Business

CNN News Viewership Tanks Amid Sale Rumors and Ideological Backlash

ATLANTA, Ga – Cable news is a tough business, and CNN is feeling it. The channel that helped build 24-hour news is now dealing with some of its lowest ratings ever. At the same time, it’s facing loud claims of left-wing bias and a parent company that seems more focused on reshuffling assets than protecting CNN’s future. As 2025 wraps up, CNN keeps losing viewers, and the chatter about a sale or spin-off hasn’t slowed. So far, no clear buyer has stepped up.

The audience drop is hard to ignore. CNN spent much of 2025 posting some of its weakest viewership numbers on record. The fall got worse after the post-election slowdown that followed the 2024 presidential race.

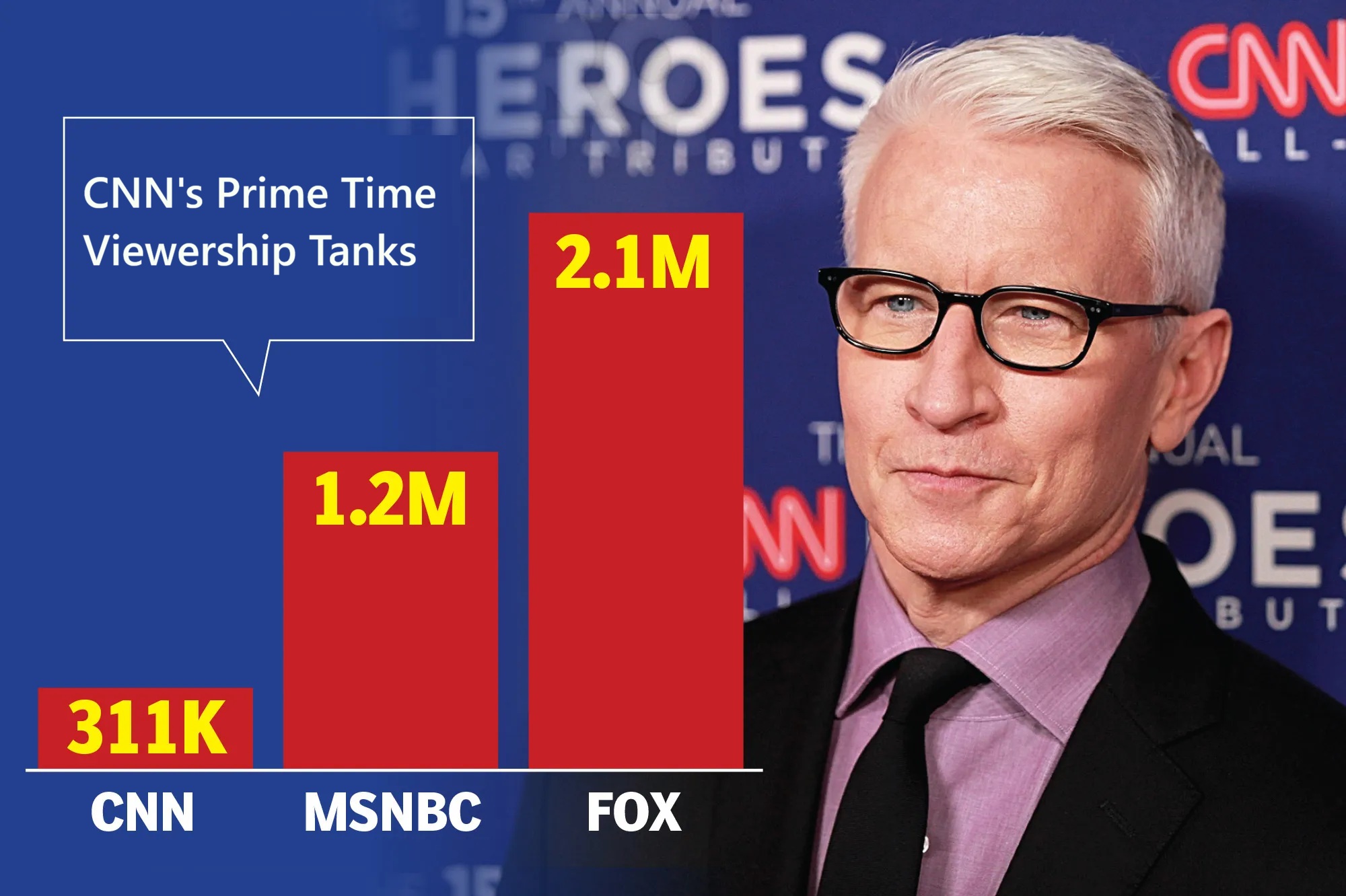

In July 2025, CNN averaged just 497,000 total primetime viewers, a 42% decline from July 2024, based on Nielsen data cited by Cord Cutters News. The slide continued into the third quarter, with primetime down 42% year over year. The 25-54 age group fell even faster, dropping 58%.

