Business

Credit Suisse Rescued By Swiss Rival UBS for $3 Billion

Credit Suisse has been rescued by its Swiss rival UBS in a government-backed deal on Sunday. The announcement came after a weekend of emergency talks between the two banks and Switzerland’s financial regulators in Switzerland.

UBS Group AG, founded and headquartered in Switzerland, is a multinational investment bank and financial services firm. According to the Swiss National Bank, the agreement is the best way to restore financial market confidence and manage economic risks.

The Bank of England welcomed the “comprehensive set of actions,” the BBC reported.

Credit Suisse shareholders will receive one share in UBS for every 22.48 shares they own, valuing the bank at $3.15 billion (£2.6 billion).

Credit Suisse was valued at around $8 billion (£6.5 billion) at the close of business on Friday.

However, the agreement accomplished what regulators set out to do: secure a result before the financial markets opened on Monday.

In a statement, Switzerland’s central bank said, “a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation”.

To mitigate any risks for UBS, the federal government announced a $9.6 billion (£7.9 billion) guarantee against potential losses. The Swiss central bank has also offered up to $110 billion (£90 billion) in liquidity assistance.

Global financial institutions quickly applauded the transaction between Credit Suisse and UBS.

The Bank of England said it welcomed the “comprehensive set of actions” set out by the Swiss authorities.

“Throughout the preparations for today’s announcements, we worked closely with international counterparts and will continue to support their implementation.”

It said the UK banking system was “well capitalized and funded and remains safe and sound”.

The UK Treasury also said it welcomed the merger and the British government would continue to engage with the Financial Conduct Authority (FCA) and the Bank of England “as is usual”.

Because both UBS and Credit Suisse have operations in London, the FCA said on Sunday that it was “minded to approve” the takeover to support financial stability.

“The FCA remains closely engaged with UK and international regulatory partners to monitor market developments,” the watchdog said.

Christine Lagarde, President of the European Central Bank, said she welcomed the “swift action” of the Swiss authorities.

“They are instrumental in restoring orderly market conditions and ensuring financial stability. “The eurozone banking sector is resilient, with strong capital and liquidity positions,” stated Ms. Lagarde.

The remarks of the European Central Bank President were echoed in the United States.

Treasury Secretary Janet Yellen and Federal Reserve Board Chairman Jerome Powell said the Swiss authorities’ announcement supported “financial stability”.

“The US banking system’s capital and liquidity positions are strong, and the US financial system is resilient,” they said.

Credit Suisse is the latest and most significant casualty of a confidence crisis that has already resulted in the failure of two mid-sized US banks and an emergency industry whip-round for another. But this is not the case. Switzerland’s second-largest lender was considered one of the world’s top 30 most important banks, so the Swiss authorities rushed through this takeover.

Although the causes of each failure vary slightly, the main factor has been a sharp rise in global interest rates, which has reduced the value of even safe investments in which banks keep some of their money. This has alarmed investors, causing all bank share prices to fall, with the weakest banks suffering the most.

The EU, US, and UK financial authorities have supported this agreement, emphasizing that banks are strong and people’s savings and deposits are secure. The acid test for whether this Swiss rescue has calmed financial markets will be when they open on Monday, so completing this on Sunday night was critical.

Following the announcement on Sunday night, UBS chairman Colm Kelleher said Credit Suisse was a “very fine asset we are determined to keep” in Bern, Switzerland.

“This acquisition is appealing to UBS shareholders, but let us be clear: this is an emergency rescue for Credit Suisse,” he added.

Mr. Kelleher stated that UBS would acquire Credit Suisse’s investment banking division.

The chairman of UBS said it was “too early” to predict what would happen to jobs: “We need to do this in a rational and thoughtful way after we’ve sat down and analyzed what we need to do,” he said.

The weekend deal comes after the Swiss National Bank’s emergency $54 billion (£44.5 billion) lifeline on Wednesday failed to reassure markets, and Credit Suisse shares fell 24%, sparking a wider sell-off on European markets.

The 167-year-old bank is losing money and has had many problems recently, including allegations of money laundering.

