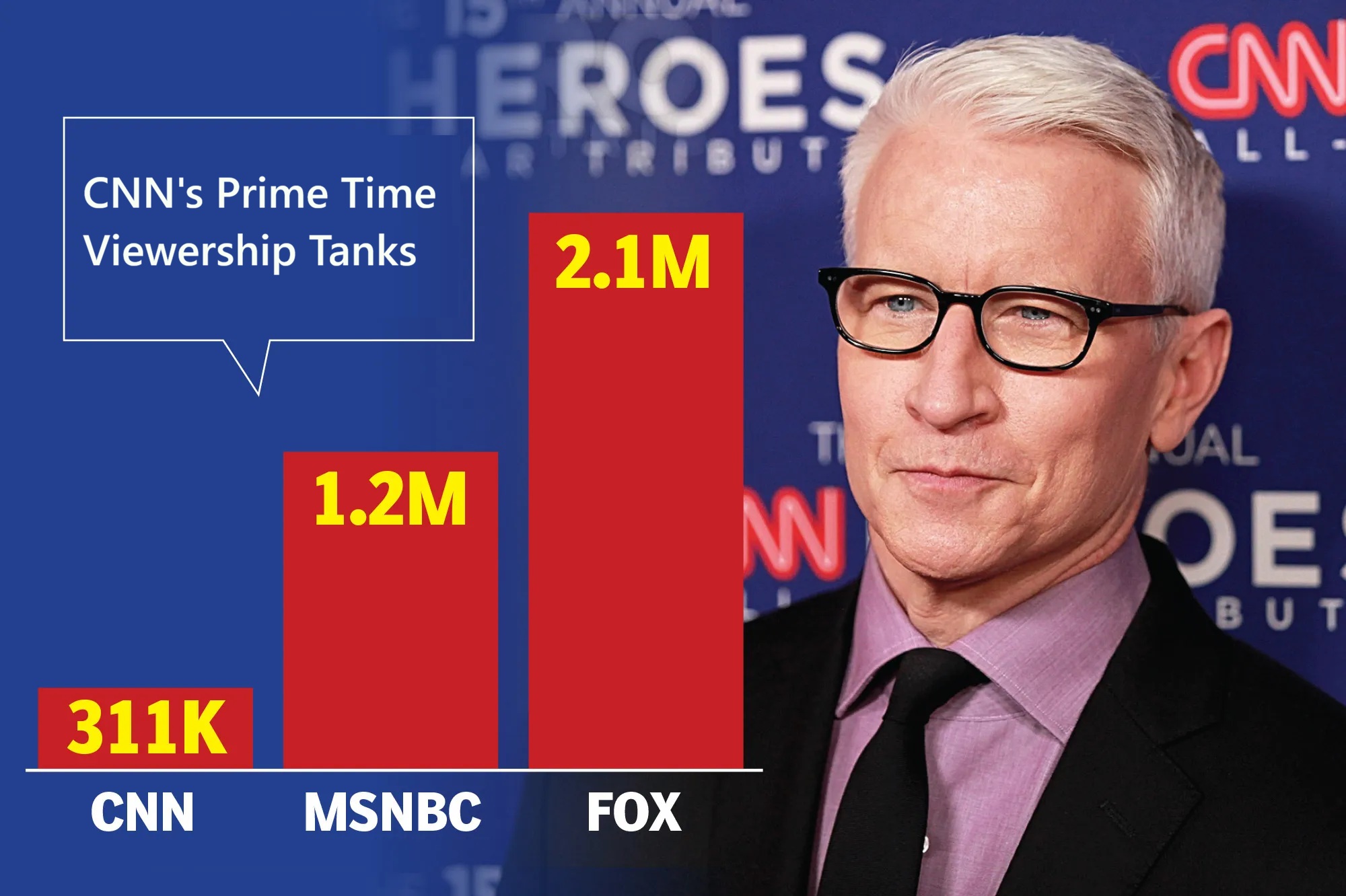

CNN News Viewership Tanks Amid Sale Rumors and Ideological Backlash

ATLANTA, Ga – Cable news is a tough business, and CNN is feeling it. The channel that helped build 24-hour news is now dealing with some of its lowest ratings ever. At the same time, it’s facing loud claims of left-wing bias and a parent company that seems more focused on reshuffling assets than protecting CNN’s future. As 2025 wraps up, CNN keeps losing viewers, and the chatter about a sale or spin-off hasn’t slowed. So far, no clear buyer has stepped up.

The audience drop is hard to ignore. CNN spent much of 2025 posting some of its weakest viewership numbers on record. The fall got worse after the post-election slowdown that followed the 2024 presidential race.

In July 2025, CNN averaged just 497,000 total primetime viewers, a 42% decline from July 2024, based on Nielsen data cited by Cord Cutters News. The slide continued into the third quarter, with primetime down 42% year over year. The 25-54 age group fell even faster, dropping 58%.