Every big cable news channel took a hit in 2025 after the election spikes of 2024. Still, CNN’s losses stand out. In many months, primetime sat around 400,000 to 500,000 viewers. Fox News, by contrast, often pulled in audiences in the millions. Some former CNN staffers called the July figures “disastrously bad.” By mid-year, the network had reached fresh lows for the post-inauguration period.

Big trends are part of the story. Cord-cutting keeps growing, streaming keeps expanding, and younger viewers often get news from YouTube and X. Even so, CNN’s steeper fall suggests the problem isn’t just the industry. Many viewers also seem worn out by the network’s tone and editorial choices.

Bias Perception Keeps Pushing Viewers Away

A major driver of CNN’s decline is trust, or the lack of it. CNN has long been tagged as left-leaning by media bias trackers. Outlets like AllSides and Media Bias/Fact Check rate CNN as Lean Left or Left-Center, pointing to editorial framing and on-air commentary that often reads as more liberal.

That view isn’t limited to critics on social media. John Malone, a major Warner Bros. Discovery (WBD) stakeholder, has also blasted what he calls CNN’s “embedded” liberal bias.

Polling has shown a sharp partisan split. Many Democrats say they trust CNN. Most Republicans say they don’t, and many see it as hostile to their views. That divide has pushed moderates and conservatives away, and it has helped speed up the ratings collapse. Efforts by past leadership teams to soften the network’s approach didn’t land well either. Those moves drew heat from the left and still didn’t bring back the viewers CNN had already lost.

CNN now has to operate in a time when trust in the news is already low. For a growing group of former viewers, the network’s perceived far-left tilt has become a deal-breaker, and the audience keeps shrinking.

Warner Bros. Discovery Upheaval Adds More Pressure

CNN’s problems aren’t happening in isolation. Its parent company, Warner Bros. Discovery, has been in turmoil. In late 2025, WBD said it was exploring a full sale after receiving multiple bids.

Netflix surfaced as a buyer for the studios and HBO assets, while leaving out CNN and other cable channels. Those cable properties would be spun into a new company called Discovery Global.

Another bidder, Paramount Skydance, came in aggressively. After finishing its own merger in August 2025, Paramount Skydance launched a hostile takeover bid for the full WBD package, CNN included. Reports said Paramount CEO David Ellison, backed by his father Larry Ellison (a Trump ally), offered signals to regulators and political influencers that CNN could see changes. WBD’s board rejected Paramount’s proposals, calling them too low and too uncertain, and stuck with the partial Netflix deal instead.

President Trump also weighed in, saying it was “imperative” for CNN to be sold separately or included in any deal, while criticizing its current leadership. Even with all the noise, CNN still hasn’t found a clear, committed buyer of its own. That raises a basic question about how much the network is worth in a cable market that keeps shrinking.

CNN: A Hard Asset to Sell

Media analysts say CNN has two big problems as a sales target. First is brand baggage. Second is the steady drop in linear TV money. CNN has promoted its digital reach and points to growth in streaming subscriptions, but the cable side still brings in a large share of revenue, and that part is sliding.

In recent years, revenue has fallen by hundreds of millions of dollars, tied to weaker ad sales and lower carriage fees. That makes CNN a harder bet for buyers who don’t want to inherit a declining business model.

There are also a number of complications. Pairing CNN with CBS News under Paramount has raised concerns about antitrust issues and newsroom independence. If CNN stands alone, experts expect more restructuring, deeper cost cuts, or another spin-off plan down the road.

What’s Next for CNN?

CNN’s path forward is cloudy. CEO Mark Thompson has tried to push a stronger focus on digital, including subscription options and a bigger emphasis on online growth. CNN also says it remains the top multiplatform news brand, pointing to strong digital engagement and solid performance from some original programming. Partnerships, including work with prediction market Kalshi for data integration, show the company is still trying new ideas.

Still, the pressure is rising. If the WBD split moves ahead, Discovery Global (with CNN inside it) could face demands to cut spending fast or find a buyer later. Layoffs have hurt morale, and the network has to balance a deeply polarized audience without driving away the viewers it still has.

