Business

International Air Chiefs Meet in Dubai for 12th DIACC

DUBAI, United Arab Emirates – Under the patronage of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, His Excellency Mohamed bin Mubarak bin Fadhel Al Mazrouei, UAE Minister of State for Defence Affairs, opened the 12th Dubai International Air Chiefs Conference (DIACC).

The opening ceremony took place at Atlantis, The Palm in Dubai, with more than 100 official delegations from across the globe. Senior officers from the Ministry of Defence, air force leaders, chiefs of staff from partner and allied countries, as well as decision-makers and CEOs from major national, regional, and international companies, also attended. These organizations work in defense, aviation, advanced technology, space sciences, and artificial intelligence.

The UAE Ministry of Defence organized the conference in strategic partnership with ADNEC Group, under the theme “Hypersonic Edge: Re-Envisioning Airpower Across Asymmetric Spaces.”

The first session, titled “Hypersonics, UAVs, and Artificial Intelligence: Adapting Airpower to Asymmetric Battlespaces,” began with opening remarks from Joseph Guastella, Corporate Vice President and Regional Executive for Europe and the Middle East at Northrop Grumman.

This session brought together Major General Rashid Mohammed Al Shamsi, Commander of the UAE Air Force and Air Defence, General Adrian L. Spain, Commander of the US Air Combat Command, General Jérôme Bellanger, Chief of Staff of the French Air and Space Force, and Lieutenant General J.R. Speiser-Blanchet, Commander of the Royal Canadian Air Force. They spoke about how to build agile coalitions and lead through modern airpower challenges, followed by an interactive discussion with official delegations.

The second session, titled “Beyond the Atmosphere: Integrating Air and Space Capabilities for Strategic Superiority,” highlighted the growing link between air and space power.

Speakers included Major General Vincent Chusseau, Commander of the French Space Command, and His Excellency Eng. Salem Butti Al Qubaisi, Director General of the UAE Space Agency. Air Marshal Stephen Chappell, Chief of the Royal Australian Air Force, also took part, followed by Air Marshal Narmdeshwar Tiwari, Vice Chief of Air Staff of the Indian Air Force.

The third and final session, titled “The Warfighter of Tomorrow: Standards, Artificial Intelligence, and Accountability in Next-Generation Airpower,” opened with an introductory remark from Dr. Chaouki Kasmi, President of Technology and Innovation at EDGE Group.

Dr. Kasmi also moderated the session, which focused on how to prepare future air forces and their people. Major General Jonas Wickman, Commander of the Swedish Air Force, spoke about new approaches to recruitment and building the force of the future.

General Son Sug Rag, Chief of Staff of the Republic of Korea Air Force, addressed the topic “Mastering asymmetric spaces: redefining the warfighter for the future.”

Lieutenant General Antonio Conserva, Chief of the Italian Air Force, discussed “Standards under pressure: maintaining excellence in the age of automation.”

Professor Peter Hays from the Space Policy Institute at George Washington University presented a paper titled “Learning to Learn: Building Intellectual Readiness for the Future Space Battlespace.” The conference wrapped up with an official recognition ceremony for participants, followed by a group photo session.

The Dubai International Air Chiefs Conference (DIAC)

The Dubai International Air Chiefs Conference (DIAC) is a high-level event held every two years. It brings together air force commanders, senior defense officials, and aerospace specialists from across the globe. The conference is one of the leading international forums devoted entirely to air and space power.

Key Details

- Organized by: United Arab Emirates Air Force & Air Defence, in cooperation with the Dubai Airshow organizing team. DIAC usually takes place alongside, or just before, the Dubai Airshow.

- First held: 2005

- Frequency: Every odd-numbered year (2005, 2007, 2009, and so on through 2025 and beyond)

- Location: Dubai, United Arab Emirates, typically at the Al Maktoum Ballroom or a similar venue close to the Dubai Airshow site at Dubai World Central (Al Maktoum International Airport)

- Next edition: The 2025 conference is planned for 10–11 November 2025, just ahead of the Dubai Airshow 2025, which takes place from 17–21 November

Main Objectives

- Promote strategic dialogue among air chiefs on current and future air power issues.