People Also Reading:

Former US President Donald Trump Says He Expects to Be Arrested

Scientists Create Mice With Cells From 2 Males For 1st Time

Finance

Freeland Dodges Media After Omitting Capital Gains Tax Adjustment from 2024 Budget

The Liberal government’s resolution to introduce Budget 2024 in the House earlier today did not include Chrystia Freeland’s proposed capital gains tax adjustments.

These measures, which include raising the capital gains inclusion rate from half to two-thirds, increasing the Lifetime Capital Gains Exemption, and creating a new incentive for entrepreneurs, have sparked strong opposition from the country’s technology elite.

During a news conference today, Finance Minister Chrystia Freeland reiterated the federal government’s support for these policies but declined to answer journalists’ inquiries about why they were not included in today’s motion. It now looks that Freeland intends to seek approval from Parliament through separate legislation.

“We are very committed to the capital gains measures that we put forward in the budget,” said Freeland, who added that “further details and implementing legislation will be forthcoming,” but did not provide a particular date or explain why they were absent from today’s motion.

When asked if she had removed these capital gains tax provisions from this bill to compel the Conservatives to vote on this specific issue, Freeland replied, “No,” and grinned.

The motion contains several of the other measures outlined in Budget 2024. The federal government restated its plans for the new capital gains measures to take effect on June 25, but has yet to provide draft legislation or a detailed technical briefing on these changes.

Capital Gains Tax a Political Football

Ben Bergen, president of the Council of Canadian Innovators, told BetaKit that it is unclear whether implementing capital gains changes through separate legislation is a “political football,” or if it simply indicates that the government has “not done its homework” on what the capital gains changes will mean for the economy.

“[This government] really struggles at some of the most basic elements of execution, and whether or not they’re able to deliver it on the 25th [is a] question mark,” Bergen told CNN. “But given what we’ve seen so far from this government over the last eight years, don’t hold your breath.”

“One simple reason for not including the capital gains tax changes in the budget implementation bill is that the government has not yet written them,” CD Howe Institute CEO William Robson told BetaKit.

“The budget provided only additional details on the rules before the higher rates go into effect on June 25th. “We may not have clarity even then,” Robson warned. “The government might believe this is smart politics. “It’s bad tax policy.”

BetaKit has contacted the Ministry of Finance for comment on why these changes were excluded from today’s motion, when it intends to share the full details of these changes and introduce legislation to support them, and whether such legislation is expected to be implemented by June 25, when the changes are scheduled to take effect.

Canadian tech executives outraged

These capital gains tax adjustments are intended to fund billions of dollars in new expenditure on housing and other priorities while also increasing tax equity between middle-class and wealthy Canadians. Freeland referred to them as the “fiscal foundation” for the government’s other investments.

“Our view is it is absolutely fair to ask those in our country who are at the very top to contribute a little bit more, and that is why we put forward a plan—which we are absolutely committed to—to increasing the capital gains inclusion rate,” Freeland said in a statement.

However, many Canadian tech executives are outraged by them: over 2,000 have signed an open letter urging the federal government to reconsider, claiming that they will hinder tech entrepreneurship and investment while exacerbating Canada’s already-existing productivity difficulties.

In a recent op-ed for The Globe and Mail, Robson stated that the next two months will likely be a “scramble” as the government attempts to issue the rules before June 25. Robson said that the government should “back up the budget’s capital gains tax proposals with rules or abandon them.”

Robson also remarked that the government may not be concerned about completing its deadline. “The June implementation of a higher inclusion rate that is retroactive—affecting past gains, not just those that accrue in the future—matters more to its revenue plans than the permanent changes,” Robson stated in an email.

Bergen noted that putting the capital gains measures to a vote suggests the government is attempting to “line up political parties” by positioning the Conservatives to vote against the reforms. On the other hand, he speculated that given the extensive—but not universal—backlash from Canadian tech executives and others, the government may be aiming to “remove the problem child” from the budget.

Bergen stated that the impact of these measures on businesses, employees, and investors will be highly depending on how the new laws are implemented. “The fact that we have so much ambiguity and chaos in this process is again just another indication of where this government is,” he said.

Canada’s Trans Mountain Pipeline Starts Operations After 12 Years and $25 Billion

Canada’s Trans Mountain Pipeline Starts Operations After 12 Years and $25 Billion

Business

Ford Recalls Maverick Pickups In US Because Tail Lights Can Go Dark, Increasing The Risk Of A Crash

Dearborn, Michigan – Ford recalls almost 243,000 Maverick compact pickup trucks in the United States because their taillights may not glow.