Some insiders think a sale could reset the brand with new leadership and a more even tone. Others worry CNN will keep sliding as streaming pulls more attention away from cable. One former executive summed up the core challenge: CNN needs to reach people where they already are, online, or risk fading out.

CNN’s story now reads like a warning for legacy media. A network that once defined breaking news is fighting to stay relevant while politics, technology, and public trust keep shifting. In 2026, more disruption looks likely for a channel that used to feel untouchable.

Trending News:

Stalker’s Arrest Reveals Alarming Threat to Conservative Voices

Business

Elon Musk Builds a $1.25 Trillion Giant as SpaceX Buys xAI in Landmark Merger

The billionaire ties together rockets and AI, forming the highest-valued private company, with an IPO now front and center

HUSTON, Texas – Elon Musk said Monday that SpaceX is acquiring his AI startup, xAI, in an all-stock deal that puts the combined company at $1.25 trillion. The announcement rippled across tech and finance, since it creates what appears to be the most valuable private company ever. Musk called it “the most ambitious, vertically-integrated innovation engine on (and off) Earth.”

Based on the terms shared, the merger pegs SpaceX at about $1 trillion, up from recent secondary market estimates near $800 billion. It values xAI at $250 billion, a bit above its January 2026 funding round, when it raised $20 billion. xAI investors will receive SpaceX shares through an exchange ratio that converts their holdings into stock of the new combined company. Reports citing banking materials and people familiar with the documents put the implied price at roughly $527 per share.

By size alone, this is the biggest merger ever reported. It lands just months after xAI’s rapid rise, driven by its Grok chatbot lineup and big spending on compute, including the Colossus supercluster. SpaceX, at the same time, continues to lead commercial space with reusable Falcon rockets, ongoing Starship work, and the growing Starlink satellite internet network, now used by millions worldwide.

A deliberate link between AI and space

In a memo posted to SpaceX’s website, Musk framed the acquisition as a logical step for two companies he already treats as connected. “This marks not just the next chapter, but the next book in SpaceX and xAI’s mission: scaling to make a sentient sun to understand the Universe and extend the light of consciousness to the stars!” he wrote. He also pointed to practical overlap, including using Starlink for low-latency data movement that can support AI training and inference.

The merger also puts fresh attention on Musk’s long-running idea of data centers in orbit. With xAI’s model work combined with SpaceX launch capacity and space hardware, the new company could place large compute systems in space. Supporters say that could help with Earth-based limits like power use and land needs for giant AI clusters. Analysts have floated the idea that this approach could strengthen Musk’s hand versus rivals such as OpenAI, Google DeepMind, and Anthropic.

This deal also follows earlier consolidation across Musk’s companies. In 2025, xAI bought the social platform X (formerly Twitter) in a separate stock swap, giving xAI access to a huge stream of real-time posts and conversations that can feed Grok training. With SpaceX now taking in xAI, the structure pulls rockets, satellites, social media, and advanced AI into one company. Some watchers have started calling it the “Muskonomy,” now fully assembled.

Market buzz and worries from some investors

The reaction was quick. On Tuesday, shares of public space-related firms moved higher, as investors priced in more momentum for the sector. Still, the news didn’t land the same way for everyone. Some SpaceX minority holders raised concerns that SpaceX may be rescuing a high-spend AI company. Reports say xAI has been burning about $1 billion per month. Those critics also point to dilution, since SpaceX is issuing stock to complete the purchase, right before a possible public listing.

Multiple reports say SpaceX is preparing for an initial public offering as soon as June 2026. If that happens, the post-merger company could price above $1.25 trillion, with talk reaching $1.5 trillion or higher. A listing on that scale would rank among the largest IPOs ever and put the company in the same market-cap conversation as Apple, Microsoft, and Nvidia.

Musk’s personal net worth could climb sharply on paper as well. He reportedly holds about 43% of SpaceX, which now includes xAI. That stake boosts his position as the value of the combined business rises, especially as Tesla’s market cap sits around $1.58 trillion. The SpaceX-xAI combination now looks like a serious challenger in the private-to-public storyline.

Big promises, big execution risk

The upside is clear, but so are the headaches. A company that spans space launch, satellite internet, AI models, and social media is likely to draw more regulatory attention. Expect closer review around competition, data access, and how much influence one owner has across several key industries.