- Share operational lessons from recent missions, such as counter-terrorism campaigns and air operations in Libya, Syria, Yemen, Ukraine, and other theaters.

- Address new technologies, including 5th and 6th generation fighters, unmanned combat aircraft, hypersonic systems, space-based capabilities, artificial intelligence, and cyber protection of air assets.

- Support international cooperation and encourage new defense and security partnerships.

- Connect industry with decision-makers, giving aerospace and defense companies direct insight into the Air Force’s needs and long-term plans.

Typical Attendees

- Air chiefs and commanders from more than 40 to 50 air forces worldwide. Recent editions have seen participation from the USAF, RAF, French Air Force, Russian Aerospace Forces, Indian Air Force, PLAAF, RSAF, Turkish Air Force, Egyptian Air Force, and many others.

- Senior officials from defense ministries and government agencies.

- CEOs and senior leaders from major aerospace and defense firms, including Lockheed Martin, Boeing, Dassault, Airbus, BAE Systems, Raytheon, Leonardo, EDGE Group, and more.

- Representatives from international bodies, such as NATO and the Gulf Cooperation Council air power coordination groups.

Format

- Day 1–2: Closed plenary sessions for air chiefs only, with classified briefings and discussions.

- Open sessions that feature keynote speeches, expert panels, and audience Q&A.

- Scheduled bilateral and multilateral meetings, along with networking receptions and side events.

- The conference often ends with a joint statement or communiqué that reflects the main themes and shared views.

Significance

- DIAC is one of the very few platforms where air chiefs from countries that may belong to rival or competing blocs, such as U.S./NATO partners and Russia or China-aligned forces, sit together and openly exchange perspectives.

- The conference has a direct impact on future procurement plans; many large defense contracts announced at or shortly after the Dubai Airshow often grow out of contacts and discussions that start at DIAC.

- The United Arab Emirates uses DIAC to highlight its role as a key global center for aerospace, defense, and advanced air power cooperation.

In simple terms, DIAC is often seen as the “Davos of air power,” a rare mix of high-level strategy talks and industry networking, held every two years in Dubai under the patronage of the UAE leadership.

Related News:

Long overshadowed by Dubai, Wizz Air will leave Abu Dhabi’s Zayed International Airport.

Business

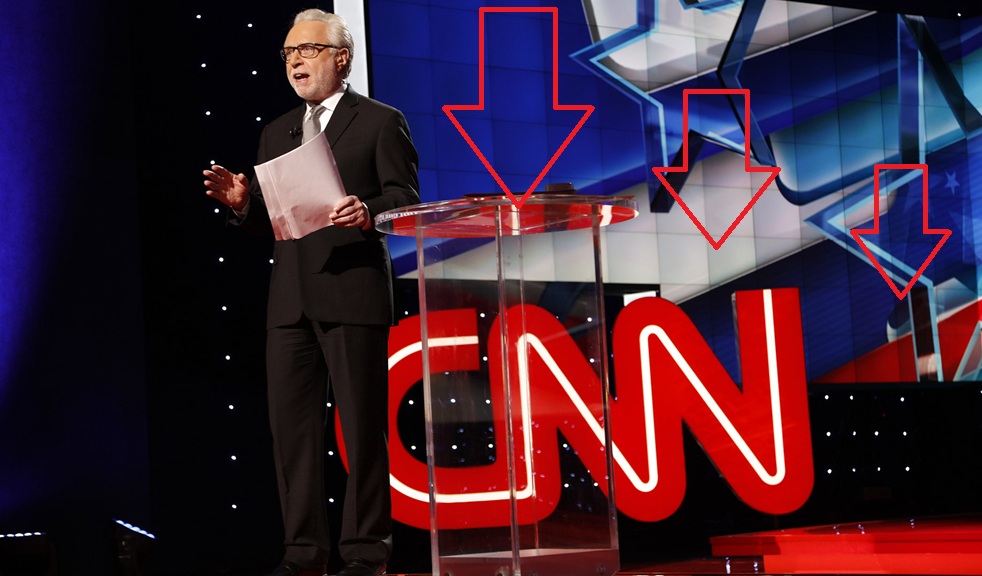

CNN Ratings Collapse As Cable Giants Face Extinction

ATLANTA – In early 2026, CNN is dealing with sharp audience drops that point to a deeper shift in how Americans follow the news. The network once led cable TV, helped by nonstop political coverage during Donald Trump’s first presidency.