Every big cable news channel took a hit in 2025 after the election spikes of 2024. Still, CNN’s losses stand out. In many months, primetime sat around 400,000 to 500,000 viewers. Fox News, by contrast, often pulled in audiences in the millions. Some former CNN staffers called the July figures “disastrously bad.” By mid-year, the network had reached fresh lows for the post-inauguration period.

Big trends are part of the story. Cord-cutting keeps growing, streaming keeps expanding, and younger viewers often get news from YouTube and X. Even so, CNN’s steeper fall suggests the problem isn’t just the industry. Many viewers also seem worn out by the network’s tone and editorial choices.

Bias Perception Keeps Pushing Viewers Away

A major driver of CNN’s decline is trust, or the lack of it. CNN has long been tagged as left-leaning by media bias trackers. Outlets like AllSides and Media Bias/Fact Check rate CNN as Lean Left or Left-Center, pointing to editorial framing and on-air commentary that often reads as more liberal.

That view isn’t limited to critics on social media. John Malone, a major Warner Bros. Discovery (WBD) stakeholder, has also blasted what he calls CNN’s “embedded” liberal bias.

Polling has shown a sharp partisan split. Many Democrats say they trust CNN. Most Republicans say they don’t, and many see it as hostile to their views. That divide has pushed moderates and conservatives away, and it has helped speed up the ratings collapse. Efforts by past leadership teams to soften the network’s approach didn’t land well either. Those moves drew heat from the left and still didn’t bring back the viewers CNN had already lost.

CNN now has to operate in a time when trust in the news is already low. For a growing group of former viewers, the network’s perceived far-left tilt has become a deal-breaker, and the audience keeps shrinking.

Warner Bros. Discovery Upheaval Adds More Pressure

CNN’s problems aren’t happening in isolation. Its parent company, Warner Bros. Discovery, has been in turmoil. In late 2025, WBD said it was exploring a full sale after receiving multiple bids.

Netflix surfaced as a buyer for the studios and HBO assets, while leaving out CNN and other cable channels. Those cable properties would be spun into a new company called Discovery Global.

Another bidder, Paramount Skydance, came in aggressively. After finishing its own merger in August 2025, Paramount Skydance launched a hostile takeover bid for the full WBD package, CNN included. Reports said Paramount CEO David Ellison, backed by his father Larry Ellison (a Trump ally), offered signals to regulators and political influencers that CNN could see changes. WBD’s board rejected Paramount’s proposals, calling them too low and too uncertain, and stuck with the partial Netflix deal instead.

President Trump also weighed in, saying it was “imperative” for CNN to be sold separately or included in any deal, while criticizing its current leadership. Even with all the noise, CNN still hasn’t found a clear, committed buyer of its own. That raises a basic question about how much the network is worth in a cable market that keeps shrinking.

CNN: A Hard Asset to Sell

Media analysts say CNN has two big problems as a sales target. First is brand baggage. Second is the steady drop in linear TV money. CNN has promoted its digital reach and points to growth in streaming subscriptions, but the cable side still brings in a large share of revenue, and that part is sliding.

In recent years, revenue has fallen by hundreds of millions of dollars, tied to weaker ad sales and lower carriage fees. That makes CNN a harder bet for buyers who don’t want to inherit a declining business model.

There are also a number of complications. Pairing CNN with CBS News under Paramount has raised concerns about antitrust issues and newsroom independence. If CNN stands alone, experts expect more restructuring, deeper cost cuts, or another spin-off plan down the road.

What’s Next for CNN?

CNN’s path forward is cloudy. CEO Mark Thompson has tried to push a stronger focus on digital, including subscription options and a bigger emphasis on online growth. CNN also says it remains the top multiplatform news brand, pointing to strong digital engagement and solid performance from some original programming. Partnerships, including work with prediction market Kalshi for data integration, show the company is still trying new ideas.

Still, the pressure is rising. If the WBD split moves ahead, Discovery Global (with CNN inside it) could face demands to cut spending fast or find a buyer later. Layoffs have hurt morale, and the network has to balance a deeply polarized audience without driving away the viewers it still has.

Some insiders think a sale could reset the brand with new leadership and a more even tone. Others worry CNN will keep sliding as streaming pulls more attention away from cable. One former executive summed up the core challenge: CNN needs to reach people where they already are, online, or risk fading out.

CNN’s story now reads like a warning for legacy media. A network that once defined breaking news is fighting to stay relevant while politics, technology, and public trust keep shifting. In 2026, more disruption looks likely for a channel that used to feel untouchable.

Trending News:

Stalker’s Arrest Reveals Alarming Threat to Conservative Voices

Business

The Impact of the 2024 IRS Mileage Rate on Small Businesses

The IRS mileage rate 2024 stands as a pivotal benchmark for small businesses, marking not just a figure on a tax form but a crucial factor influencing their financial strategies and daily operational decisions. This rate, set at 67 cents per mile for business travel, reflects not only the cost of fuel and vehicle maintenance but also broader economic trends and regulatory shifts that impact businesses of all sizes.