There’s also the basic work of combining two intense cultures. xAI has scaled fast, powered by heavy spending on chips and data centers. SpaceX runs on tight engineering discipline and mission schedules. Bringing those priorities under one roof will test management, timelines, and focus.

Supporters see the deal as a direct expression of Musk’s long-term plan: use AI to speed up space progress, and use space infrastructure to push AI forward. As one industry insider put it, “If anyone can make space-based AI a reality, it’s the man who’s already revolutionized rockets and electric cars.”

Now that the merger is out in the open, attention turns to what comes next. If the IPO arrives this summer, it could reset expectations for how private giants enter public markets, and it could lock in Musk’s boldest corporate structure yet.

Related news:

Somali TikToker Threatens Elon Musk’s Life After Fraud Posts

Business

Amazon Layoffs Begin, Company Trims 16,000 Corporate Potions

SEATTLE, Washington – Amazon revealed a major round of job cuts on January 28, 2026, which removed about 16,000 corporate positions. This cleanup follows a previous reduction of 14,000 roles. These two events mark the biggest workforce decrease in the history of the company. Amazon currently employs nearly 1.58 million people, but these cuts mostly target the 350,000 employees in its office divisions.

Beth Galetti, the Senior Vice President of People Experience and Technology, shared the news through an internal note and a public blog post. She explained that the company wants to move faster by removing unnecessary management layers. While she admitted the news is painful for those involved, she promised that the company will provide help to everyone leaving.

Why Amazon Is Changing Its Structure

These Amazon layoffs are part of a larger plan by CEO Andy Jassy to make the tech giant operate more like a small startup. Since he took the lead in 2021, Jassy has worked to make the company move with more agility. The goal is to stop spending on old processes and put that money into high-priority tech like artificial intelligence.

In her message, Galetti noted that some teams finished their changes last year, but others needed more time in early 2026. Amazon hasn’t named every group getting cut, but sources point to AWS, the Alexa team, and other tech branches. Some employees even claimed that AI tools helped choose which teams to cut by reviewing Slack messages, though the company hasn’t confirmed this.

This move fits a trend across the tech world. Even when profits are high, companies are cutting costs to stay ahead in the AI race. Amazon is still making good money from its online store, cloud services, and ads, but building AI requires a lot of cash for data centers and specialized chips.

Shifts in Strategy and Culture

Executives say these cuts aren’t because the company is struggling for money. Instead, they want to spend more on AI to keep up with rivals like Google and Microsoft. Analysts believe the pressure to win in generative AI is forcing Amazon to find savings in other departments.

During the October cuts, Jassy mentioned that some parts of the company didn’t fit the original culture anymore. He also hinted that AI is starting to do some work that people used to do. The company says these aren’t temporary fixes for a bad economy; they’re permanent changes to stay on top.

Support for Departing Employees

Workers found out about the layoffs early on January 28. Many received texts or emails before the official company memo went out. Amazon is offering severance pay and help finding new work for those in the U.S. Impacted staff also get three months to look for a different job inside the company.

Social media platforms like LinkedIn quickly filled with posts from former employees. Many shared their sadness about leaving long careers so suddenly. In Seattle, where Amazon is based, local shops and cafes are worried that having fewer tech workers will hurt their sales.

What Happens Next for Amazon

Amazon says it doesn’t plan to make these massive layoffs a regular habit. The company is still hiring in areas like robotics and Prime services. Some critics don’t like seeing job cuts while profits are hitting record highs, suggesting the company cares more about investors than staff. However, supporters think these tough choices are necessary for the company to lead in an AI-focused future.

As the tech world changes, these layoffs show how volatile even the biggest companies can be. Amazon is betting its future on automation and efficiency. It remains to be seen how these changes will affect the company’s long-term success.

Related News:

CNN News Viewership Tanks Amid Sale Rumors and Ideological Backlash

Business

Fed Holds Interest Rates Steady as Politics Heat Up

WASHINGTON, D.C. – At its first meeting of 2026, the Federal Reserve (Fed) chose to keep its key interest rate unchanged. The benchmark federal funds rate stays in a target range of 3.5% to 3.75%. The decision, released January 28, 2026, follows three quarter-point cuts made in late 2025.

The Fed said the US economy is still growing at a steady clip. Inflation is still a bit higher than the Fed wants, but risks to jobs and inflation now look more balanced.

Fed Chair Jerome Powell said the economy has “surprised us with its strength.” He also said the current level of rates fits the Fed’s two goals, strong employment and stable prices. Powell added that officials will keep watching new economic data before making more moves.