Since then, however, its audience has shrunk. In 2025, CNN averaged 573,000 total viewers in primetime, down from 1 million in 2017. Total day viewing slipped to 432,000, a 44% decline over the same stretch. In other words, CNN lost more than 40% of its audience from the first Trump term to the second, even while politics stayed intense.

- Primetime viewers fell 45% from 2017 to 2025.

- Total day viewers dropped 44% in that same period.

- Compared with 2015, primetime slid from 711,000 to 573,000.

January 2026 brought a small lift. Primetime rose to 660,000 viewers, up 26% from January 2025. Still, that bounce looks limited next to years of decline.

CNN’s drop also fits a wider pattern. Its left-leaning competitor, now called MS NOW (formerly MSNBC), posted double-digit declines in 2025 as well. Fox News stayed on top, often drawing more than 2 million primetime viewers, although it also saw weakness in key demographics.

What’s happening at CNN is not a one-off. Cable news as a category faces pressure from cord-cutting, streaming growth, and changing habits. In 2025, many cable channels lost large chunks of their audiences, and some smaller networks fell by as much as 78%. During parts of 2025, streaming also moved ahead of broadcast and cable combined, which signals a broad move away from scheduled TV.

Why Cable News Viewers Keep Leaving

Several trends explain why cable news keeps losing ground:

- Faster cord-cutting: Fewer homes keep a traditional cable package, while streaming takes more viewing time.

- Older audiences: Cable news viewers trend older. Median ages for major networks sit around 67 to 70, while younger people skip linear TV.

- More places to get news: People now use social apps, YouTube, and on-demand services, so fewer people tune in at a set time.

- Bias concerns and burnout: After major elections, many viewers feel tired of politics and distrust big outlets, so they look elsewhere.

Pew Research data from 2025 shows watching is still the top choice for news (44%). At the same time, digital options keep growing, and podcasts play a bigger role. Listening holds at 19% preference, yet it carries more weight with younger audiences.

The Podcast Surge and What It Offers That Cable Can’t

Podcasts now compete directly with cable news, especially for deeper, host-led conversations. In 2025, news podcasts hit new highs. About 27.3% of monthly podcast listeners tuned into news shows, up from earlier years. Around 15% of Americans got news from podcasts each week, which puts it near print newspapers by some measures.

Several reasons explain the rise:

- Easy to fit into daily life: People can listen while driving, exercising, or doing chores, unlike a scheduled TV block.

- More time for context: Longer episodes support detailed talk, which appeals to listeners tired of quick TV panels.

- Stronger host connection: Personalities like Joe Rogan and many independent creators build loyalty through a more casual style.

- Younger listeners: The typical podcast listener is often around 34 to 47, far younger than cable news audiences that skew 67 and up.

- Niche trust: Many listeners say independent voices feel more honest, and on the right, podcasts often outscore traditional sources on trust.

In the US, news podcasts like PBD Podcast now mix legacy reporting and analysis (for example, The Daily from The New York Times) with opinion-driven shows. Many also post videos on YouTube and clips on TikTok, which helps them reach new audiences and blur the line between audio and video. By mid-2025, Republicans made up a larger share of news podcast audiences (39%), which matches the growing demand for point-of-view content.

Independent media adds even more momentum. Substack newsletters, YouTube channels, and creator-run outlets keep pulling attention away from cable. Many people want reporting that feels less filtered, along with deeper dives and a sense of community. Surveys show 82% of independent media users treat it as their main news source and trust it for more detailed coverage.