For small businesses, where every expense matters, the IRS mileage rate directly affects how they allocate resources. It shapes budgeting decisions, tax planning strategies, and even employee compensation policies. Understanding and effectively applying this rate can mean the difference between maximizing tax deductions and facing unexpected financial liabilities.

Moreover, the IRS mileage rate serves as a barometer for economic conditions affecting transportation costs. Changes in this rate can prompt businesses to reassess their logistics and supply chain strategies, explore alternative modes of transportation, or renegotiate contracts with service providers.

Thus, the rate extends beyond a mere tax calculation, becoming a catalyst for strategic adaptation and operational efficiency. The 2024 IRS mileage rate is not just a number—it’s a critical factor that small businesses must navigate strategically to optimize financial performance and maintain compliance with tax regulations.

A crucial adjustment for small businesses impacting various aspects

The 2024 IRS mileage rate plays a pivotal role in shaping financial strategies and operational efficiencies for small businesses. Adapting to these changes proactively can help businesses navigate challenges, optimize tax benefits, and maintain competitive advantages in their respective markets.

Cost Management and Budgeting: Small businesses often rely on accurate mileage tracking to calculate transportation costs. The updated IRS rate affects budgeting forecasts, requiring adjustments to financial plans to accommodate higher mileage expenses.

Tax Deductions and Reimbursements: The IRS mileage rate directly affects tax deductions and reimbursements for business-related driving. Small businesses can deduct eligible mileage expenses from their taxable income, reducing their overall tax liability. Therefore, understanding and correctly applying the updated rate is crucial for maximizing tax benefits.

Employee Compensation: For businesses that reimburse employees for mileage, the IRS rate serves as a benchmark. Compliance with the standard rate ensures fair reimbursement practices while simplifying administrative tasks related to expense reporting.

Strategic Decision-Making: Changes in the IRS mileage rate prompt strategic evaluations regarding transportation logistics. Businesses may reconsider vehicle leasing versus reimbursement policies or explore alternative transportation methods to optimize cost-efficiency.

Compliance and Documentation: Accurate record-keeping is essential for IRS compliance. Small businesses must maintain detailed logs of business miles driven and associated expenses to substantiate deductions during audits. Failure to adhere to IRS guidelines can result in penalties and additional scrutiny.

Impact on Profit Margins: Fluctuations in mileage rates directly influence profitability margins for businesses heavily reliant on transportation. The increased rate may squeeze profit margins unless offset by corresponding adjustments in pricing or operational efficiencies.

Operational Efficiency: Efficient mileage tracking and management systems become more critical with higher IRS rates. Adopting digital tools or mileage tracking apps can streamline reporting processes, ensuring compliance while reducing administrative burden.

Everlance as a tool to facilitate compliance with the IRS

Everlance serves as a robust tool to streamline compliance with IRS regulations, particularly regarding mileage tracking and reporting for small businesses.

Automated mileage tracking

Everlance provides a sophisticated solution for automated mileage tracking, which greatly simplifies the process of documenting business trips. This feature allows users to accurately record each drive and link it to relevant business activities, ensuring the accuracy and reliability of data required for IRS reporting.

Integration with IRS standards

Everlance is designed to easily integrate with IRS standards, including the latest mileage reimbursement rate. Users can easily monitor rate changes and automatically apply updated rates to their rides, ensuring compliance with the latest regulations and maximizing tax returns.

Using the Everlance platform allows small businesses to effectively manage their driving expenses while ensuring they are in compliance with IRS requirements without significant administrative effort

Trending News:

Appeals Court Says Alina Habba Illegally Served as New Jersey U.S. Attorney

-

Crime2 weeks ago

Crime2 weeks agoYouTuber Nick Shirley Exposes BILLIONS of Somali Fraud, Video Goes VIRAL

-

Politics3 months ago

Politics3 months agoHistorian Victor Davis Hanson Talks on Trump’s Vision for a Safer America

-

Politics3 months ago

Politics3 months agoFar Left Socialist Democrats Have Taken Control of the Entire Party

-

News3 months ago

News3 months agoPeace Prize Awared to Venezuela’s María Corina Machado

-

Politics4 weeks ago

Politics4 weeks agoIlhan Omar’s Ties to Convicted Somali Fraudsters Raises Questions

-

Politics3 months ago

Politics3 months agoThe Democratic Party’s Leadership Vacuum Fuels Chaos and Exodus

-

Politics3 months ago

Politics3 months agoDemocrats Fascist and Nazi Rhetoric Just Isn’t Resognating With Voters

-

News3 months ago

News3 months agoThe Radical Left’s Courtship of Islam is a Road to Self-Defeat