According to the firm, a computer can mistakenly identify too much electricity in one or both tail lamps, forcing them to remain dark while the vehicles are driving. This can increase the likelihood of a crash.

Le Auto – VOR News Image

Ford Recalls Maverick Pickups In US Because Tail Lights Can Go Dark, Increasing The Risk Of A Crash

The recall applies to certain pickups from the 2022 to 2024 model years.

Ford said it has received no reports of crashes or injuries due to the problem. Headlights, turn signals, and brake lights will continue to work.

According to documents uploaded Wednesday on the National Highway Traffic Safety Administration website, dealers will update software to resolve the issue at no cost to owners. Notification letters will be mailed beginning May 20.

AP – VOR News Image

Ford Recalls Maverick Pickups In US Because Tail Lights Can Go Dark, Increasing The Risk Of A Crash

Ford trucks are renowned for their rugged durability and reliable performance. They’re designed to tackle the toughest jobs, whether hauling heavy loads or navigating challenging terrain.

These trucks boast tough body-on-frame construction and high-strength steel frames, ensuring they can withstand the rigors of hard work. From the iconic F-150 to the heavy-duty Super Duty series, Ford’s trucks deliver impressive towing and payload capacities, making them ideal for contractors, ranchers, and anyone with serious hauling needs.

The Globe – VOR News Image

Ford Recalls Maverick Pickups In US Because Tail Lights Can Go Dark, Increasing The Risk Of A Crash

Inside, Ford trucks prioritize functionality and comfort. The spacious cabins offer ample room for crew and gear, while user-friendly tech and convenience features enhance productivity. With their legendary Ford Tough attitude, these trucks are ready to do the job right, day in and day out.

SOURCE – (AP)

Business

What Marijuana Reclassification Means For The United States

Washington — The United States Narcotic Enforcement Administration is considering reclassifying marijuana as a less harmful narcotic. The Justice Department’s proposal would recognize cannabis’ medical purposes but not legalize it for recreational use.

The proposal would shift marijuana from the “Schedule I” category to the less stringent “Schedule III.”

So, what does this mean, and what are the implications?

Technically, nothing has happened. The White House Office of Management and Budget must first examine the idea, followed by a public comment period and an administrative judge’s assessment, which could be a lengthy process.

Nonetheless, the change is considered “paradigm-shifting, and it’s very exciting,” Vince Sliwoski, a Portland, Oregon-based cannabis and psychedelics attorney who runs well-known legal blogs on those topics, told The Associated Press when the federal Health and Human Services Department recommended it.

AP – VOR News Image

What Marijuana Reclassification Means For The United States

“I can’t emphasize enough how big of news it is,” he said.

It came after President Joe Biden last year requested that HHS and the attorney general, who controls the DEA, investigate how marijuana was classified. Schedule I legalized it alongside heroin, LSD, quaaludes, and ecstasy, among other substances.

Biden, a Democrat, is in favor of legalizing medical marijuana “where appropriate, consistent with medical and scientific evidence,” White House press secretary Karine Jean-Pierre said on Thursday. “That is why it is important for this independent review to go through.”

No. Schedule III medicines, such as ketamine, anabolic steroids, and several acetaminophen-codeine combos, are still considered controlled narcotics.

AP – VOR News Image

What Marijuana Reclassification Means For The United States

They are subject to a variety of restrictions that allow for some medical usage as well as federal criminal punishment of anyone who traffics in the medications illegally.

Medical marijuana programs, which are already regulated in 38 states, and legal recreational cannabis markets in 23 states are expected to remain unchanged, but they are unlikely to meet federal production, record-keeping, prescribing, and other Schedule III drug criteria.

There haven’t been many federal prosecutions for simply possessing marijuana in recent years, even with marijuana’s existing Schedule I designation, but reclassification would have no immediate impact on those currently in the criminal justice system.

“Put simply, this shift from Schedule I to Schedule III is not keeping people out of jail,” said David Culver, senior vice president of public relations of the United States Cannabis Council.

However, rescheduling would have an impact, especially on research and marijuana business taxes.