Markets took the news in stride. Big stock indexes barely moved, since most investors expected the Fed to stay put.

Two Fed Policymakers Vote for a Cut

The Federal Open Market Committee approved the hold with a 10-2 vote. Two governors, Stephen I. Miran and Christopher J. Waller, dissented and backed a 25-basis-point cut.

Miran, whom President Donald Trump appointed in late 2025, has pushed for faster easing and has dissented more than once in recent meetings. Waller broke with the majority for the first time in this stretch, siding with the view that lower borrowing costs could help keep growth on track as the labor market cools.

The split shows an ongoing debate inside the Fed. Most officials see rates as close to neutral, meaning they are not strongly slowing the economy or boosting it. The dissenters said a small cut could act as insurance against a slowdown without sending inflation back up.

Some economists and market watchers think the Fed’s pause has a political angle, even if it’s not stated. The Trump administration has pushed hard for deeper rate cuts. Trump has argued that lower rates would reduce government borrowing costs, support economic growth, and help consumers with cheaper mortgages and loans.

To some observers, the timing matters. Holding rates steady can also signal that the Fed won’t be seen as responding to White House pressure. Powell’s term as chair is close to ending, which adds to the scrutiny. The Fed’s statement and Powell’s remarks stayed focused on the data, but the optics of a pause are hard to ignore.

Trump and Powell Keep Clashing

The relationship between Trump and Powell has grown tense. Trump has criticized Powell in public and called for much lower interest rates, even floating rates near 1% in past comments. He has also signaled that his pick for the next Fed chair will favor aggressive easing.

Powell avoided political back-and-forth at the press conference. He also offered simple advice for whoever comes next: stay out of elected politics, while accepting congressional oversight as part of a democratic system. The standoff has turned into a larger argument about how independent the central bank should be during a deeply divided period.

The situation escalated in early January 2026, when Powell said he and the Federal Reserve were part of a criminal investigation by the Department of Justice. The investigation relates to his June 2025 testimony to Congress about a $2.5 billion renovation of the Fed’s headquarters, including cost overruns.

Powell addressed the issue in a rare public video message. He called the subpoenas “pretexts” meant to pressure the central bank into matching the administration’s push for lower rates. He warned that the investigation could weaken the Fed’s ability to set monetary policy based on economic facts, not politics.

Powell’s Fed Chair Term Ends in May 2026

The investigation has drawn strong criticism from lawmakers, economists, and legal experts, who describe it as an unusual threat to the Fed’s independence. As of late January, the Fed had not fully complied with related grand jury subpoenas, and the case remains active.

Powell’s four-year term as Fed chair ends in May 2026. His separate term as a Fed governor runs through January 2028. He hasn’t said whether he plans to stay on the Board after stepping down as chair, which has fueled more talk about what comes next.

Trump is expected to name a new chair soon, and the list of possible picks includes candidates seen as more willing to cut rates. That handoff could shape the Fed’s direction for years, especially if the next chair lines up more closely with the White House.

For now, the Fed’s latest decision shows how hard the job has become. Officials are trying to manage a strong but uncertain economy, while also dealing with rising political pressure. Investors are still watching for possible rate cuts later in 2026, with some market pricing pointing to two quarter-point cuts. The mix of economics, interest rates, and politics is likely to stay front and center.

Related News:

2026 Midterm Elections: Key Races and Predictions (What Voters Need to Know)

-

Crime1 month ago

Crime1 month agoYouTuber Nick Shirley Exposes BILLIONS of Somali Fraud, Video Goes VIRAL

-

Politics2 months ago

Politics2 months agoIlhan Omar’s Ties to Convicted Somali Fraudsters Raises Questions

-

China1 week ago

China1 week agoChina-Based Billionaire Singham Allegedly Funding America’s Radical Left

-

News2 months ago

News2 months agoWalz Tried to Dodges Blame Over $8 Billion Somali Fraud Scandal

-

Crime2 months ago

Crime2 months agoSomali’s Accused of Bilking Millions From Maine’s Medicaid Program

-

Asia3 months ago

Asia3 months agoAsian Development Bank (ADB) Gets Failing Mark on Transparancy

-

Crime2 months ago

Crime2 months agoMinnesota’s Billion Dollar Fraud Puts Omar and Walz Under the Microscope

-

Politics3 months ago

Politics3 months agoSouth Asian Regional Significance of Indian PM Modi’s Bhutan Visit