What Comes Next for Cable New:,Change or Continued Decline

As 2026 unfolds, cable news sits in a tough spot. Forecasts suggest streaming will pass 50% of TV use, while FAST channels and creator-led programming keep rising. As a result, cable networks may merge, shift harder into online products, or shut down. Some experts expect multiple closures in 2026 as subscribers keep dropping.

CNN and other networks have already started adjusting. They are building out streaming, launching podcasts, and pushing a multi-platform strategy. CNN also pointed to strong digital reach in 2025, with millions of monthly users across apps and subscriptions. Even so, major hurdles remain, including rebuilding trust, competing with free content, and staying relevant as social feeds and AI-generated material flood the market.

On-demand news keeps gaining because it fits how people live. Podcasts and independent outlets offer portability, clear voices, and stronger engagement, while linear cable struggles to match that experience. As audiences spread out across platforms, traditional networks need to adapt quickly or keep shrinking.

This change also reflects a simple expectation: people want control over when news arrives, how it sounds, and who delivers it. CNN’s ratings drop shows the stakes, and cable news now has to connect old habits with new ones before more of the audience moves on for good.

Related News:

CNN Warns 58% of Americans Say Democrats Have Moved Too Far Left

Business

Trump Tariff Revenue Jumps 300% as Supreme Court Fight Nears

Trump Tariff Windfall: Customs Revenue Jumps About 300% as Supreme Court Fight Nears

Tariff revenue hits $124 billion so far this fiscal year, with January collections at $30.4 billion, fueling talk of debt payoff and direct checks

WASHINGTON, D.C. – President Donald Trump’s tariff push is driving a major spike in federal customs revenue. New Treasury Department figures show customs duties are up about 300 percent since Trump returned to office. In January, the US brought in about $30.4 billion from customs duties. As a result, the fiscal year-to-date total sits near $124 billion, up roughly 304 percent from the same period a year earlier.

The administration is using those numbers to back a central claim: tariffs can raise money without raising US income taxes. Trump has also said the new tariff revenue can help chip away at the $38 trillion national debt. At the same time, he argues that the duties shield US industries from unfair competition abroad.

The jump in revenue follows a set of broad tariff moves that began in early 2025. First, the White House rolled out across-the-board duties on many imports starting in April 2025. Next came “reciprocal” tariffs aimed at certain countries. The administration tied these actions to the International Emergency Economic Powers Act (IEEPA), citing national emergencies tied to issues such as fentanyl trafficking and trade imbalances.

Collections started rising fast. Monthly totals moved from about $9.6 billion in March 2025 to more than $23.9 billion later that year. That run-up set the stage for the big fiscal 2026 numbers now being reported.

Looking back, fiscal 2025 (which ended September 30, 2025) produced $215.2 billion in customs duties, more than twice the prior year. So far, fiscal 2026 is moving even faster. In addition, the early deficit picture looks better. The federal budget deficit fell 17 percent in the first four months of fiscal 2026 (or 21 percent after calendar adjustments), as revenue grew more quickly than spending.

A core part of Trump’s economic pitch

Trump has cast the rising customs revenue as proof that his trade strategy works. In posts and public remarks, he has said other countries end up paying because tariffs reduce their export edge, while the US collects the money. Supporters inside and outside the administration point to the monthly totals as evidence that the policy is producing real cash for the Treasury.

That revenue talk has also revived a big idea: direct $2,000 payments to Americans. Trump has described the plan as a “tariff dividend” aimed at lower- and middle-income households. He has said the money would come from the “hundreds of billions” flowing in through customs duties. In comments from November 2025, he said he was taking the idea seriously and still supported it. Even so, no bill or detailed framework has been released. Because of that, the proposal has drawn both attention and doubts, including concerns about how to target payments fairly.

Many economists and trade researchers argue that tariffs act like a tax on US importers, and those costs often show up in higher prices. Research cited from the New York Federal Reserve suggests US firms and households cover most of the bill, as much as 90 percent in some estimates.

Some analyses put the added cost at about $1,000 per household in 2025. Projections rise to around $1,300 in 2026 if the policy stays the same. Over time, tariffs could bring in large gross revenue, but critics say the net gain shrinks once you factor in slower growth, job losses in exposed industries, and possible retaliation from trading partners.