Because marijuana is classified as a Schedule I substance, it has been extremely difficult to undertake permitted clinical trials involving its administration. This has produced a Catch-22 situation: there is a need for further study, but there are hurdles to doing so. (Sometimes, scientists rely on people’s claims of marijuana use.)

Schedule III medications are easier to study, although reclassification would take time to remove all hurdles to research.

“It’s going to be really confusing for a long time,” says Ziva Cooper, director of the University of California, Los Angeles Center for Cannabis and Cannabinoids. “When the dust has settled, I don’t know how many years from now, research will be easier.”

Among the unknowns include whether academics will be permitted to study marijuana from state-licensed shops and how the federal Food and Drug Administration would regulate this.

Some researchers remain optimistic.

“Reducing the schedule to schedule 3 will allow us to conduct research with human subjects using cannabis,” said Susan Ferguson, director of the University of Washington’s Addictions, Drug, and Alcohol Institute in Seattle.

Firms involved in “trafficking” marijuana or any other Schedule I or II substance are not allowed to deduct rent, payroll, or other expenses that other firms can. (Yes, despite the federal government’s prohibition on marijuana, at least some cannabis firms, particularly those permitted by states, pay federal taxes.) According to industry associations, tax rates frequently reach 70% or more.

The deduction regulation does not apply to Schedule III medications, so the proposed amendment would significantly reduce cannabis companies’ taxes.

They claim it would treat them like other industries and let them compete with unlawful competitors that frustrate licensees and officials in locations like New York.

“You’re going to make these state-legal programs stronger,” says Adam Goers, an executive at Columbia Care, a medicinal and recreational cannabis provider. He co-chairs a group of corporate and other stakeholders advocating for rescheduling.

According to Beau Kilmer, co-director of the RAND Drug Policy Center, deducting those expenditures could result in greater cannabis marketing and advertising.

Rescheduling would have no direct impact on another marijuana business issue: limited access to banks, particularly for loans, due to federally regulated institutions’ concerns about the drug’s legal status. Instead, the sector has focused on the SAFE Banking Act. It has frequently passed the House but is stuck in the Senate.

AP – VOR News Image

What Marijuana Reclassification Means For The United States

Yes, there are, notably the national anti-legalization organization Smart Approaches to Marijuana. President Kevin Sabet, a former Obama administration drug policy official, said the HHS suggestion “flies in the face of science, reeks of politics” and gives a disappointing nod to an industry “desperately looking for legitimacy.”

Some legalization supporters argue that rescheduling marijuana is too modest. They want to keep the focus on totally removing it from the controlled substances list, which does not include alcohol or tobacco (although they are regulated).

According to Paul Armentano, deputy director of the National Organization for the Reform of Marijuana Laws, simply reclassifying marijuana would be “perpetuating the existing divide between state and federal marijuana policies.” According to Kaliko Castille, President of the Minority Cannabis Business Association, rescheduling simply “re-brands prohibition,” rather than giving state licensees the green light and bringing an end to decades of arrests that disproportionately affected people of color.

“Schedule III is going to leave it in this kind of amorphous, mucky middle where people are not going to understand the danger of it still being federally illegal,” the senator stated.

Peltz reported from New York. Associated Press writers Colleen Long in Washington and Carla K. Johnson in Seattle contributed to this story.

SOURCE – (AP)

-

Entertainment5 months ago

Robert Downey Jr. Won’t Be Returning To The Marvel Cinematic Universe As Tony Stark

-

Politics5 months ago

Unveiling the Power and Influence of The Conservative Treehouse

-

Sports4 months ago

Saints’ Aggressive Play-Calling Ends Up Coming Back To Hurt Them In Loss To Rams

-

Celebrity5 months ago

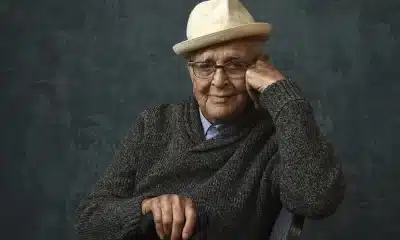

Norman Lear, Producer Of TV’s ‘All In The Family’ And Influential Liberal Advocate, Has Died At 101

-

Innovation5 months ago

Sony Debuts First PS5 Controller For Disabled Gamers

-

Business4 months ago

Nike Says It Will Cut $2 Billion In Costs In A Major Warning For Consumers