Supreme Court decision could change everything.

The revenue boom is unfolding while the tariff program faces heavy legal pressure. The Supreme Court is expected to rule on whether Trump can use IEEPA to impose broad tariffs without Congress. The court heard oral arguments in November 2025 in cases that challenge the scope of that authority, since Congress normally controls tariff policy.

Lower courts have already pushed back. The US Court of International Trade and the Federal Circuit Court of Appeals ruled against key parts of the tariff structure, saying the measures go beyond what the statute allows.

Meanwhile, importers have filed hundreds of refund suits. If the Supreme Court sides with challengers, the federal government could owe tens of billions, or even more, in returned duties. That outcome would cut into the revenue totals and could force the White House to rely on other trade laws.

For now, administration officials say they expect to win. Treasury Secretary Scott Bessent has called an adverse ruling “very unlikely.” Still, the wait has stretched longer than many expected. That has added stress for importers dealing with compliance demands and growing bond requirements. US Customs data also shows record importer bond shortfalls, totaling nearly $3.6 billion in fiscal 2025, which highlights the strain tied to the policy.

What it means for trade and the economy

Trump’s tariff strategy has shifted global trade talks. Negotiations continue as some countries push for lower rates while the US keeps pressure on issues like intellectual property theft and currency practices. Supporters say tariffs are helping bring investment home, open factories, and boost jobs in protected sectors.

On the other hand, critics warn about higher prices, supply chain headaches, and risks to industries that depend on exports, including agriculture and manufacturing, if retaliation grows.

As fiscal 2026 continues, tariff revenue will stay at the center of budget and trade arguments. The big unknown is whether the surge holds up, or whether a Supreme Court ruling forces a reset. For now, the numbers are clear: customs duties are pouring in at a pace that is reshaping the budget debate and fueling bold ideas on debt reduction and direct payments.

Trending News:

Trump and EPA Chief Zeldin End Obama Era Net-Zero Climate Policies

Business

Tech Titans Flee California to Low-Tax Havens Like Florida

California’s Wealth Drain: Billionaires Leave as Taxes Climb and Debt Grows

Tech Leaders Head to Low-Tax States Like Florida

Mark Zuckerberg’s $150M+ Miami Mansion Buy Points to a Bigger Shift Among Silicon Valley’s Rich

LOS ANGELES – A high-profile real estate deal is adding fuel to the talk of money leaving California. Meta CEO Mark Zuckerberg has reportedly bought a waterfront estate on Miami’s Indian Creek Island, the guarded enclave often called the “Billionaire Bunker,” for an estimated $150 million to $200 million.

Sources familiar with the deal, widely reported in February 2026, say the purchase puts him near neighbors like Jeff Bezos and Ivanka Trump. People close to the situation also suggest it’s more than a second home, with Zuckerberg and his wife, Priscilla Chan, planning to settle in by April. For many observers, it looks like another major tech name is choosing to leave California as new tax proposals stir concern.

Zuckerberg’s reported move fits into a bigger story, a capital exodus tied to California’s high tax burden and a new ballot push that critics say could speed up departures. The proposal is called the 2026 California Billionaire Tax Act. It would place a one-time 5% tax on the net worth of residents over $1 billion, paid over five years (about 1% per year).

Supporters, including groups such as the Service Employees International Union-United Healthcare Workers West, say it could raise tens of billions for health care as federal support shrinks. Opponents, including Gov. Gavin Newsom, warn it could damage a tax system that already depends heavily on a small group of top earners.

California Facing Ongoing Outmigration

California already has one of the toughest tax setups in the country. The top state income tax rate is 13.3%, the highest in the U.S. In many cases, the state doesn’t separate regular income and capital gains. When federal taxes are added, the bill can be steep. The state also relies heavily on the top 1% of earners, who pay roughly half of all personal income tax revenue.

With the proposed wealth tax set to apply to people who are residents as of January 1, 2026, some wealthy residents appear to be moving early. Entrepreneurs like Chamath Palihapitiya and David Friedberg have cited estimates that $1 trillion to $2.5 trillion in assets left the state in late 2025 and early 2026. Private polling has also suggested that 80% to 90% of those affected have already moved or plan to if the measure moves forward.

This isn’t only about billionaires. California has faced ongoing outmigration tied to taxes, regulations, homelessness, and the high cost of living. U.S. Census data shows net domestic losses of more than one million residents from 2020 to 2024.

Higher earners, especially those making over $200,000, tend to be the most likely to leave. Many head to states with no state income tax, including Florida, Texas, and Nevada. The effects can stack up fast: less income tax revenue, weaker sales and property tax collections, fewer big donations, and risks to jobs linked to businesses and investors that relocate.

California Lawmakers Target the Wealthy

California’s budget problems sit in the middle of this debate. The state moved from a record $97.5 billion surplus in 2022 to recurring deficits. Current projections point to an $18 billion gap that could reach $35 billion by 2028.

A major issue is how dependent the state is on income and capital gains taxes from top earners, which rise and fall with markets and can shrink when people move. Critics blame years of Democratic-led spending, pointing to expanded programs, health care growth, and environmental rules they say raised long-term costs without steady revenue to match.

Many Democratic lawmakers and progressive groups have responded to the budget strain by pushing for higher taxes on the rich. If the billionaire tax qualifies for the November 2026 ballot, it would need nearly 875,000 signatures. Backers say it would apply to about 200 ultra-wealthy residents with a combined net worth above $2 trillion.

Supporters frame it as a fairness issue, arguing billionaires can face lower effective rates because much of their wealth is tied to unrealized gains. The push has sparked strong pushback, with economists warning it could trigger even more departures. Recent examples often mentioned include Google co-founder Larry Page (reported to have bought Miami property), PayPal’s Peter Thiel, and other major names who have set up residency outside California.

Even if the wealth tax never passes, the threat of it can change behavior. Florida, with no state income tax, offers a clear financial draw. For celebrities and executives, it also offers privacy and security. Indian Creek, with gates, its own police, and marine patrols, is part of the appeal for people who want distance from public attention.

Wave of Billionaire Relocations

The bigger concern for California is what happens if this pattern continues. When investors and founders leave, Silicon Valley’s funding networks and job creation can weaken over time. People who want tighter budgets argue that constant tax hikes on the rich backfire, pushing out the very people the state relies on, then shifting pressure onto everyone else through higher costs and fewer services.

Supporters of progressive tax policy say top earners benefit greatly from California’s system and should pay more, and they often argue that claims of mass migration are overstated based on past research showing limited millionaire movement.

Still, the trend line is hard to ignore. From Oracle’s headquarters move years ago to the latest wave of billionaire relocations, California is competing with states that make it easier to keep more of your income. In a country where people and money can move quickly, that competition matters.

If Zuckerberg is settling into Florida life, the signal is clear. With high taxes and growing debt fears, even leaders tied to California’s tech boom are choosing to leave. California now faces a tough choice: adjust its approach, or keep losing the wealth that has long helped fund the state.

Related News:

Vice President JD Vance to Head Anti-Fraud Task Force Targeting California Welfare Abuses

-

Crime2 months ago

Crime2 months agoYouTuber Nick Shirley Exposes BILLIONS of Somali Fraud, Video Goes VIRAL

-

China1 month ago

China1 month agoChina-Based Billionaire Singham Allegedly Funding America’s Radical Left

-

Politics2 months ago

Politics2 months agoIlhan Omar Faces Renewed Firestorm Over Resurfaced Video

-

Politics3 months ago

Politics3 months agoIlhan Omar’s Ties to Convicted Somali Fraudsters Raises Questions

-

News3 months ago

News3 months agoWalz Tried to Dodges Blame Over $8 Billion Somali Fraud Scandal

-

Crime3 months ago

Crime3 months agoSomali’s Accused of Bilking Millions From Maine’s Medicaid Program

-

Crime3 months ago

Crime3 months agoMinnesota’s Billion Dollar Fraud Puts Omar and Walz Under the Microscope

-

Business2 months ago

Business2 months agoTech Giant Oracle Abandons California After 43 Years